Finance teams need to track every step of every purchase within an organization, from an initial request to a final payment. For many teams, a comprehensive procure-to-pay (P2P) system is the key element for maintaining control over often complex purchasing environments. And when implemented judiciously, the right P2P system can improve efficiency, speed, and accountability.

But how do you know which P2P system is the right one for you? In this article, we look at two — the traditional PO system and the Airbase purchase approvals system. For a 360-degree comparison, we consider four key purchasing metrics:

- Approval time.

- Ease of implementing new approval processes.

- Employee experience.

- Reconciliation effort.

1. Approval time.

The easier it is for employees to pay for the products and services they need to be effective in their jobs, the faster the company moves forward. Long approval timelines can slow down employee productivity.

When it comes to approval timelines, the main difference between Airbase approvals and purchase orders is the amount of paperwork involved.

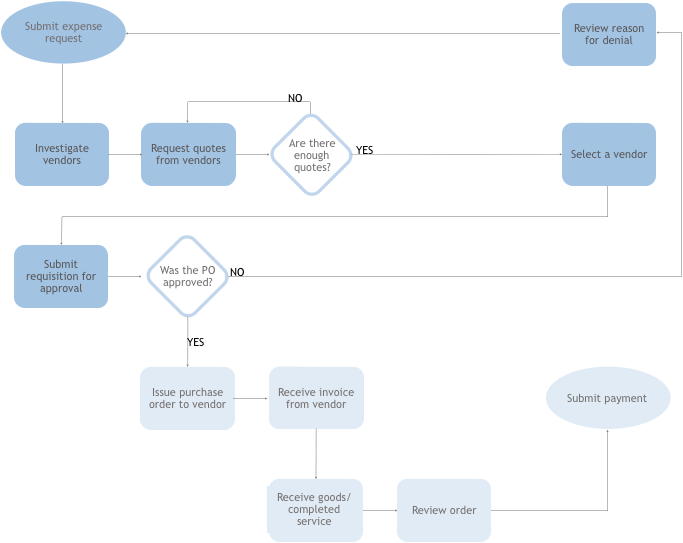

Generating and processing a PO involves a purchase requisition form (which goes out to managers for approval), a PO, and an invoice. If the quote or contract changes during negotiation, the requester needs to update the PO. Over hundreds of transactions, this can create a hefty stack of files, which lengthens approval timelines and ultimately slows the company down.

A purchase order workflow.

With Airbase approvals, finance teams can manage requests, vendor documents, and payments in one place, without any paperwork.

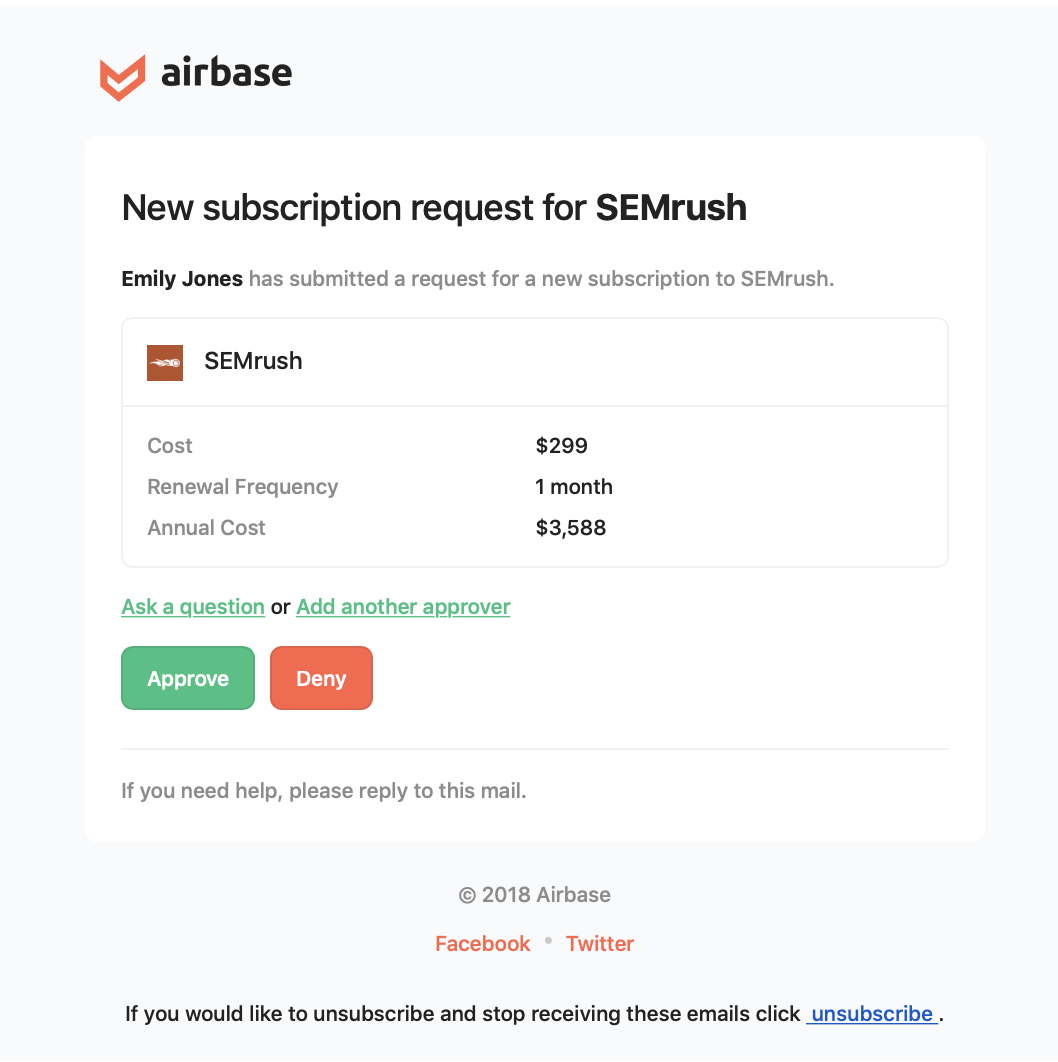

Employees submit an expense request that acts as the source of truth for the expense. The request is sent to managers/department heads for approval via email or Slack. Contracts, quotes, and invoices upload directly to the request, substantially reducing the time to approval.

An example expense approval request email

2. Ease of implementing new approval processes.

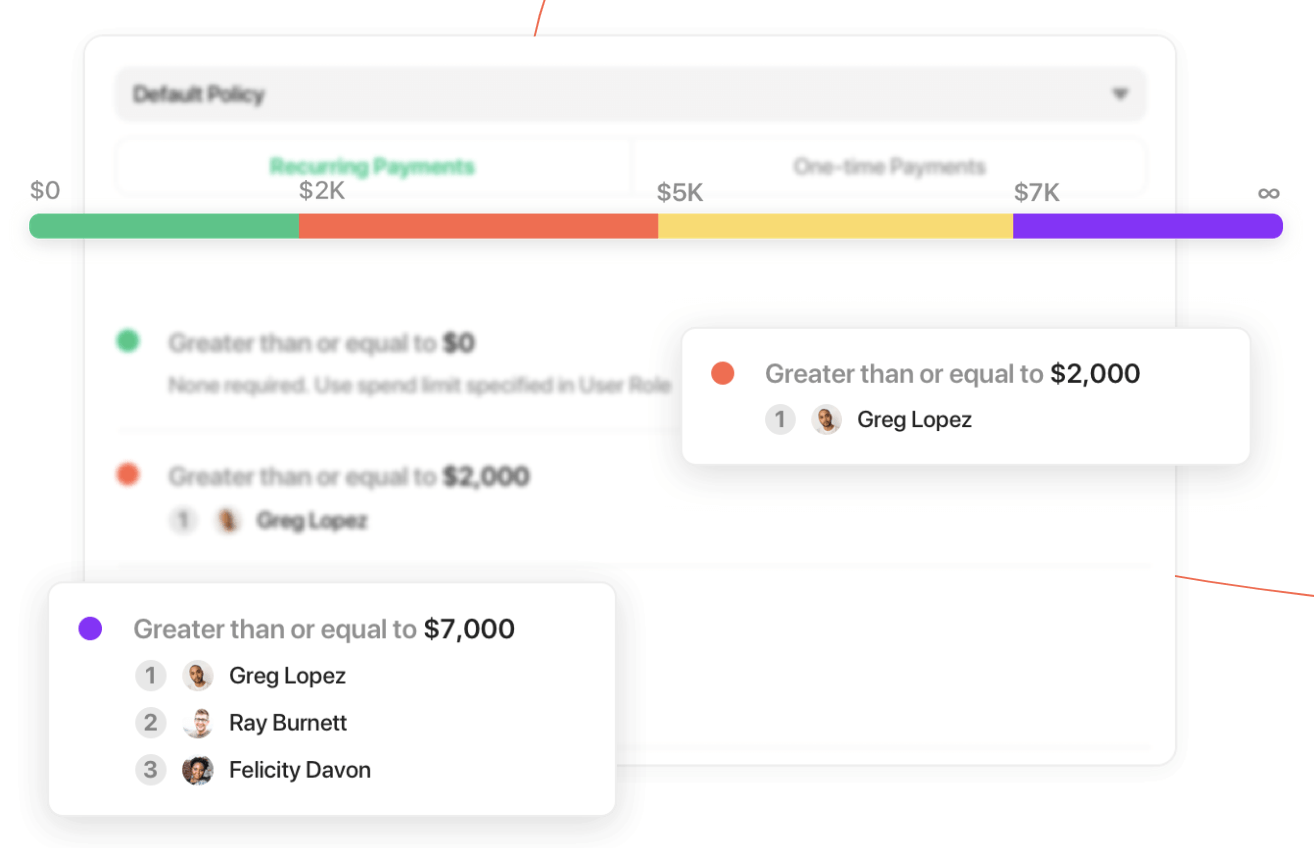

Airbase approval policies let finance teams set department-level policies, add new approvers, and set no-approval-needed rules for specific individuals. The result is a far more flexible approval process.

David Coffman, Airbase customer and VP Finance at Doximity, tells us that the flexibility of a “heavier or lighter touch for approvals” helped him “keep friction to a minimum” when he rolled out an approval process to employees.

“We have a light-touch, upfront approval policy for now,” he says. “All expense requests go to the finance team for approval. But if we ever need to tighten controls and add more approvers or change approval thresholds, I can do it without disrupting operations.”

Unfortunately, POs don’t easily have a “control dial” that finance teams can turn up (or down). The PO process is rigid, and trying to fine tune it for departments or individuals interferes with the ease of use.

3. Employee experience.

Most companies wait as long as they can before implementing a purchase order process because they know that POs are viewed by employees as a “necessary evil,” instead of a tool to support responsible spending.

David Coffman tells us this was the main reason why he held off on implementing a PO process at Doximity. “I saw my job as finding ways to delay that level of red tape and hoop-jumping for my business partners as long as I could,” he says.

An overly bureaucratic process encourages rogue spending by pushing employees to ignore the process and purchase the tools they need themselves. The Hackett Group reports that “rogue spend” can account for five to 10 percent of a company’s AP budget. The easier you make the purchase experience for employees, the easier it is to keep expenses in the system.

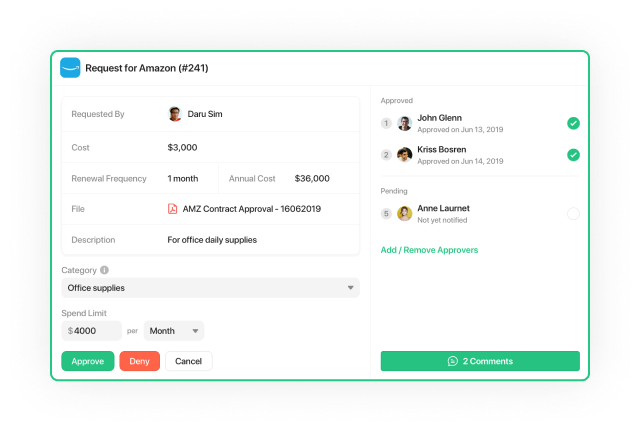

Giving employees an easy-to-use system with quick approval times keeps processes simple and automated, providing a seamless employee experience. Creating an expense request in Airbase takes less than a minute — all an employee needs to do is enter the vendor name and spend amount, specify if the expense is recurring or one-time, and categorize the expense (if possible).

4. Reconciliation effort.

PO reconciliation requires matching the purchase requisition to the line items on the PO to the line items on the invoice. The three-way match process helps companies avoid paying for fraudulent or incorrect invoices, or paying for an unused service.

But the three-way match costs companies countless hours of accounting time, especially if the charges are recurring.

Airbase approvals automate away the bulk of reconciliation work by prompting employees to categorize expenses at the approval stage. This makes the downstream accounting work for the finance team easy.

The accounting team still has to review the categorization before posting the transaction to the GL for the first time, but if the expense is recurring, future transactions sync to the GL automatically with the correct coding rules so that the finance team can achieve near real-time reporting on expenses.

Is it time to replace POs?

Purchase orders used to be the go-to system for approvals. That’s why Airbase still has a full PO system to support legacy accounting processes. But the PO system is no longer the obvious choice. Airbase approval policies outperform POs across four key approval metrics – approval time, ease of implementing a new approval process, employee experience, and reconciliation effort.

Combining a streamlined approval system with new payment methods, such as virtual cards, can help employees spend without any bottlenecks and automate away the bulk of finance’s reconciliation and reporting work.

Give Airbase spend management with decentralized approval workflows a try.

To learn more about Airbase, contact us for a product demo.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana