In the relatively early days of a company, handing off a shared company credit card with a verbal agreement on what will be purchased is often a common practice. However, as companies grow, finance teams face a choice. On one hand, teams need to be able to make purchases quickly to do their jobs. But on the other hand, managers and finance need real-time visibility and control over spend to keep spending within budget.

It often comes down to efficiency. Few people like to fill out time-consuming forms, but finance and accounting teams need information to get transactions booked to the general ledger. They’re often forced to find the time to chase down multiple expense owners to find missing information.

What’s the answer? It’s possible to balance accountability and productivity and make everyone happy with:

- A streamlined expense request & approval process that makes life easier for employees.

- Full control and visibility over payment card & invoice spend for finance departments.

- An intuitive workflow for receipt uploads & supporting document storage, including automatic verification that all necessary documents have been submitted.

A comprehensive, end-to-end spend management system makes this all possible by incorporating user-friendly, intuitive purchase request workflows, accounting automation, and the consolidation of all payment types (virtual cards, physical cards, checks, and ACH). These tools empower finance teams to create a pre-approval process that everyone will love, regardless of the payment type. They also make it possible to track every step of an expense, from request to the final payment.

Five tips for an efficient pre-approval process.

Follow the advice below to create an approval workflow that’s easy for employees to follow, but still provides all of the control that your company needs.

1. Keep it simple.

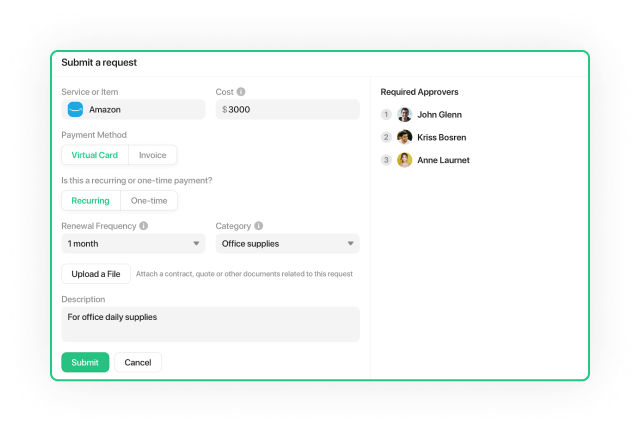

Simplicity is key, so pare down the request form so that it only asks for what you need to know: the vendor name; the cost; whether the expense is a one-time or recurring purchase; the expense account (if known); and any invoice or other supporting documentation.

Once that information is submitted, the request should flow automatically to the correct approvers, based on your company’s specific approval policy. For further clarity, the employee should be able to see who must approve the expense, including the approval flow when there are multiple people required to sign off.

An Airbase expense request form.

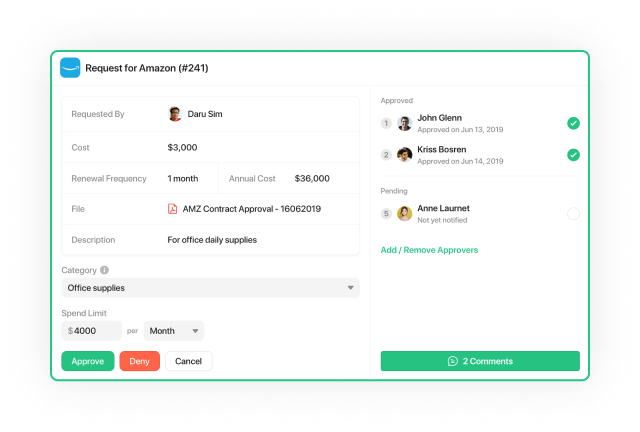

A comprehensive spend management system elevates an expense request to the next level by providing a virtual card if an employee chooses to create one. After the request is approved, they will receive a confirmation email with a link to auto-generated virtual card details that they can use to complete their purchase.

To the employee, this process is even easier than getting an approval and then using a corporate credit card to make a purchase, since it’s automatically created in the same system at the same time that the expense is approved. To the business, using virtual cards adds an extra layer of control and visibility. Now finance can easily see who owns each transaction, what it’s for, who approved it, and any supporting documentation. The information is available in real time — no more surprises at the end of the month.

Plus, the cards have an added layer of security because they are only good for the pre-approved amount and agreed timeframe, and can be easily canceled or locked. (And because a card is only linked to one vendor, canceling will not lead to a domino effect of failed charges with other vendors.)

2. Create an approval matrix.

It’s not always clear to an employee who has to approve an expense request and, in many companies, the approval workflow can depend on things such as the dollar amount of the expense. To make sure that purchase order requests always go to the right person, start by creating an approval matrix. This is the workflow that automatically routes spend requests to the correct approvers based on the employee making the purchase, amount thresholds, roles, and reporting lines.

For example, you could have managers approve expenses for their direct reports up to a certain amount, perhaps $200. Then you could set VPs and directors as approvers for expenses up to a larger spend threshold – $10,000, for example. You might decide that any expense that exceeds that $10,000 limit will have to go through another approval level, such as the CEO, CFO, or VP of finance.

For further flexibility, you can set an approval policy specific to each department. For example, you could require that all support expenses be approved by both the support manager and the director of customer success, while sales department expenses may only need to go through the VP of sales.

You may also want to introduce finance people into the approval chain as the business grows. For example, there may be some type of expenses that you want to have the controller or CFO also approve. This requirement can be configured into the settings.

Option for reviewers to approve or deny an expense.

4. Add clarity to recurring purchases.

Ten years ago, nearly everything was a one-time purchase. Today, many payments are recurring subscriptions. Recurring expenses require additional scrutiny as monthly subscriptions costs can add up over time. They can also renew automatically without your finance team even noticing. A spend request form should ask about renewal frequency and automatically calculate the total cost for the duration of the subscription. To avoid problems down the road, you should be able to add the date when the subscription is up for renewal so you can review the subscription as needed. In Airbase, you can even choose to set the virtual card to lock before that date in order to prevent auto-renewal charges.

To keep the books up to date, a modern approval system will sync transactions with your general ledger software and correctly code recurring transactions automatically.

5. Create rich audit trails for accounting.

The final key element is to ensure your system creates an audit trail that your accounting team can use to easily find all of the necessary information for internal and external review.

We’ve made this document collection process easy in Airbase. Users can upload contracts, invoices, and any other supporting documents that you want, from within the approval request form.

Save time, improve accountability: Take control of your expense approvals.

A formal expense pre-approval process doesn’t need to be complicated and time-intensive, or a heavy lift for your team. By using automated pre-approvals, you can create a culture of accountability, because spend controls are applied before spending happens. That’s much better for everyone than asking for forgiveness after a department goes over budget.

Interested in learning how Airbase can help you implement an expense pre-approval process? Schedule a demo today.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana