SOLUTIONS FOR CONTROLLERS

Control your company’s destiny with Airbase.

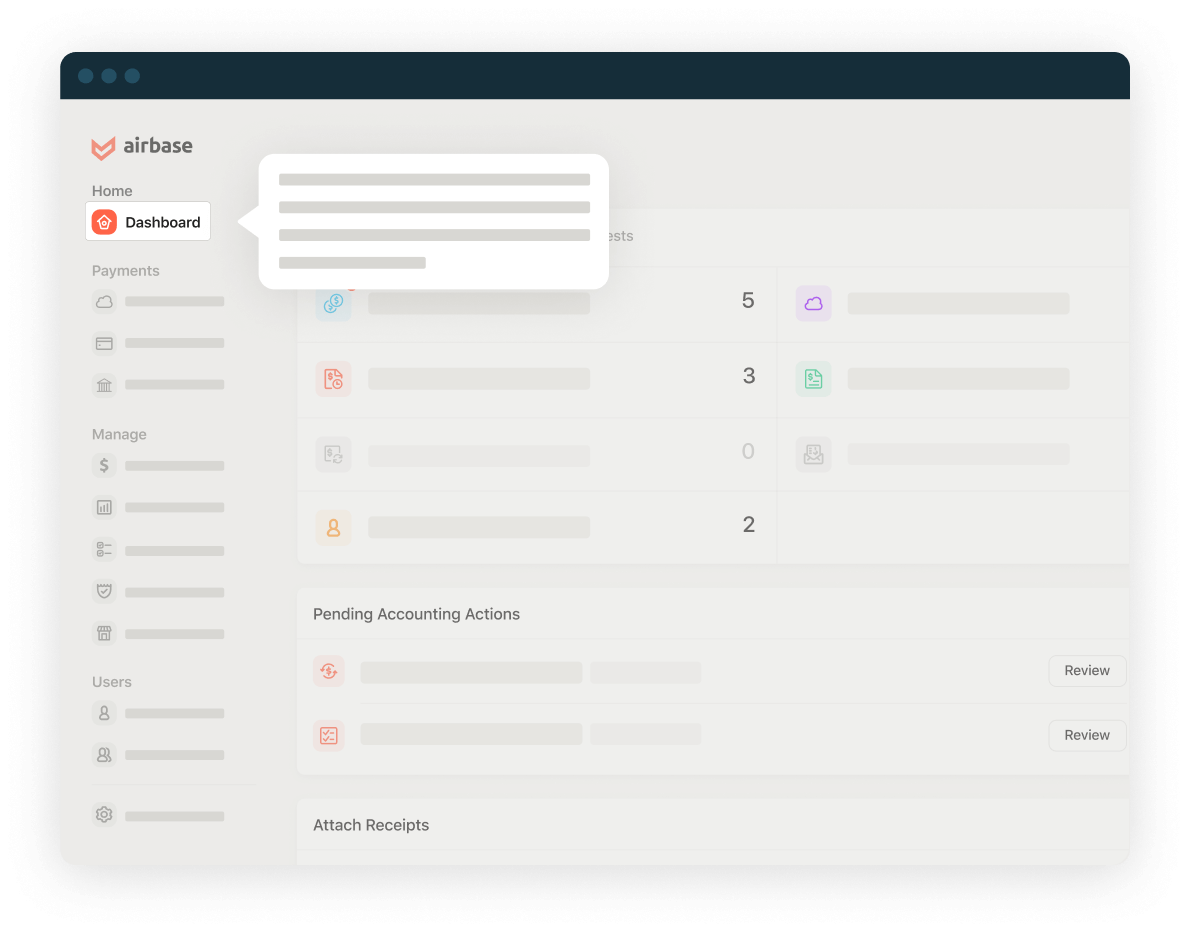

Build operational muscle and controls to efficiently close books and scale.

Automate manual tasks, including approvals for all spend, and shift expense compliance enforcement to the system.

Eliminate receipt chasing and card reconciliations.

Consolidate guided procurement, accounts payable automation, expense management, and corporate cards onto one platform.

Get visibility and control for real-time reporting, and reduce wasted spend.

Experience easy onboarding, happy employees, and well-designed UI with plenty of extra features.

Get visibility and control to truly manage all non-payroll spending.

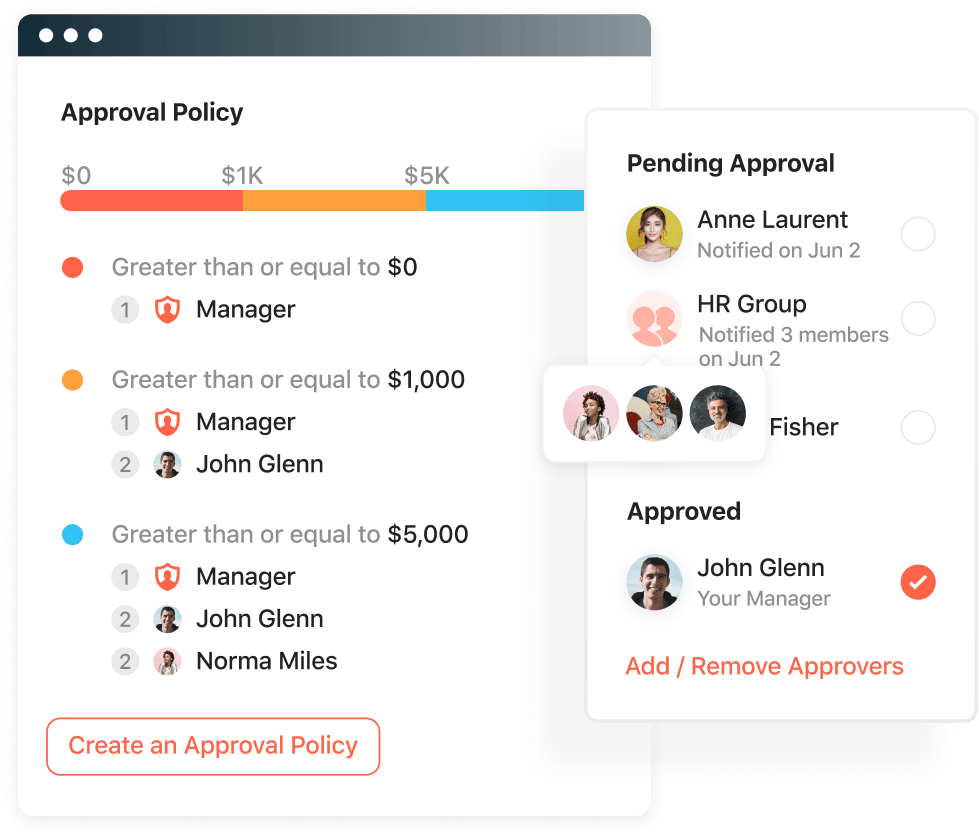

Automate requests and approvals to company policy using tools you already use — mobile app, Slack, email.

Use virtual cards so that every purchase made has an approval audit trail.

Automatically sync transactions to the GL to keep it current.

Get additional control by setting limits on cards, either amounts or expiration dates.

Let the system send reminders for missing receipts and eventually lock card use until they have been received.

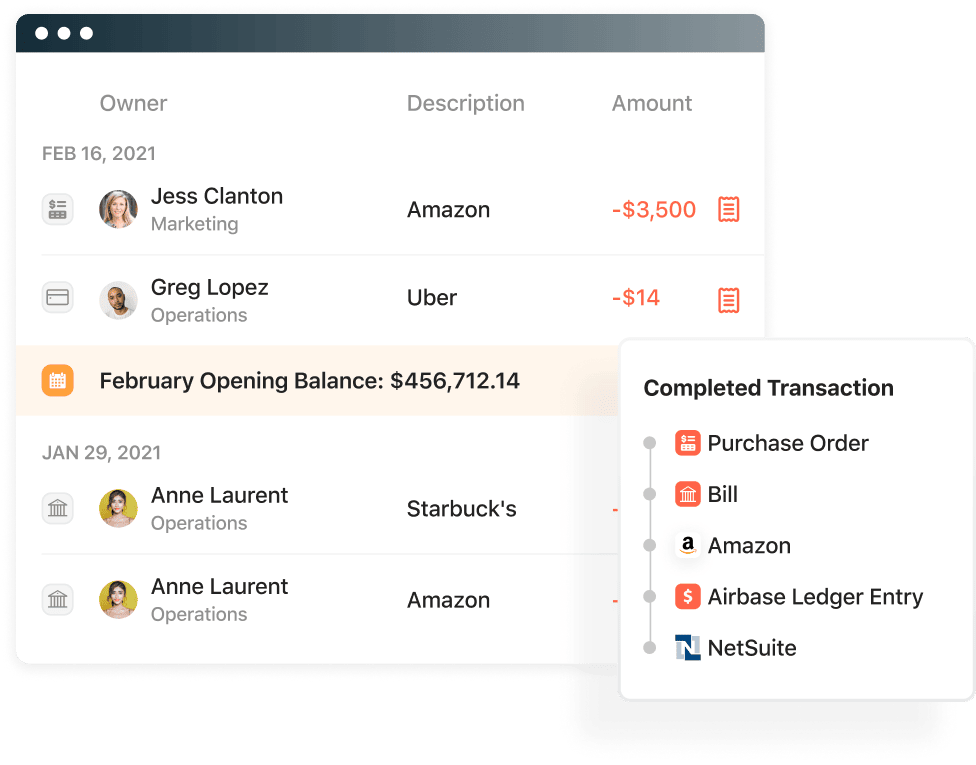

Close the books in half the time.

Our customers consistently report that they’ve cut their time-to-close in half or are even moving toward a continuous close. Eliminate credit card reconciliations, streamline bank reconciliations, and automate the syncing of spend directly to the GL. No more chasing expense receipts or documentation to understand an invoice. Continuous syncing to the GL means you won’t be scrambling at month-end to pull together the numbers.

Free up valuable time from routine, low-value tasks.

We’ve built automation into every activity associated with company spend, including:

Request and approval workflows.

Auto-categorizations.

Automatically syncing to the GL.

Bank reporting for reconciliations.

Invoice Inbox for automatic capture of invoice details.

Get control, visibility, and cash back.

Improve spend controls.

Give every card a budget.

Set spend limits and expiration dates for each card to prevent overspending and unauthorized vendor charges. Use the card lock for exceptional cases.

Automate accounting.

Automation tools free up your time to focus on important strategic business issues. Consolidate all payments onto one platform.

Generous cash back.

Achieve a positive ROI on your Airbase subscription. Cash back, plus savings on legacy systems, lets you monetize your spending.

“It’s huge that we can do purchase orders and credit cards from the same place — it saves us time and removes friction from our operations.”

Dmitri Litin, Controller at AspireIQ

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana