AIRBASE PRICING

Simplify spend with head-turning ROI.

Procure-to-pay software that puts you in control.

Guided Procurement, AP Automation, Expense Management, and Corporate Cards.

Enterprise

Up to 10,000 employees

Ultimate visibility and control with our most advanced configuration, bringing highest value for large organizations.

• Full platform experience

• Complete depth of features

• Complex processes

• Advanced accounting automation

See all features

Premium

Up to 500 employees

Manage efficiency and compliance at scale — higher ROI and same rapid time-to-value.

• Includes all primary modules

• Advanced integrations

• Advanced features/ workflows

See all features

Standard

Up to ~200 employees

A scalable, easy-to-use, entry package with fast time-to-value so you can start saving time and money.

• Guided Procurement

• AP Automation

• Corporate Cards

• Expense Management

• Accounting automation

See all features

Custom packages available.

Whether you start with one module, or adopt the whole platform, Airbase saves you time and money.

Where efficiency meets profitability.

Experience real, measurable ROI.

Efficiency & ROI

Investing in financial software is the path to improved productivity, efficiency, and ultimately savings. Discover the ROI of spend management.

- Money saved on wasted spend.

- Money earned on cash back.

- Time saved.

- User satisfaction & easy adoption.

- Accurate, timely data & reporting.

- Consolidated system for all non-payroll spend.

Everything you need to manage spend.

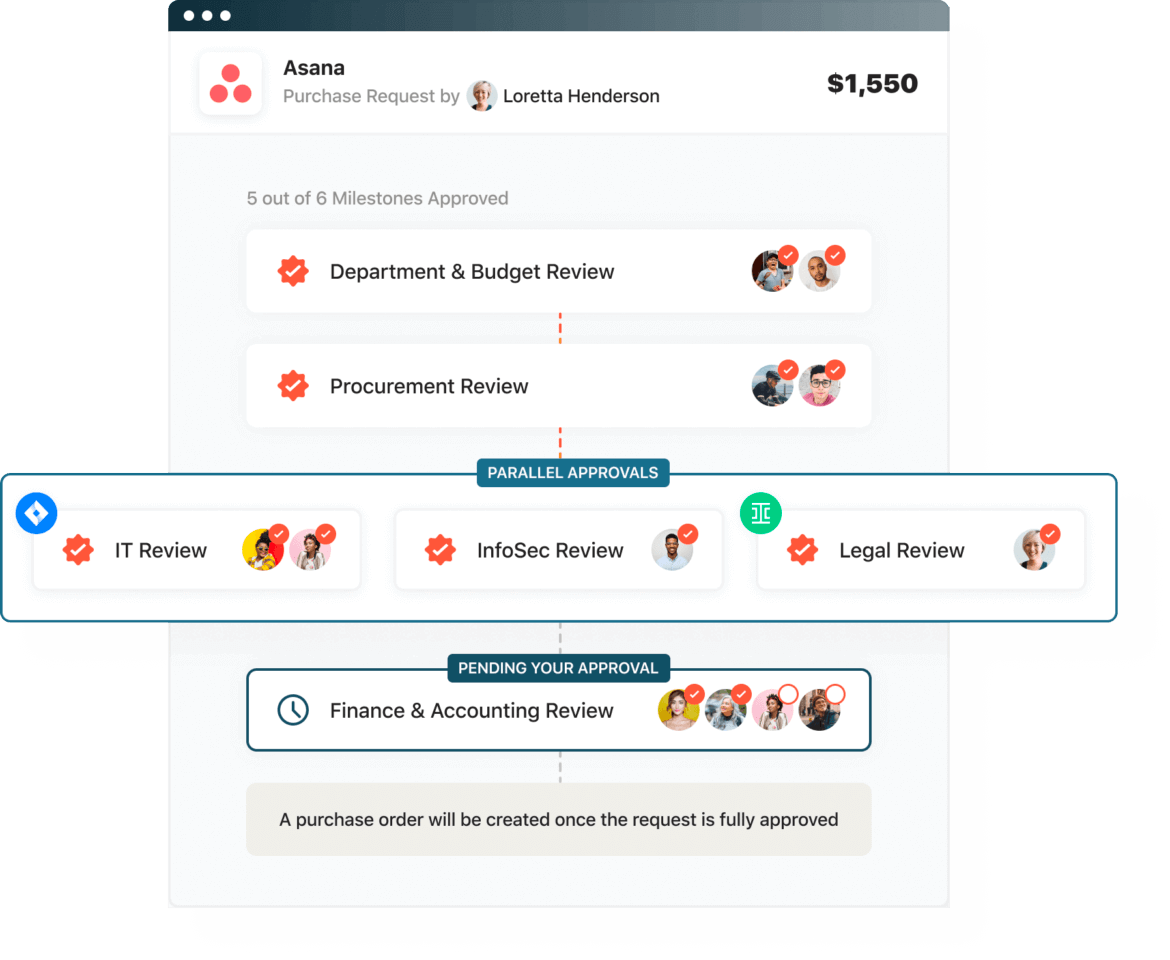

Guided Procurement

Intake orchestration that guides employees through spend requests and ensures all requirements are met for every purchase.

- Guided employee purchase approvals.

- No-code, customizable purchase approval workflows with milestones.

- Customizable forms, permissions, and processes.

- Vendor onboarding, renewals.

- Savings insights such as vendor card acceptance.

AP Automation

Advanced AP automation functions including support for global operations, and complex amortizations, reconciliations, and approval workflows.

- Domestic & international bill payments.

- Pay via ACH, check, vendor credit, virtual card, wire transfer.

- Invoice inbox, AI-powered OCR, recurring invoices.

- Service POs, inventory POs.

- Payment scheduling, tracking, batch approvals.

- Department-specific auto-categorization.

- Vendor portal with invoice submission and payment tracking.

Expense Management

AI-powered expense reports, intuitive, easy-to-use system fuels employee adoption.

- Create expense reports through web, email, mobile app.

- Receipt capture and AI-powered OCR automatically populates expenses.

- Auto-categorization, delegation.

- Employee bank account setup and changes.

- Policy compliance with blocking and warning policies.

- Domestic and international employee payments.

- Optional travel management.

Corporate Cards

Get visibility and control over card spend using Airbase, AMEX, or SVB cards on the Airbase spend management platform.

- Physical and virtual cards with generous cash back.

- Manage subscriptions and avoid duplicate spend.

- Receipt compliance settings and auto-matching.

- Auto-categorization, temporary spend limits, auto-lock.

- Spend owner transfer, delegation for executives.

- Optional: use of American Express or Silicon Valley Bank cards.

Platform Features

Make Airbase part of your broader company and software ecosystem.

- GL sync, amortization with NetSuite, Intacct, or Quickbooks.

- Advanced user management with HRIS integration.

- Business system integrations: Slack/Email, Jira/Asana, Ironclad, DocuSign.

- Real-time reporting and trend analysis.

- Customizable approval workflows for all types of spend.

- Observers, @mentions collaboration.

- Advanced, rule-based approval workflows.

- Multi-currency and multi-subsidiary support.

Pricing FAQ

Which package is right for me?

We obsess over our customers’ needs, and we want to know about yours. To determine the best package for you, we invite you to schedule a call to tell us your challenges, goals, and priorities.

How do I calculate my ROI, and what can I expect it to be?

Our customers’ returns range from 3x to 10x. Cost savings, improved efficiencies, greater productivity, and risk mitigation are all factors included in this calculation. Our experts will take you through a full ROI calculation so you can measure the value it will bring to your company.

Does Airbase replace my existing tools or integrate with them?

Airbase can completely replace your bill payments system (like BILL, Tipalti, or AvidXchange), expense reimbursement system (like Expensify, Concur, or Abacus), corporate cards (like Brex, Ramp, or bank cards), and procurement (like Coupa or Zip). While we strongly recommend bringing all non-payroll spend into one system, you can also start with one Airbase module if you’re not yet ready to commit to the entire spend management platform.

How fast is implementation?

We offer guided onboarding with a tailored implementation plan to meet your needs. Most mid-market customers are able to fully replace existing tools and implement the Airbase platform in 30-60 days. Enterprise customers can expect a 60-90 day process depending on their internal resources.

Do I have to implement the whole platform or can I start with part of it?

Airbase can be implemented in whole or in part. Our primary modules are Guided Procurement, Accounts Payable Automation, Expense Management, and Corporate Cards. You can deselect any of these and implement the most critical modules for your business. We’re confident that you, like others, will soon see the value of getting everything onto one platform.

When do I receive the cash back on corporate card spend?

Airbase pays you the cash back you’ve earned at the end of every month. We don’t make it hard for you to access your money. You won’t have to wait till the end of the year or deal with opaque reward points. It’s your money, and you get immediate access to spend it as you see fit.

What are the benefits of consolidating Guided Procurement, Accounts Payable Automation, Expense Management, and Corporate Cards on one platform?

There are measurable benefits to consolidating all of your company spend on one platform, like only paying for one system and saving time grappling with multiple solutions and outputs. There are also some intangibles that come with consolidation, like improved employee satisfaction, consistent approval, and oversight, that make things clearer. We’re happy to help measure the benefits for your company.

One platform. Procure, pay, close.

Best user experience for all.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana