Accounts payable (AP) refers to the series of steps that companies take to pay their bills. It requires the safe handling and recording of funds transferring from the company’s bank account to suppliers and vendors. Automation replaces the manual accounts payable process with software that can make everyone more efficient and lead to cost savings.

What is AP automation?

AP automation refers to software that handles the workflows associated with the AP process. At its most narrow, these steps include invoice verification, processing and approval, issuing payments to suppliers or vendors, and recording the payments in the accounting system.

AP automation enables the safe, compliant, and efficient processing of large volumes of invoices and financial transactions between a company and its suppliers.

Using AP automation software.

One of the earliest hires on most accounting teams is an AP manager, typically an accountant who uses the software for automating invoice processing. Managers and executives can also use AP automation software to monitor AP processing activities. AP automation improves the efficiency and accuracy of the AP department and helps with other accounting activities, such as financial closing.

Features of AP automation software.

The following is a list of criteria used by the review site G2 to determine if a software product belongs on their AP automation list:

- Deliver customizable workflows to streamline repetitive accounts payable tasks, such as data entry.

- Include document capture and imaging features to convert paper invoices into electronic documents.

- Process large volumes of supplier documents, such as invoices or credit memos.

- Provide a single repository for users to search and retrieve AP documents.

- Match supplier invoices with corresponding purchase orders to accurately track the amounts owed.

- Offer approval processes for payments, debits, or any modifications to AP transactions.

- Comply with accounting standards and regulations for AP processing.

- Integrate with accounting software, ERP, or advanced financial systems, such as budgeting and planning systems.

The importance and evolution of accounts payable.

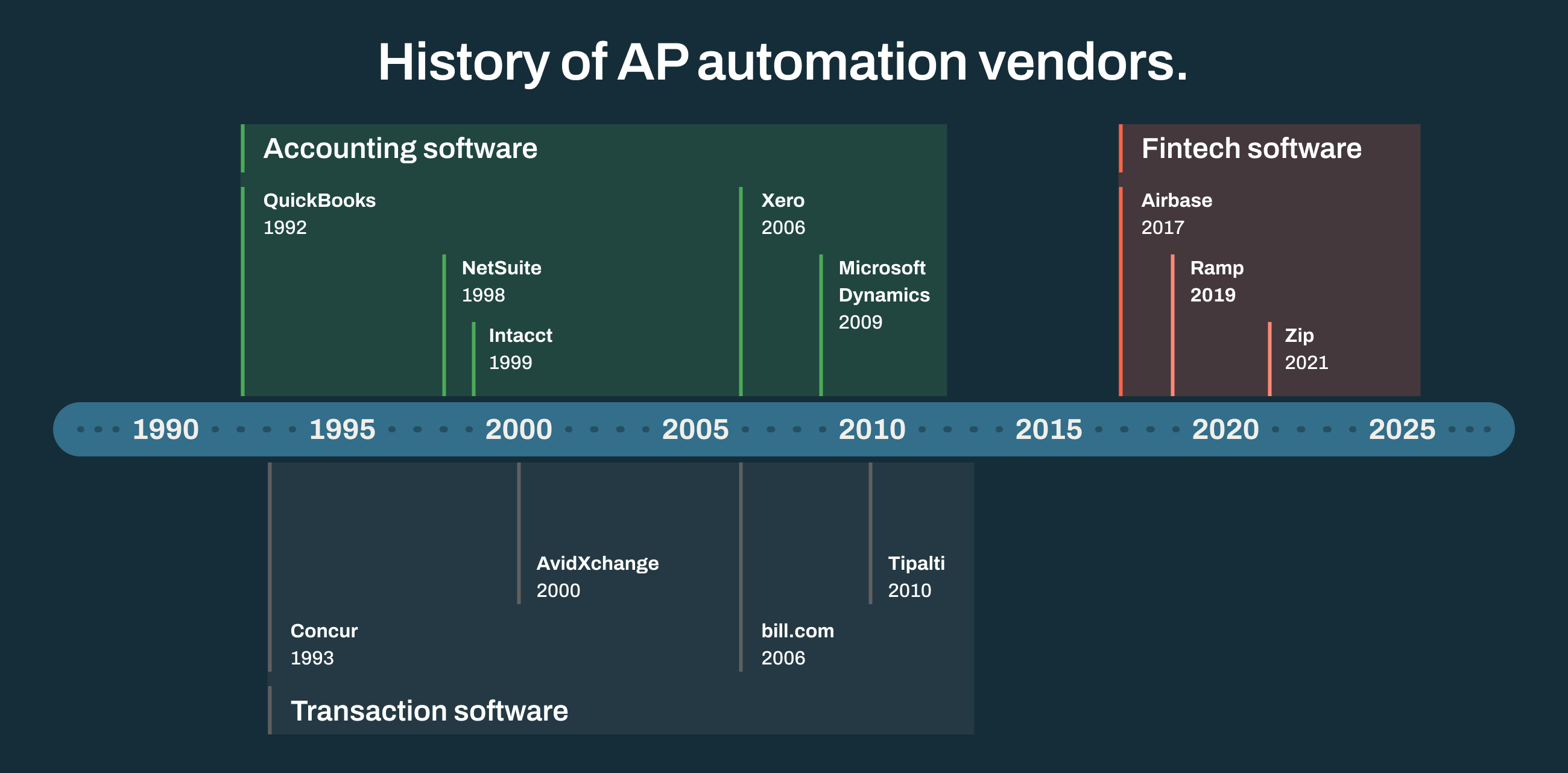

Accounts payable demands a significant portion of a finance team’s time and effort. The accounts payable automation software that automates aspects of the AP process has been around for 25 to 30 years. However, early versions of AP automation systems focused on the more narrow function of invoice processing and paying bills.

Modern solutions increasingly take a more holistic approach and automate many pre-accounting tasks, like approval workflows and securing receipts and contracts. They also offer a broader array of payment options as the fintech boom has opened up new digital payment rails. These newer systems also use AI technology to automate the accounting entries that are needed to close the books.

ERP/General ledger vs transaction solutions.

ERP or accounting system software like QuickBooks, Xero, Oracle NetSuite, Sage Intacct, and SAP offer a version of bill payments from their platforms. Some companies find that this software is sufficient for their needs.

Specialized software, sometimes called transaction software, offers a more comprehensive solution to solve the many levels of complexity involved in the full AP process.

Transaction software for AP automation was first launched in 2000 and was tailored for specific industries, such as real estate, healthcare, and manufacturing.

Others followed, focused on paying bills for smaller companies, and then additional ones launched to support a procure-to-pay process to meet the complexity of procurement needs for enterprise-grade companies.

The fintech movement paved the way for a new approach to AP. It allowed developers to tie payments to software for workflows and accounting directly. This meant for example, that virtual cards could be used in the AP process to trigger pre-approvals and then flow directly to the general ledger.

The developing future of AP software.

The major benefits of AP automation in 2024 relate to the expanded sophistication and depth offered by the more advanced solutions.

AP automation eliminates human errors and reduces invoice processing times. With AI-enhanced AP automation, real-time visibility into financial data enables more informed decision-making.

The results are far-reaching: organizations can adapt to rapidly evolving financial regulations and market dynamics, giving them a competitive edge in a dynamic business landscape.

Traditional benefits of accounts payable automation.

Traditional AP software offers many benefits that are still important, and we list 12 below. You should expect these benefits as “table stakes” in an AP automation solution.

1) Automating mundane tasks for increased productivity.

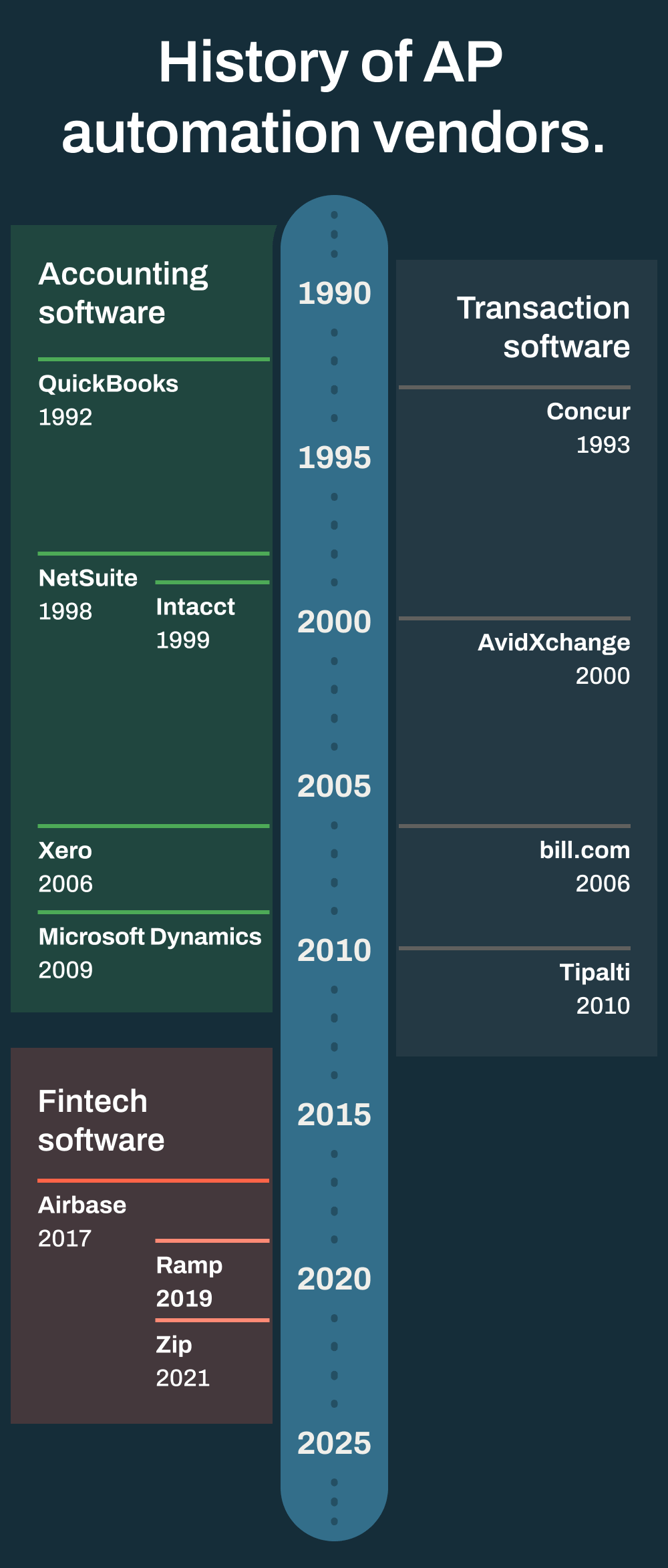

Automation frees finance teams from repetitive manual tasks by handling the routine and time-consuming processes inherent in accounts payable. AP automation can enhance employee job satisfaction and morale and reduce turnover.

With more time to contribute to innovation and problem-solving, team members can drive business growth and use their many skills in areas that add greater value.

Some examples of the types of automated tasks are:

- Automatic payment scheduling and payment execution.

- Automatic amortization schedule creation.

- Auto-categorizations for transactions.

- Automatic invoice reader to create the journal entries for any transaction.

- Automatic PO creation and matching to invoices.

2) Minimizing expenses and improving financial management.

By eliminating manual data entry and streamlining processes, AP automation reduces operational tasks, including the time it takes to investigate and resolve human errors. That saves resource costs over time. Accounting teams continue to lag behind many other professions in automation, and even when they work to find solutions, they don’t solve the whole problem. One survey found that 44% of surveyed finance professionals said their company is losing time and money due to poorly automated processes.

Additionally, automation contributes to better payment terms and early payment discounts, reduces late payment fees, and maximizes cash-flow management.

3) Eliminating human errors for more accurate financial data.

Manual processes introduce errors, and these can be costly and time-consuming. A 2022 PYMNTS survey of finance professionals in SaaS firms found that an average of 10% of supplier payments require adjusting due to processing errors.

- For 37% of firms, these payments represent more than 10% of total payments to suppliers in the last 12 months.

Automation significantly reduces the risk of data entry errors.

Unlike manual data entry, automated systems perform accurate calculations and record-keeping tasks, eliminating the possibility of transposition errors, miscalculations, or oversights.

This precision ensures financial data is consistent and accurate, contributes to regulatory compliance, and minimizes the need for time-consuming and costly error corrections.

4) Payment cycles.

Efficient accounts payable invoice automation benefits both businesses and suppliers by making payment cycles more transparent and faster.

In the same PYMNTS survey noted above, an average of 5% of firms’ payments to suppliers with late fees are due to delays in processing.

- For two out of ten firms, these payments represent more than 10% of total payments to suppliers in the last 12 months.

It is not just the cost of late fees — more efficient payment cycles lead to greater predictability and control over an organization’s cash flow. This provides opportunities for better strategic management of all payments.

5) Improved supplier relationships.

AP automation can help improve supplier relationships. Prompt payments and transparent processes enhance trust with vendors. When payments are made on time, vendors know they can rely on consistent and predictable cash flow.

AP automation resources, including solutions like Airbase, also improve transparency in the bill payment process with a vendor portal. This gives vendors access to easily track their invoices’ status and ensures they receive clear and accurate information. The result is a stronger, more collaborative supplier relationship.

6) Protecting sensitive financial information from breaches.

Security is becoming increasingly important as cybercrime rises at alarming rates. Advanced AP automation tools have robust security features to safeguard financial data. Some important features include:

- Data encryption protocols to protect sensitive information.

- Access controls and user authentication mechanisms, like two-factor authentication, to restrict access.

- Audit trails for complete visibility and real-time monitoring.

- Regular software updates and patches to address potential vulnerabilities.

- Data backup and data recovery mechanisms to ensure data integrity even in the face of unexpected events.

- Automatic alerts when fraud is suspected.

7) Audit trail transparency.

Automated AP systems create a comprehensive and real-time digital audit trail by systematically capturing every step of every transaction. Auditors and reviewers can swiftly verify the accuracy and compliance of financial records, reducing the time and effort to manually gather and reconcile this data. Finance teams tell us Airbase plays a crucial role in setting up AP for success in the event of an audit.

8) Adapting to business growth and changing needs.

The best AP automation systems are designed to easily accommodate increased transaction volumes, additional suppliers, and expanding operational complexities. Whether a business doubles in size or enters new markets, a scalable AP system adapts without the need for a complete overhaul or a costly upgrade to a more complex solution.

The finance leaders interviewed in our Unicorn Playbooks, Volume 1 and Volume 2, repeatedly emphasize the importance of starting with a strong foundation to accommodate growth. Automated processes make that scalability painless.

9) Optimizing cash flow and working capital.

The efficient processes supported by AP automation play a pivotal role in better capital management. By leveraging automation and real-time data analysis, organizations can swiftly identify trends, irregularities, and opportunities in financial operations.

A real-time view of cash flow, expenses, and revenue streams supports proactive, informed decision-making, which helps businesses optimize their capital allocation strategies.

Whether identifying areas for cost reduction, capitalizing on early payment discounts, or reallocating resources for higher returns, efficient processes and timely insights strengthen agility. As a result, organizations can enhance liquidity, reduce financial risks, and ensure their capital is directed toward investments and opportunities that yield the best returns.

10) Easier to ensure compliance.

A top-notch accounting automation solution eases the burden of compliance. These include both external regulatory requirements and compliance with internal company policies. AP automation solutions automatically flag discrepancies or non-compliance by incorporating compliance checks and regulatory updates into workflows.

Airbase’s Guided Procurement module addresses compliance issues at the onset of request by ensuring the appropriate people review for legal, regulatory, or security protocol compliance. Businesses can confidently navigate the complex regulatory landscape, eliminating the need for manual, error-prone efforts.

11) AP anytime, anywhere.

With cloud-based AP solutions like Airbase, businesses can access accounts payable data from virtually anywhere, at any time. This mobility is one of the top AP automation trends due to today’s fast-paced business environment, where remote work and travel are common.

Authorized team members can review, approve, or initiate payments, check invoice statuses, and perform other AP tasks, whether they are in the office, on the road using the mobile app, or working at home.

12) Environmental sustainability.

When deciding how to automate accounts payable processes, some companies consider environmental sustainability as described by their ESG policies. AP automation can help support these efforts by better tracking vendors’ and suppliers’ environmental policies to ensure compliance.

Airbase automates the intake process as part of its automation system. It automates the routing of purchase requests to all stakeholders in alignment with an organization’s policies. In the case of ESG, the procurement officer would see the request to spend before a purchase is committed. This visibility gives procurement an opportunity to influence vendor selection. If the vendor selection criteria include ESG compliance, they would allow them to evaluate a vendor’s practices before contracts are signed.

AP Automation Tour

Explore this self-guided tour to see the benefits of modern AP automation software.

Modern accounts payable automation benefits.

A new generation of cloud-based software products incorporating fintech and accounting software has emerged. These best-of-breed modern solutions offer additional benefits over legacy AP automation solutions.

1) Excellent user-experience.

Newer automation solutions provide an excellent user experience with an intuitive, easy-to-use UI. This enhanced experience leads to greater adoption, which in turn helps secure maximum benefit from AP automation.

2) Intake workflows for multi-stakeholder compliance.

Tying AP to the procurement process is achieved by incorporating intake at the front end of the AP process. When intake serves as the first step in the process, approval workflows for all stakeholders is built into the system. This insures that the full invoice approval process is followed before payment and booking occurs.

3) Collaboration to support remote work and global teams.

Supports collaborative workflows for employees who often work across global geographies and time zones. With one user interface for all purchasing, companies can ensure consistency and compliance across all operations.

4) Integrations with the broader tech stack.

Modern solutions provide interoperability across other automation solutions. Modern AP automation integrates into the broader financial tech stack, including your general ledger or ERP, plus systems like HRIS, business systems like Ironclad and Jira, travel booking, and card networks.

5) Multiple payment options.

Newer systems offer multiple payment methods, including checks, ACH, vendor credits, and international wire transfers. They even offer payment options via virtual card, which can earn cash back and contribute directly to a company’s bottom line.

6) Better fraud protection.

There are additional methods for fraud protection in modern systems, such as alerts for suspicious activity and notifications for changes in bank account details by a vendor. Airbase even maintains a fraud team that operates 24/7 to monitor all payments moving through the Airbase platform.

Benefits of Airbase AP Automation:

Save time by simplifying bill creation from invoices with OCR technology, scheduling domestic or international bill payments, and automatically amortizing bills to your GL.

Earn income on your expenditures with the option to pay bills using virtual cards with cash back.

Selecting the right AP Automation solution.

Whether you use the AP automation system offered by your ERP accounting software to pay bills or advanced AP automation solutions, you’ll want to ensure that it fits your needs today and in the future.

Identifying the requirements needed to support your accounts payable process is important. You’ll want to set up a good process as you would with any automation software to find the alignment between your company and the different solutions offered.

Some AP automation systems are better at handling international payments, including multi-subsidiary and multi-currency payments. Others are better at invoice processing using optical character recognition (OCR) technology to scan receipts and invoices and extract key transaction details.

Airbase offers modern accounts payable software. It is the right AP automation software for mid-market to early-enterprise companies that have complex accounts payable automation work to handle. Things like large volumes of invoices, multi-stakeholder approval workflows, and foreign currency payments.

Airbase is also designed to protect against payment fraud and duplicate payments. It promises the greatest visibility and control over your AP process. Airbase can turn a single AP manager into a full accounts payable department.

Schedule a demo

Learn how Airbase can transform your entire purchasing process.

Jira

Jira  Ironclad

Ironclad  Asana

Asana