Get control over company spend and save time and money. Airbase software-enabled virtual and physical cards are powered by the top-rated spend management platform.

With built-in approval workflows, easy receipt upload, and transaction information that is automatically captured and flows directly to your general ledger, Airbase corporate cards will fast become your favorite software-enabled product.

Airbase’s virtual and physical cards provide best-in-class visibility along with control and generous cash back.

And, because our cards are part of a spend management platform that includes accounts payable automation and expense management, you’ll consolidate and manage all non-payroll spend from one convenient, consistent place.

Key Benefits of Airbase Corporate Cards:

Get generous cash back on Airbase corporate cards and never worry about hard-to-use rewards or points again.

Popular features:

Multi-subsidiary support makes it easy and efficient to manage company spend across subsidiaries and countries.

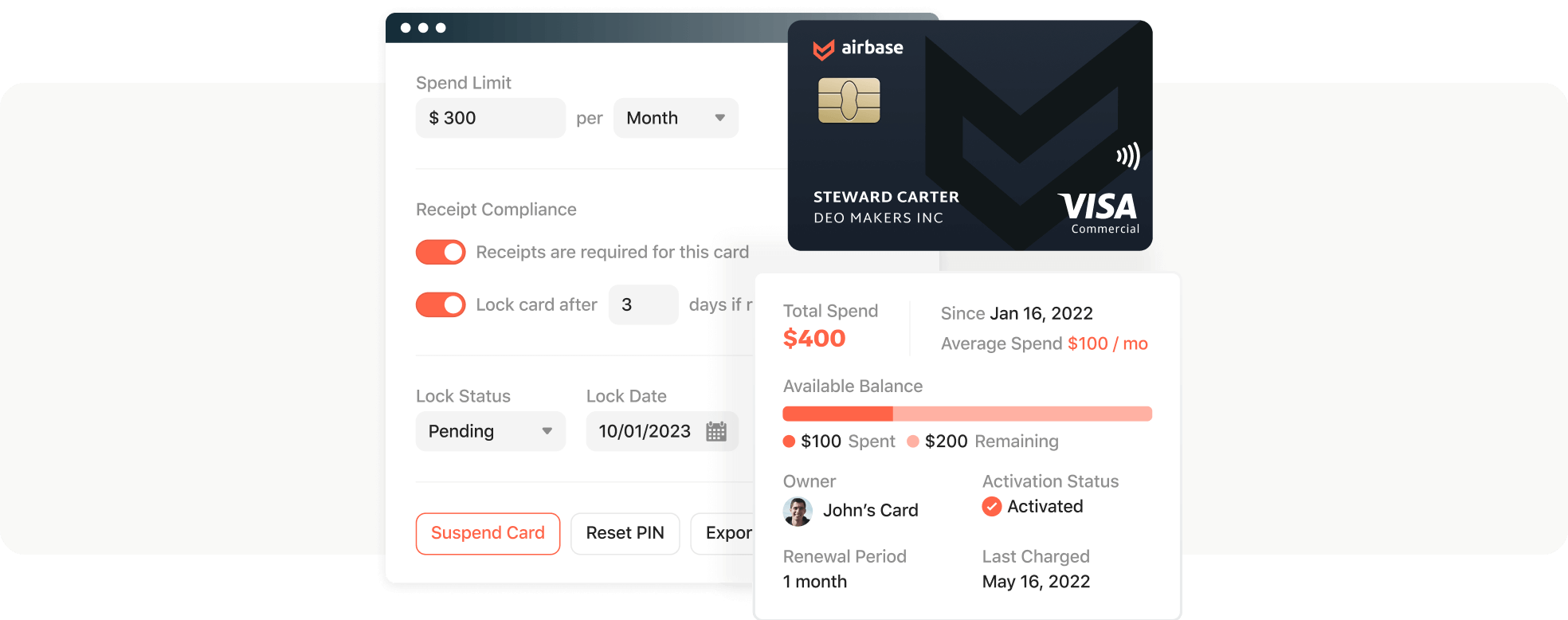

- Automated approval workflows and upfront spend categorization ensure budget owners know what they are approving so they can both expedite and control spend.

- Auto-lock card settings, receipt compliance controls, and fraud detection add an extra layer of security.

- Delegation support saves time for executives.

- Subscription management and duplicate spend alerts eliminate wasted spend.

- Apple Pay and Google Pay support for virtual and physical cards allow employees to spend anywhere Visa contactless payments are accepted.

The Airbase spend management platform offers a variety of card options. Select from Airbase cards, or keep your Silicon Valley Bank or American Express Cards for use on the Airbase platform.

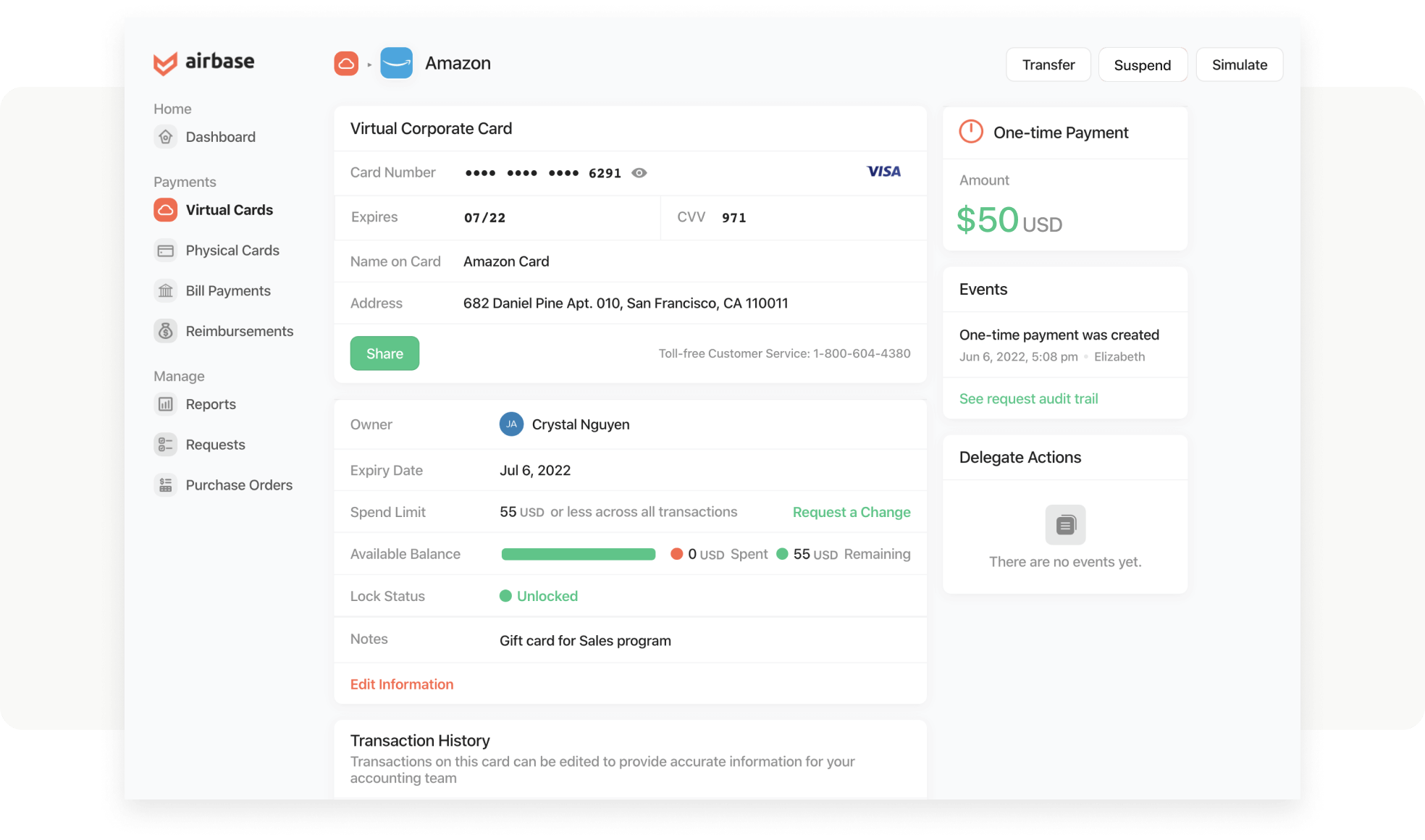

How virtual cards work:

- The employee submits a virtual card request, complete with the category of spend, and it is automatically routed to the right approver(s).

- Once approved, the employee simply copies the card details and uses them for one-time or recurring online spend. Receipts are uploaded directly to the transaction in Airbase or emailed to a unique Receipt Inbox and automatically matched to the transaction — for USD and non-USD currencies. OCR is used to populate the details of the transaction.

- Transactions are automatically synced to the GL, including vendor coding, GL, category, line and transaction tags.

Note: Physical card transactions can also have automated approval workflows, upfront spend categorization, and will automatically sync to your GL.

Learn more about virtual cards.

Use case example:

An employee request to purchase a $50 Amazon Gift Card with a one-time virtual card was approved. They simply copy the card details and make the purchase.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana