Manage out-of-pocket employee expenses with ease. Choose our Expense Management product on its own or as part of our comprehensive spend management platform.

Your employees sometimes need the flexibility to use personal credit cards or cash to make purchases on behalf of your company or use their own vehicles for business purposes. The problem is that out-of-pocket expense management is disconnected from your AP workflow. This burdens your accounting team with unwieldy expense reports, time-consuming approvals, manual journal entries, GL coding, and reconciliation. At the same time, your employees are slow to be reimbursed and left frustrated.

Airbase’s first-of-its-kind spend management platform solves this problem.

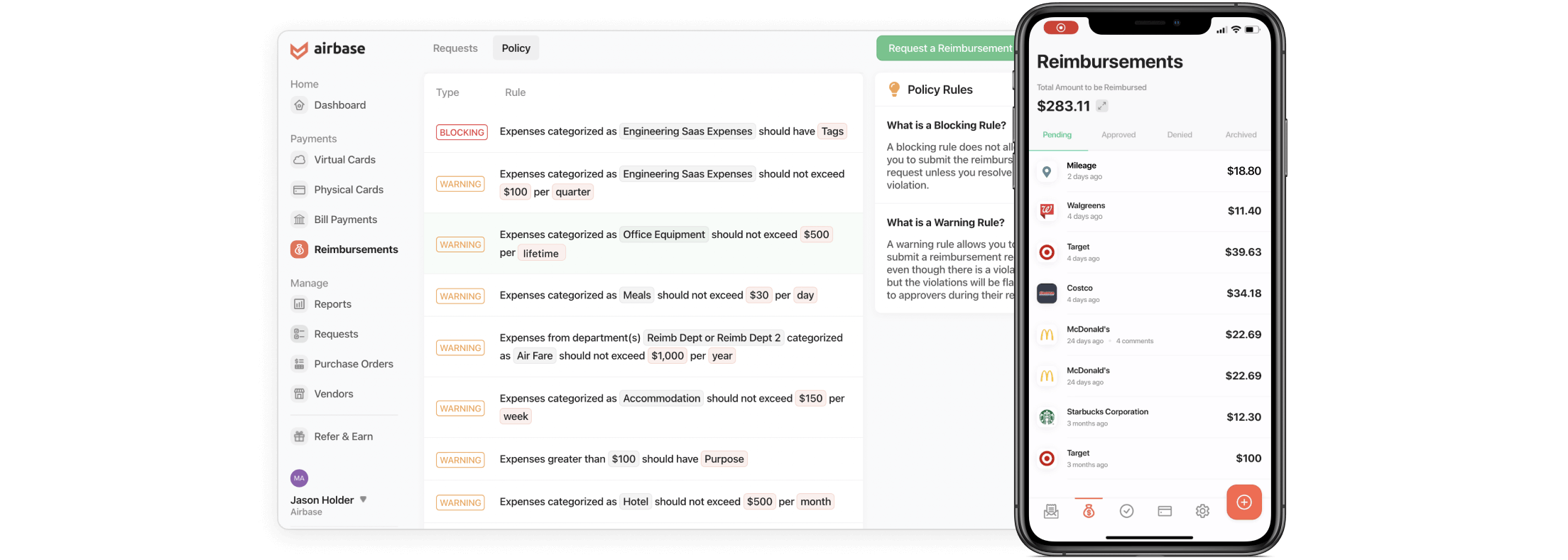

Now you can easily manage out-of-pocket employee expenses in the same platform you use for all spend types, including bill payments, virtual cards, and physical cards. Airbase’s Expense Management eliminates expense reports altogether and provides effective policy controls, built-in approval workflows, and accounting automation.

Learn more about expense management tips to help your business.

Benefits of Airbase reimbursements:

Save time and money by consolidating all expenses — including bill payments, corporate cards, and employee expenses — in one platform with consistent approval workflows, accounting automation, and real-time reporting.

Boost efficiency for your accounting team by avoiding the need to chase employee expense reports, receipts, and approvals for expenses requests.

Delight employees with the ability to submit and receive expenses on the go through our mobile app, without the need of creating tedious expense reports.

How it works:

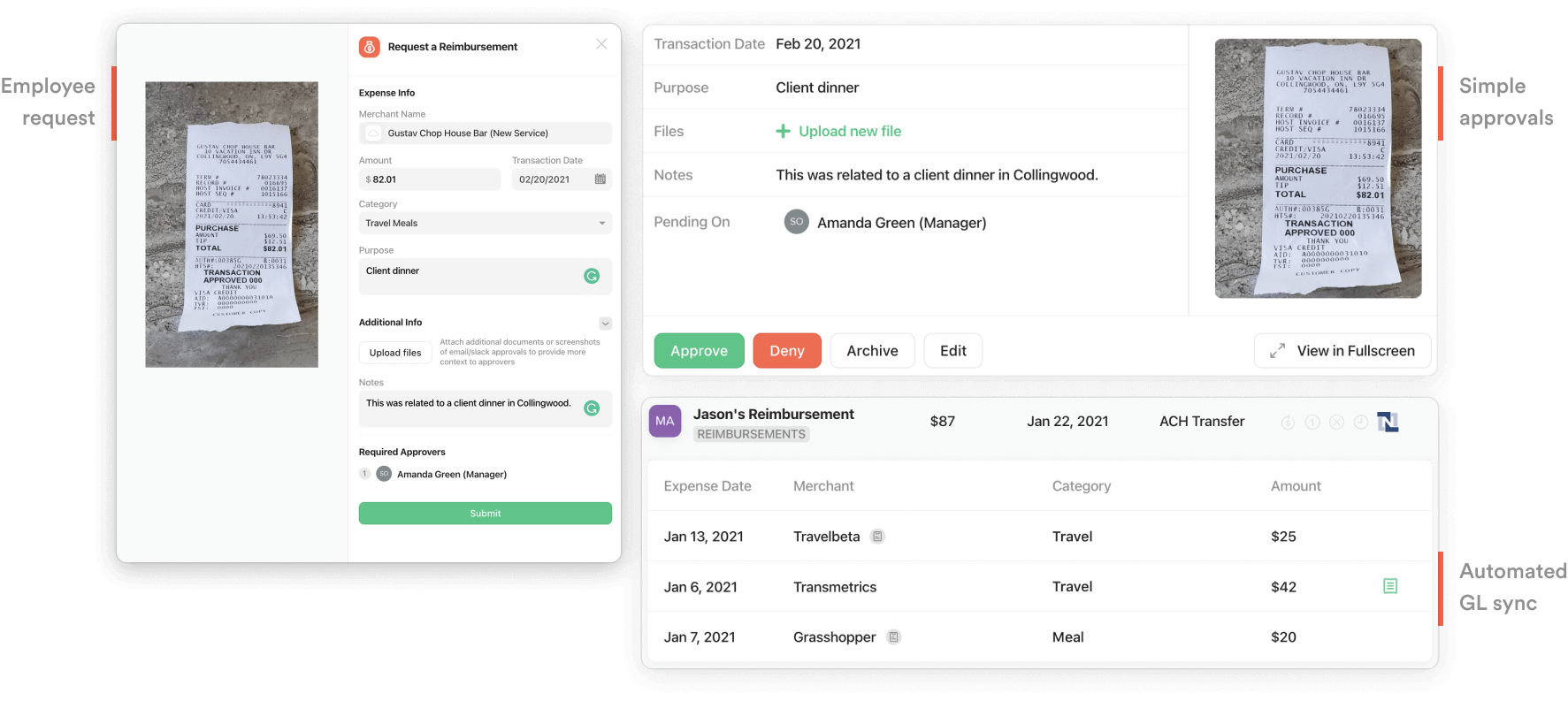

Airbase makes it easy and efficient to process out-of-pocket expenses, for employees and accounting teams alike. Available on mobile or desktop.

- Admins configure expense rules to reflect company policies, including mandatory fields, submission time window as well as daily, weekly, quarterly or annual budget. Admins also configure the approval policy, defining who needs to approve expenses.

- Employees add their preferred bank account to receive reimbursements. They submit requests, upload receipts, while our OCR technology auto-populates mandatory fields such as merchant name, amount, transaction date, and category. Employees receive a warning or are blocked from submitting out-of-policy requests.

- Approvers review expense items, exchange comments, edit details, and approve or deny via Slack, email, or the web to keep teams moving and employee expenses processed quickly.

- Accounting teams focus on higher value work since expenses are approved, categorized, and automatically sync to their GL.

User experience:

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana