Reconciliations can feel like a never-ending black hole for accounts payable teams, particularly at the end of the month. Not only is reconciliation work frustratingly time-consuming, it also frequently fails to produce the necessary level of accuracy. As a result, despite the hours of work involved reconciling data, many finance pros remain unhappy with the results. In one survey, only 20% of those surveyed feel good about their closing process, and only 28% trust that their financial reporting data is accurate.

Let’s take a look at some ways to dig out of the bottomless pit of reconciliations.

Why is reconciliation such a sore point?

The first step is understanding why AP reconciliations are so difficult in the first place. One of the biggest challenges is that most companies still rely on manual reconciliation processes. This means accounts payable teams are forced to comb through paper credit card statements and bank account logs, which can be extremely time-consuming and error-prone. But despite these significant drawbacks, in Airbase’s survey of 745 finance professionals, 55% said they still manually reconcile bank accounts, and 36% said they manually reconcile credit card statements.

Why do companies continue to rely on these outdated methods? Not only are they inefficient, but they can be extremely dangerous, especially for AP teams. Inaccurate reconciliations can lead to missed payments, late fees, and even bankruptcies.

Another reason why reconciliation is difficult is because of the sheer number of transactions that take place each day. As a company grows, that number just gets larger — but the finance team is typically the last to add new resources.

Further magnifying the problem is the way many companies do their accounting. For example, some companies post payments to their accounting software as soon as they are made, while others wait until the end of the month. This means that reconciling accounts at the end of the month can be a challenge, since there may be discrepancies between what has been paid and what appears in the accounting software.

How automated accounting simplifies reconciliation.

Thankfully, reconciliation can be made easier through automation. When virtual or corporate card spending is booked as it takes place, there is no need to spend hours pouring over credit card statements. The reconciliation process can be completed in a fraction of the time, and with far fewer errors.

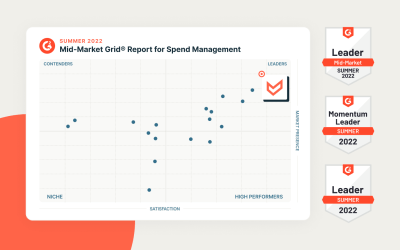

A consolidated spend management platform powered by accounting automation further reduces reconciliation effort, because all employee spending syncs to the general ledger automatically.

The benefits of automation and consolidation include:

- Reduced reconciliation effort.

- Fewer errors during reconciliation.

- Easier identification of employee spending discrepancies.

- Faster resolution of mismatches between accounting and spend data.

Approval workflows streamline reconciliations.

The automated approval workflows of spend management platforms also eliminate the need to correct errors during reconciliation.

Because the correct information, such as categories and tags, is supplied and verified at the time of approval, it has already been confirmed as valid before spending takes place. It’s no longer necessary to make changes after you’ve got accurate data in place up front. In addition, supporting documents like receipts or invoices are uploaded into the purchase event when they’re relevant, ensuring that all required documentation for all purchases is preserved by the system as they happen. This generates an audit trail at any moment in time.

This all sounds great in theory, but what about when something goes wrong? What if an employee accidentally charges a personal expense to the company credit card? In this case, reconciliation becomes necessary in order to identify and correct the error. Because purchase events are immediately associated with specific accounts and tagged with detailed information, like vendor names, product codes, and quantities ordered, it’s much easier to track down and resolve errors when they occur. Without a good reconciliation process in place, it can be difficult (or even impossible) to determine where an incorrect charge came from or which employees were responsible for making it.

Ultimately, proper reconciliation is essential for maintaining accurate financial records and preventing unauthorized spending. Find out how Airbase can help.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana