The Definitive Guide to Spend Management

Foreword

From innovation to best practice.

Since the first edition of this Definitive Guide, published in Feb 2021, the number of companies on the G2 Grid® for the Spend Management category has skyrocketed from a handful to around 30.

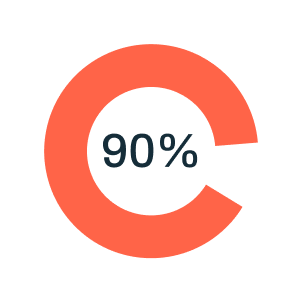

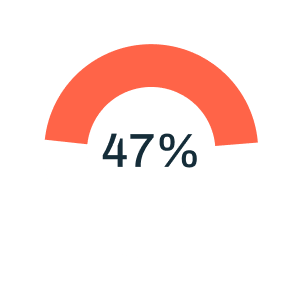

When a whopping 90% of finance leaders* report that they lack visibility and control over company spending, it’s clear that a solution providing both is needed. That’s why it’s not surprising to see the spend management category gathering new fans every day. Yet, not all solutions are equal. Some are narrowly focused on specific aspects of spending, others may be broader, but are missing feature depth.

Airbase is proud to offer a comprehensive platform that provides a full range of products and deep features. As a pioneer and market leader, Airbase is constantly pushing the frontiers of the category including the latest addition to our platform called Guided Procurement.

For the first time, a single spend management platform guides employees through the procurement process including navigating the complexity of multiple stakeholders, like IT, legal, and procurement. This ensures compliance while bringing clarity to employees and accuracy to accounting teams.

Ultimately, spend management exists to improve efficiency while controlling risks. Airbase has earned top rankings on review sites not only because it meets these objectives, but because all stakeholders love to use the platform.

It’s why finance teams who want to control their destiny turn to Airbase.

01

What is spend management?

Spend management is an automated process to facilitate safe, compliant, accurately recorded company spending.

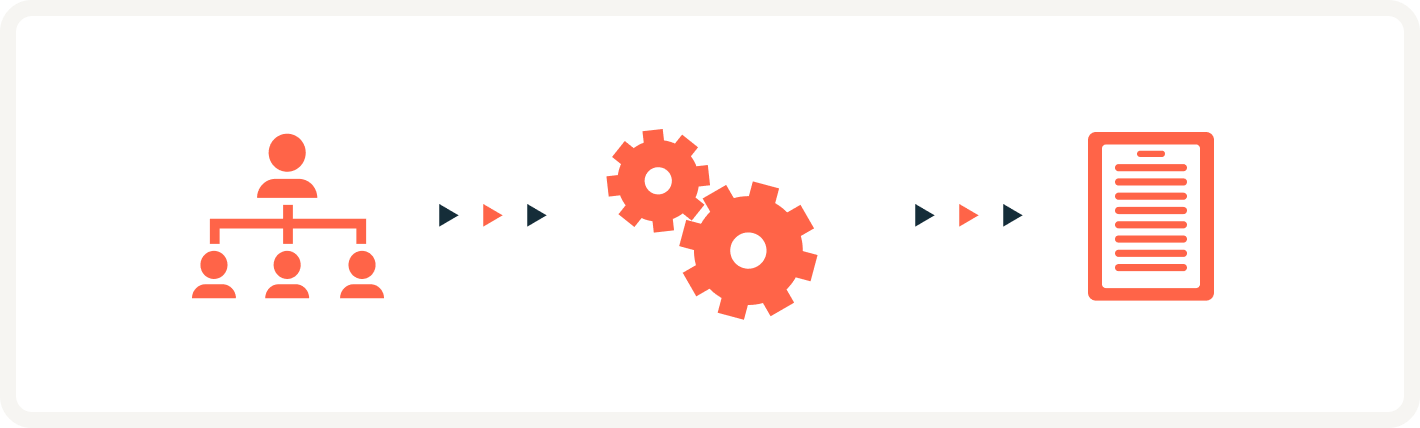

How does it work?

Spend management is collaborative software for the many stakeholders and workflows involved in spending company money. All data and related documentation flow across all touch points, including employees, approvers, accounting teams, other business unit systems, and the GL.

Payments are scheduled, executed, and booked from an easy-to-use dashboard. And, a full audit trail is created of all spend activities.

- Guided Procurement.

- Accounts Payable Automation.

- Expense Management.

- Corporate Card Programs.

- Purchase request (intake).

- Stakeholder routing.

- Approval workflows.

- Documentation capture.

- Accounting entries.

- Payment scheduling and execution (ACH, card, check, international, vendor credits).

- Direct syncing to the GL.

- Real-time reporting.

- Easy capture of and access to transaction data.

- Spend policy compliance (through automated approvals and spend controls).

02

The benefits of spend management.

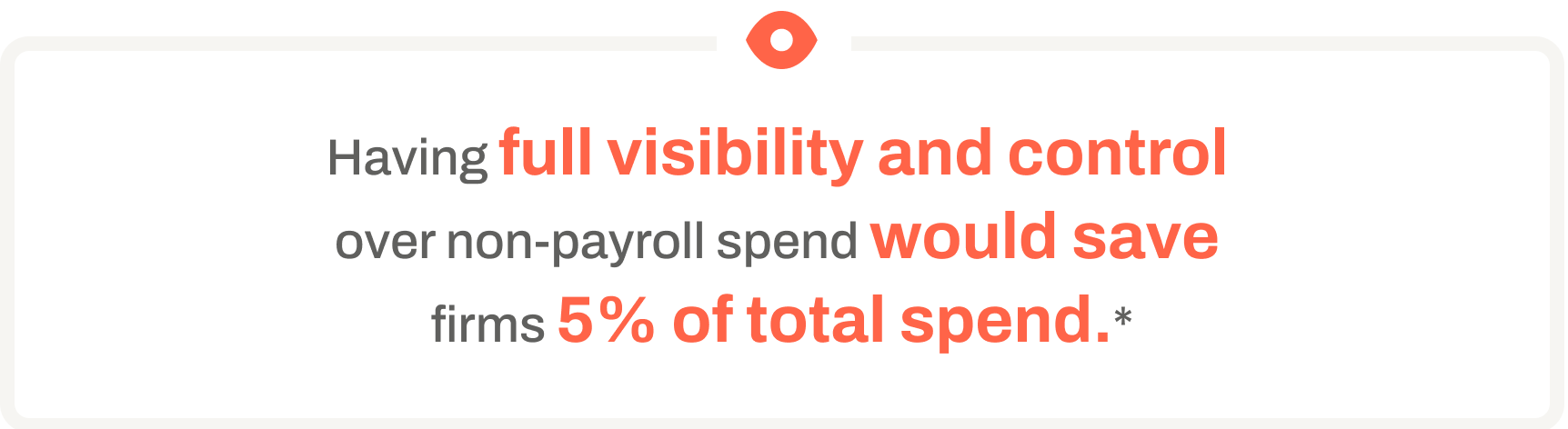

Two words: visibility and control.

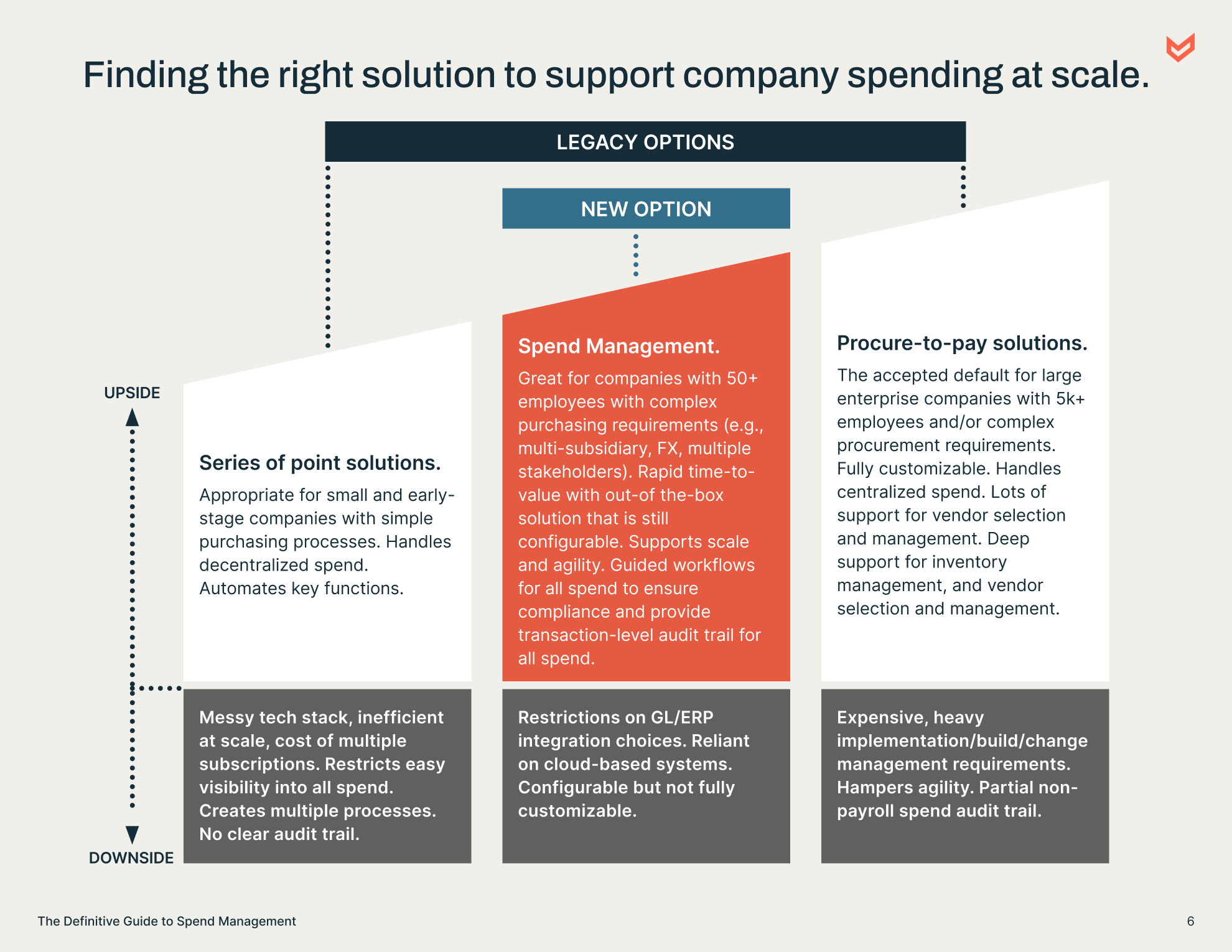

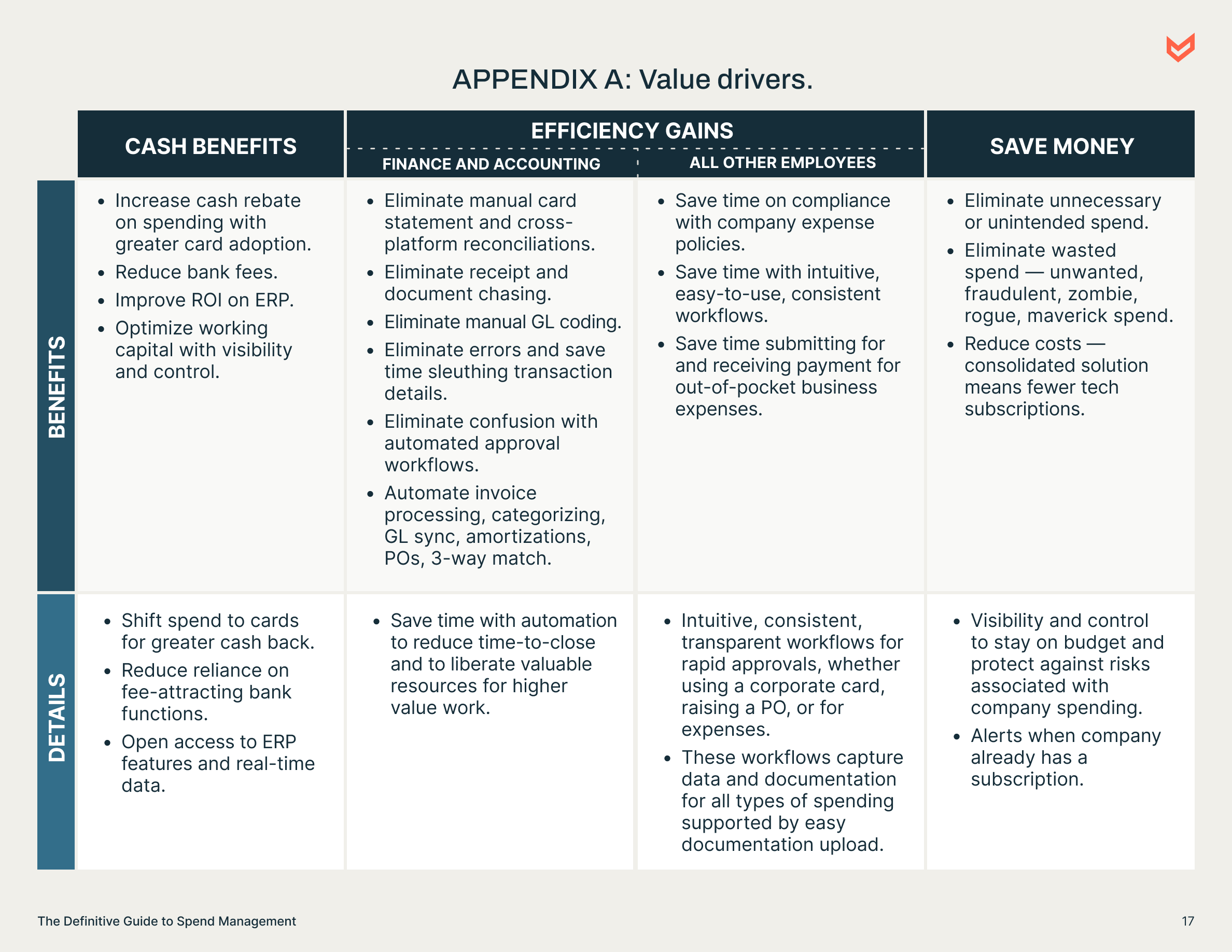

The status quo for company spending in companies with 100 to 5,000 employees is broken. It consists of messy tech stacks of siloed solutions that give rise to manual work, a lack of control, wasted spend, and unnecessary risks. The benefits of shifting to spend management are tangible, measurable, and are felt across the whole organization.

- Elimination of confusion and chaos.

- Better data and cleaner processes.

- Automated workflows from spend request to final booking.

- An efficient and easy-to-use process for accounting teams and for all employees who need to spend company money.

- A single source of truth for all non-payroll spend.

- Improved spend culture across your company.

- Faster time-to-close.

- Automatic compliance.

- Customizable controls in line with budget and policy.

“I’m solving the problem of paying for company expenses in a remote world. Now I can track and immediately pay for things with my company’s approval and I don’t have to think twice.”

*G2 is a top-ranked review site. All reviews are from verified users and can be accessed by visiting their site.

03

Here, there, everywhere.

The rise of decentralized spending helps employees get what they need, but it creates challenges for those charged with accounting and oversight. Increased remote work has compounded the risks.

It’s not an either/or world — your systems should handle it all.

Employees pay vendors directly using a corporate card or their own personal funds before being reimbursed.

Purchases can be made by individual employees without scrutiny by an intermediary (e.g., an IT or procurement team) before they’re executed.

- The good: Empowers employees to easily and quickly get access to the services and tools they need to do their jobs.

- The bad: Without spend management it’s impossible to have visibility into, and control over, this type of spending.

Common in enterprise-level companies with formal procurement teams. High-level managerial access and oversight occurs over spending.

Funds are not necessarily accessible to other employees.

- The good: Visibility and control over all spending.

- The bad: Tends to overburden employees administratively, and creates friction in getting access to the tools and resources to do their jobs.

04

Four modules of spend management.

The functionality of each area is essential. The combination is magic.

Guided Procurement

Guided Procurement Accounts Payable Automation

Accounts Payable Automation Expense Management

Expense Management Corporate Cards

Corporate CardsThese modules can be configured to address the needs of your company. Let’s take a look at each of the areas.

* Key Performance Indicators for B2B SaaS Companies. A PYMNTS & Airbase Collaboration, June 2022.

“On a weekly basis — between the automation, and everything being in one platform — I’m saving at least 15 hours a month. That time is much better spent making further improvements and serving the company.”

1. Guided Procurement.

It can be confusing for employees to know what types of purchases are allowed, how much can be spent, who needs to approve, and what information and documentation must be collected.

Guided Procurement directs employees to gather necessary information and documentation, and automatically routes it to all stakeholder systems for their approvals. This innovation provides clarity, reduces friction, and ensures compliance.

Using flexible, no-code workflows, rules can be dynamic depending on the type and amount of spend.

This approach to purchasing intake gives additional stakeholders, like legal, IT, and procurement, complete control and visibility from the moment a purchase request is initiated.

For companies who are growing, but not yet in a position to implement an expensive P2P system with heavy, lengthy implementation processes, Guided Procurement through a spend management system can provide a more appropriate choice — in function and cost.

What does Guided Procurement do?

- No-code customizable purchase and approval workflows.

- Automated, multi-step request submission process for employees.

- Customizable forms, approval matrices, and conditions.

- Integrations with IT, finance, and legal systems of record, such as Jira, Ironclad, Vendr, and more.

- Complete audit trail.

2. AP Automation.

AP Automation features of spend management:

- Bill creation.

- Purchase order automation.

- 3-way match.

- OCR scanning of documents (auto-fill).

- Global subsidiary support.

- Amortization scheduling.

- W-9 compliance settings.

- Auto-categorization of invoices and transactions.

- Vendor portal.

- Vendor credits.

- Automated receipt compliance.

- Scheduling/executing payments.

- Real-time spend reporting.

- International payments.

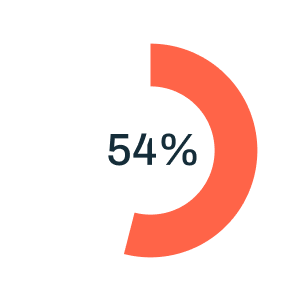

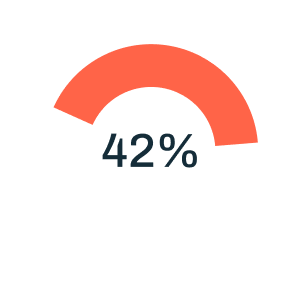

Over 85% of finance and accounting professionals agreed that they wish they had more visibility, control, and automated workflows regarding company spend.*

3. Expense Management.

The expense management process requires:

- Employees to provide documentation.

- Accounting to book the expense.

- A non-taxable payment made to employee in the case of reimbursements.

Previously, single-point expense management solutions offered limited functionality to effectively reconcile, report, execute, and review expenses — multiple solutions and systems were needed, but not anymore.

What does spend management do to help?

- Automatic receipt upload.

- OCR auto-scan of receipts and emails for details.

- Automated requests and approvals.

- Review, clarification, and approval from within Slack and email.

- Deposit funds for expenses directly into an employee’s personal bank account.

- Total audit trail of every detail, all synced to the ledger.

- Consolidated expense management process in one system — no switching between solutions.

- Automated approval workflows that expedite expenses while also enforcing compliance.

“Airbase Expense Management is a super smooth integration with NetSuite. I measure that success off of how few complaints we get from employees. To get nearly 300 employees onto an expenses process and have it go smoothly is a big deal.”

4. Corporate cards.

A corporate card used on a spend management platform is sometimes referred to as “software-enabled.” This means that all transaction activity such as approvals, spend category, vendor, amount, and date are captured by the spend management platform and transmitted to the GL.

Corporate cards can refer to:

- Traditional physical cards.

- Virtual cards.

- Debit or credit cards.

- Spend management cards which are software-enabled.

Virtual cards can be generated for:

- Specific vendors.

- Specific initiatives.

- Specific employees.

- Specific departments.

- One-off purchases.

- Specific expiration dates.

Meet virtual cards, meet card control.

The ability to quickly generate virtual cards is a defining benefit of using a spend management system. After receiving approval for a purchase, a quick tap generates a card number to share with the relevant vendor.

- Virtual cards are synced to the GL.

The categorization of spend and the transaction flow directly to the ledger for automatic booking. - Approval workflows are connected to the card in the spend management system.

This ensures compliance with company policies and leaves a clear audit trail of approvals.

Spend management takes your traditional cards into the software-enabled future.

Comprehensive spend management platforms give you a choice of card options. Virtual and physical cards and sometimes cards from a third-party provider.

For example, Airbase’s partnership with American Express means that — in addition to offering Airbase cards — we give you the option to simply integrate your existing card provider into the Airbase platform.

05

Complex workflows and accounting needs.

Advanced approval and oversight workflows, 3-way match, amortizations, invoice and receipt processing, consolidated real-time reporting, multi-subsidiary and multi-currency support— spend management automates them all in one place.

1. Approval workflows.

Approval workflows mean spend will be accurately categorized, on budget, requested, supported with relevant documentation, and kept compliant under the watch of delegated observers or approvers

Qualities of strong approval workflows:

- As simple or complex as required — customizable.

- Routed depending on size and type of spending.

- Easy to set up, update, and use.

- Applicable across all use cases (cards, PO requests, expenses).

- Manageable within a single platform.

- Reflective of company policies.

- Integrated with communication tools (e.g., Slack, email, Jira, Ironclad) minimizing time between requests, approvals, and follow-up communications.

- Avoids bottlenecks in productivity (e.g., establishing replacement approvers).

- Creates audit trails of approval process.

- Integrated with HRIS software to provision employees and capture organization hierarchies and changing employee status.

The automated linking of approval processes to card spend is a radical contribution by spend management.

Making sure only the right spend happens:

Approvers: Approvers are the delegated party to approve or deny spend or expenses.

Observers: Observers are users who can be assigned oversight access without the explicit power of an approver.

@Mentions: Any others who might be involved in the communication about a purchase.

2. Additional stakeholders.

3. Accounting automation.

Automation has revolutionized accounting in many ways. Here’s how it’s helping spend management:

AP processes: Basic AP features, such as bill amortization, payment scheduling, and payment execution are fully automated.

Approval workflows and receipt compliance: Automated approvals, as well as receipt and invoice processing, mean you have every detail on hand.

Auto-categorization for GLs: Using machine learning to improve its performance, auto-categorization frees up substantial time for accounting teams.

OCR: Automatically extract key information without manual input.

Compliance tracking: Additional oversight to ensure adherence to company policies.

Alerts and reminders: Fraud warning, missing W-9s, approval requests, requests for subscriptions.

4. Purchase orders and 3-way match.

Invoice management: Automatic routing of invoices to an invoice inbox saves time, administrative work, and provides context. Scan emails to capture and add in any relevant additional information.

PO creation: When a purchase order is needed, the system should be able to generate one and match it against the invoice(s). The GL identification number of your ledger will appear on POs and bills to help organization and syncing.

NetSuite 3-way Match from Airbase: A time-tested verification and risk control procedure ensuring your company gets what it pays for. Airbase partners with NetSuite to create a fully-automated, seamless 3-way match experience, keeping PO processes aligned with an up-to-date ERP.

Alerts and reminders: Fraud, missing W-9s, approval requests, requests for subscriptions.

5. Real-time reporting.

A spend management system tracks and captures every detail of all spend as it happens. This increases visibility and creates actionable insights in real time.

Consolidation of non-payroll spend means that budget owners can pull total spending, whether on cards, via POs, or for expenses any day of the month.

Spend management creates opportunities to keep the GL updated and balanced as transactions occur — a continuous close.

This turns an activity that can take several days, or weeks, into a manageable daily task. Leadership can take a more agile approach to planning and forecasting.

Capturing data and organizing it into a complete transaction-level audit trail also means that information is where it needs to be whenever it is needed.

Find out more about the real-time reporting capabilities of Airbase here.

6. Multi-subsidiary and multi-currency support.

A comprehensive spend management system offers multi-subsidiary reports, multi-currency-enabled payments, and reporting.

When the GL supports multi-subsidiary reporting, like with NetSuite, spending can be easily booked to the subsidiary level. A unified and consistent approach to managing spend across multiple entities, and around the globe, adds efficiency to your finance operation.

See our ebook Managing Subsidiaries: Payments, Accounting, and Control to further understand the benefits of a spend management system for multi-entity businesses.

If spend isn’t visible, it’s invisible. Time is up for delayed payments and manual entry.

06

Conclusion.

Airbase is the #1 spend management platform on G2 which is based on verified user reviews.

Modern solutions are holistic and collaborative.

Spend management solves the many problems companies face when it comes to making purchases. It’s an innovation made possible because of advances in digital payments technology, APIs, no-code tools, and cloud-based collaborative software.

Modern finance teams see that automation takes low-value work off their hands while accurately capturing and organizing data and documentation. They also appreciate the unprecedented visibility and control to ensure efficiency and compliance.

Spend management supports the increasingly complicated procurement workflows of modern company spending. It takes a holistic approach to solving for the risks and inefficiencies, and redefines best practices for the safe, efficient, compliant, and properly recorded use of company capital.

APPENDIX B: So, what does the system actually do for you every day?

- Vendor details.

- Information/document requirements.

- Automated, multi-step request submission process for employees.

- Customizable forms, approval matrices, and conditions.

- No-code customizable purchase and approval workflows.

- Stakeholder routing.

- Integrations with IT, finance, and legal systems of record, such as Jira, Ironclad, Vendr, and more.

- Complete audit trail.

- OCR invoice processing.

- Invoice inbox.

- Vendor portal.

- Slack and email integration.

- Pre-approval workflows.

- ACH, check, or card.

- Multi-currency/international payment options.

- Scheduled payments to arrive on exact due date.

- Clear audit trail of spend.

- Readily available data for reporting or budgeting.

- Vendor timelines and history.

- GL fully up to date.

- Employees bank account linked in Airbase app.

- Expense policies can be viewed.

- Request through app.

- Spend policy and approvals accessible so spend is compliant.

- Immediate receipt upload available through mobile app.

- Automatic syncing to GL.

- Correct observers, approvers, and stakeholders have visibility into expenditure.

- Easy receipt upload.

- Request funds for expenses at the point of purchase through mobile app.

- All spend details categorized and available for review in real time.

- Pre-approvals.

- Spend limits.

- Auto-categorizations.

- One-time or recurring cards.

- GL categorizations applied.

- Pre-set budget and policy conditions.

- Approver and observer visibility.

- Automatic booking, categorization, and sync to GL.

- Virtual, physical, single-use cards.

- Secure payment.

- Multi-currency and international payments.

- Clear audit trail of card transactions.

- Readily available data for reporting or budgeting.

- GL fully up to date.

G2 awards.

“It’s easy to use, very intuitive. Scheduling payments is seamless. Airbase makes paying bills a painless process now.”

“I would say that Airbase is a ‘Day 1’ tool. The longer you wait, the longer you’ll have bad spend in the system. The earlier Airbase is part of all of your workflows within your company, the easier it will be for you to manage spend over the longer term.”

“One of the reasons why we like Airbase is because it just saves us a lot of time with real-time syncing. We don’t have to do a lot of reconciliations, we have to do fewer accruals now because everything’s on credit card, so it’s getting charged when it’s supposed to charge.”

“Both the physical and digital cards are easy to use. As a team lead, the best part about this platform is that the approvals process is quick and easy and I don’t feel like the bottleneck that’s holding up our spending process anymore. I also love that you can upload receipts straight to the platform — which definitely helps streamline the process.”

* We use quotes from the #1 review site G2, which does not allow full attribution. All reviews are from verified Airbase users and can be accessed by visiting their site.

Jira

Jira  Ironclad

Ironclad  Asana

Asana