When you are growing quickly, you need to know how much money is coming in, how much is going out, and what investments are delivering the best results.

Nobody waits for month-end and quarter-end reports because that slows down the decision-making process. Oftentimes executives and managers make up for this information delay by reaching out to the finance team to pull reports manually whenever they need up-to-date numbers.

This isn’t an efficient use of time for a finance team that could be focusing on more strategic work. The solution is to implement a real-time expense accounting system that can save your team time on ad-hoc reporting and shave days off your month-end close.

Automating expense accounting

If you are a fast-growing startup, you likely have hundreds or thousands of transactions on a monthly basis coming in through credit cards and vendor invoices. Reconciling, coding and posting all of these transactions to the general ledger is manual, tedious, and takes a ton of time.

The Airbase spend management platform allows you to automate a lot of this work by coding and recording many of the transactions in your general ledger automatically.

Here is an example of how it works:

- Your employee submits a spend request in Airbase asking for $240 for a one-year subscription to a new SaaS application.

- The request goes to the employee’s manager following the company’s approval matrix, and gets approved.

- Airbase creates a unique virtual card with a custom spend limit for that vendor, and sends the employee an approval notification with the card details.

- The employee uses the virtual card and makes the transaction.

- Finance reviews the transaction to set the coding rules for the vendor and that particular virtual card.

- Airbase automatically categorizes and records all subsequent transactions in the general ledger.

You can use Airbase’s AP platform to process and manage your POs, invoices, and ACH & check payments, but we recommend shifting more transactions to virtual cards to drive more automation and save your team a lot of time and effort.

For example, if the subscription charge for the new SaaS app lands monthly, the employee won’t have to submit a $20 expense report every month and finance won’t have to code and post each transaction.

You can also set up automated rules to amortize payments. If you buy an annual subscription for a SaaS app that costs $1,200, you can create a rule that says this is a pre-payment and to assign $100 for the next 12 months instead of tracking it in a spreadsheet and doing it by hand.

This process will help you scale without adding to your accounting headcount as your transaction volume increases.

Enable faster reporting

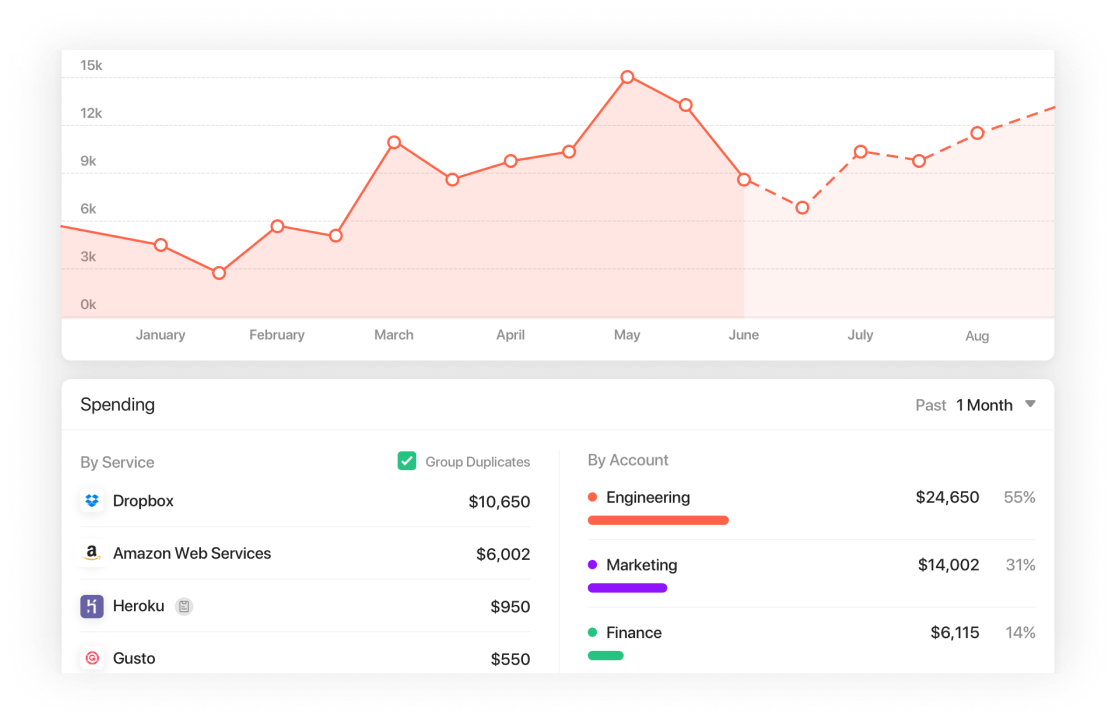

Giving each transaction a spend owner in the Airbase system allows you to see exactly how much money an employee or a specific team is spending with a couple of clicks instead of the old way of moving between different systems and crunching numbers in spreadsheets.

Once you aggregate all your expense numbers in one place in real-time, you can instantly see if spend is within plan.

You can also answer expense-related questions much faster:

- How does our AWS spend this month compare to the past 3, 6, and 12 months?

- How much has marketing spent on Linkedin and Facebook this month?

- Is this normal for us to spend this much on Salesforce?

Managers and executives can use Airbase as a self-serve reporting tool to look up the data themselves, and save everyone time.

Understanding the main benefits

The benefits of setting up real-time accounting through Airbase:

- Reduce time-intensive, administrative tasks such as chasing down approvals and receipts

- Automatic transaction reconciliation

- Faster employee-, team-, expense account- and vendor-specific reporting

Real-time accounting allows you to gather financial information, and access it when you need it so that your organization can make faster data-driven decisions.

Interested in learning how you can use Airbase? Explore our plans and schedule a demo today.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana