Invoice automation software focuses on streamlining invoice handling for AP teams. Due to its many benefits, invoice automation software is a critical tool for companies seeking to optimize their payable processes. By reducing manual data entry and eliminating approval bottlenecks, invoice automation software improves efficiency and minimizes errors in the AP process.

What is invoice automation software?

Invoice automation software refers to digital solutions that streamline and manage the handling of invoices with minimal manual effort.

The most advanced invoice automation software extracts, validates, and processes invoices by leveraging technologies like:

- OCR

- AI

- Machine learning (ML)

- Automated workflows

What’s the difference between invoice automation and AP automation?

Although they can be confused, these terms differ in scope. AP automation is a broader term that encompasses the automation of all processes within the AP function, including invoice automation, payment processing, vendor management, and compliance tracking.

Here’s a quick summary:

| Aspect | Invoice Automation | AP Automation |

| Scope | Solely handling invoices | Includes invoice processing, payments, vendor management, and compliance |

| End goal | Accurate and efficient invoice approval | Full automation of the AP lifecycle, from invoice receipt to payment |

| Tasks automated | Invoice capture, validation, approval | Invoices, payments, vendor records, spend tracking, audit trail, compliance |

| Targeted users | AP teams | Entire finance or AP department |

| Technology used | OCR, AI, ML, workflow automation | Same as invoice automation, with the addition of payment platforms and compliance tools |

What is automated invoice processing software? (& how it’s different from invoice automation).

While they sound similar, automated invoice processing software and invoice automation software differ in their scope and focus.

Invoice automation software refers to tools designed to streamline the entire invoice management process using technologies like OCR. These platforms handle tasks such as data capture, validation, approval workflows, and integration with accounting or ERP systems. By automating repetitive manual tasks, invoice automation software reduces errors, accelerates processing times, and improves financial accuracy and visibility.

Invoice processing software, while overlapping in functionality, generally refers to tools focused specifically on the operational aspects of handling invoices, such as digitizing and recording invoice data, matching purchase orders, and validating information. It may lack the broader integration or advanced automation capabilities seen in comprehensive invoice automation solutions.

Why invoice automation is superior to manual entry.

Invoice automation is significantly superior to manual entry in terms of speed, accuracy, cost, and scalability.

Here’s a breakdown:

- Cost efficiency: Manual processing can cost between $12 and $16 per invoice due to labor, paper, and error correction costs. A less obvious benefit is that the invoice automation software frees up the AP team to focus on more strategic tasks, such as optimizing cash flow.

- Time savings: Automated systems can reduce invoice processing times. This means quicker vendor payments and fewer late payment penalties compared to the slower, human-intensive manual process.

- Error reduction: Manual entry has an inherently higher risk of errors, such as incorrect data entry or lost invoices, which can lead to inaccuracies, strained vendor relationships, and wasted time trying to fix those mistakes. Automation, through technologies like OCR, drastically reduces these risks by validating data automatically.

- Scalability: While manual processes struggle to handle high invoice volumes, automation scales effortlessly, accommodating growth without adding headcount.

- Visibility and reporting: Manual systems often lack real-time visibility, which holds back budgeting and decision-making. Automated systems provide enhanced visibility with dashboards and reports for better control over financial operations

The main benefits of invoice automation software.

The main benefits of accounts payable (AP) automation software include:

- Increased efficiency: Automating tedious, time-consuming tasks like invoice data capture speeds up the AP process, allowing teams to focus on higher-value activities.

- Cost savings: Reduces expenses associated with manual processing and helps surface opportunities for cost savings, such as identifying early payment discounts.

- Improved accuracy: Reduces human errors through automated data extraction and validation, ensuring accurate financial records and reducing the risk of compliance issues.

- Better cash flow management: Provides real-time visibility into outstanding liabilities and payment schedule. This supports better cash flow planning and forecasting.

- Enhanced compliance: Maintains audit-ready records with detailed logs of approvals, payments, and policy adherence, simplifying audits and regulatory reporting.

- Scalability: Handles high volumes of invoices, making it ideal for growing businesses or enterprises with multiple subsidiaries and diverse operational needs.

- Stronger vendor relationships: Supports timely payments, reducing late fees, and building better trust with vendors, which can lead to more favorable terms.

- Advanced reporting and insights: Offers dashboards and analytics for spend tracking, allowing companies to identify trends and optimize financial strategies, enhancing strategic decision-making.

The 5 best invoice automation software platforms.

1. Airbase.

How Airbase solves invoice automation.

Airbase handles invoice automation by streamlining invoice processing through AI-powered features. Key capabilities include:

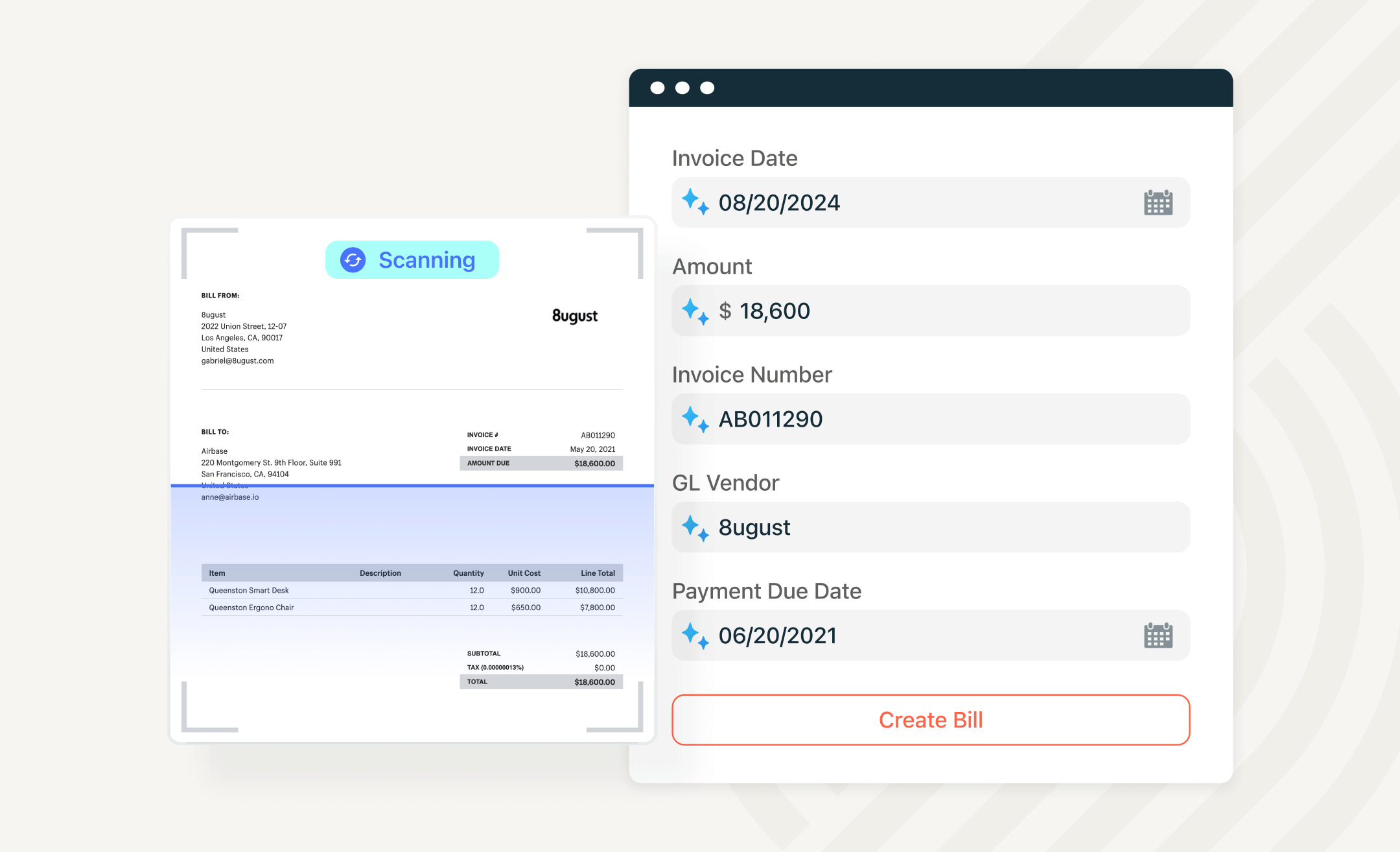

Automated invoice capture and coding: Airbase uses OCR and AI to extract data from invoices at both the header and line-item levels. This ensures accurate data entry and categorization.

OCR extracts data at both the header and line-item levels

Approval workflow automation: Airbase has customizable approval workflows based on specific attributes such as invoice amount or department. Automatic routing and reminders expedite the approval process, reducing bottlenecks.

Approval workflows can be easily customized

PO matching: Airbase supports both 2-way and 3-way matching to help ensure all payments are compliant and error-free.

Streamlined payments: Airbase automates payments by multiple methods, including ACH, checks, wire transfers, and virtual cards. It flags possible duplicate payments.

Compliance and audit readiness: The system automatically maintains an audit trail of invoices, approvals, and payments, ensuring audit readiness and compliance with tax and regulatory requirements.

Filter all transactions with missing receipts and get the system to enforce compliance

Vendor Management: Airbase enables efficient onboarding and management of vendor details, including tax compliance validations like W-9 forms for U.S. vendors. Vendors can update payment and contact details on the self-serve portal and monitor payment status, reducing administrative workload for finance teams. Airbase tracks vendor activity and compliance, offering full visibility into vendor-related transactions and contracts for better control and reporting.

Airbase pros.

- Ease of use: Airbase’s intuitive workflows support easy adoption and onboarding.

- Multi-subsidiary and multi-currency support: Make payments across global or domestic subsidiaries in over 145 currencies.

- Advanced analytics: Comprehensive spend analytics provide strategic insights into spending patterns and workflow weaknesses.

- Consolidated spend management: In addition to invoice automation, the Airbase platform can include modules for other AP functions like expense management and procurement. Combining these functions creates a unified AP operations system, reducing silos and enhancing visibility across all spend categories. Organizations can start with the module they need most, and add others as needed.

Airbase cons.

- Lack of AR invoice processing: Airbase is focused on AP.

- Complexity for small teams: Smaller businesses might find the range of features more than necessary and not realize the platform’s full potential.

- Lack of inventory control: Enterprise companies with complex procurement needs might require more advanced inventory management features.

Airbase is best for:

Airbase is best suited for mid-sized businesses that value visibility and control. Companies looking to streamline their AP tech stack benefit from Airbase’s consolidated approach.

AP Automation Tour

Explore 3-way matching in our AP Automation Product tour.

2. MineralTree.

How MineralTree solves invoice automation.

MineralTree automates invoice processing by using AI-driven tools to extract data, streamline GL coding, and route invoices through customizable approval workflows.

MineralTree pros.

MineralTree enhances security with built-in fraud prevention tools and integrates seamlessly with popular accounting software.

MineralTree cons.

- Occasional syncing delays: Some users report delays in syncing with accounting systems like QuickBooks, which can disrupt workflows.

- Limited in-app communication: The platform lacks robust tools for messaging or resolving invoice-related queries directly within the application, which may slow collaboration.

MineralTree is best for:

MineralTree is best for small to mid-sized businesses.

3. Nanonets.

How Nanonets solves invoice automation.

Nanonets handles invoice processing through AI-powered automation, combining OCR and ML. It captures data from invoices in various formats, validates this data using rule-based logic (like PO matching), and automates approvals and exception handling to expedite the invoice lifecycle.

Nanonets pros.

Nanonets stands out from competitors with its highly customizable workflows and superior AI-driven accuracy in extracting data from complex invoice formats, ensuring faster and error-free processing. Its seamless integrations with a wide range of accounting and ERP systems offer more flexibility for businesses compared to platforms with limited integration options.

Nanonets cons.

- Pricing concerns: Can be expensive for small businesses or startups, particularly for advanced features or high document volumes.

- Learning curve for custom model: While the interface is user-friendly, training custom models may require some familiarity with machine learning concepts.

Nanonets is best for:

Nanonets is a strong choice for organizations seeking to streamline document processing and data extraction. However, companies must weigh its cost and any potential technical challenges against the efficiency and automation benefits it delivers.

4. Plooto.

How Plooto solves invoice automation.

WIth Plooto, users can import invoices via email or direct upload for automated processing and integration with the ERP.

Plooto pros.

Plooto provides an easy-to-use platform for managing domestic and international payments. Plooto is cost-effective and well-suited for small to mid-sized businesses.

Plooto cons.

- Limitations on approval workflows: Plooto’s approval workflows lack the advanced customization capabilities needed to accommodate the complexities of rapidly growing businesses.

- Limited ERP integrations: Plooto’s ERP system integrations are limited.

Plooto is best for:

Small to mid-sized businesses seeking a straightforward invoice solution.

5. Yooz

How Yooz solves invoice automation.

Yooz automates invoice processing by leveraging advanced OCR and AI technologies to capture, extract, and validate data from invoices across multiple formats, including email, mobile uploads, and bulk uploads.

Yooz pros.

Yooz’s strengths include its cutting-edge OCR technology, ERP system integrations, and comprehensive analytics capabilities.

Yooz cons.

- Complex interface: While Yooz offers a wide array of powerful features, its interface can be overwhelming for new users, which may slow down adoption and hinder overall efficiency.

- Data extraction issues: Some users have reported difficulties with uploading invoices and inaccuracies in the system’s data extraction process.

Yooz is best for:

Yooz is best suited for small to mid-sized businesses (SMBs).

Why Airbase stands out as the best choice.

When it comes to invoice automation software, Airbase offers the best combination of features, ease of use, and scalability. Its advanced AI and OCR capabilities ensure precise invoice capture and categorization, while customizable workflows eliminate approval delays and reduce manual work. Airbase goes beyond traditional invoice automation by consolidating spend management functions and providing a unified platform for invoice processing, expense management, and procurement.

With its multi-currency and multi-subsidiary support, Airbase is ideal for mid-sized and growing businesses looking to streamline their AP processes while gaining full visibility and control over spending.

But don’t just take our word for it. Book a demo to see for yourself!

More invoice automation FAQs.

Is invoice automation software worth it?

Yes, invoice automation software is worth it for any business looking to streamline their AP. It reduces manual effort, minimizes errors, ensures timely payments, and provides better control over finances. As a result, invoice automation software typically delivers significant ROI through cost savings and efficiency gains.

How do you select the best invoice automation software?

Selecting the best invoice automation software involves taking a close look at factors such as:

- Ease of integration with your ERP.

- The software’s use of features like OCR and approval workflows.

- How easily the software will support scalability for growing needs.

- Pricing.

- User interface — how easy is the platform to use?

- Ease of implementation.

- The level of customer support offered.

Reading reviews and requesting demos can help in making an informed decision.

How does invoice automation software work?

Invoice automation software uses technologies like OCR and AI to capture, extract, and validate invoice data. It routes invoices through customizable approval workflows and matches them with purchase orders and receipts.

What is OCR technology & how is it used for invoices?

OCR (optical character recognition) technology converts scanned or digital invoice images into structured text data. It extracts key details like invoice numbers, dates, vendor information, and line items.

How does invoice automation improve supplier relationships?

Invoice automation ensures timely payments, reducing delays and avoiding late fees, which creates trust in suppliers. It also provides vendors with real-time updates on payment status, improving communication and overall satisfaction.

Can invoice automation software handle 2-way & 3-way matching?

Yes, most invoice automation software supports 2-way (invoice and purchase order) and 3-way matching (invoice, purchase order, and goods receipt). This ensures that all records align before payments are approved, enhancing accuracy and preventing fraudulent or duplicate payments.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana