For a long time, invoice processing was a repetitive, multi-step manual process. Starting in the 1990s, automated solutions aimed to reduce the tedious data entry components. Fast forward to today, and on the most advanced AP platforms, automated invoice processing is a touchless experience that improves efficiency, accuracy, and much more.

What is automated invoice processing?

Let’s take a look at the different steps in invoice processing and the role of automation.

1. Invoice data extraction.

- Optical character recognition (OCR) and artificial intelligence (AI): Scanned paper invoices or digital invoices (PDFs, emails) are processed using OCR and AI to extract key data points like:

- Vendor name.

- invoice number.

- Date.

- Line items.

- Amount.

- Payment terms.

- Error handling: The system flags unclear or missing data for manual review.

2. Data validation.

- The extracted data is compared against existing vendor records in the database to ensure accuracy.

- The system checks for duplicate invoices and matches key details like invoice number and amount to avoid overpayments.

3. Approval workflow.

- The system routes the invoice through predefined approval workflows based on the organization’s rules. For example:

- Low-value invoices might only need to be approved by one stakeholder.

- High-value invoices may require multiple approvers.

- Notifications and reminders are sent to approvers to keep the process moving.

4. Matching.

- The invoice is matched with relevant documents such as purchase orders (PO) and receipts to verify accuracy (2-way or 3-way matching).

- If discrepancies are found, the system flags the invoice for review and manual resolution.

5. Coding and categorization.

- The invoice is automatically coded to the appropriate GL accounts based on AI and machine learning examining past behavior.

- Categories such as expense type, department, or project are assigned.

6. Posting to the accounting system.

- Once approved and coded, the invoice data is sent to the organization’s accounting or ERP system (e.g., QuickBooks, NetSuite) for recording.

7. Payment scheduling.

- Payment terms (e.g., due date, discounts) are analyzed, and the system schedules payments to optimize cash flow, ensuring timely payment while potentially leveraging early payment discounts.

8. Audit trail creation.

- Every step is logged to create a comprehensive audit trail, ensuring compliance and transparency.

9. Reporting and analytics.

- Data from processed invoices is used to generate insights, such as spend by vendor, department, or category, and track metrics like Days Payable Outstanding (DPO).

Automated invoice processing streamlines accounts payable workflows, reduces manual effort, and minimizes errors, making it a critical tool for modern financial operations.

AP Automation Tour

Explore 3-way matching in our AP Automation Product tour.

What are the main benefits of automated invoice processing?

Automated invoice processing is a game-changer for AP departments with many benefits. Check out some of the top perks:

Time savings with faster invoice processing.

Here’s a benefit that can’t be overlooked: a PYMTS survey found that 95% of organizations who employed automation say it streamlined their processes significantly.

That’s not surprising when we consider 97% of surveyed AP professionals say they waste time chasing down invoice details every month. (And let’s face it — that’s not exactly fulfilling work.) Automated invoice processing takes that burdensome task away.

Cost savings.

Invoice automation can save organizations significant amounts of money. Here’s how it delivers cost savings:

- Reduced manual labor costs: Automating tasks like data entry and invoice matching cuts down on labor costs and lets employees focus on higher-value tasks.

- Error prevention: Eliminating errors reduces potentially costly mistakes and the time spent correcting them.

- Fewer late fees: Automation leads to faster invoice processing, helping organizations to avoid late fees and potentially qualify for early payment discounts.

- Better cash flow management: About 54% of finance pros say they have no visibility into spending until after it happens. That makes it hard to manage cash flow and budgets. Automated systems give real-time visibility into payment schedules and upcoming payments.

- Fraud reduction: Invoice fraud costs the average company over $1 million annually. Invoice automation platforms have built-in fraud detection mechanisms to flag potential fraud.

- Early payment discounts: Being able to automatically schedule payments ensures that you don’t miss opportunities for early payment discounts.

- Reduced paper costs and storage: A digital system reduces environmental impact and lowers operational experiences.

Avoiding duplicate invoices & payments.

In manual systems, it’s easy for duplicate invoices to slip through unnoticed — and be paid! This can be due to a lack of internal controls, data-entry errors, vendor errors, or even fraud.

Streamlined approval process.

Who needs to approve what can be a complex knot to untangle. As companies grow, these approval chains can become even more complex. Sometimes approvals need to be sequential, but other times, concurrent is fine. Sometimes a manager may just want visibility into a request, without having to approve it. Being able to automatically route approvals saves time, improves visibility, and lowers stress.

Better vendor relationships.

Invoice automation ensures timely payments to vendors, which helps build trust and good relationships. Automation can provide real-time updates on payments, which reduces the need for follow-ups. And thanks to automated data entry, fewer errors occur, which also makes vendors happy.

Plus, with fewer administrative tasks on their plates, finance teams can focus more on building strategic relationships with their vendors, something that benefits both parties.

How does automated invoice processing work?

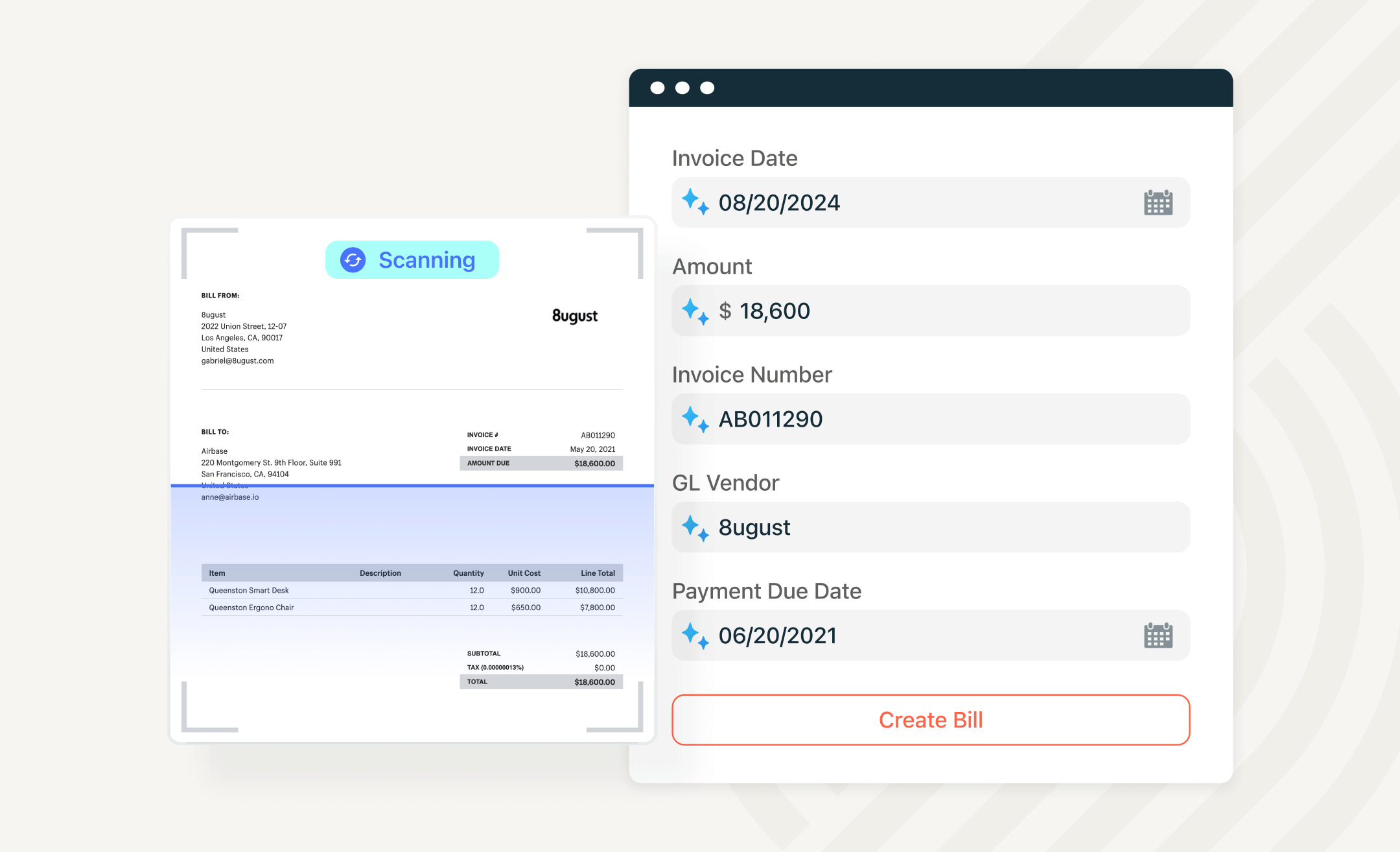

Invoice automation leverages advanced technologies like optical character recognition (OCR) and artificial intelligence (AI) to streamline the invoicing process.

OCR extracts key data when an invoice is received — such as invoice numbers, dates, supplier names, and amounts due — from documents in various formats, including PDFs, images, and handwriting, and converts the data to a bill for payment. AI automatically assigns GL categories based on past behavior. Transactions are coded, tagged, and recorded in the GL without any manual effort.

Automated approval workflows ensure approvals are routed to the correct stakeholders. The best invoice automation platforms include features like PO matching to identify discrepancies, built-in compliance with reporting requirements (e.g., collecting W-9s for 1099 reporting from vendors), automatic syncing with the GL, and flexible payment options like virtual cards, ACH, checks, and vendor credits.

Automated payment scheduling further enhances efficiency by ensuring timely payments, taking advantage of early payment discounts when applicable. Once approved, payments are executed automatically through the preferred method, with real-time tracking and visibility into payment statuses.

The ultimate result is less manual effort, faster processing speed, and better overall accuracy, freeing up time for finance teams to focus on strategic tasks.

What software & systems can be used for automated invoice processing?

Early invoice automation solutions primarily aimed to automate data entry and validation, relying on a mix of OCR technology and manual input to handle invoice information.

By the 2010s, solutions like NetSuite and SAP began providing fully automated accounts payable (AP) processes, enhancing efficiency, accuracy, and financial control.

With the advent of AI and ML, invoice automation systems like Airbase have become even more sophisticated, enabling automatic data classification and extraction from invoices while also predicting and preventing fraud.

The top 5 automated invoice processing software solutions.

1. Airbase.

Airbase is a pioneering platform that has redefined invoice processing by providing a touchless AP experience.

Airbase rating: Airbase has a G2 rating of 4.7/5.

Airbase strengths.

Airbase’s reviews frequently mention its ease of use and simple onboarding.

“What I like best about Airbase is its user-friendly interface and efficiency. It’s incredibly easy to use and understand, making managing finances a breeze.” — G2 review.

On a feature level, Airbase’s strengths include:

- Consolidated spend management: Airbase brings together touchless AP, a guided procurement experience, touchless reimbursements, and a software-enabled corporate card program. Organizations can start with the one module they need most, and add others as needed.

- Multi-subsidiary support: Airbase gives businesses the ability to manage multiple subsidiaries within a single platform, seamlessly linking each to its respective bank account.

- Custom approval workflows: Tailored, granular workflows can be designed to meet the unique needs of each subsidiary, ensuring compliance and control.

- Global payment capabilities: Supporting over 200 countries and 140+ currencies, Airbase simplifies international transactions and global financial operations.

- Advanced procurement features: Airbase’s dynamic procurement tools adapt workflows and steps based on user input.

- Streamlined spend management: Powered by OCR, machine learning, and AI, Airbase optimizes spend management processes, improving accuracy and efficiency in expense tracking and reporting.

- Advanced analytics: Easily gain strategic insights into spending patterns.

Payment scheduling tools further enhance efficiency by analyzing invoice terms to optimize cash flow. The system ensures timely payments, taking advantage of early payment discounts when applicable. Once approved, payments are executed automatically through the preferred method, with real-time tracking and visibility into payment statuses.

The ultimate result is less manual effort, faster processing speed, and better overall accuracy, freeing up time for finance teams to focus on strategic tasks.

Approval workflows are easily customized.

Airbase weaknesses.

Airbase lacks inventory management features that large companies with complex procurement needs require.

Invoice processing with Airbase.

Airbase’s AP automation and bill pay capabilities include an AI-driven invoice processing experience. Airbase converts invoices into bills by extracting key information and using AI to populate the bill based on past experiences. Airbase has advanced accounting functionality for streamlined invoice processing, W-9 enforcement for easy 1099 tracking, and flexible payment options.

2. Melio.

Melio is designed to help SMBS to schedule and automate vendors easily.

Melio rating: Melio’s G2 rating is 4.5.

Melio strengths.

Melio is free to use, making it a good choice for early-stage SMBs. It’s also often praised for its ease of use. Melio integrates seamlessly with major accounting platforms and offers multiple payment options.

Key features include:

- AP automation: Seamlessly integrates with accounting platforms to sync vendor and payment data.

- Invoice management: Extracts details from uploaded or emailed invoices, schedules payments automatically, and syncs transactions with the general ledger.

- Accounts receivable: Simplifies invoice creation with a built-in payment button for emails and automatic payment reconciliation.

- Flexible payment options: Supports batch payments, same-day bank transfers, instant transfers, and expedited check payments.

- Virtual cards: Provides virtual card options through integration with American Express.

Users can easily schedule payments.

Melio weaknesses.

Melio’s reviews frequently mention delays in payment processing. The platform also lacks advanced accounting features like in-depth reporting and analytics.

Invoice processing with Melio.

When integrated with popular accounting systems, Melio syncs bill details to eliminate the need for manual entry. Users can make recurring payments, split bills, or pay multiple bills in one go. Melio offers flexibility in payment methods, supporting options such as bank transfers, virtual cards, and checks.

3. Plooto.

Plooto is a user-friendly accounts payable system designed for small businesses. It provides a streamlined platform for managing payments, approvals, and cash flow, all in one place.

Plooto rating: Plooto averages a 4.6 rating on G2.

Plooto strengths.

Plooto simplifies AP and AR processes with automated workflows and efficient international payment capabilities.

Top features:

- Automatic invoice processing: Import invoices via email or direct upload for automated processing and integration with accounting software.

- Accounting integrations: Two-way sync with QuickBooks, NetSuite, and Xero to eliminate data entry errors.

- International payments: Send payments across 40+ countries, simplifying global money transfers.

- Plooto Instant: Pre-fund Plooto Instant account for faster bill payment.

- Centralized dashboard: Manage global money transfers, track payment statuses, and generate reports from a single platform.

- AP approval workflows: Customize and automate approval processes with tiered approvals and detailed audit trails.

Currency is converted automatically.

Plooto weaknesses.

Plooto’s approval workflows lack the detailed customization needed for rapidly growing businesses, and its integrations with ERP systems are relatively limited.

Invoice processing with Plooto.

With Plooto, users can import, manage, and pay both paper and electronic invoices from one centralized platform. It supports online checks, international payments, and automatic invoice reconciliation with accounting software like QuickBooks and Xero.

4. QuickBooks.

QuickBooks Online provides a comprehensive suite of financial management tools designed for small to mid-sized businesses. Its features include expense tracking and automated invoice processing.

QuickBooks rating: QuickBooks Online has a G2 rating of 4.0.

QuickBooks strengths.

- Consolidation: Provides a complete set of financial management tools, including cash flow tracking and budgeting functionality.

- Accounts receivable: Automates the creation and sending of invoice, in addition to invoice processing.

- User-friendly interface: Designed with simplicity in mind, QuickBooks features an intuitive interface with drag-and-drop functionality.

- Comprehensive expense tracking: Simplifies expense tracking by automatically categorizing transactions and linking receipts to specific expense.

QuickBooks weaknesses.

QuickBook’s financial reporting capabilities may not be as customizable or detailed as those offered by other platforms. Its invoice processing can be limited in customization, making it difficult for businesses with complex billing needs to fully tailor the system to their workflow. Plus, while it automates invoicing, the integration with some third-party applications isn’t always seamless, causing potential delays or data inconsistencies.

Invoice processing with QuickBooks.

QuickBooks invoicing lets users add logos, set currency preferences, and include a Pay Now button for easy credit card or Apple Pay payments. Automation features allow for recurring invoices and payment reminders. Users can also convert estimates to invoices, track billable expenses, and monitor payment status in real time, QuickBooks integrates with its own payment system, keeping everything synchronized and up to date.

Recurring invoices are easy to set up.

5. Yooz.

Yooz is a cloud-based AP automation platform that streamlines invoice processing and payment workflows.

Yooz rating: Yooz’s G2 rating is 4.4.

Yooz strengths.

Yooz stands out for its advanced OCR technology, seamless integrations with ERP systems, and robust analytics tools.

Key features include:

- Invoice capturing: Offers multiple ways to capture invoices, POs, and other documents including email, imports, mobile uploads, bulk uploads.

- PO automation: Makes it easy for employees to create purchase requests while generating POs upon approval.

- Automated coding: Leverages ML, AI, and big data to automate GL coding and PO matching across a network of vendors.

- Custom approval flow: Enables admins to set up approval flows or employees can select an approver from a dropdown list.

- Payment system: Allows users to approve and make payments using YoozPay, while payments get updated on the ERP system.

- Document segregation: Differentiates batches of invoices and prevents their duplication with YoozStamp.

Yooz offers multiple ways to upload invoices.

Yooz weaknesses.

While Yooz offers robust features, its interface can feel overwhelming to new users, potentially slowing adoption and efficiency. Users also have reported issues with uploading invoices and inaccuracies in data extraction.

Invoice processing with Yooz.

Yooz offers multiple ways to capture invoices, POs, and other documents including email, imports, mobile uploads, and bulk uploads. In addition to batch invoice management, Yooz leverages ML, AI, and big data, to automate GL coding, PO matching, and invoice processing across a network of vendors. Users can approve and make payments using YoozPay, while payments get updated on the ERP system.

See why Airbase leads the pack for advanced automated invoice processing. Take a self-guided tour!

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana