How would you describe the account reconciliation process? Tedious, time-consuming, a massive headache?

Every month, finance teams scour bank statements and ledgers to verify the accuracy of thousands of transactions. This process costs businesses significant amounts of time and money. It’s also subject to manual errors that can lead to compliance issues down the road.

But what if you could leverage automation software to accomplish the same lengthy task in just minutes? And not only faster — but with much higher accuracy rates.

Automatic account reconciliation speeds up the financial close process. As a result, businesses can reduce their dependence on manual, error-prone processes which leads to a strategic, data-driven approach that enhances decision-making and efficiency.

Why automate account reconciliation with software?

Traditional methods of reconciliation are tedious and prone to errors. They are no match for the complexities of modern financial ecosystems. When transactions occur across multiple platforms and currencies at lightning speed, organizations need equally advanced reconciliation tools.

Manual processes, burdened by inefficiencies, cannot match the pace of rapid transactions that span today’s financial landscapes. These shortcomings delay financial close processes and make it difficult to manage transactions across different platforms. This impedes timely decision-making and reduces operational agility.

In essence, traditional methods fall short in today’s complex financial environments. To that end, organizations need advanced reconciliation tools to keep pace.

The shift toward automated reconciliation tools strategically tackles the operational difficulties associated with manual reconciliation procedures, unlocking substantial strategic advantages. This, in turn, improves decision-making abilities and financial reliability.

Account reconciliation software solutions can automate the entire financial close process, driving greater efficiency, accuracy, and security. With automated reconciliation, businesses can save time and money and achieve greater financial integrity.

In order to tackle the complexities of today’s financial environments, account reconciliation software provides essential features like real-time transaction matching, discrepancy identification, and corrective action. This solution immediately reconciles transactions as they occur, identifying any discrepancies in the process. It also enables instant correction of any detected errors. This speeds up the accounting process and enhances the accuracy of financial reports.

Automating reconciliation processes reduces the potential for human error by taking over manual reconciliation tasks. Such advancements free up valuable time for finance and accounting teams, allowing them more time for analysis and strategy. This transition from manual to automated processes redefines the finance department’s role. Instead of endlessly crunching numbers to reconcile bank accounts and transactions, they can serve as a strategic business partner.

For senior finance and accounting leaders, this means an increased ability to allocate and protect company capital effectively. With the data-driven insights delivered by account reconciliation software, leaders are better equipped to make informed decisions.

What is account reconciliation software?

Account reconciliation software is a sophisticated tool designed to automate and simplify the reconciliation of financial accounts. At its core, this software compares account balances, including those from bank and credit card statements, against the ledger’s individual transactions. This ensures every entry matches its corresponding transaction in the financial statements. These powerful tools help ensure the accuracy of financial records and streamline accounting processes.

AP Automation Tour

Explore 3-way matching in our AP Automation Product tour.

How account reconciliation software works.

The operation of account reconciliation software involves several key functions.

Automated matching: The software uses algorithms to match transactions recorded in the organization’s ledger with those reported by the bank or credit card company. This includes checks, deposits, withdrawals, and other financial transactions.

Discrepancy detection: When transactions don’t match, the software flags these discrepancies for review. This could be due to timing differences, errors in recording, or unauthorized transactions.

Resolution support: It offers tools and workflows to investigate and resolve unmatched transactions, including the ability to annotate and attach documentation directly within the software.

Flexible reconciliation policies: Some software can accommodate various reconciliation policies and procedures. This allows for customization according to the specific needs and rules of an organization.

Seamless integration: It directly integrates with banking systems and ERP solutions, ensuring real-time data accuracy and consistency across departments.

Transaction-type versatility: There is software to handle a broad spectrum of transactions and, in some cases, the transaction software has this type of reconciliation capability built in. They range from daily operations to complex financial dealings, making it an essential tool for thorough and accurate financial reconciliation.

In essence, account reconciliation automation supports an organization’s financial health by allowing it to find any issues quickly and easily. It establishes a strong framework that carefully captures and reconciles all financial activities.

Key benefits of using account reconciliation software.

Account reconciliation software offers a range of strategic advantages that go well beyond just increased efficiency. Automating bank reconciliations leads to benefits like:

Error reduction.

One of the primary benefits of account reconciliation automation is its ability to significantly decrease errors in financial reporting. By automating the reconciliation process, it minimizes human errors that can occur during manual data entry or transaction matching.

In addition, automated solutions can better identify discrepancies during transaction matching, leading to more accurate accounting records. For example, during accounts payable reconciliation, the software can highlight invoice discrepancies, preventing overpayments.

This level of accuracy is important in maintaining the integrity of financial statements. In turn, greater financial accuracy supports strategic decision-making and investor confidence.

Time and cost efficiency.

The efficiency gains from automated account reconciliation are substantial. Previously, the financial closing process took accounting teams hours or days to complete.

Now, automated software can accomplish the same tasks in a fraction of the time. In turn, accounting teams are free to focus on core business objectives, rather than tedious manual tasks. This not only reduces costs but also enhances the overall productivity of the finance department.

Along with saving time, automating reconciliation can also save money. It reduces the need for extensive manual labor, thereby lowering operational costs. Additionally, the accuracy it provides can help prevent financial losses due to errors or discrepancies.

These time and cost efficiency gains can extend throughout the organization. Through automated bank reconciliations, businesses can identify patterns that point to inefficient internal processes. Refining these processes can help optimize internal systems and increase efficiency across the board.

Accurate financial reporting.

Accuracy is paramount in financial reporting, and automated reconciliation plays a key role here. Automated reconciliation ensures that financial statements are a true and fair reflection of the company’s financial position. This level of accuracy helps enhance control and ensure compliance with accounting standards and regulatory requirements

Accurate financial reports are also critical for strategic financial planning, building trust with stakeholders, and ensuring efficient cash management. Automated reconciliation aids in these results by reducing discrepancies. This promotes a clear understanding of the company’s financial status, optimizes cash flow, and underpins business objectives. In essence, the precision offered by automated reconciliation is foundational to a company’s strategic decision-making and financial stability.

Enhanced fiscal control and audits.

Enhanced fiscal control and streamlined audits are pivotal advantages when using account reconciliation software.

Account reconciliation software improves fiscal governance by creating an audit trail, and a detailed and clear record of all financial activities. This includes transactions, payments, and the reconciliation process.

Such transparency is invaluable during audit processes. It leads to a smoother, more efficient approach to financial review and makes it easier to prove regulatory compliance. This simplifies the audit process, reducing effort and complexity.

Improved fiscal control also boosts internal compliance. With clearer visibility, businesses can ensure employees follow reconciliation policies and financial rules. This transparency helps to identify and fix deviations quickly, maintaining strong financial management within the organization.

Also, the clear documentation and easy retrieval of financial records helps businesses quickly respond to audits and compliance checks — without the scramble often seen with manual systems. This not only expedites the audit process but also minimizes the disruption to regular business operations, maintaining productivity and focus on core objectives.

Reduced risk.

The automated reconciliation process reduces the risk of financial discrepancies and fraud by ensuring the accurate recording of transactions. This level of oversight is essential in protecting the business’s bottom line and safeguarding against financial loss.

Through automated internal controls and vigorous matching rules, businesses can better maintain the integrity of their financial operations.

Fraud prevention.

One of the most critical benefits of reconciliation is its ability to help prevent fraud. When reconciliation is automated, it surfaces irregular patterns or inconsistencies, and acts as a powerful early warning system. Such pre-emptive detection is invaluable, alerting businesses to potential fraud risks before they escalate.

This real-time oversight also has an immediate benefit. It significantly bolsters financial defense. Businesses gain the ability to move from a reactive stance — dealing with fraud after it has already impacted the financial statements — to a proactive approach. By quickly spotting fraud, companies can avoid its effects, including financial loss and damage to reputations.

Key areas for account reconciliation automation.

Account reconciliation automation can transform your financial processes, particularly in these key areas.

Automated flagging.

Through powerful transaction matching rules and defined workflows, reconciliation software can automatically flag payment discrepancies or unusual transactions in real time. Instead of spending time manually reconciling items and identifying discrepancies, accounting teams can focus on resolving issues and ensuring general ledger accuracy.

This allows businesses to promptly identify and address errors or potential fraud. As a result, companies can maintain the accuracy of their financial records and support effective financial management.

Seamless integration.

Cloud-based account reconciliation software can integrate with other business systems as well. This facilitates a seamless flow of data across platforms, providing greater accuracy and deeper insights.

Rather than relying on manual data entry, businesses can integrate the software with their accounts payable and receivable solutions. Data will sync automatically, reducing the potential for errors and ensuring consistency in financial reporting.

In addition, reconciliation software can analyze and compare historical data, internal records, bank statements, and other supporting documentation. As a result, businesses gain insights into their financial situation from both a macro and micro perspective. This level of data-driven understanding is key for strategic analysis and making informed decisions.

Workflow automation.

By automating accounts payable and accounts receivable reconciliation processes, businesses can develop standardized, efficient financial close and approval workflows. Managers can get real-time insights into reconciliation status, task assignments, outstanding issues, and other financial close processes.

This not only speeds up account reconciliations but also enhances the reliability of financial data, supporting accurate financial reporting and informed decision-making.

How you can automate account reconciliation with Airbase.

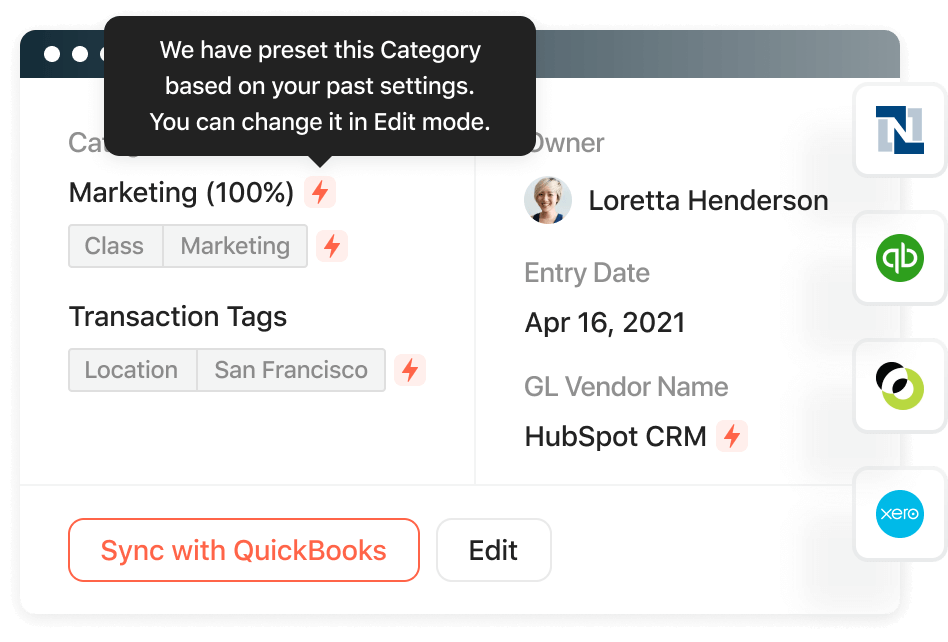

Airbase eliminates the burdensome task of finding areas of reconciliation.

Airbase automatically retrieves real-time GL data, matches transactions, and identifies discrepancies, all in a matter of minutes.

You simply review the reconciliation report to see the reconciliation entries between Airbase and your GL such as timing differences, transaction amount discrepancies, sync errors, missing entries, or entries created manually in the GL. This speeds up the reconciliation process by hours, reduces the margin for error, and significantly reduces your time-to-close.

SeekOut used to spend about six hours doing reconciliations. Thanks to Airbase, it’s now done in less than an hour. “I think during our time using Airbase, that’s one of our favorite features rolled out in the last two years,” says Director of Accounting, Chris Morello. “We’re getting four or five hours back every month. It’s not frustrating. We’re in control.”

Now is the time to explore how Airbase can help your business realize these benefits. With Airbase’s automated account reconciliation solution, you can transform your approach to financial management.

Start today and see how automated account reconciliation can improve your financial health.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana