Easily manage and gain visibility into global company spend across all subsidiaries and countries — in one consolidated spend management platform.

As your business grows, you need to manage company spend across the entire company, including all subsidiaries and countries. The problem is that many scaling companies with multiple entities rely on disparate solutions or manual processes that don’t provide global visibility or consistent controls.

Airbase brings all of the workflows for spending company money across subsidiaries into one system, with automated booking and reporting of transactions at the parent and subsidiary levels.

Benefits of Airbase multi-subsidiary support:

Drive internal efficiencies by managing your global business with uniform spend policies and consistent controls across your organization.

How it works:

Multi-subsidiary support makes it easy and efficient to manage company spend across subsidiaries and countries.

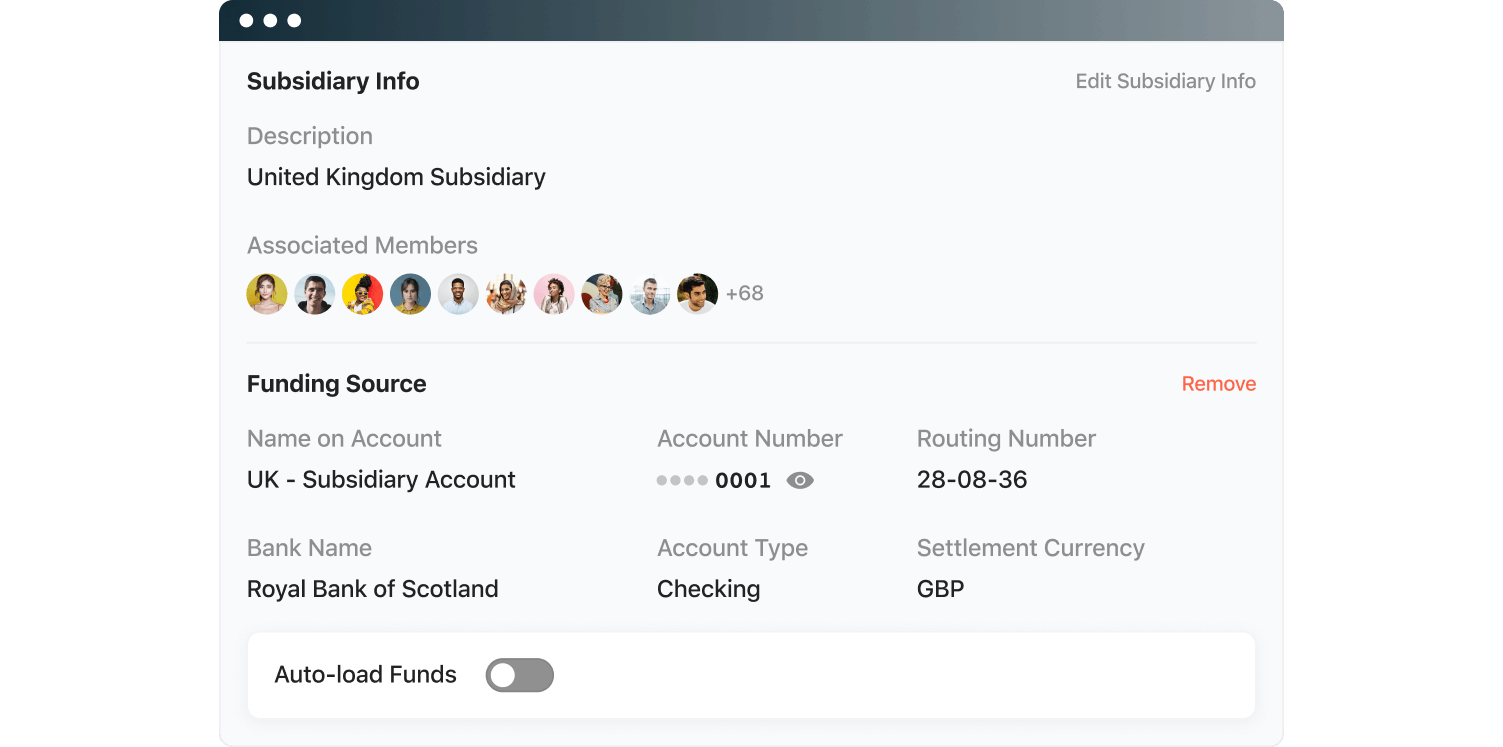

- Create multiple subsidiaries in a single Airbase instance, link each to a corresponding bank account, and connect subsidiaries to the GL.

- Assign a default subsidiary to each Airbase User and Airbase will automatically assign the cards, accounts payables, and expense transactions to the right subsidiary in the GL.

- Make payments from the associated subsidiary’s bank account. Cards, accounts payables, and expenses can be associated with your subsidiary-specific bank account.

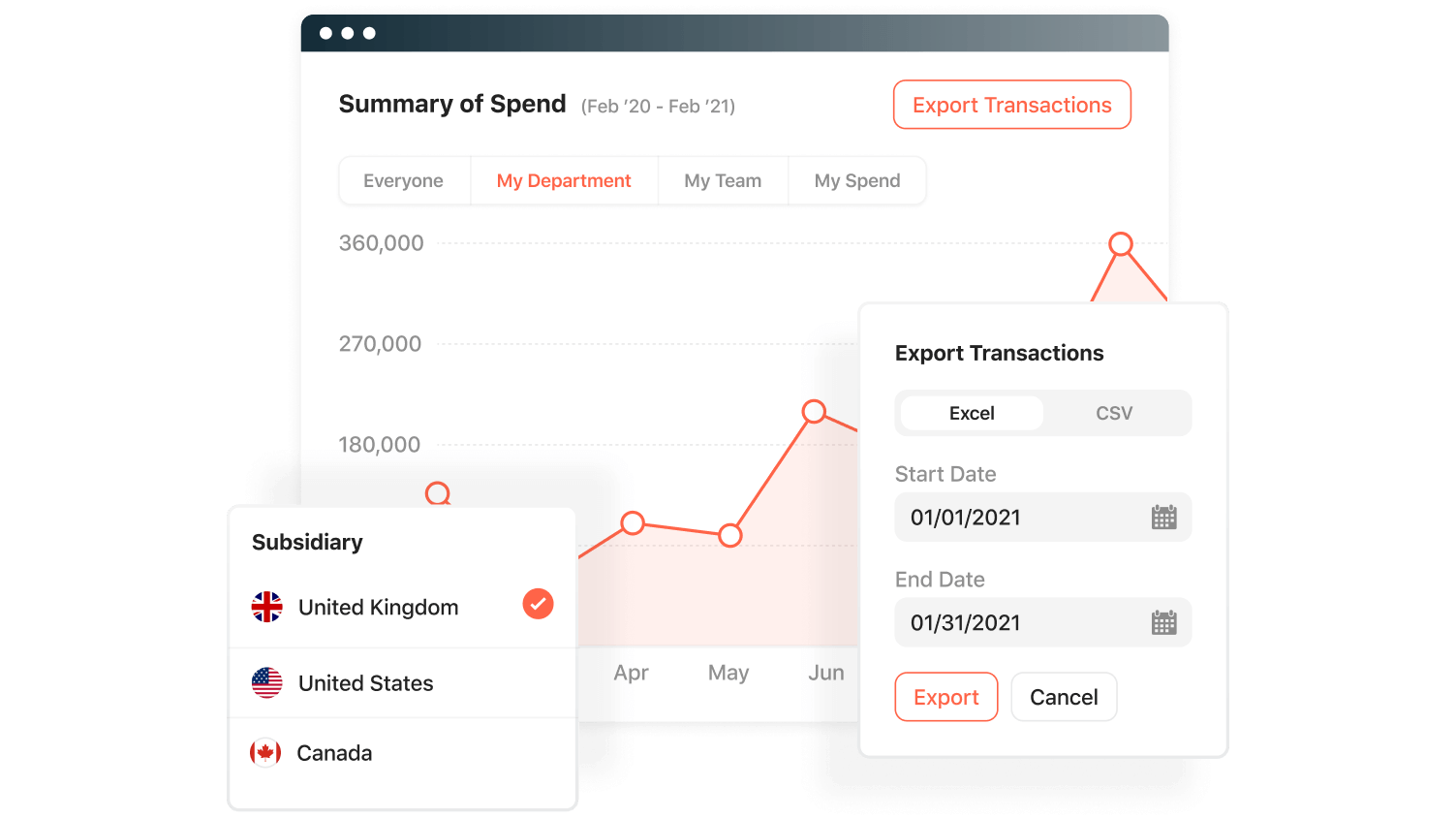

- View real-time reporting by subsidiary or consolidated across all subsidiaries and automatically sync transactions to the correct subsidiary in NetSuite.

For subsidiaries outside the US:

Cards, accounts payables, and expenses can be requested, created and approved by any employee irrespective of their location or currency of spend. However, please note the following differences from domestic subsidiaries:

- Visa branded cards issued against the international entity can be used for card payments in any country. These cards would be denominated in USD. Customers can fund their international entity card wallets by sending a wire transfer from their bank account.

- Get full multi-currency support across all major workflows.

Use case example:

View real-time spend by individual subsidiary or consolidated at the company level by easily selecting one or more subsidiaries.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana