Business’ back offices often have their hands full ensuring spending compliance, accurately recording transactions, capturing documentation, and reporting purchases to budget owners.

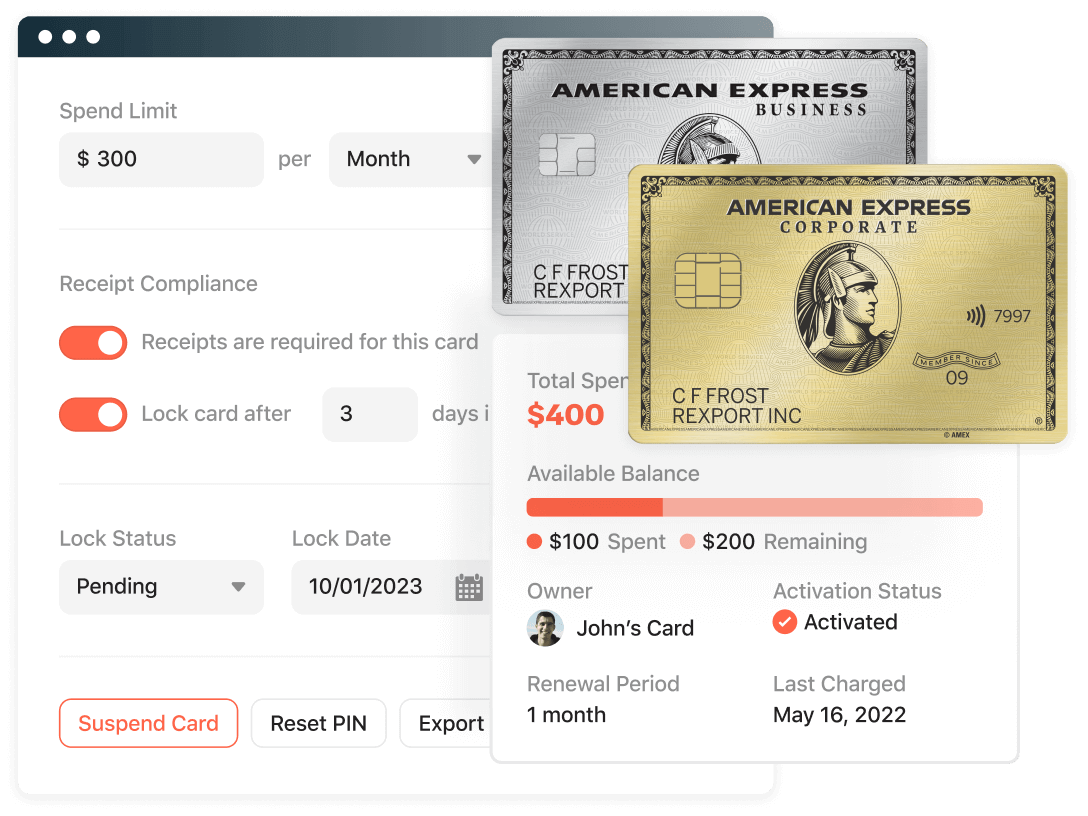

That’s why American Express has come together with Airbase, a spend management platform, to automate operational and accounting workflows associated with Business and Corporate American Express virtual Card spending. Airbase helps streamline approvals, categorizations, receipt capture, compatible general ledger sync, and real-time virtual Card and physical Corporate Card reporting.

Once enrolled,1 you can use American Express virtual Cards to help provide additional spending controls for your company and simplify the purchase process for your employees.

Unlock the potential of American Express virtual Cards.

American Express® Card Integration + Airbase Software Platform.

Use American Express virtual Cards to make online purchases and pay vendors. Streamline and increase control over your spend management process while enhancing the security of your transactions through virtual Card unique tokens for purchases.

Increase Control

- Set limits on virtual Cards.

- Pre-approve all virtual Card spending.

- Adjust and course-correct budgets.

Save Time

- Save time by automating manual tasks like checking for receipts, transaction categorization, and reconciliation.

- Enjoy faster time-to-close as transactions sync to your NetSuite, QuickBooks Online, and QuickBooks Desktop general ledgers as transactions occur.

Enhance Visibility

- Track and view virtual Card and physical Corporate Card spend in real time by department, program, category, or individual.

- Anticipate virtual Card spend before it happens with transaction pre-approvals in Airbase.

- Receive notifications for auto-renewals and possible duplicate spending.2

The Airbase packages include:

Earn Rewards

Earn the rewards of your American Express Card3 when used to make virtual Card payments on eligible purchases.

Reduce Risk

Simplify Spending

Streamline Processes

Save Money

Spend Smart

Contact your American Express Representative to learn more.

1Card enrollment required for U.S.-issued American Express Small Business and Corporate Cards. Separate enrollment with each of Airbase and American Express is required to utilize combined product offering. There is no fee to generate American Express virtual Cards. To make a Card payment to a supplier through the service, the supplier must be an American Express-accepting merchant and agree to accept American Express virtual Card payments. Additional upgrades, features, and payment methods may require separate activation, and fees may apply. Airbase is solely responsible for determining additional fees. Please contact your Airbase representative to learn more.

2Airbase does not cancel virtual Card purchased recurring subscription charges. Please contact the subscription provider to cancel services.

3Not all Cards are eligible to earn rewards. Terms and limitations vary by Card type.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana