Sync all your purchase transactions to Sage Intacct in real time for better reporting and a faster month-end close.

Your team spends hours manually reconciling, coding, and posting transactions to your GL, which is both time consuming and prone to errors. Month-end close is often delayed, restatements are common, and your business is left waiting for financial results.

Airbase’s first-of-its-kind spend management platform solves this problem.

With our Sage Intacct integration, closing the books is fast. Reconcile and automate your month-end close process by syncing transactions directly into your Sage Intacct GL. Whether bill payments, corporate cards, virtual cards, purchase orders, or personal expense reimbursements, continual syncing to the GL means you won’t be scrambling at month-end to pull together the numbers for leadership.

Benefits of the Airbase Sage Intacct integration:

Shorten your month-end close by handling all AP from one platform that automatically syncs transactions to your GL in real time, including refunds from vendors and cash back generated from virtual cards.

Save time and minimize errors by reducing the need for manual data entry, spreadsheets, expense reports, reconciliations, and multiple AP tools.

How it works:

Airbase syncs all of your spend to your GL in real time.

3 easy steps to integrate Airbase and Sage Intacct:

- Connect your Airbase and Sage Intacct accounts with our native integration.

- Set up accounting and GL syncing rules for your Airbase accounts payables, corporate cards, and expenses. Airbase auto-populates the appropriate GL accounts for each transaction for your review.

- As transactions get approved, Airbase automatically syncs the transactions to your Sage Intacct GL and keeps an audit trail of all the supporting documentation.

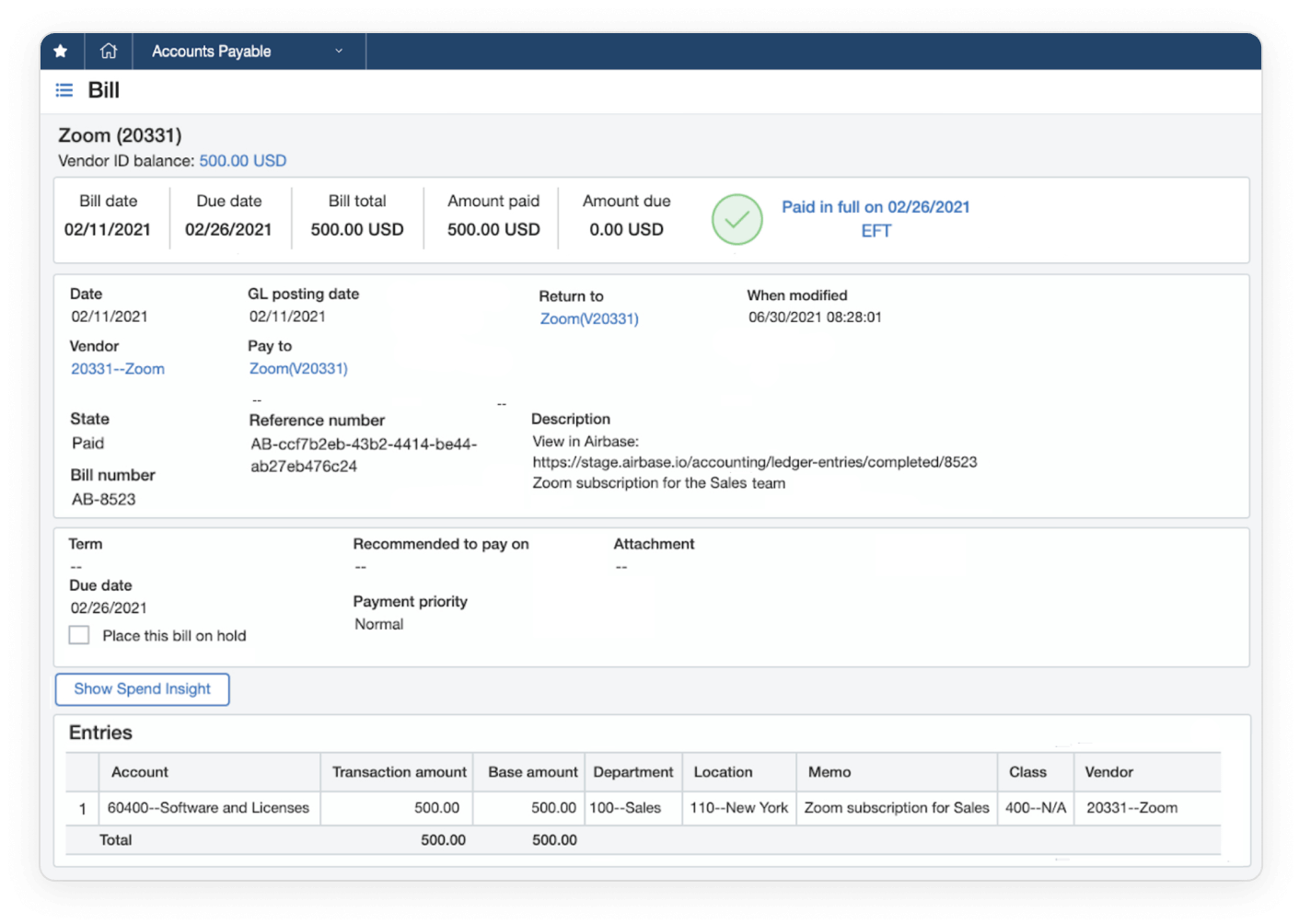

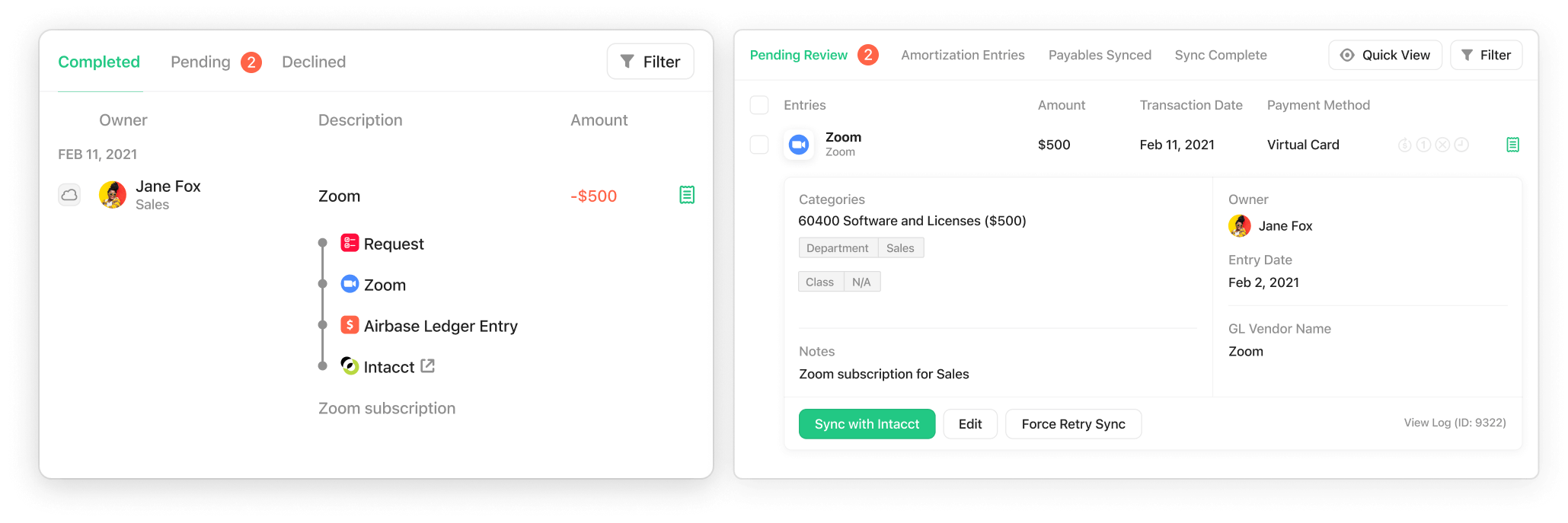

Use case example:

Your company pays its monthly Zoom subscription with one of Airbase’s virtual cards (to get cash back from the expense). When the payment is scheduled, a ledger entry is automatically made in Airbase with details populated from preset rules specific to that card. This entry is synced to Sage Intacct with the push of a button.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana