Business Expense Management Solutions

AI-powered automation streamlines expenses.

- Scan receipts and let Airbase’s AI extract all necessary information instantly.

- Automate manual expense work and ensure accurate reporting.

- Route expenses for approvals and automate payments.

- Consolidate all spend in one platform and gain real-time visibility into employee expenses.

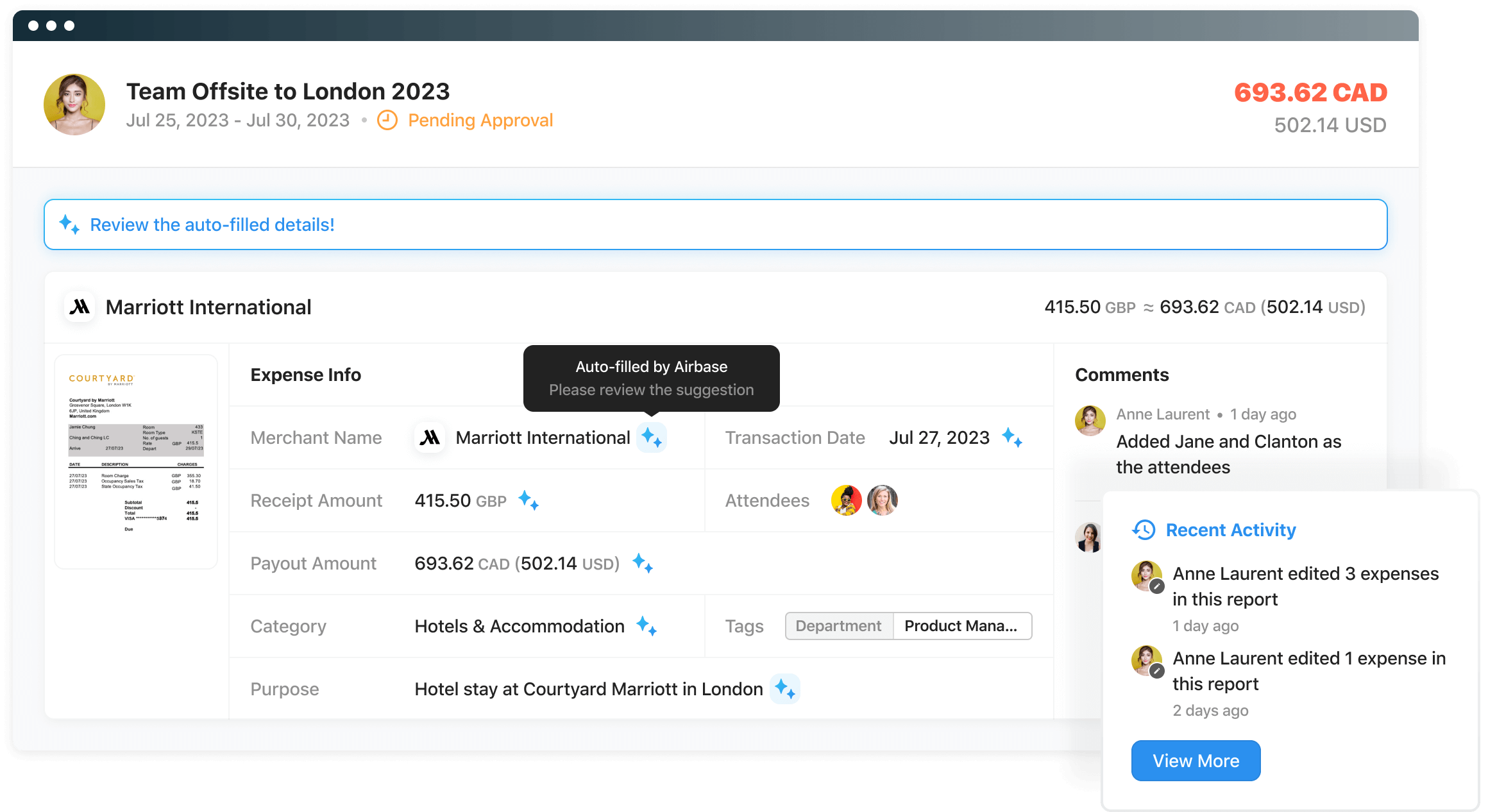

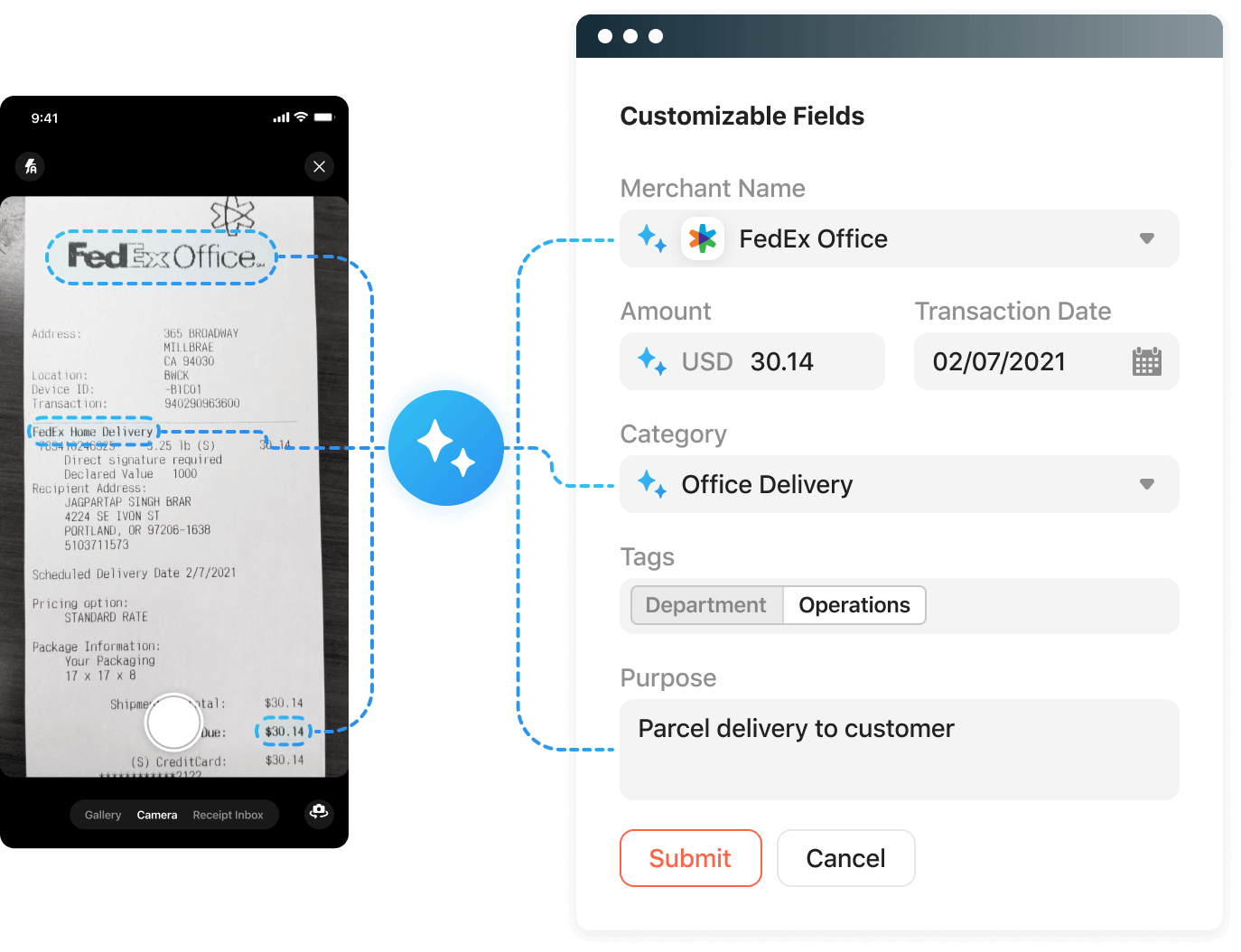

Scan a receipt and let Airbase take it from there.

Simply take a photo of your receipt using the Airbase mobile app. If you prefer to finish reporting later, save the photo to your receipt inbox so it’s ready when you are.

Airbase will automatically populate your expense request details using OCR technology. Built-in ML extracts all necessary fields, GL category, date, amount, and merchant/vendor and generative AI assigns a purpose based on past patterns.

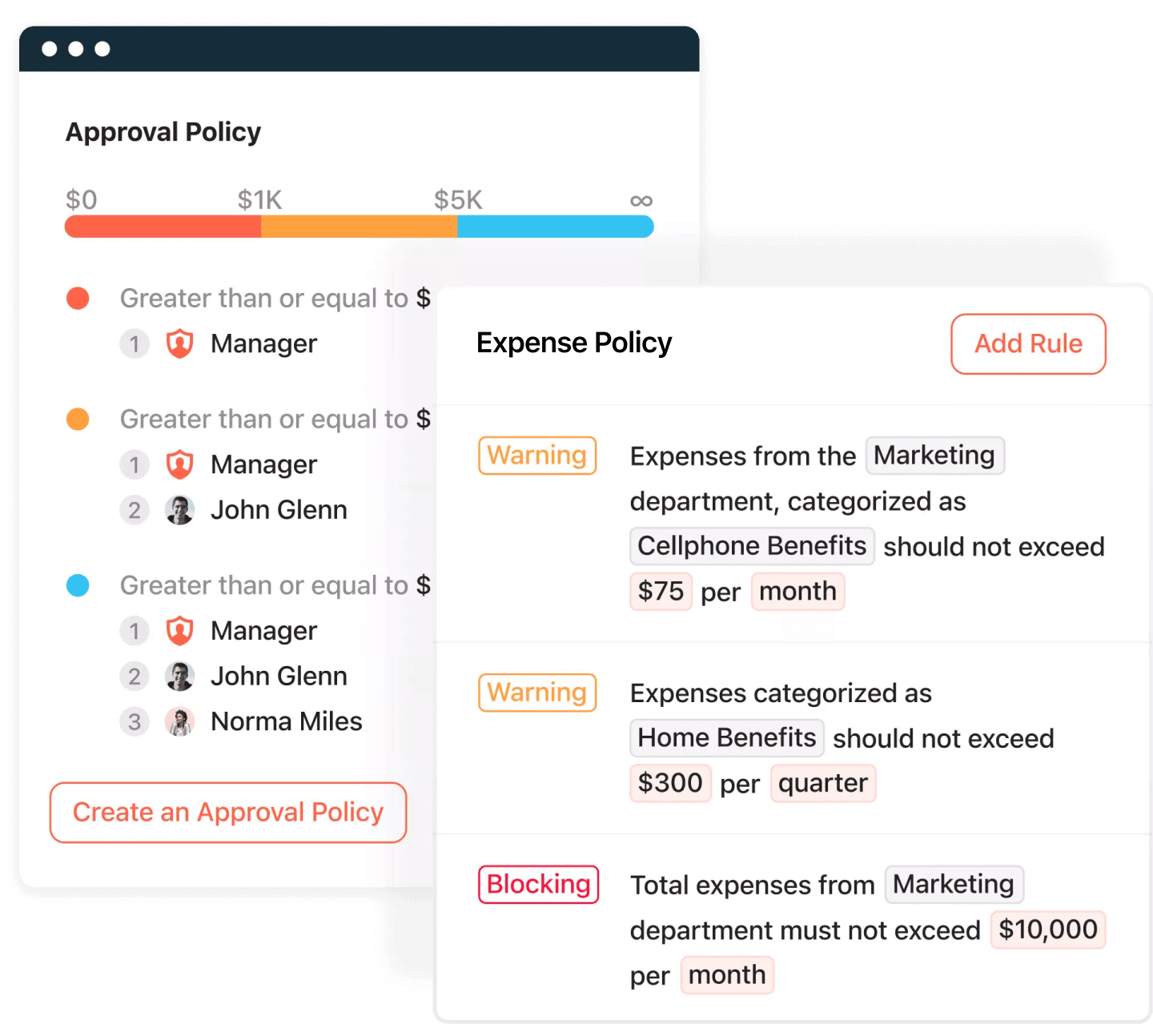

Easy expense policy compliance.

Automated approval workflows ensure compliance with your company’s policies. Set mandatory fields, a time window for submission, and any budget limits by role and expense type. If an employee submits an out-of-policy request they are flagged or blocked, providing instant clarity so they can make necessary changes to their request.

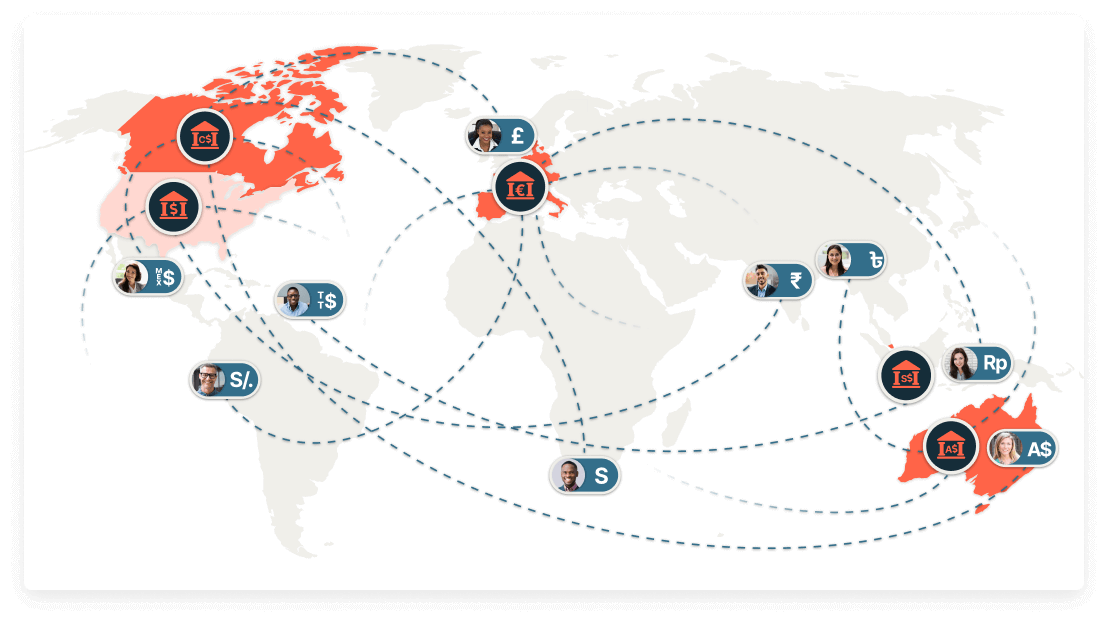

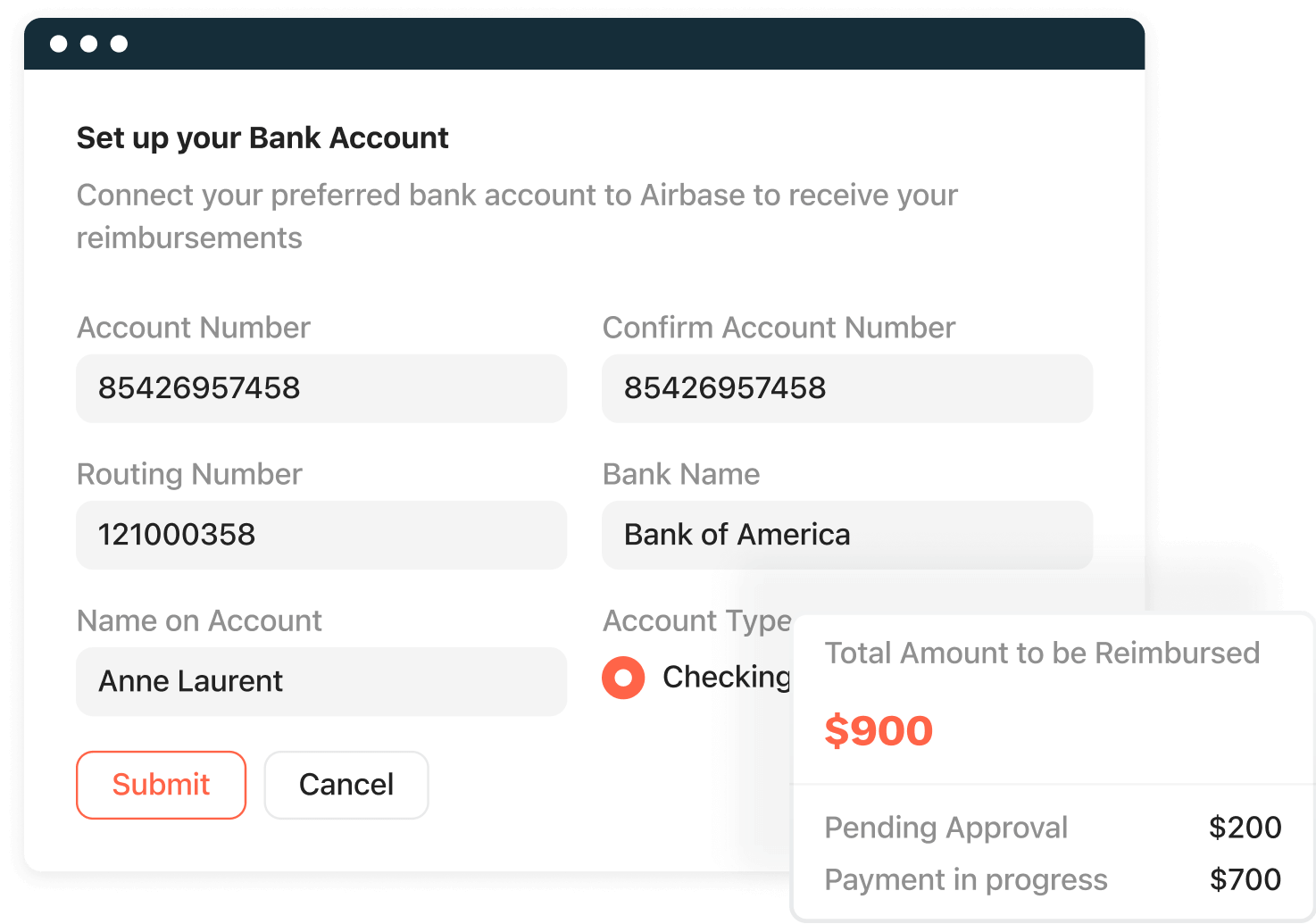

International reimbursements.

Customers can reimburse expenses from a U.S.-based subsidiary to employee bank accounts located locally in the U.S. or remotely in 44 supported countries and 14 currencies. Additionally, you can reimburse expenses from an international-based subsidiary, operating in any of 5 currencies — Canadian Dollar, British Pound, Euro, Australian Dollar, and Singapore Dollar.

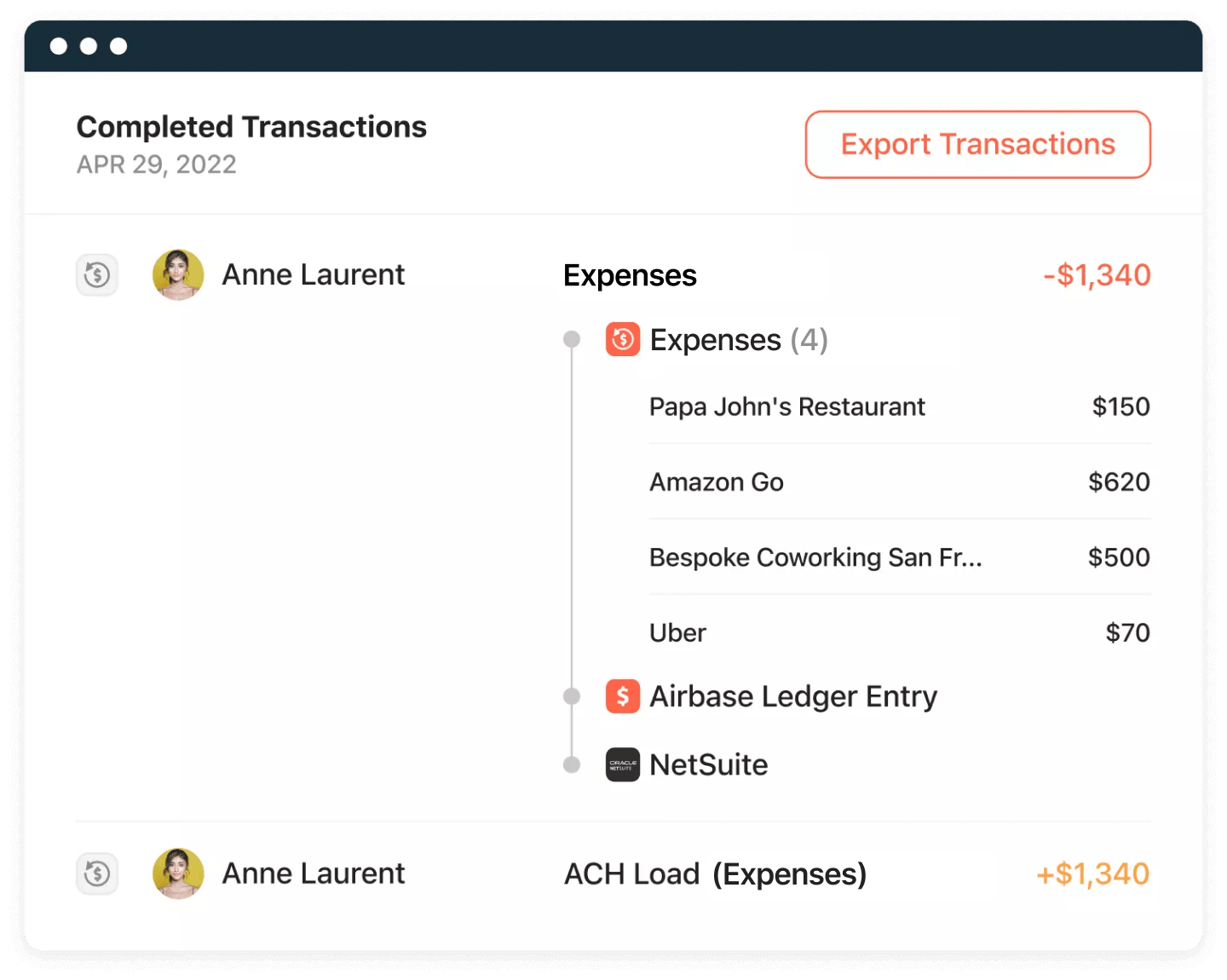

A detailed audit trail of every expense.

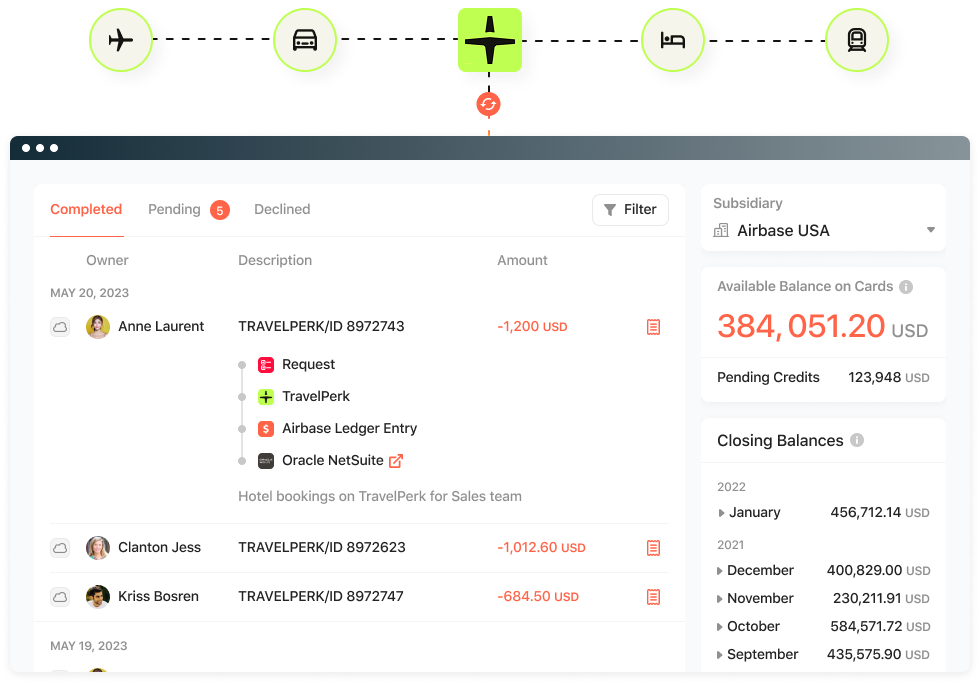

Level up your Travel Management for a full T&E experience.

Airbase’s travel booking integration gives the control and visibility over travel spend that budget owners and finance teams need while making it easy for employees to book and expense travel — all within company policy.

Automate business expenses and reimbursements.

Once approvals are secured, set payments to flow automatically to the employees’ bank account. Take the back and forth out of reimbursements and keep employees happy with rapid reimbursement for out-of-pocket business expenses.

Airbase let’s you track your time from submission to payment so that you can benchmark reimbursements against best practices.

Awards

#1 award-winning AP automation solution.

Spend Matters

50 Providers to Watch in Procurement Technology

3rd year in a row

Juniper Research

Best B2B Payments Platform 2024

Platinum Winner

American Business Award

Stevie Awards for the Most Innovative Tech Company of the Year

4th year in a row

Technology Fast 500™ North America

Awarded to Airbase by Deloitte

#45 out of 500

ProcureTech Cup 2024

Winner in Procurement Technologies

#1 out of 64

Expense Management FAQs

What is expense management?

Each time an employee spends money, it triggers a requirement to manage the expense. That’s because companies must track against budgets and accurately account for every cent of every dollar that leaves the company. Expenses can be either a direct payment from the company to a vendor, or as a reimbursement to an employee who has paid for goods or services out of pocket.

Expense management is the process of tracking, controlling, and optimizing an organization’s outgoings. It involves activities such as capturing, categorizing, and analyzing expenses incurred by employees during business operations.

Expense management includes expense reporting, policy enforcement, reimbursement, and financial analysis.

What are the benefits of good expense management?

With effective expense management practices, organizations can:

- Gain better visibility into company spending.

- Identify cost-saving opportunities.

- Enforce compliance with company expense policies.

- Streamline the process of reimbursing employees.

- Make informed financial decisions.

The result is improved financial control, reduced costs, better efficiency, and enhanced visibility into all employee spending.

How does expense management work?

Expense management involves a systematic process to track, control, and analyze an organization’s expenses. In a good expense management system, expense management typically starts with an employee submitting a purchase request.

The request is reviewed by managers or administrators who ensure compliance with company policies.

The purchase is then recorded in the organization’s financial system for accounting purposes.

Expense management software like Airbase automates and streamlines this process, providing features like receipt scanning, policy enforcement, automated approval workflows, and integration with accounting systems.

What are the features to look for in expense management software?

When purchasing an expense management solution, there are several key features to look for:

- An intuitive and user-friendly interface for easy navigation and adoption.

- Automated receipt capture and expense categorization capabilities to save time and improve accuracy.

- Policy enforcement features to ensure compliance with company guidelines and reduce fraudulent claims.

- Mobile accessibility for expense submission on the go.

- Integration with accounting systems to streamline the reconciliation and reporting processes.

- Customizable approval workflows to accommodate various organizational structures.

- Robust reporting and analytics capabilities provide insights into spending patterns and help with financial decision-making.

- Data security measures protect sensitive financial information.

What is an expense management policy?

An expense management policy sets rules around employee spending for business expenses. Modern expense management software builds these rules right into the purchasing process.

A policy sets spending limits, specifies documentation requirements, and defines any reimbursable expenses. It may cover areas such as travel expenses, meals, entertainment, transportation, and office supplies.

Well-defined expense policies help control costs, prevent misuse of company funds, and align spending with an organization’s financial goals.

How do I choose the best expense management software for my business?

When deciding which expense management software is best for your business, consider the following factors:

- Assess your specific needs and requirements, such as the volume of expenses, complexity of workflows, and integration requirements with current systems.

- Identify features that are essential for your organization, such as receipt capture, policy enforcement, reporting capabilities, and mobile accessibility.

- Consider the scalability and flexibility of the software to accommodate future growth.

- Evaluate user-friendliness, ease of implementation, and customer support.

- Request demos or trials to assess the software’s usability and compatibility with your workflows.

- Evaluate the pricing structure and ensure it aligns with your budget.

How does Airbase improve expense reporting?

Implementing Airbase’s Expense Management module significantly improves expense reporting processes.

First, it streamlines the process by automating data entry, eliminating manual paperwork, and reducing the chances of errors or missing information.

Employees can easily capture receipts using mobile devices, OCR technology, and generative AI can extract relevant details automatically.

Secondly, it enforces policy compliance by validating expenses against predefined rules, ensuring adherence to spending guidelines. This reduces the need for manual review and improves accuracy.

Additionally, Airbase provides real-time visibility into expenses, so managers can monitor spending trends, identify potential issues, and make informed decisions.

How can I improve receipt submission by employees?

Airbase improves receipt submission by making it easy for employees to simply take a photo of a receipt and submit it, or email it to a receipt inbox.

If a receipt isn’t submitted, Airbase sends reminders to users to upload their receipts. You can also set policies that require receipts be uploaded for all expense reports.

How can we ensure our teams follow our expense policies?

The best way is to use a rule-based expense management system where employees cannot proceed with purchasing unless rules are met. This way, the system is enforcing your policies, which removes ambiguity and the risk of errors.

- Implement a user-friendly expense management solution that enforces policy compliance by flagging violations and providing real-time guidance.

- Regularly review and update policies to align with evolving business needs.

- Lead by example, and foster a culture of accountability and transparency in expense management.

By combining these approaches, organizations can increase policy adherence and promote responsible spending behaviors among their teams.

Learn why spend management means better Expense Management.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana