Corporate Cards

Best software =

Best card program.

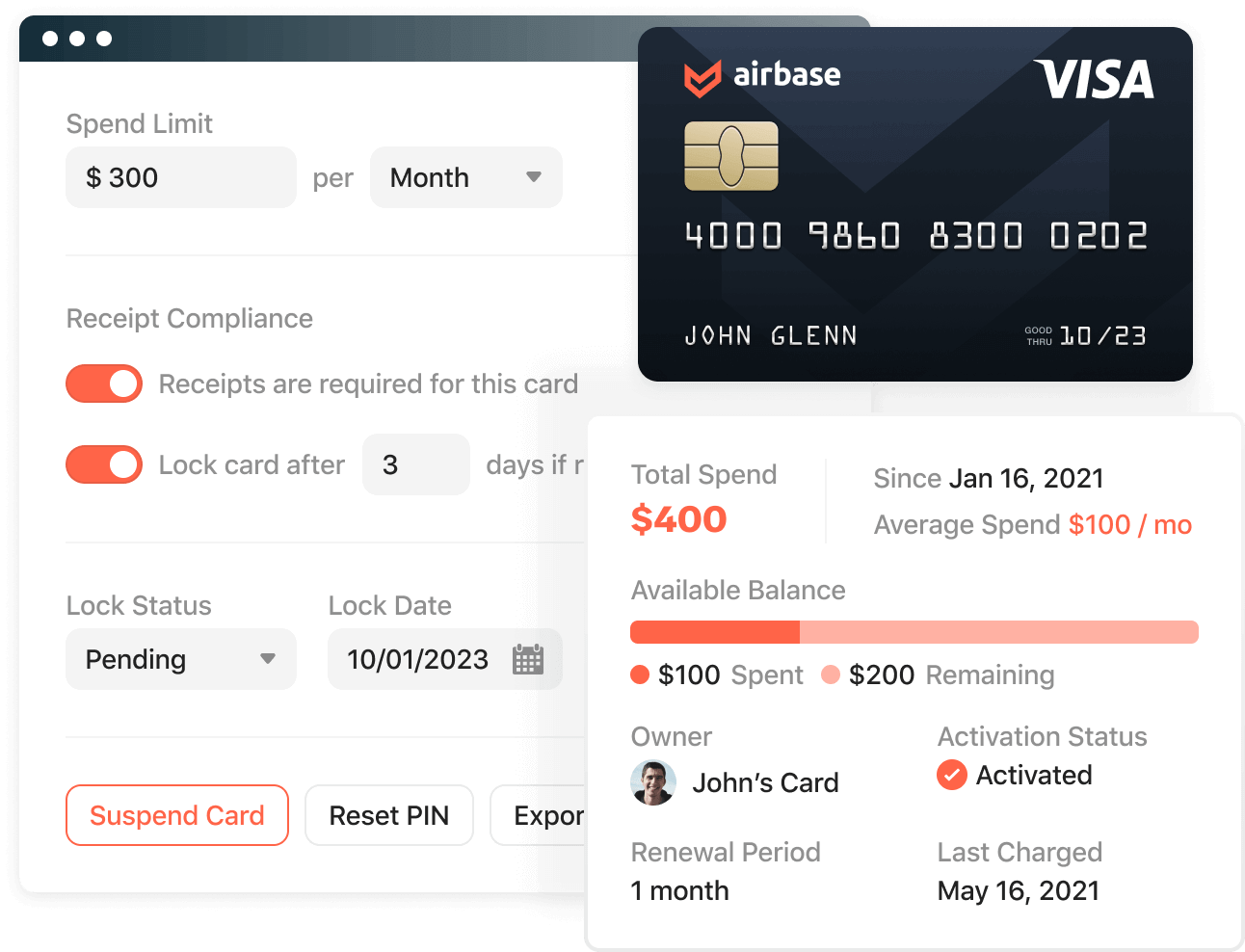

- Gain complete control over corporate card spend with Airbase.

- Manage card spend, review limits and expenses, all from our leading spend management platform.

- Earn cash back on every transaction.

- Use virtual cards for one-time or recurring payments to improve internal controls.

Unlimited cash back.

Earn on every dollar spent.

- Unlimited cash back across all categories of spend.

- No rewards gimmicks or promotional periods.

- Get access to cash back every month.

- Easily shift from ACH and checks to card payments for all AP.

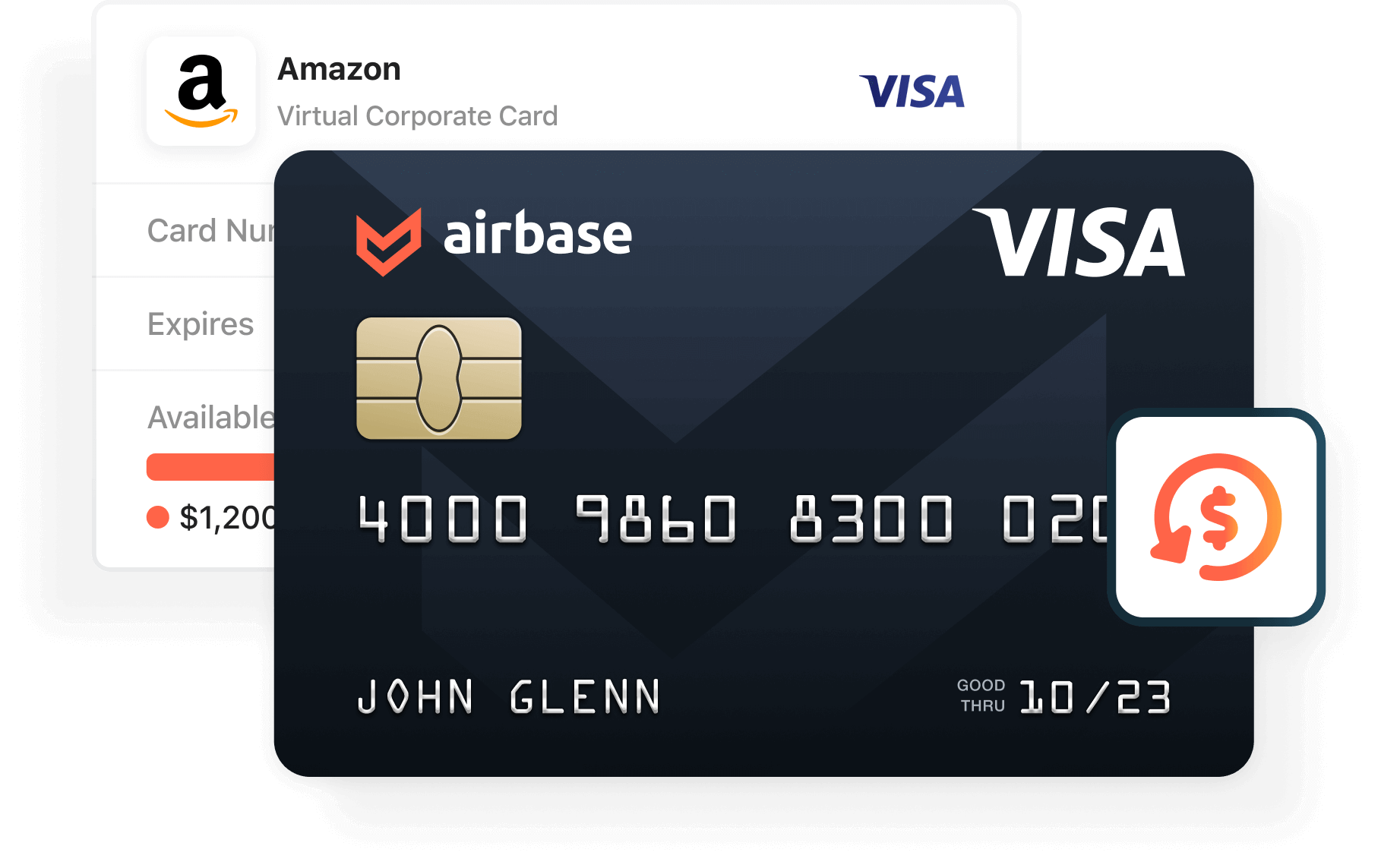

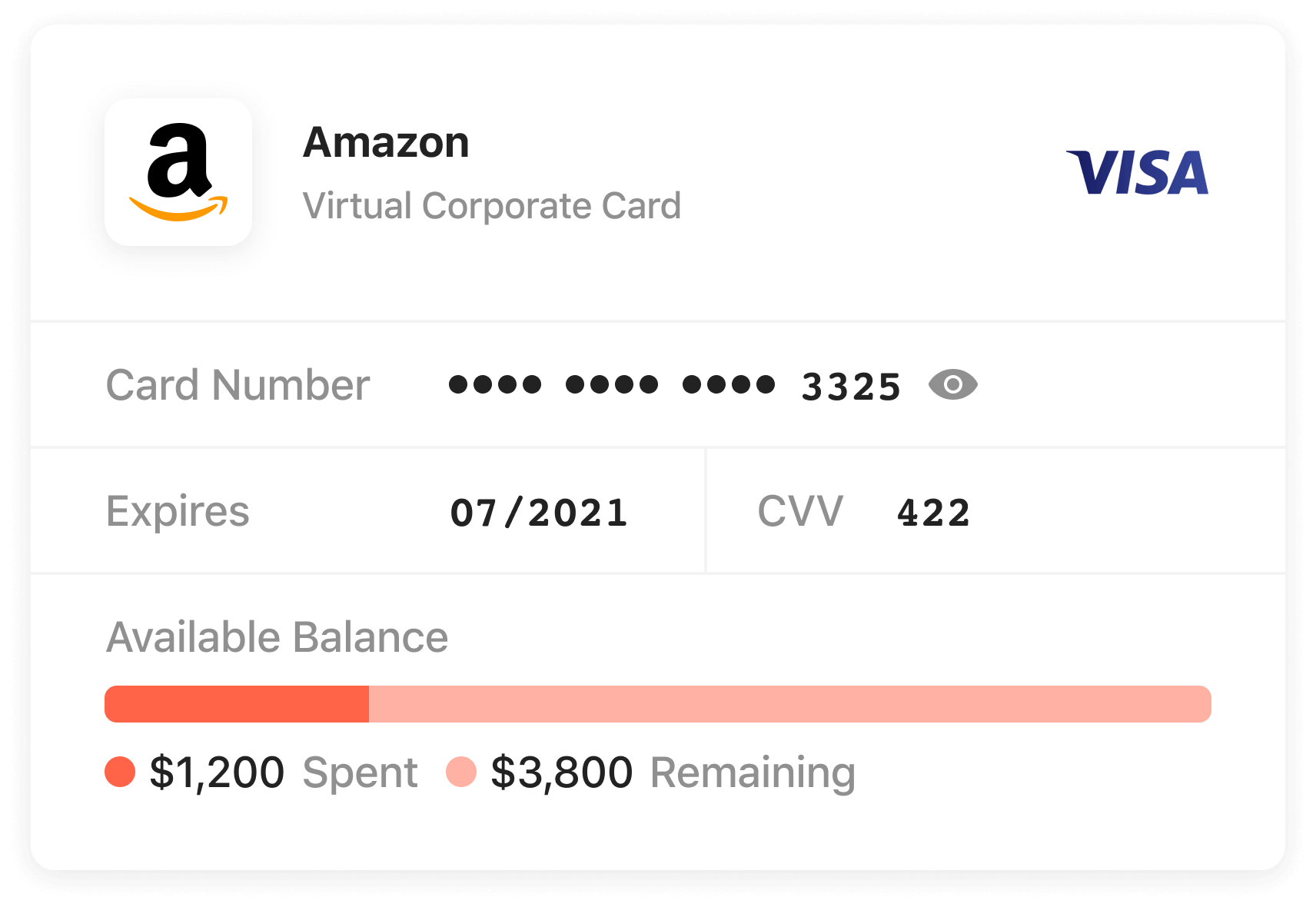

Virtual cards — flexible, convenient.

When employees create virtual cards for one-time or recurring payments, a full audit trail is generated and transactions are automatically booked to the GL.

Physical cards — in-person purchases.

Physical corporate cards for in-person spending by employees can be customized for additional control by setting a spending limit, or set to block card usage if employees are delinquent on receipt compliance.

Need to keep your existing Corporate Card program?

Airbase has partnered with Silicon Valley Bank and other leading financial institutions to integrate their cards into our platform. Get all the benefits of spend management without switching cards.

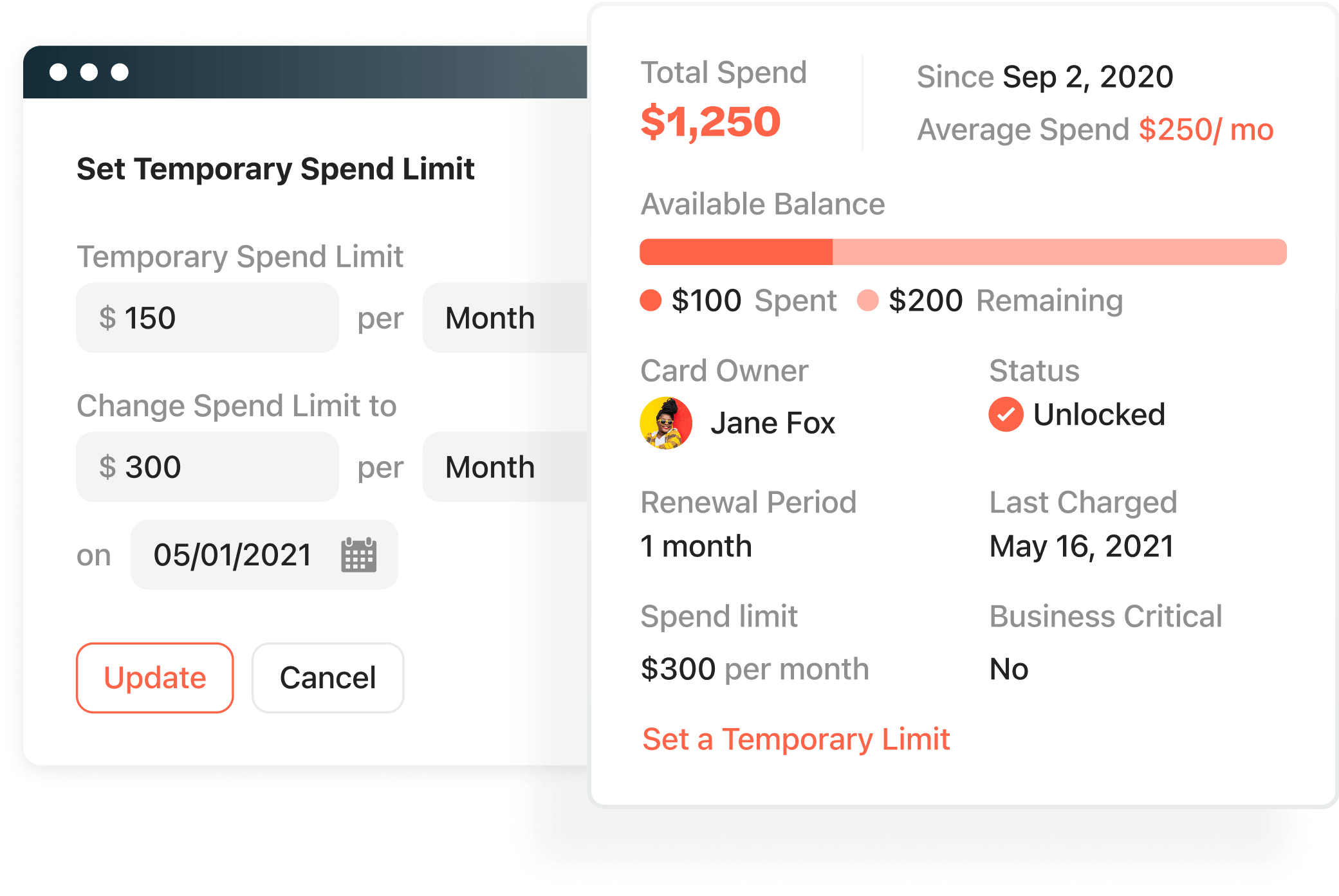

Manage Corporate Card budgets.

Limit the amount that can be spent on a Corporate Card and adjust up or down to accommodate changing circumstances. Use virtual cards with pre-approval workflows, or physical cards for point-of-sale purchases, and get control of your budget.

Restrict card spend to specific categories, review transactions that have been blocked or flagged, and allow for exceptions based on past behaviors.

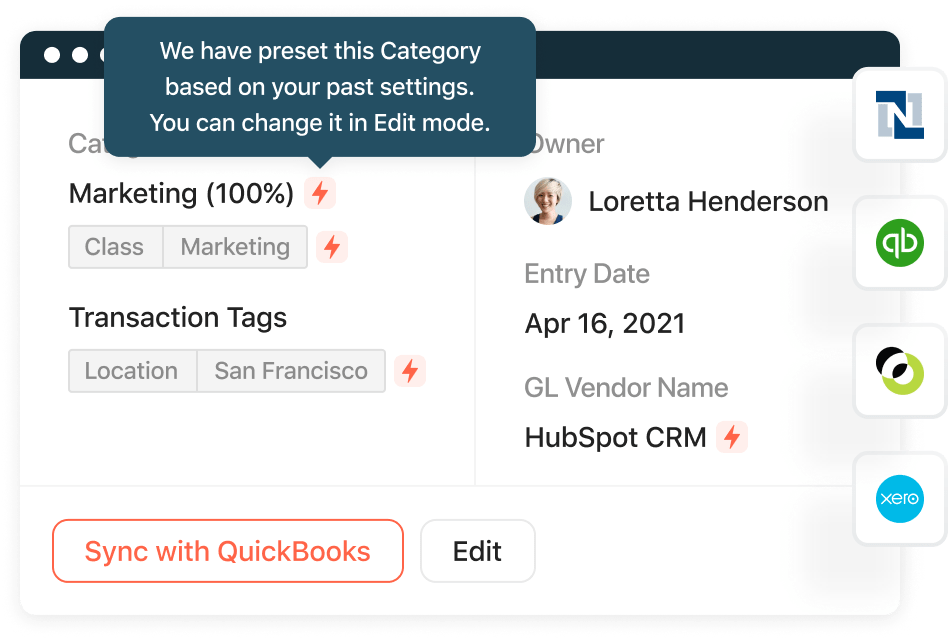

Automatic sync to the GL.

Proper syncing of transactions to the GL requires accurate categorization up front. That’s why we’ve built the auto-categorize feature for physical cards and invoices. Integrate Airbase with 70+ ERPs including Oracle NetSuite, Sage Intacct, and QuickBooks Online.

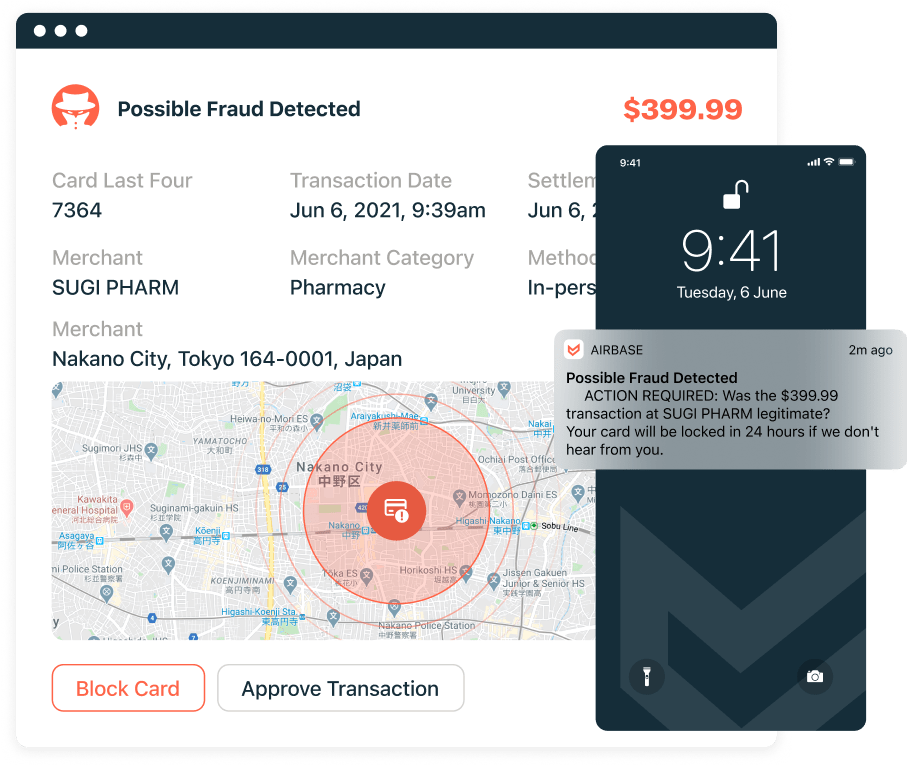

Security for safe spending.

Automatic fraud detection alerts cardholders to any suspicious transactions.

Whether you add your physical card to your digital wallet, or use the card’s chip technology to avoid contact at the point of purchase, contactless payments are safer.

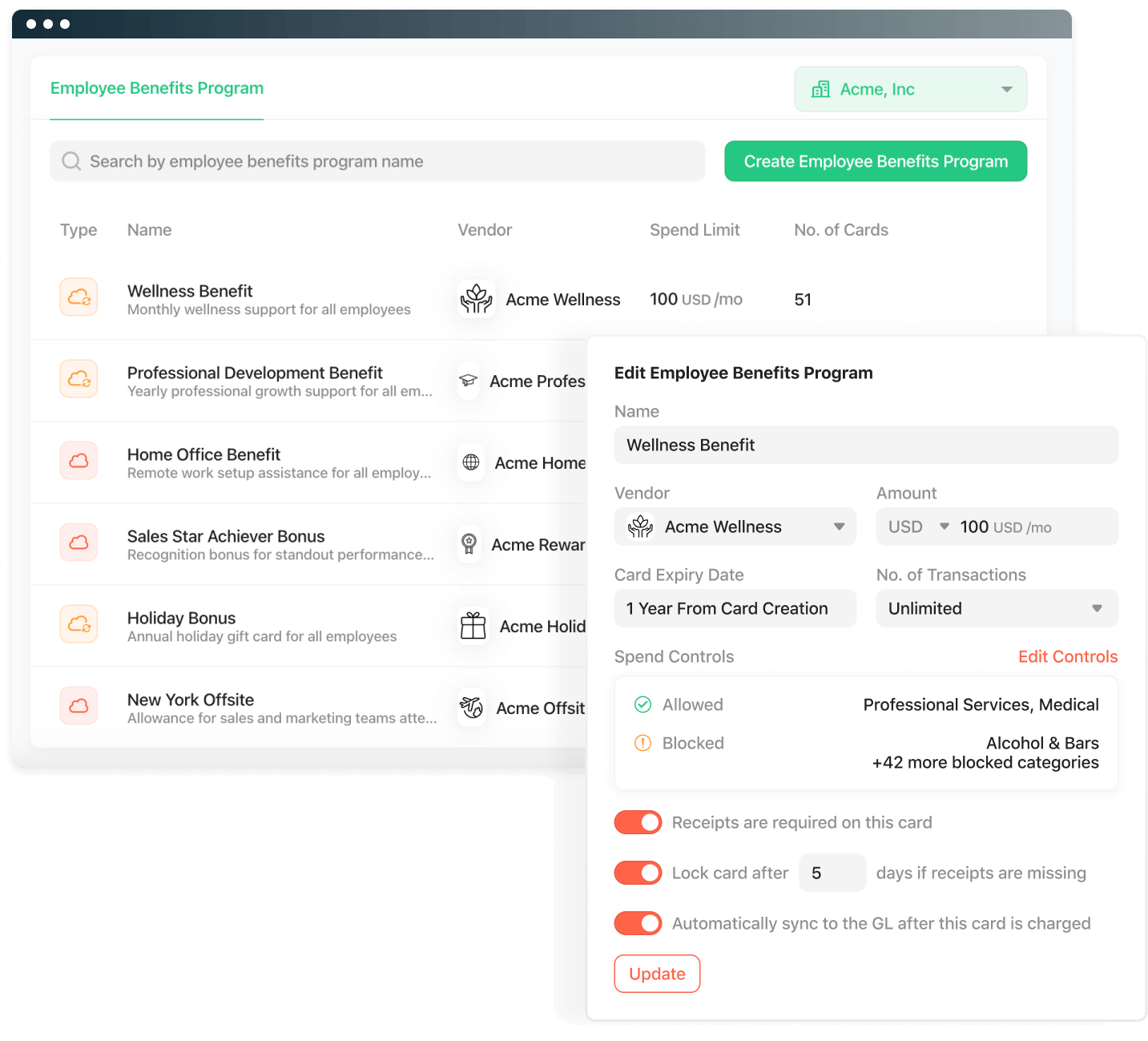

Employee benefits program.

Effortlessly create customized employee benefits programs, like “Home Office Benefit” and “Wellness Benefit” cards, each with pre-set spending limits to align with your company’s budget and policies. Empower your employees with the resources they need for well-being and productivity without burdening your accounting team.

Simple & safe with Apple Pay and Google Pay.

Interactions in the physical world are safest when contactless. Our physical cards are “tap cards” so that you don’t have to touch a swipe terminal. Add our physical cards to your digital wallet for greater ease and security.

Get control, visibility, and cash back.

“I can set coding rules when I’m approving an expense to automatically reconcile it with the GL. It’s a system that allows one person to address the manual work of three.”

Michael Zheng, Head of Finance at Affinity

Awards

#1 award-winning AP automation solution.

Spend Matters

50 Providers to Watch in Procurement Technology

3rd year in a row

Juniper Research

Best B2B Payments Platform 2024

Platinum Winner

American Business Award

Stevie Awards for the Most Innovative Tech Company of the Year

4th year in a row

Technology Fast 500™ North America

Awarded to Airbase by Deloitte

#45 out of 500

ProcureTech Cup 2024

Winner in Procurement Technologies

#1 out of 64

Learn how our Corporate Card program helps cut your time-to-close in half.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana