When I first joined Airbase almost four years ago, we were focused on defining a new software category called spend management. It grew out of new possibilities for software solutions resulting from advancements in cloud computing, hyper-digitization, and the opening up of payment rails.

For the first time, software could offer employees around the globe a system for easy collaboration that linked payment flows directly to other workflows like approvals, general ledger coding, and documentation gathering. This approach solved the large and important challenge faced by companies that relied on a decentralized spending model rather than a formal centralized procurement model.

Unattended decentralized spend.

Many of today’s businesses control spending via the budget and let employees make purchase decisions by contracting directly with vendors and suppliers. Primarily, these expenditures have to do with indirect spend, which includes things like marketing spend, T&E, and software subscriptions.

For many organizations, this represents the lion’s share of their spending. Yet, until Airbase offered it, there was little in the way of automation for the workflows of this type of decentralized spend.

The growing spend management market.

I watched as many other companies jumped into the space, often referring to their solution as a spend management one even though it was far less comprehensive than Airbase’s.

For example, many of the software-enabled card companies referred to their software as spend management because it had the approval layer attached to card spending. However, we remained committed that a true spend management platform should include all non-payroll spend, whether that was cards, bill payments, or reimbursements.

Fast forward to early 2023, when it became apparent that the depth and breadth of our product made it tremendously valuable to mid-market and early-enterprise companies who needed to support more complex accounting and compliance requirements.

This segment also has a more complex focus on procurement and its multi-stakeholder challenges, which we solved with an intake function called Guided Procurement.

Merging of spend management and procure-to-pay.

I have seen firsthand how, as a spend management product expands to handle the needs of a procurement function, it enters the realm of procure-to-pay (P2P) software.

However, legacy P2P software is designed for the needs of large enterprise companies and is not typically a good fit for smaller organizations of, say, less than 5,000 employees.

Airbase’s spend management offers a more modernized version of P2P software — lightweight, more agile, easier to operate and implement, and far less expensive. It has been designed for the needs of organizations with up to about 5,000 employees.

At this cross-current of spend management and procure-to-pay, we find a solution that works for the unique needs of mid-market and early-enterprise companies, especially ones with a lot of decentralized spend.

P2P support for strategic supplier relationships.

Organizations that make large purchases of physical supplies and need deep vendor management tools and supply chain support will find more of the tools for these needs in legacy P2P. These types of purchases rely on ongoing supplier relationship management, regular supplier performance reviews, and contract compliance efforts. These are the activities that a traditional procurement team would focus on along with their core activities of identifying cost-saving opportunities.

Traditional procurement management is less focused on account payable systems and other payment processes that are the responsibility of the accounts payable team.

Large company resources for procurement.

In large enterprise companies, especially ones with significant direct spend, a procurement department provides visibility and control over the spending of company funds. Software developed over the last several decades to support the workflows around this centralized procurement practice is “procure-to-pay” (P2P).

How P2P software supports centralized procurement.

The concept of procure-to-pay systems is an efficient one. It automates workflows around a process that is operationally complex with cross-departmental roles and responsibilities.

It addresses an array of requirements, including sourcing activities like the request for quotes or requests for proposals. It will provide a central function with the tools to execute contracts and ensure that suppliers perform to the terms agreed upon. It relies on good tools for visibility and control and it efficiently captures transaction activity to the general ledger.

Filling the gaps in purchase to pay.

Now, newer players are adapting the concept of “procure to pay” to include spending made outside of the formal procure-to-pay process, as well as for procurement-type spending by smaller companies for whom complex and expensive procure-to-pay systems are a bad fit. This new generation of procurement management software fills a long-standing gap.

The steps in a procure-to-pay process:

Let’s begin by looking at the many benefits of a procure-to-pay solution. The following steps are supported by the software.

- Supply management: Identifying, connecting to, and managing supplier relationships.

- Vendor selection: Researching and selecting the preferred vendor for specific purchases.

- Requisition: An internal process to secure formal approvals to order a product.

- Purchase order: Creation of a document containing order quantities and requirements for the vendor.

- Receiving: Taking in the physical shipment and entering it into inventory, tracking, and accounting systems.

- Invoice reconciliation: Comparing the invoice to the purchase order.

- Accounts payable: Sending the payment per the terms of the purchase order, and entering the amount into accounting systems.

Guided Procurement Tour

Explore our automated procurement workflows in the Guided Procurement tour.

What P2P solutions offer.

Procure-to-payment systems are designed to provide organizations control and visibility over the entire life cycle of a transaction, providing full insight into cash flow and financial commitments. Some solutions have additional modules for:

- Payments contract management

- E-sourcing

- Sourcing optimization

- Spend analysis

- Savings tracking

- Supplier information management

- Supplier risk management

- Employee expense management

AI-enabled features.

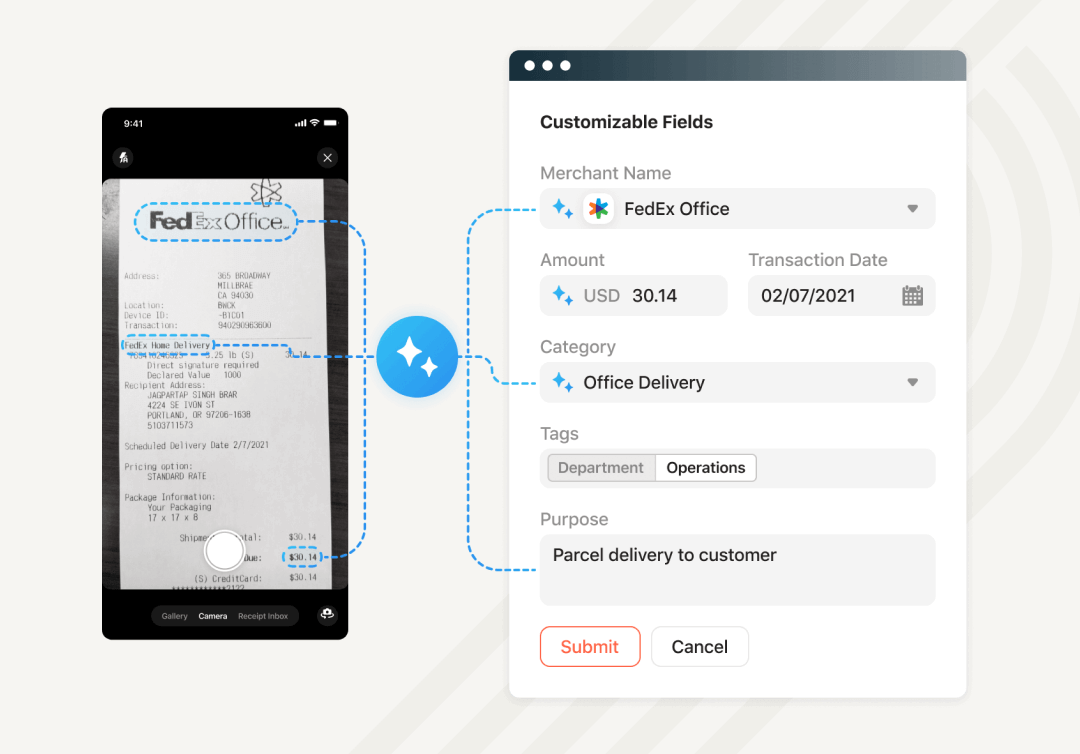

Innovation continues to be added, with AI being layered into vendor management tools, price transparency, and ERP integrations. Expense reporting, for example, can now be done on a touchless basis with AI lifting details directly from a receipt and automatically generating an expense report.

Other implementations include AI-powered analytics. Understanding how, when, and where spend is impacting a business is crucial to its success.

Increasingly, spend management platforms are offering AI-powered analytics, especially around larger purchases and renewals for services.

Building in source-to-pay processes.

As the system became more complex, the P2P model was expanded to include source-to-pay systems, where the focus is on assessing competing vendors and negotiating those contracts.

Procure-to-pay systems have been available for decades and early entrants include Oracle, Baseware, and GEP. Other large providers of procure-to-pay software, like SAP, moved into the market via acquisition. A later entrant, Coupa, has come to dominate the sector, especially as legacy providers struggled with the shift to cloud-based services.

Intensive implementation requirements.

Still, the automation and analytic tools offered by procure-to-pay systems are not widely used, as only a little over half of all businesses operate with a full-time procurement department and, of those, about a third have adopted third-party cloud-based procure-to-pay software.

What do the studies show?

One survey of businesses showed that only 10% of small companies and 16% of mid-market companies use P2P software solutions. For the most part, companies rely on a set of homegrown processes instead of a fully automated procure-to-pay system.

While these automation solutions can provide real value, there are cost barriers to adoption, especially since it is generally accepted that the implementation of a procure-to-pay system brings with it a meaningful requirement for change management in an organization.

Implementation and understanding the procure to pay cycle.

As with any system that touches a significant number of users, implementing a procure-to-pay system requires significant knowledge of both the current business processes and the aspirational process for that business.

Many of the big players in this market use third-party partners (consulting firms like Deloitte and Accenture) for the implementation because of the complexity involved. These teams of consultants take months to set up and deploy a new system and train all impacted employees in its use.

The impact of decentralized spend on procurement.

P2P systems solve the problems around centralized spending operations but, over the past several years, the purchasing process has been disrupted by a new way of operating. The move toward decentralized spending means that an increasing number of transactions occur outside the procurement system.

We have written about the move to decentralized spending where high-performing teams are empowered to make their own purchase decisions, especially for software subscriptions, marketing expenses, and outside contractors for specialized work.

Digital payment systems and decentralized spend.

This trend has been enabled by digital payment systems, most notably corporate cards and, more recently, virtual credit cards and virtual debit cards. In the case of decentralized spend, the traditional model of contract negotiation followed by an invoice for goods or services has been replaced by an expense report for spending that is submitted after the purchase has been made.

The procure-to-pay cycle in a decentralized spending model.

The shift is especially pronounced for software companies whose direct spend can include subscriptions to other software platforms. The shift to subscription-model pricing by companies for their software and services is expected to continue to grow and expand to other services and tools.

When the cost for an individual to purchase a subscription is low, there is little need to involve a procurement department to assess vendors and negotiate contracts. The basis for the procure-to-pay model breaks down, and more and more payments happen outside the process designed for visibility, invoice approval, and control.

A chaotic approach to gathering information.

Accounting teams have scrambled to ease the burden that this decentralized spending places on an organization, especially transactions made with a corporate card. That process includes:

- Approval request/granting workflows

- Expense reporting

- Reconciliation of spending

- Capturing all transactions in the general ledger

Most procure-to-pay systems have worked to integrate corporate card transactions into their platforms with direct feeds of transactions into their systems.

Management can then review and approve transactions, and accounting teams can reconcile amounts against budgets. However, unlike in the procurement process, these transactions are only seen by accounts payable teams and oversight teams after the purchase has been made.

Missing functionality for mid-market and early-enterprise organizations.

The procure-to-pay model has delivered efficiencies to larger businesses for their centralized spending. For companies with fewer than 1,500 employees without a dedicated procurement department, the procure-to-pay solution is typically over-engineered and too expensive for their purposes.

This leaves teams working to replicate the visibility and control with homegrown processes.

Spend management software designed for decentralized spend.

In the wake of this shift in spending habits within companies, a new segment of the market is being defined as a “spend management” approach to P2P.

This is the need to manage payments made on a decentralized basis, for example, the marketing manager purchasing Google Ads or automation software, the developer purchasing subscriptions for software tools, or the product manager purchasing an analytics platform.

The recent advent of spend management type P2P software offers lightweight alternatives to the heavyweight legacy procure-to-pay tools. Spend management platforms mimic the approach to solving the problem by looking at the full continuum from approval for spend, execution by accounts payable or via cards, and the booking of the transaction to the GL.

Leaders prioritize agility.

In the article, Gartner Predicts 2020: Sourcing and Procurement Application Technology Disruptions, the first of three conclusions is:

“Enterprise leaders will increasingly seek to increase the agility and flexibility of sourcing activities by expanding their supply base to include multiple supplier networks.”

Finding agility in P2P process automation.

However, modern companies have found another way to achieve this type of agility and efficiency, which is to put the procurement decision in the hands of the expert using the service or tool. This is the power of decentralized spending. It allows those with the greatest knowledge and decision-making authority to transact within a budget.

Until recently, there have not been systems designed to support this activity with necessary oversight, control, and automation. When well-designed spend management platforms add procurement intake flows into their product, they can provide the multi-stakeholder visibility and control that an established procurement team provides.

This has the added benefit of real-time visibility into actual spend since everything is captured to the platform as it happens.

Selecting the right approach.

The ROI for a fully integrated procure-to-pay platform depends on the size and needs of a procurement department. For companies without a procurement department or where decentralized spending has been delegated to various departments, a spend management platform can provide the type of automation, visibility, and control that large enterprise companies enjoy with their procure-to-pay software.

Perhaps even more valuable is that, as a lightweight software solution, a spend management platform can be adopted at a lower cost and without the burdensome change management implementation required by procure-to-pay software.

Understanding the procure-to-pay process.

The procure-to-pay (P2P) process is a comprehensive approach that encompasses the entire cycle of procurement activities, from identifying a need for goods or services to making payments to vendors. This entire process is critical in large companies where procurement departments oversee spending and procurement teams provide control over company funds.

What is procure to pay?

Procure to pay refers to the procure-to-pay cycle — the structured process of procuring required goods or services and paying for these purchases. It is a crucial component of supply chain management, involving a series of steps that ensure purchases and vendor payments are made efficiently, cost-effectively, and within compliance standards.

Procure to pay solutions.

Procure-to-pay solutions are software systems developed to support the workflows of the P2P process. These solutions automate complex operational tasks, facilitate cross-departmental collaboration, and provide essential tools for visibility and control over transactions. They are designed to capture transaction activity efficiently and integrate it into the general ledger.

Procure to pay automation.

Automation is a key feature of modern procure-to-pay systems. It streamlines various steps in the P2P process, reducing manual efforts, enhancing accuracy, and improving overall efficiency. This includes automating tasks such as vendor selection, purchase orders, vendor invoice creation, invoice processing, and payment execution.

Procure to pay system: The evolution.

Procure-to-pay systems have evolved over the years to become more sophisticated and comprehensive. Initially focused on the basic tasks of purchasing and payments, these systems have expanded to include modules for contract and supplier management, e-sourcing, spend analysis, and more. The introduction of AI and ERP integrations has further enhanced their capabilities.

Procure to pay process flow.

The process flow in a typical procure-to-pay system involves several key stages and steps:

- Supply management: This includes identifying and managing supplier relationships.

- Vendor selection: Choosing the right vendor based on various criteria.

- Requisition: The internal process of securing approval for a purchase.

- Purchase order: Creating and issuing a formal purchase order to the vendor.

- Receiving: Receiving the goods or services and updating inventory and accounting systems.

- Invoice reconciliation: Matching invoices to purchase orders.

- Accounts payable: Processing payments according to the terms of the purchase order.

Is spend management the new procure-to-pay software?

The traditional P2P model of procurement software is being challenged by the emerging concept of spend management.

This approach extends beyond traditional procurement processes and activities to include all types of spending, even those that occur outside the standard procurement process.

Spend management platforms are particularly advantageous for smaller companies where complex P2P systems may not be practical or cost-effective.

Adding intake to the requisition phase.

Recent advances in spend management lend support for traditional P2P processes. This has come in the form of intake processes. In the case of Airbase software, this module is called Guided Procurement.

This name describes the solution that it provides. Often, employees are uncertain about what process they should follow to make a purchase, who they should ask, who needs to sign it off, and what documentation is required. This happens at the purchase requisition phase of the purchasing contract.

With an intake module, the employee is guided on the information and documentation requirements like legal contracts or SOC reports, and then the system routes information to the right departments and approvers. A full audit trail of every purchase is created.

Without a formal procurement team, the finance and accounting team typically struggles to ensure that the company’s policies are followed and that all of the required information and documentation from a suitable supplier is secured. By automating intake with Guided Procurement, this problem is solved.

Spend management platforms: A comprehensive approach.

Spend management platforms represent a new wave in financial management software. These automated systems are designed to manage payments on a decentralized basis, covering various types of expenditures like marketing expenses, software subscriptions, and contractor payments. They offer a full continuum of services from approval to execution and recording of transactions.

Decentralized spending and procure-to-pay software.

With the trend toward decentralized spending, traditional P2P systems are being adapted to accommodate transactions that occur outside the standard procurement process.

This includes using digital payment systems such as corporate credit cards and virtual cards. The shift is particularly noticeable in companies with significant software and service subscriptions, where the traditional model of contract negotiation and invoicing is replaced by direct purchase and expense reporting.

Challenges and opportunities in implementing procure-to-pay systems.

Implementing a procure-to-pay system can be a complex and resource-intensive process. It often requires significant change management, especially in larger organizations with entrenched processes.

The implementation involves deeply understanding current business best practices and the desired future state. Despite these challenges, the automation and analytics tools provided by P2P systems offer substantial value, enhancing efficiency and cost savings, and providing greater visibility into spending.

The role of spend management software.

In response to the challenges posed by decentralized spending and the limitations of traditional P2P vendor payment systems for smaller businesses, spend management software has emerged as a viable solution. These platforms offer a lightweight, more adaptable alternative to traditional P2P tools, providing real-time visibility into spending and facilitating easier management of decentralized transactions.

Evolving landscape.

The evolution from traditional procure-to-pay systems to modern spend management platforms reflects the changing landscape of business financial management. While the P2P model continues to deliver value, especially in larger organizations with centralized spending operations, spend management platforms are evolving to become a modernized version of P2P software.

Modern solutions for modern businesses.

Both approaches offer automation of purchasing processes. The lightweight approach is increasingly relevant for businesses seeking a more flexible, cost-effective solution. These platforms enable companies of all sizes to maintain control and visibility over their spending, ensuring efficient capital deployment and financial health.

As businesses navigate this transition, the choice between a traditional P2P accounting system and a spend management platform with P2P functionality will depend on their specific needs, size, and spending requirements.

Schedule a demo

Learn how Airbase can transform your entire purchasing process.

Jira

Jira  Ironclad

Ironclad  Asana

Asana