Optimizing financial operations and implementing strategic fiscal management can be challenging but the end results are well worth the effort. Central to this transformation is your accounts payable software, so choosing the right one for your business goals is vital.

Modern AP software can streamline financial processes by automating workflows. These tools provide deep insights into spending and financial health, helping businesses identify new opportunities for increased efficiency. This reduces costs and strengthens vendor relationships, laying the groundwork for scalable growth.

If you’re searching for a robust, scalable accounts payable solution to support business growth, this guide will provide valuable insights into the best options on the market today. These powerful, automated solutions empower finance leaders to make informed, strategic decisions, manage risks effectively, and identify growth opportunities.

What is accounts payable software?

Accounts payable software has evolved from simple data-entry tools to comprehensive platforms. This transition reflects a broader shift toward data-driven decisions and strategic planning. Finance leaders can now elevate their role, contributing to operational efficiency and strategic business outcomes.

AP management plays a critical role in maintaining healthy cash flow and supplier relationships. Accounts payable software automates numerous manual processes to simplify payment management. This automation extends from invoice capture and approval to payment processing and reconciliation. These tools can replace manual, error-prone processes with streamlined, accurate operations.

AP automation for better data and better insights.

Leveraging powerful accounts payable processing software offers numerous advantages. By enhancing efficiency, it allows finance teams to allocate their time to strategic analysis and decision-making rather than tedious, routine tasks. Meanwhile, improved accuracy reduces the risk of payment errors, unnecessary costs, and strained supplier relationships.

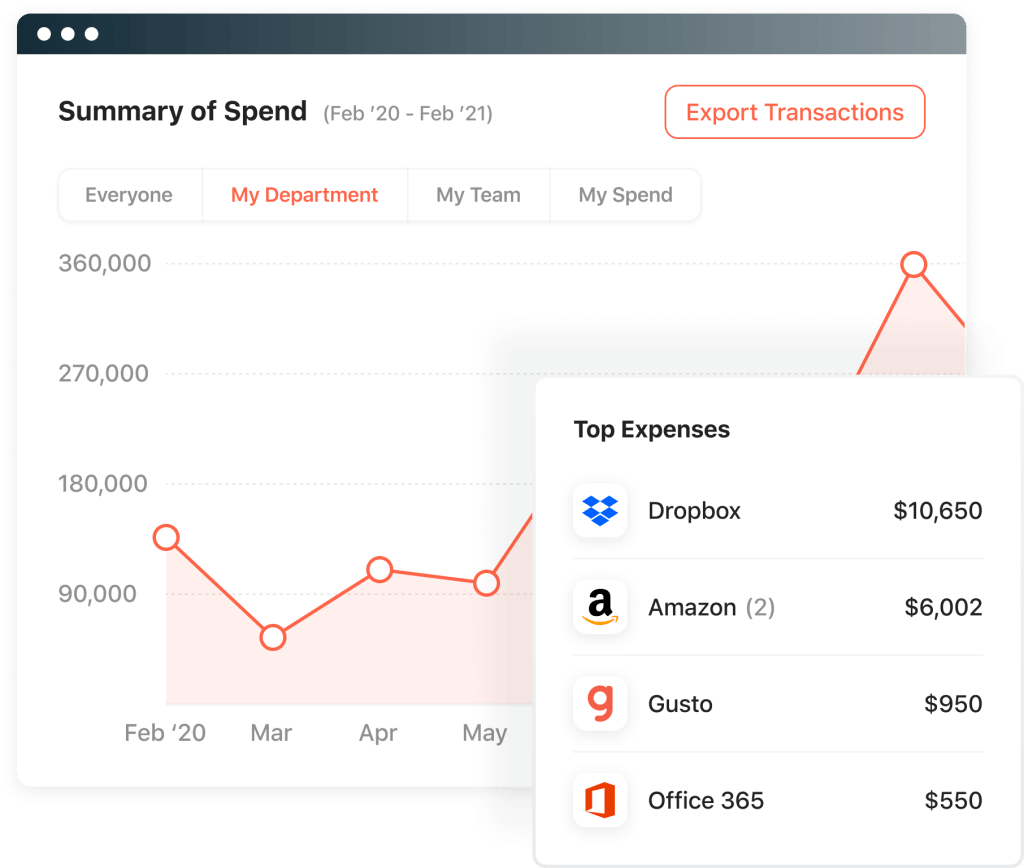

However, one of the most significant benefits of modern accounts payable software is the wealth of data and insights it provides. Beyond streamlining invoice processing and payments, these solutions offer detailed analytics on spending patterns, vendor performance, and financial efficiencies. These data-driven insights can inform budgeting and cash management decisions, safeguarding capital.

By leveraging these insights, finance leaders can identify cost-saving opportunities, negotiate better terms with suppliers, and optimize cash flow management. All of these actions directly contribute to the company’s bottom line and strategic growth.

In addition, the ability to integrate accounts payable data with other financial and operational systems provides a holistic view of the company’s financial health. This integration enables accurate budgeting, forecasting, and strategic planning, allowing leaders to make decisions based on comprehensive, up-to-date information.

AP Automation Tour

Explore 3-way matching in our AP Automation Product tour.

The top 10 accounts payable software to choose in 2024.

With a clear understanding of what modern AP automation software can do for a business, let’s delve deeper into today’s top solutions. From small business accounting software to complex cloud ERP systems, we’ll highlight their standout features, best use cases, and the unique benefits they offer.

Airbase.

As one of the top accounts payable automation software solutions, Airbase goes beyond simple invoice processing to level up your entire AP workflow. The platform offers a comprehensive spend management system that integrates intake, accounts payable, expense management, and corporate card programs into a single workflow. This all-encompassing approach provides unparalleled visibility and control over all non-payroll company spend.

With Airbase, account payable teams can eliminate manual data entry and optimize existing AP processes. Airbase offers all of the accounts payable features a business needs to maximize its finance team’s productivity and gain deep insights into financial health, from expense tracking to invoice automation.

It all starts at the beginning of a purchase request. A centralized intake module acts as a user-friendly front door for all spend requests, leveraging no-code workflows to route all relevant information to the correct stakeholders.

Airbase’s AP software is particularly beneficial for companies looking for a solution that can scale with their growth. Its cloud-based modular design caters to businesses of all sizes, from small and mid-size businesses to global enterprises, allowing them to add or drop individual solutions as their needs change.

Features:

- Powerful automation tools streamline accounts payable workflows.

- Self-service vendor portal makes onboarding easy.

- Complete visibility into every invoice.

- Automated three-way invoice matching to ensure accuracy.

- Expenses auto-sync to the general ledger in real time.

- Guided procurement standardizes purchasing across the entire organization.

BILL.

BILL is a financial operations platform for small and mid-size businesses (SMBs). BILL integrates both accounts payable and accounts receivable, which can help with budgeting and cash management. Hundreds of thousands of SMBs rely on BILL’s proprietary member network of millions to pay or get paid faster.

Features:

- Automatic approval workflows.

- Audit trails and authenticity verification ensure compliance.

- An extensive network of pre-loaded vendors to simplify vendor onboarding.

- 2-way sync with major accounting systems.

NetSuite.

Oracle’s NetSuite solution is a holistic enterprise resource planning (ERP) system that incorporates advanced accounts payable functionalities. Its cloud-based nature ensures accessibility and scalability — vital for businesses looking for a solution that can grow alongside them. NetSuite also offers real-time financial reporting, aiding in swift decision-making and strategy implementation.

Features:

- Centralized, customizable dashboards provide a comprehensive overview of AP processes.

- Trackable purchase requests simplify procurement processes.

- Auto-fill capabilities eliminate manual invoice processing.

- One-time and recurring payment scheduling ensures on-time compensation.

Oracle Cloud EPM.

Designed for complexity, Oracle Cloud EPM caters to large enterprises with extensive financial management needs. The advanced accounting software excels in offering detailed analytics and reporting capabilities. These tools enable businesses to navigate the complexities of global markets with precision and agility. The platform provides a comprehensive view of financial operations, supporting strategic planning and performance management.

Features:

- Smart View allows you to import data directly into Microsoft 365 programs for simple management and distribution.

- View key KPIs at a glance on the comprehensive dashboard.

- Built-in integrations and APIs ensure seamless data exchanges across all applications.

- AI/ML delivers advanced data analysis for deep, actionable insights.

Intuit QuickBooks.

As one of the most popular accounts payable software solutions for small businesses, Intuit QuickBooks is synonymous with user-friendliness and efficiency. These qualities make it an ideal choice for small businesses and freelancers. Its straightforward accounts payable module simplifies financial tasks, enabling businesses to manage invoices and payments with ease. QuickBooks’ cloud-based system ensures financial data is accessible anywhere, fostering flexibility in financial management.

Features:

- Lightweight solution that enables AP management on the go.

- With over 750 integrations, it syncs easily with existing tools.

- Built-in payment processing allows for a wide variety of payment options.

Tipalti.

Tipalti was designed to help small organizations scale with software that automates 80% of the manual work in the AP process. It positions itself as the alternative to hiring outside resources to handle AP. A streamlined approach relies on machine learning to help scan, capture, match, and process invoice data at header and line levels. Built-in approvals and payment scheduling make the process virtually touchless.

Tipalti integrates with 10 ERPs, including NetSuite, QuickBooks, Sage, and Xero.

Features:

- AI-powered automation streamlines AP processes.

- Support for payments to 196 countries and 120 currencies.

- PO support.

- Integrates with other tools for seamless data flow.

Sage Intacct.

Sage Intacct’s appeal lies in its rich automation features, which streamline the entire accounts payable process — from invoice capture to payment execution. This software stands out for its adaptability to various industries and its powerful analytical tools. AI-powered data analysis provides deep financial insights for more effective cash flow management and better compliance.

Features:

- AI-powered automation streamlines AP processes.

- Incorporates payroll and HR management for an all-in-one solution.

- Integrates with other tools for seamless data flow.

- Powerful reporting offers multi-dimensional insight into finances.

SAP.

SAP’s ERP solutions are renowned for their robustness and versatility, making them suitable for multinational corporations with complex financial processes. Its accounts payable module integrates seamlessly with other financial systems. The platform offers customizable workflows and comprehensive compliance features to meet the diverse needs of global businesses.

Features:

- Brings accounts payable, accounts receivable, cash flow management, and financial trading into a centralized platform.

- Two-way connections with multiple banks ensure seamless data flow.

- Set up an internal bank for intercompany payments.

- Enables standardized payment processing organization-wide.

Stampli.

Stampli is an AP automation platform founded in 2016. It offers invoice management, vendor management, approvals, and payments. More recently, it has added corporate credit cards and expense management. Stampli targets small businesses and large mid-market organizations. Stampli integrates with 70+ ERPs. It does not have an intake capability.

Features:

- Invoice processing.

- Purchase order support.

- Advanced vendor management.

- Multi-entity support.

- Currency payments to 150 different countries.

- Billy the Bot AI assistant.

Acumatica.

Acumatica’s cloud ERP system is distinguished by its flexibility and scalability, catering to mid-sized businesses looking to grow. Its user-friendly interface and customizable dashboards simplify complex financial data, making it easier to effectively manage accounts payable, vendors and suppliers, and more.

Features:

- Cross-module workflows enable seamless collaboration.

- Flexible, consumption-based licensing for easy scalability.

- Serves as a single source of truth for enhanced consistency, coordination, and records management.

How to choose the best accounts payable software for your company.

The right accounts payable software is key to achieving operational excellence, strategic insight, and a competitive advantage. Whether you’re a small business or a multinational corporation, choosing the software that best fits your needs will allow you to more effectively protect and optimize your company’s capital.

Selecting the right accounts payable automation software requires a thorough understanding of your company’s needs and strategic goals. Here’s what you need to consider when choosing the best AP automation software for your business.

Consider the size of your organization.

The size and complexity of your business will significantly influence your choice of accounts payable software. Small business owners may prioritize ease of use and cost. Meanwhile, larger enterprises might need comprehensive AP software solutions that offer advanced reporting, global payment capabilities, and integration with existing financial systems. Ensuring the software can scale with your business is critical to avoid disruptive transitions in the future.

Evaluate the time and cost savings.

Investing in accounts payable software should yield significant time and cost savings by automating manual business processes, reducing errors, and improving workflow efficiency. Consider solutions that offer features like electronic invoicing, automated approval processes, and real-time financial analysis to maximize these benefits.

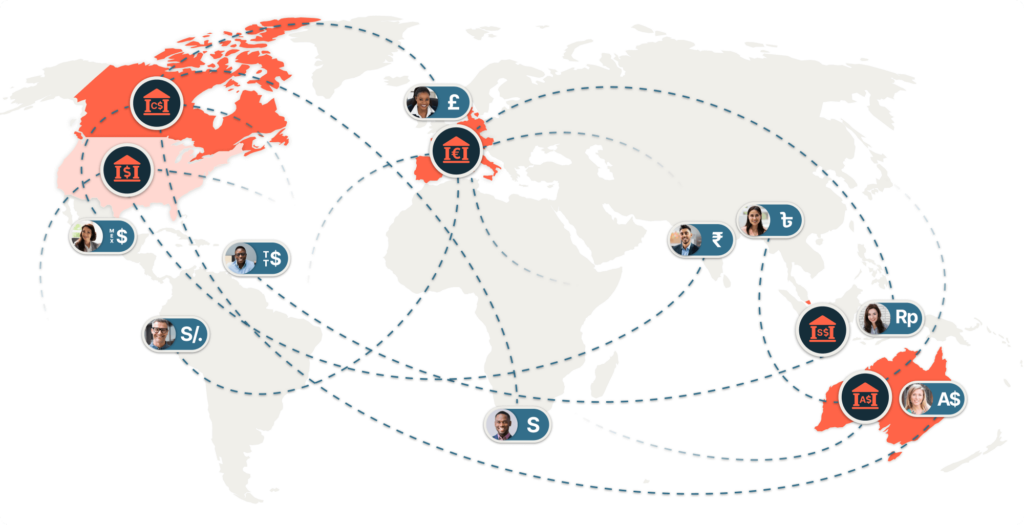

Global payment features.

For companies operating across borders, handling multiple currencies and adhering to international tax regulations is essential. Software that provides robust features for global payments, including currency conversion and regulatory compliance tools, is vital for streamlining international transactions.

Analyzing your invoice workflow.

A deep dive into your current invoice processing workflow can reveal inefficiencies and opportunities for improvement. It can also help you determine which key features to look for in an accounts payable software solution. Choose accounts payable software that is customizable to fit your unique workflows, enhancing efficiency and cost control.

Scalability — cloud solutions scale more flexibly.

Cloud-based accounts payable solutions offer the advantage of scalability and flexibility, both of which are essential for growing businesses. These solutions adapt to your business needs, allowing for easy upgrades and integrations without significant infrastructure changes. In addition, they enable seamless data exchange across multiple systems and provide access across a range of devices.

Vendor onboarding capabilities.

Efficient vendor management is important for maintaining healthy relationships with vendors and suppliers. The right software for accounts payable will simplify vendor onboarding, maintain accurate vendor information, and ensure compliance with payment terms and conditions.

User interface.

A user-friendly interface ensures that your team can effectively utilize the software without extensive training. Look for solutions that offer intuitive navigation, clear instructions, and accessible support resources to facilitate smooth operation and adoption.

Airbase: The best AP software for growing companies.

Selecting the right software for accounts payable automation is a strategic decision that impacts not just the efficiency of financial operations but also the overall growth and scalability of your business.

While we’ve looked at several excellent solutions, Airbase stands out for its comprehensive approach to spend management and AP automation. Its adaptability, user-friendly interface, and robust support make it an ideal choice for growing companies seeking to streamline their financial processes and focus on strategic growth.

In selecting an accounting software solution like Airbase, companies gain not just a tool for managing payments but a partner in financial management — capable of supporting strategic decisions, safeguarding capital, and facilitating growth.

Ready to transform your accounts payable process and elevate your company’s financial strategy? Explore how Airbase can support your journey toward streamlined operations, enhanced insights, and strategic growth. Discover the difference the right accounts payable software can make for your business today.

Schedule a demo

Learn how Airbase can transform your entire purchasing process.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana