There’s a lot at stake when you’re making the world a better place — but non-profit financial management is often a challenging juggling act with limited resources and high demands. Many non-profit organizations operate with low funding levels while at the same time needing to maintain the highest levels of financial accountability for donors and other stakeholders. They require effective financial planning and budgeting to ensure visibility, maintain donor trust, and empower strategic decision-making.

In this post, you’ll discover how this cornerstone of non-profit success can drive both operational efficiency and stakeholder confidence. You’ll gain access to different budgeting templates tailored for non-profits, actionable steps to implement them effectively, and expert tips to optimize your financial planning process.

Whether you’re a seasoned non-profit leader or just starting out, this guide will equip you with the tools to navigate financial challenges and achieve long-term impact.

What is a non-profit budget template?

A non-profit budget template is a pre-built framework, often available in formats like Excel, Google Sheets, or PDF, that helps non-profit organizations plan, track, and manage their finances.

Its primary purpose is to provide a structured way to allocate resources, monitor spending, and ensure alignment with the organization’s goals.

By organizing financial data into easy-to-read categories and providing a clear overview of income and expenses, these templates streamline non-profit financial management. They eliminate guesswork, save time, and allow non-profit teams to focus on what matters most — achieving their mission.

Take a tour of Airbase.

Explore Airbase with a self-guided tour.

Benefits of using a non-profit budget template.

Budgeting is the backbone of effective financial management for non-profit organizations, enabling them to track expenses, manage cash flow, and plan for future needs.

The non-profit sector operates under unique constraints, relying heavily on grants, donations, and limited funding sources. This dependence on external support makes precise budgeting even more critical. Especially since funding often comes with expectations of regular reporting of how and where those funds are being spent.

Without effective budgeting, non-profits can face significant challenges, such as:

- Funding gaps: Difficulty predicting and managing irregular revenue streams like grants and donations.

- Cash flow issues: Struggling to cover operational costs due to inconsistent funding.

- Operational shortfalls: Inability to meet program goals or sustain essential services.

Non-profit budget templates help overcome those challenges providing a structured, user-friendly framework for efficient financial planning.

Here are some of the key benefits.

Saves time and improves efficiency.

Using a pre-designed budget template eliminates the need to build a financial structure from scratch, saving non-profit teams countless hours. A ready-to-use framework provides a starting point so finance teams can focus on analyzing results rather than formatting spreadsheets.

A standardized format reduces redundancies, allowing staff to dedicate more time to mission-critical tasks.

Ensures accuracy and consistency in financial reporting.

Non-profit budget templates come equipped with pre-set formulas and standardized categories. This ensures that income and expenses are tracked accurately and consistently across monthly and annual reports.

At board presentations and stakeholder meetings, showing precise data builds credibility and confidence.

Helps with grant proposals and funding applications.

Specialized templates, such as grant proposal budget templates, simplify the process of presenting detailed financial plans to potential donors and grantors. These templates align with common grant application requirements, ensuring compliance and boosting the likelihood of approval.

Facilitates collaboration among team members.

Cloud-based budget templates, like those in Google Sheets, allow real-time collaboration among team members, so everyone stays aligned. Finance teams, program managers, and executive directors can simultaneously update data, share insights, and gather feedback, anywhere, any time. Features like version control and simultaneous editing are particularly valuable for non-profits with distributed teams.

Improves financial transparency and accountability.

Budget templates help non-profits maintain organized records of income and expenses, which is essential for donor trust and internal or regulatory compliance.

Supports strategic planning and goal setting.

Budget templates make it easier for non-profits to set financial goals, track progress, and adjust plans based on actual performance. This structured approach ensures that resources are aligned with the organization’s mission and priorities.

EBOOK

The 10 steps non-profit finance teams are taking to transform spend management.

Read our guide.

Types of non-profit budget templates.

Budget templates help non-profits strengthen financial oversight so they can focus on their mission. But it’s important to choose the template that fits best with your organizational needs.

Considerations for choosing the right template:

- Size and scope: Smaller non-profits benefit from simple templates, while larger organizations may need detailed ones for tracking multiple programs and funding streams.

- Funding types: Grants, donations, and government contracts often have unique reporting needs, influencing the structure of the template.

Annual operating budgeting template.

An annual operating budget template is a crucial tool for non-profits to plan and manage their finances for the year. It outlines projected income, expenses, and any anticipated surplus or deficit, creating a 360-degree view of the organization’s financial health.

This template helps non-profits:

- Forecast income from sources like grants, donations, and program fees.

- Plan for expenses, including salaries, operational costs, and program delivery.

- Identify potential surpluses for reinvestment or deficits to address in advance.

Key features:

- Monthly breakdowns: Tracks income and expenses on a monthly basis for better oversight and timely course correction.

- Expense categories: Includes detailed sections for salaries, program costs, administrative expenses, and fundraising efforts.

- Income sources: Categorizes funding streams for transparency and compliance.

- Variance tracking: Compares actual performance to the budget to highlight areas needing attention.

Using this template helps non-profits set clear financial goals and monitor progress throughout the year.

Smartsheet is a software provider of spreadsheets for solving specific problems. They offer some helpful templates that you can download for free. Here is a link to their operating budget template.

Project budget template.

A project budget template is specifically designed for planning and managing the financial aspects of projects or programs for non-profits. It helps ensure resources are allocated effectively and projects are completed within their financial limits.

Key features:

- Detailed cost breakdowns: Provides itemized sections for expenses like staffing, materials, travel, and overhead costs.

- Timelines: Aligns budget allocations with project schedules to track spending over time.

- Specific objectives and deliverables: Links budget items to measurable goals, ensuring transparency and accountability.

You can download a non-profit project template here.

Cash flow budget template.

The cash flow budget template helps non-profits manage irregular cash flows by tracking daily transactions, payment schedules, and expected revenue. It provides a clear overview of when funds will be available and when expenses are due.

By predicting cash shortages or surpluses, the template helps with proactive financial management, allowing non-profits to adjust spending, secure short-term funding, or plan for cash gaps. It helps ensure that the organization maintains liquidity and operates smoothly despite fluctuating income and expenses.

You can download a cash flow budget template here.

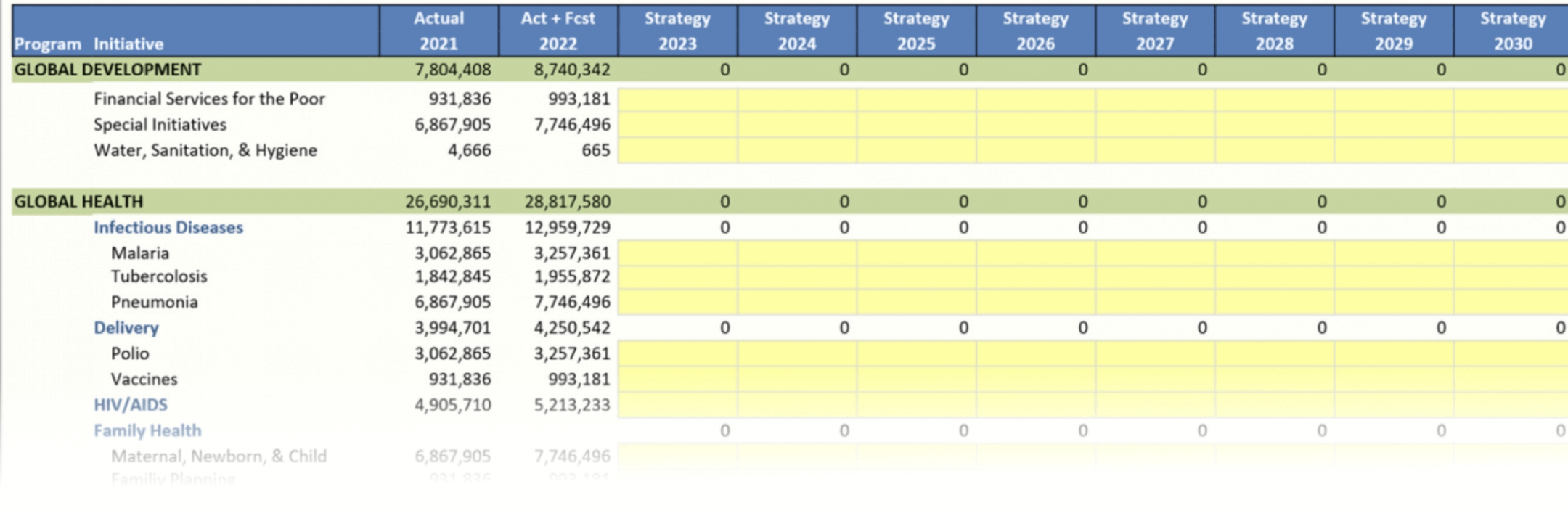

Multi-year budget template.

The multi-year budget template is used for long-term financial planning, covering multiple years to help organizations set and achieve their long-term goals. It helps project expected financial outcomes, track progress toward future objectives, and incorporate contingency plans.

Key features:

- Long-term goals: The template aligns financial resources with the organization’s strategic vision in order to ensure funds are allocated to the key priorities over several years.

- Expected financial outcomes: It projects revenue and expenses for each year, providing a roadmap for growth and sustainability.

- Contingency plans: The template includes provisions for unexpected events, such as shifts in funding sources or unforeseen costs, for flexibility and risk management.

How to choose the right non-profit budget template.

As you can see, non-profit budget templates aren’t a one-size-fits-all solution. To get the most out of a non-profit budget template, it’s important to select the right one for your needs.

Here are the key considerations to guide you in choosing the best non-profit budget template:

Type of non-profit.

Small vs large non-profits.

Small and large non-profits have different financial structures and management needs, which can influence the choice of budget template.

- Small non-profits can benefit from straightforward templates with basic categories for revenue, expenses, and cash flow.

- Large non-profits typically have more complex operations, multiple programs, diverse revenue streams, and larger budgets. A more advanced template that supports detailed breakdowns by department or program, as well as consolidated financial reports, will manage these complexities effectively.

Scope of activities.

The broader the non-profit’s activities, the more specialized its budget template may need to be.

- Community programs: For organizations focused on local initiatives, a simple, program-specific budget template may be enough. It should include sections for each program’s revenue and expenses.

- Advocacy: Non-profits focused on advocacy may need templates that track not only funding but also lobbying expenses, compliance with political activity laws, and PR costs.

- International initiatives: Non-profits operating internationally may require templates that account for foreign currency, foreign grants, and international financial tracking.

Funding sources.

The source of funding can significantly impact the type of budget template required:

- Grants: Organizations that rely on grants need templates that track restricted and unrestricted funds separately, with the ability to allocate expenses to specific grant categories and maintain compliance with donor restrictions.

- Donations: Templates for donation-based non-profits should include tracking for fundraising expenses, donor contributions, and major giving programs. It’s important to manage the balance between donor-restricted funds and general operating expenses.

- Government contracts: Non-profits receiving government contracts may require templates that comply with specific regulations, including detailed expense reporting, indirect cost rates, and audit trails to meet government standards.

Organizational goals.

The scope of the non-profit’s goals should guide the choice of template:

- Long-term strategy: If an organization is focused on expansion, capital projects, or long-term sustainability, a multi-year budget template is the best choice.

- Short-term needs: For non-profits primarily concerned with day-to-day operations, a more straightforward annual operating budget template may be sufficient.

Flexibility and scalability.

- Customization options: No two non-profits are alike, so flexibility is key. The budget template should allow for modifications, such as adding unique income streams or expense categories specific to the non-profit’s mission.

- Scalability: As a non-profit grows, its financial needs will also change. Any template should be scalable, allowing the organization to add more programs, departments, or funding sources without overhauling the entire system.

Best practices for using non-profit budget templates.

By standardizing the process of budgeting, non-profit budget templates help ensure that they can allocate resources efficiently and make informed financial decisions.

Below are some key best practices for using non-profit budget templates effectively:

Consistent data entry.

- Maintain accuracy: To avoid confusion and errors, it’s vital to have consistent and accurate data in the template. This means adhering to standardized categories and naming conventions across different sections of the template.

- Regular updates: It’s important to update the budget template regularly to reflect changes in funding, expenses, or program activities. Regular updates keep the budget aligned with the actual financial status of the organization, ensuring it remains a reliable tool for decision-making.

- Data validation: Implementing a data validation process — where entries are periodically reviewed for accuracy and completeness — ensures that all figures are correct and reflect the latest information. This process reduces the risk of financial discrepancies and ensures the budget is a true representation of the non-profit’s financial health.

Regularly review and adjust the template.

- Monthly reviews: Regular reviews, ideally on a monthly basis, are crucial to ensure the organization is on track with its budget. These reviews help identify any variances between projected and actual spending, allowing for adjustments before issues become significant.

- Forecast updates: Keep the budget dynamic by updating forecasts based on actual financial performance and any anticipated changes. This ensures that the budget stays responsive to evolving circumstances.

- Adjust for new information: Budgets should be flexible enough to accommodate unforeseen changes. Regularly revisit and adjust the template to account for new projects, unexpected expenses, or additional revenue streams that might not have been part of the original budget.

Involve stakeholders.

- Collaborative planning: Engaging key stakeholders from different departments in the budgeting process ensures that the budget reflects the organization’s entire financial landscape. This collaborative approach promotes transparency and accuracy by incorporating diverse perspectives and needs.

- Regular feedback: Gathering input from department heads, program managers, and other relevant stakeholders helps refine the budget template and ensures it meets the specific financial needs of each area.

For financial analysis.

- Track financial performance: Beyond planning, a non-profit budget template should be used for ongoing financial analysis. Track variances between budgeted and actual figures to gain insights into financial trends and patterns that can inform future decision-making.

- Identify cost-saving opportunities: Regularly analyzing the budget can help identify areas where cost savings are possible. By comparing actual spending with budgeted amounts, non-profits can pinpoint inefficiencies and make adjustments to optimize resources, maximizing the impact of their funds.

Document changes and rationale.

- Keep a change log: It’s important to maintain a change log within the budget template, documenting any alterations along with the rationale behind them. This helps track the evolution of the budget over time and provides clarity on why specific changes were made.

- Maintain audit trails: Maintaining clear records ensures accountability and transparency. This is particularly important for audit purposes or during financial reviews, as it helps demonstrate proper financial management and compliance with regulations.

- Review historical changes: Periodically reviewing past changes to the budget can offer valuable insights into the effectiveness of previous adjustments. This helps refine future budgeting practices, making the non-profit more adept at managing its finances in the long term.

Key takeaways for effective non-profit budget templates.

Using non-profit budget templates offers a structured approach to financial management, helping organizations maintain financial health and make informed decisions.

By adhering to best practices such as consistent data entry, regular reviews, conducting financial analysis, and documenting changes, non-profits can optimize their budgeting process. Whether working with an annual budget, program-specific budget, or cash flow template, a well-maintained budget helps keep the non-profit on track toward its mission.

Non-profits looking to streamline processes and boost efficiency and control should consider Airbase. With features like flexible approval workflows and real-time data insights, Airbase helps non-profits manage, and track their budgets more effectively.

Here’s how Airbase can support non-profit budget templates:

- Centralized spend management: Airbase consolidates all financial transactions, including invoices, card spend, and expense reimbursements, into one platform. This integration allows non-profits to align their budget templates with all non-payroll spending, making it easier to track budget variances and adjust forecasts accordingly.

- Automated workflows: With Airbase’s automated approval workflows, non-profits can ensure that every spend request follows a standardized process, reducing the risk of errors and improving compliance with internal policies. This means that all departments or programs can work within the same template, ensuring consistency across the organization.

- Real-time financial insights: Airbase provides real-time data and reporting, allowing non-profits to continuously monitor and update their budget templates as new information becomes available.

- Improved transparency and accountability: Airbase’s platform allows all stakeholders to see where money is being spent and compare it with the approved budget.

- Data-driven decision-making: With detailed reports and analytics, Airbase empowers non-profit leaders to make data-driven decisions when adjusting their budget templates. It helps identify cost-saving opportunities, track financial performance, and plan for future needs.

- Compliance and audit readiness: Airbase helps maintain audit trails by logging all changes and approvals, ensuring that non-profits can easily track modifications to their budget templates and provide transparent reports during financial reviews or audits.

By using Airbase, non-profits can take their budget templates to the next level, gaining greater control, flexibility, and insight into their financial operations, ultimately helping them better allocate resources and achieve their mission.

To explore more resources on effective financial management for non-profits, reach out today and learn how Airbase can help streamline your non-profit’s budgeting and financial processes.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana