Accurate accounting depends on careful reconciliations. While reconciling both the incoming and outgoing money flows in your organization is important, we focus here on the outgoings. Ensuring those payments are correct requires meticulous transaction matching, where every dollar spent is accurately recorded in both internal and external systems, with documentation to support it.

Reconciling internal records with outside sources reveals errors, omissions, and possible fraud. This is an essential task for any business, albeit often tedious and time-consuming. Modern account reconciliation tools streamline the process with greater accuracy and precision. Here, we’ll examine some of the most common reconciliation challenges accounting teams face and how to overcome them.

What is account reconciliation?

Account reconciliation is a critical accounting process that ensures the accuracy and integrity of financial statements. During reconciliation, accounting teams compare internal records against external ones — like credit card and bank statements or inter-company transactions. The goal is to verify that the amounts recorded in the general ledger match those reported externally.

This process confirms the accuracy of financial data, identifies errors, discrepancies, and potential fraud, and lays the groundwork for sound financial health with robust reporting and compliance.

Bank reconciliation.

Bank reconciliation looks specifically at cash account balances and transactions. Accounting professionals verify that the company’s accounting records line up with each external bank statement.

Discrepancies reveal hidden bank fees, income not yet recorded, or errors in the bank’s or the company’s records.

Inter-company reconciliation.

Organizations with multiple businesses under a single parent company must reconcile inter-company transactions between subsidiaries to verify organization-wide accuracy and consistency. This eliminates redundant or repeated expense records.

Credit card reconciliation.

Finance teams compare transactions on credit card statements against company receipts and records to verify that charges are accurate, legitimate, and accounted for in the correct financial period.

Common challenges of account reconciliation.

Account reconciliation is straightforward but it’s also a tedious, time-consuming process — especially for companies that still use manual methods.

Here are common issues accounting teams face when closing the books.

Using outdated methods.

One of the biggest challenges of AP reconciliation is the continued reliance on manual reconciliation processes. AP teams often have to comb through paper credit card statements and bank account logs, which can be extremely time-consuming and error-prone.

Not only are manual processes inefficient but they also put the business at risk. These outdated practices can lead to financial discrepancies, missed payments, and late fees. In severe cases, they can even affect a business’s financial stability.

Despite these challenges, an Airbase survey of 745 finance professionals revealed that 55% still manually reconcile bank accounts. In addition, 36% continue to manually reconcile credit card statements.

Vast number of transactions.

Another reason account reconciliations are difficult is the sheer number of transactions that take place each day. As a company grows, the number of transactions becomes larger but the finance team may be the last department to hire new resources. Instead, they find themselves reliant on Excel spreadsheets and basic bookkeeping tools to validate thousands of transactions from various sources.

Double-entry accounting.

Double-entry accounting in a general ledger affects the reconciliation process. A GL should be a snapshot of the movement of funds at a specific moment but problems arise when the timing of payment authorization and settlement don’t align. This makes it difficult for finance teams to determine exactly how much money is available and whether adjustments are needed during reconciliation.

Multiple payment types.

Accounting teams also face challenges when they have to reconcile payments from multiple external systems. Different systems have different processes for handling exceptions, increasing the number of manual interventions required to ensure accuracy and consistency.

How to streamline the account reconciliation process.

A streamlined reconciliation process for outgoings begins with a consolidated spend management platform powered by accounting automation. With this in place, all employee spending syncs to the general ledger automatically, eliminating numerous manual tasks.

Automate the reconciliation workflow.

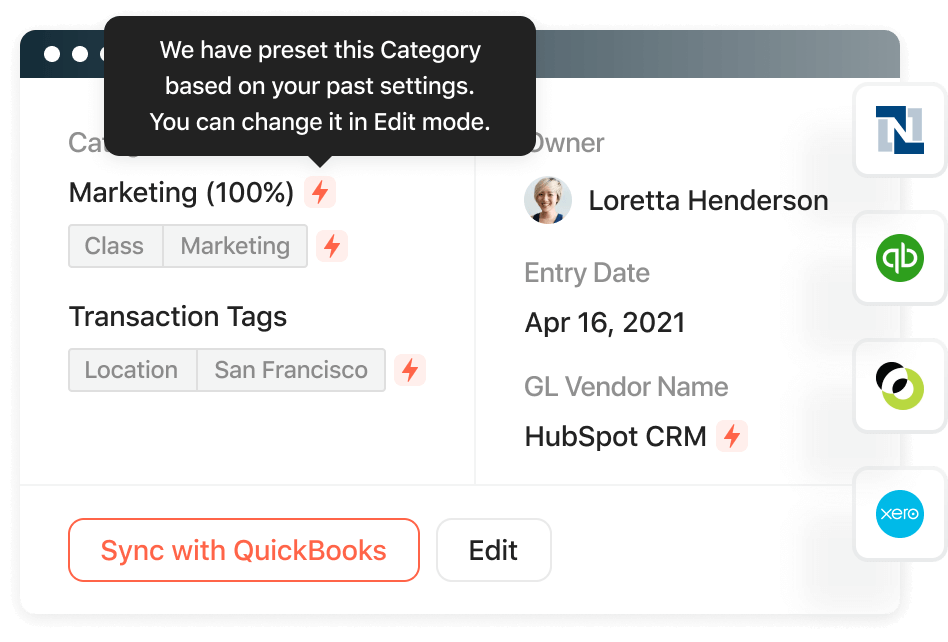

Comprehensive spend management platforms automate approval workflows, eliminating the need to correct errors during reconciliation.

Categories, tags, and other transaction details are supplied and verified at the time of approval, so this information is validated before spending takes place. As a result, accounting teams confidently work with accurate data during reconciliation, saving time otherwise spent on correcting discrepancies.

Procurement professionals upload receipts and invoices into the purchase event, which preserves all required purchase documentation in the system for a clear audit trail.

Centralize data sources.

A central repository for all financial data relating to outgoings creates a single source of truth for accounting teams. Bank statements, credit card transactions, receipts, and documentation exist in a single platform.

Reducing manual data entry lowers the potential for errors at the month-end close. Centralization also provides a unified view of financial data, enhancing the accuracy and efficiency of the reconciliation process.

Ensure real-time visibility.

Real-time visibility into the reconciliation process allows companies to monitor financial data as transactions occur. Immediate insight is invaluable for maintaining up-to-date and accurate financial records. Users can also set up alerts for unusual activity to address potential issues promptly before escalating into larger discrepancies.

Real-time visibility also means faster decisions. Finance teams access the most current data when evaluating the company’s financial health or performing month-end closes. Plus, companies can track the flow of funds and identify trends or anomalies as they happen, increasing financial control.

Leverage APIs and integrations.

APIs and integrations connect financial systems with software to further streamline the account reconciliation process flow. Data automatically transfers between systems, reducing manual data entry and associated errors. In other words, transactions recorded in an ERP or other accounting software automatically sync to the reconciliation tool.

Any updates or changes in one system sync across all connected platforms so information is always consistent and accurate.

Cross-functional communication.

Close collaboration between accounting, finance, and operations quickly resolves issues like missing transactions and other reconciliation discrepancies. Insights and data from different functional areas lead to improved processes and comprehensive solutions.

When all teams involved in reconciling accounts collaborate through a centralized, shared platform, miscommunication risk decreases as the reconciliation process speeds up.

AP Automation Tour

Explore 3-way matching in our AP Automation Product tour.

Benefits of a streamlined account reconciliation process.

When virtual or physical card spending data is automatically transmitted to the spend management platform as it occurs, there’s no need to spend hours poring over credit card statements. Accounting teams complete the reconciliation process in a fraction of the time and with far fewer errors.

Reduced manual errors.

Automating account reconciliation reduces human errors prevalent in manual accounting methods. Transposition mistakes — where figures are accidentally reversed — and other simple data entry errors create discrepancies in financial reporting.

Automation cross-verifies entries, flags inconsistencies, and prompts for human review only when necessary, freeing up valuable time for finance teams to focus on more strategic tasks.

Faster reconciliations.

Automated tools and standardized procedures accelerate transaction matching between internal records, bank statements, and other financial data sources.

This speed is crucial at month-end closes, where timely reconciliations mean the difference between meeting and missing reporting deadlines. Faster reconciliation also means quicker responses to irregularities, which improves financial health.

Proactive risk identification.

Streamlined account reconciliation includes continuous monitoring and exception reporting that detects irregular activities that could signify errors or fraud. Proactive risk identification helps organizations mitigate potential losses by addressing discrepancies as soon as they appear.

Early risk identification meets regulatory compliance and audit readiness by ensuring financial records are accurate and accounted for, protecting companies from potential fines and non-compliance penalties.

Improved financial accuracy.

Reduced errors and real-time entry validation keep financial statements accurate. This translates to better decision-making, better financial reporting, and improved stakeholder confidence — from investors to board members. Additionally, reliable financial records inform strategic planning and improve forecasting.

Using integrated systems to reduce reconciliations.

Integrated systems streamline the account reconciliation process by centralizing and automating numerous manual tasks. Required information, such as categories and tags, is entered and vetted at the time of approval, so data has already been verified before spending occurs, eliminating the need for reconciliation adjustments.

Supporting documents, like receipts or invoices, are uploaded into the purchasing event, so the system captures all spending documentation as it happens. This produces an audit trail for any point in time.

With one dashboard, users see all financial data from bank statements, credit card transactions, and invoices, eliminating manual comparison between accounts or systems.

In addition, the system automatically matches transactions recorded in the company’s books with those reported by banks and credit card companies. Any mismatches or unusual transactions are flagged for review, allowing AP teams to quickly identify potential errors or fraudulent activity.

Accounting professionals approve matches, investigate discrepancies, and make necessary adjustments through a straightforward, interactive interface. This speeds up the account reconciliation process and improves accuracy by minimizing human error.

Real-time reconciliation gives finance teams accurate financial status and instant alerts on issues.

Continuous oversight supports financial regulation compliance, generates customized reports that meet auditing or business requirements, and frees financial teams to focus more on analysis and strategic decision-making rather than the minutiae of routine data entry and error correction.

Transform your account reconciliation process with Airbase.

For customers with NetSuite or Sage Intacct, Airbase’s assisted reconciliation feature eliminates the burdensome and time-consuming task of finding reconciling items at the month end.

Assisted Reconciliation automatically retrieves real-time GL data, matches transactions, and identifies discrepancies — all in a matter of minutes. AP teams simply have to review the reconciliation report to see the reconciling items between Airbase and the GL, such as timing differences, transaction amount discrepancies, sync errors, missing entries, or entries created manually in the GL.

This speeds up the reconciliation process by several hours, reduces the margin for error, and significantly reduces the time-to-close.

Plus, by including expenses, corporate cards, and accounts payable into a unified platform, Airbase simplifies financial operations, enabling automatic real-time transaction matching and immediate discrepancy resolution.

The Airbase platform keeps your financial statements accurate and audit-ready with minimal manual effort, allowing teams to focus on more strategic tasks. And it enhances cross-functional communication and ensures that all departments have visibility into financial transactions, which is crucial for maintaining accuracy and preventing errors due to miscommunication or information delays.

With advanced automation features and detailed analytics, Airbase provides valuable insights into financial operations, aiding in informed decision-making and driving business growth.

Schedule a product demo today to see how Airbase streamlines your account reconciliation processes.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana