“Knowledge is knowing that a tomato is a fruit. Wisdom is knowing not to put it in a fruit salad.” — Rugby player Brian O’Driscroll

Most finance team members know the basics of the Internal Revenue Service Form 1099 requirements, and the IRS has issued clear guidelines, including updates for the current tax year.

But it takes more than knowledge of the regulations to handle 1099 reporting in a way that flows smoothly without causing disruption and a last-minute scramble every January. Making a game plan before it’s time to tackle 1099s makes the whole process much easier.

Build Form 1099 in your processes year-round.

Instead of considering Form 1099 filing obligations as a nuisance to deal with at the last minute each year, build it into your processes all year round. In doing so, you’ll have everything you need when it’s time to send out 1099s to independent contractors.

Wendy Walker of Sovos says it’s crucial to be on top of Form 1099 obligations to save on stress and avoid penalties.

“It’s important to ensure your reporting on these forms is both accurate and timely. The penalties for non-compliance are pretty sharp,” she notes.

Wendy advises on Form 1099 requirements and serves as a member of the Information Reporting Subgroup within the Internal Revenue Service Advisory Council (IRSAC). In this capacity, she counsels the IRS on industry matters concerning forthcoming and ongoing tax reporting modifications that affect businesses.

Wendy cautions that the IRS generates penalty notices for things like late filings, returns filed on the wrong form, incorrect information, and other errors — and the penalties have increased for inflation this year.

Here are some simple steps to sail through these often-onerous tax forms this year!

1099 Prep | On-Demand Webinar

Learn how to de-stress your 1099 process with Wendy Walker from the Internal Revenue Service Advisory Council (IRSAC).

Step 1: Understand your Form 1099 obligations.

Before you start, you need a clear understanding of IRS regulations, the different types of 1099 forms, and who is considered an independent contractor.

Who gets a Form 1099?

If you paid independent contractors or self-employed individuals more than $600 in 2023, you must complete an IRS Form 1099 and send Copy A of the form to the IRS. Copy B must be sent to the independent contractor.

There is one exception to the $600 cut-off, which is that any royalties paid over $10 must be reported as taxable income.

Form 1099-NEC.

In 2020, the IRS introduced Form 1099-NEC (which stands for non-employee compensation). The majority of 1099s that businesses send out will be Form 1099-NEC. Use Form 1099-NEC for:

- $600 or more of services paid to non-employees.

- Payments of more than $5,000 of consumer products for resale.

Wendy gives some examples of the types of payments requiring 1099-NEC: fees paid to lawyers, accountants, and landscapers, taxable fringe benefits for non-employees, commissions paid to non-employees, and fees paid to directors on the board.

Form 1099-MISC.

The older form, 1099-MISC, is now used for miscellaneous expenses, such as:

- Medical or healthcare services.

- Rent.

- Fishing boat proceeds.

- Gross proceeds paid to an attorney.

- Section 409A deferrals.

- Non-qualified deferred compensation.

- Royalties or broker payments in lieu of dividends of $10 or more.

It’s always best to consult the IRS instructions for any form and to seek advice from a tax attorney when needed, but here are some general instances when you are required to issue a 1099:- Services over $600 performed by an LLC, LLP, or independent contractors or consultants, and paid for by check, ACH, or debit card: Issue a 1099-NEC.

- Rent over $600: Issue a 1099-MISC.

- Royalties over $10: Issue a 1099-MISC.

- Medical and health payments over $600: Issue a 1099-MISC.

Who doesn’t receive a Form 1099?

1099s do not need to be issued to C-Corps (check the W-9 to see if they are a C-Corp), with the exception of medical and health payments, gross proceeds paid to attorneys, or substitute payments in lieu of dividends or tax-exempt, all of which require a 1099-MISC.

Tax-exempt entities, government agencies, and foreign payees should also not receive a 1099 form.

1099s are also not required for things such as business travel expenses, employee expense reimbursement, office supplies, freight, storage, or similar items, or rent if the payments are made to real estate agents or property managers.

Income paid to foreign persons, including non-resident aliens and foreign corporations, is reported on Form 1042 instead of Form 1099.

Internal Revenue Service deadlines to note.

Deadlines are a critical part of the 1099 requirements, and you will be penalized if you miss one. Here are some key dates to report payments made in 2023:

January 31, 2024: 1099-NEC due to IRS and vendors. 1099-MISC due to vendors.

March 31, 2024: Deadline for the 1099-MISC to be filed electronically with the IRS.

Filing tax forms electronically: Changes for this year.

Wendy says one of the biggest changes for 2023 reporting is the threshold for e-filing requirements. To report payments in 2023, you must file electronically if you’re filing ten or more aggregate returns.

Previously, the threshold was 250, and it was applied separately to each tax form type, so this is a significant change.

“When you’re determining if you meet the ten-form threshold, you do have to include in your count employment tax returns like 945 and payroll 941s. However, you are not required to file them electronically.”

Another change applies to Form 8508, which is used to apply for an exemption from electronic filing requirements.

If this is your first time submitting Form 8508, it will automatically be accepted by the IRS, but subsequent years require justification.

This year, the IRS has added examples of appropriate justifications, including natural disasters, fire, or serious illness.

If you request an exemption from electronic filing due to financial hardship, you must attach two cost estimates from service providers to show hardship.

“Obviously, they’re really serious about this e-file requirement. They need to reduce as much paper as possible.”

Another new change is the addition of transmitter control code limits (TTC). This means each EIN has a limit of 1,000 separate files to one TTC. If you submit more than 1,000 files, you’ll need more TCCs.

Effective for 2023 reporting, Form 1042 must be filed electronically. This is another significant change, as Form 1042 was typically only filed by paper.

Making corrections.

Note that all corrections must be made in the same format as the original filing.

That means if you need to correct an electronic submission, the correction must also be made electronically.

Combined federal / state filing program.

The Combined Federal / State Filing program (CF/SF) facilitates the electronic submission of tax forms, such as Form 1099, to both the Internal Revenue Service (IRS) and participating state tax agencies.

This streamlined program aims to simplify and expedite the reporting process for businesses, ensuring compliance with federal and state tax regulations.

The regulations around CF/SF are complex and have undergone recent changes, so do your due diligence on how they affect your company.

Back-up withholding for independent contractors.

The IRS requires 24% back-up withholding on gross non-employee income when:

- The recipient doesn’t provide a TIN in the required manner.

- The IRS notified you that the payee provided an invalid tax payer identification number (TIN) on a previous 1099.

- Payee indicates they are subject to back-up holding on their W-9.

Note that failure to back-up withhold transfers the liability to the payer — plus penalties and interest.

“The Internal Revenue Service is becoming more aggressive about back-up withholding,” says Wendy.

“Make sure that you reconcile withholdings on 1099 to your 945. That’s an area where we’re seeing penalty notices.”

Step 2: Develop a foundation for your game plan.

1099 forms are easier when the end goal is embedded in the purchasing process. That way you are on top of 1099 filings throughout the tax year, with all the necessary information and tax documents at hand.

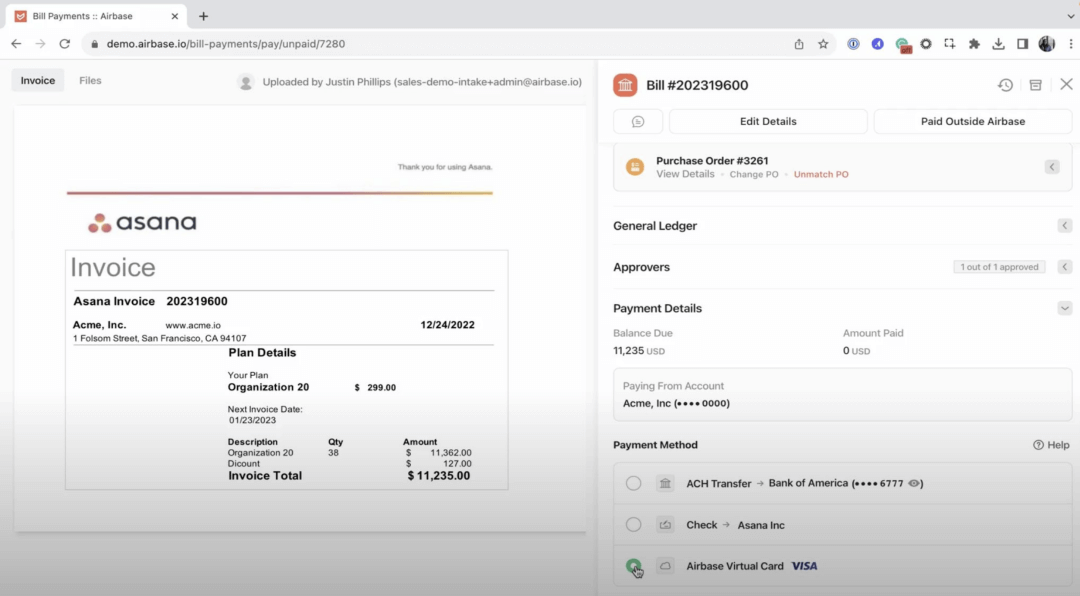

An AP automation platform that addresses the entire payment process, from initial request to GL sync, will take 1099 requirements into account every time a bill is paid.

AP Automation Tour

Explore 3-way matching in our AP Automation Product tour.

Here’s how Airbase helps.

- The minute a vendor is added to the system, simply indicate if the vendor fits the criteria for receiving a 1099.

- If it does, Airbase collects their tax information by having the vendor fill out and submit a W-9 form. The W-9 has all of the relevant information you will need for the 1099 forms: name, address, contact information, email address (preferably for the accounting department), and EIN/SSN.

- An Airbase setting can be used to block any payment to a vendor who must submit a W-9 until that form is received. Motivating vendors to submit this documentation is easier when payment is on the line.

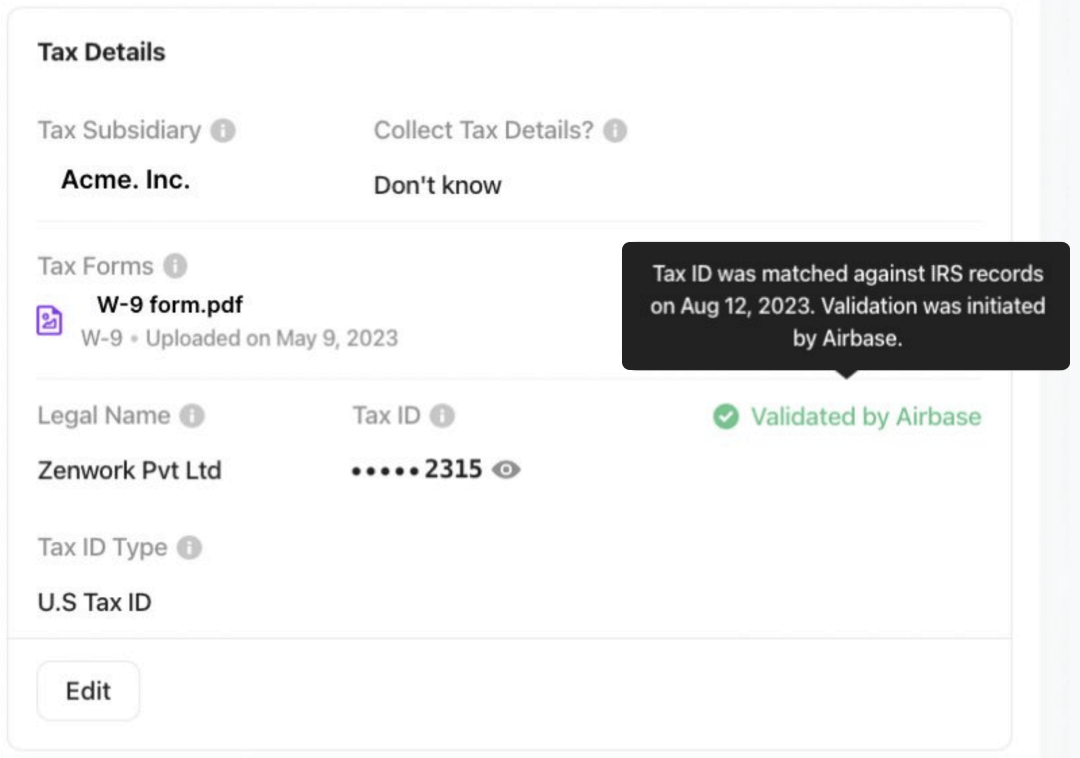

- Verify the tax ID. Wendy’s top best practice for smooth 1099s is to validate all taxpayer identification numbers (TINs) before you report to the Internal Revenue Service.

- Airbase validates all tax IDs for domestic vendors against IRS records and international vendors’ tax IDs against government records.

- AI-powered OCR technology takes this tax information from the submitted W-9 to get the relevant details to cross-reference against IRS records. This automated process protects you from penalties for submitting invalid tax information and helps you meet global compliance requirements.

- In Airbase, a vendor’s contracts, invoices, W-9s, and other documents are attached to the same record, so you have everything you need to manage payments for that vendor in one place.

- Airbase’s reporting functionality will produce a real-time report showing those vendors, together with other vital tax information you’ll need for 1099 reporting.

Step 3: Enforce vendor compliance.

You can choose to make W-9 submission a requirement for getting paid. In other words, if a vendor hasn’t submitted the form, you won’t pay them. We recommend enabling this feature so you don’t have to chase down the information when it’s 1099 time.

You’ll find vendors submit their W-9s much faster if it’s tied to payment!

Step 4: Strategically shift the reporting burden when possible.

When a vendor is paid by credit card, PayPal, or other types of payment processors, the 1099 obligation moves to the payment processing company. This is one reason why astute finance teams are moving bill payments to their card programs.

With a payment-agnostic AP automation platform, such as Airbase, you can make bill payments through your corporate card program and shift the burden of 1099 reporting to the card company.

It’s an easy way to avoid 1099 forms (as fun as they are) without any extra work on your part. As an added bonus, you can earn cash back on card spending. Think of it as monetizing accounts payable.

Wendy notes that PayPal terms and conditions should be examined carefully, since some PayPal products indicate they are not responsible for the 1099 forms.

FAQ’s on Form 1099.

Do I file a 1099 form for travel reimbursements?

Only non-employees receive a 1099 for travel expenses, and only if they don’t submit a detailed expense report indicating it’s a reimbursement.

Are software purchases considered a service, rent, or royalties?

Wendy says she is asked this a lot — and the answer depends a lot on the nature of the software.

Downloadable for a one-time fee: this type of software is considered “goods” and is not reportable.

Software that you purchased and for which you own 1-3 copyrights: Considered a “royalty” and reportable on Box 2 of form 1099-MISC.

Downloadable software that runs on your server for an ongoing fee and for which you have copyright rights: Considered a “rental payment” and reportable on Box 1 of Form 1099-MISC.

Software that runs on the provider’s servers, for which you don’t control the content or assume any risk: Considered a “service,” reportable in Box 1 or Form 1099-NEC.

Are payments to attorneys reportable?

Again, this is dependent on the nature of the payment.

Gross fees payable to an attorney are reported in Box 14 of 1099-MISC. This includes litigation-related payments.

For example, if your company settles a lawsuit and you pay the attorney part of the settlement, that belongs on Form 1099-MISC.

On the other hand, fees paid for legal services, such as insurance contract reviews, are reported in Box 1 of 1099-NEC.

Can I file multiple Form 1099s for the same vendor?

You can file multiple 1099 forms for the same vendor for the same business entity (although they may not be thrilled to receive a 1099 form multiple times from you).

The IRS requires that you delineate each account number on each separate 1099 form, so they don’t get flagged as duplicates.

De-stress the 1099 process with Airbase.

The wise approach to 1099s is to embed the process into a complete bill payment system so that when it’s time to report to the IRS and to the vendor, all of the information will be at your fingertips — vendor name, validated tax ID, address, and amount owed.

To learn more about our automated procure-pay-close system can help, talk to Airbase.

Because knowing you have to do 1099 forms and having the wisdom to do them without making them into a fruit salad, well … that’s how great companies are built.

Watch the complete 1099 webinar here.

Note: This post is based on publicly available information and does not constitute legal or tax advice. Please consult a tax professional with any questions specific to your situation.

Schedule a demo

Learn how Airbase can transform your entire purchasing process.

Jira

Jira  Ironclad

Ironclad  Asana

Asana