Managing full-cycle accounts payable efficiently is vital for optimizing cash flow, maintaining good vendor relationships, ensuring compliance, and achieving business growth.

But if you’re wondering what the full-cycle accounts payable process involves, this write-up is for you.

Join us as we explore full-cycle accounts payable, the steps involved in the process, and some tips on improving your AP cycle efficiency.

What is full-cycle accounts payable?

Full-cycle accounts payable refers to the process that businesses use to manage their accounts payable functions, from receiving invoices to making vendor payments.

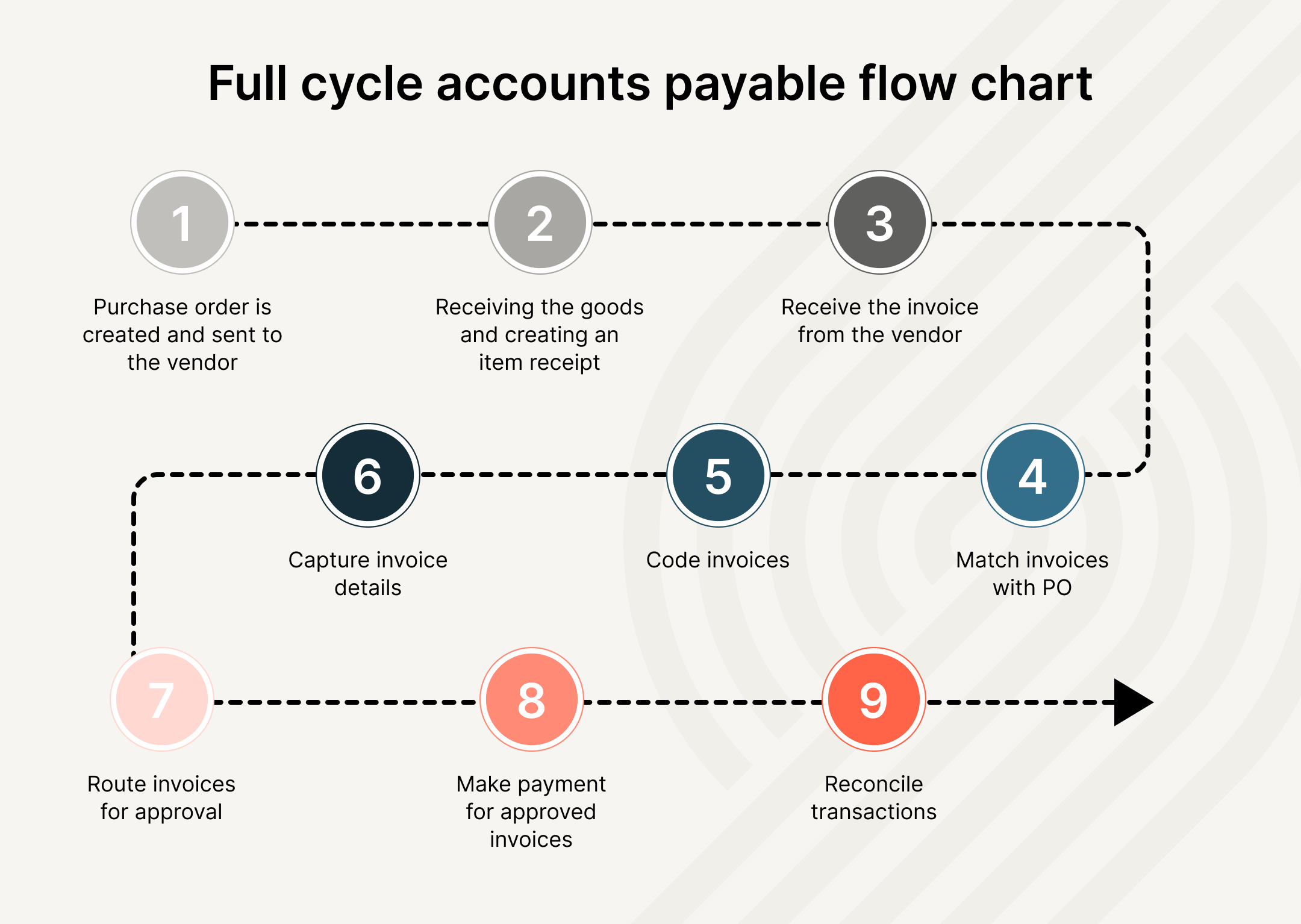

Here’s a detailed breakdown of what full-cycle accounts payable typically involves:

- Creating, approving, and sending the purchase order to vendors.

- Receiving the invoice from vendors.

- Capturing and coding the invoice.

- Matching the invoice with the PO and item receipt.

- Obtaining invoice approvals from relevant stakeholders.

- Recording approved invoices in the ERP or accounting system.

- Processing the payment for approved invoices.

- Reconciliation of transactions.

Is full-cycle accounts payable the same as end-to-end AP?

Yes. Full-cycle accounts payable is the same as the end-to-end process of accounts payable.

What are the steps in full-cycle accounts payable?

Here are the steps involved in the full-cycle accounts payable process.

Step #1: Creating and sending the purchase order.

The buyer specifies the quality and quantity of goods or services as well as the expected timeframe for delivery to the vendor through a purchase order (PO). As a legal document, the PO helps both the buyer and the vendor streamline and document the transaction.

The process of creating a PO begins with the creation of a purchase request. Here are the steps involved in this process:

- Creating a purchase request: Relevant stakeholders use a purchase requisition form to create a purchase request, marking the start of the intake process.

- Routing the request to approvers: The requisition form is then routed through the necessary approval channels.

- Creating the PO: Once the necessary approvals are obtained, a PO is created along with a unique PO number.

- Sending the PO to the vendor: The PO is sent to the vendor via email or through an automated system using an accounts payable software.

Step #2: Receipt of goods or services.

The following are the typical steps that ensue once the PO is issued.

- Receipt acknowledgment: The vendor reviews the PO and acknowledges its receipt. The PO now becomes a legally binding contract.

- Order fulfillment: The vendor fulfills the order by delivering the specified goods or services according to the terms outlined in the purchase order.

- Inspection of goods: The buyer inspects the products or services received and confirms that they are in line with the terms outlined in the PO.

- Item receipt: The buyer issues the item receipt or the Goods Received Note (GRN). The GRN details the name and number of the vendor, the quantity of products received, and the date of delivery.

Step #3: Capturing and coding the vendor’s invoice.

The next phase is all about capturing the vendor’s invoice with these steps:

- Invoice creation: The vendor creates an invoice based on the PO, detailing the goods or services provided, their quantity, the payment breakdown, and terms.

- Sending the invoice: The vendor can send the invoice to the buyer via fax, mail, email, or a website portal.

- Invoice capturing: The invoice data is captured and entered into an ERP (Enterprise Resource Planning) or accounting system.

- Coding: The invoice then undergoes general ledger (GL) coding, where the invoice is connected to relevant GL accounts. Coding helps accounting teams to identify the account, location, or department, responsible for the bills.

Step #4: Matching the invoice.

The accounting team matches the invoice against the PO. This helps them identify any discrepancies such as incorrect quantities, prices, or items and ensures that payments are made only for goods or services received.

There are two types of PO matching:

- 2-way PO matching: Compares the invoice with the PO. 2-way matches are typically used for non-complex purchases where there is no requirement of a GRN.

- 3-way PO matching: Involves comparing the PO with both the vendor’s invoice and the Goods Receipt. Ideal for complex purchases, 3-way matching provides stronger control and verification over accounts payable processes compared to 2-way matching.

Step #5: Obtaining invoice approval.

Both PO-matched and non-PO invoices are routed for necessary approvals for payment. Non-PO invoices are invoices received for goods or services not ordered through a formal purchase order process.

- Approval routing: Invoices are routed to the appropriate approver(s) via email or automated systems.

- Invoice review: Approvers review the invoice details, ensuring compliance with company policies and budget constraints.

- Completion: Once approved, invoices proceed to the accounts payable department for processing and payment.

Step #6: Making the payment.

After receiving approval, the invoice is prepared for payment processing. Approved invoices can be paid individually or in batches.

- Categorization and prioritization: Approved invoices are grouped based on priority, payment methods, and payment deadlines to determine the order for payment authorization.

- Payment execution: Based on vendor preferences and AP department processes, the appropriate payment method is chosen, including checks, ACH, virtual cards, or wire transfers.

Step #7: Reconciliation of transactions.

The last step in the accounts payable process is account reconciliation. Here’s an overview of what it involves:

- Matching invoices and payments: Ensuring that invoices received from suppliers match the payments made or scheduled.

- Identifying discrepancies: Detecting and addressing any discrepancies between invoices and payments, such as incorrect amounts, late payments, or missing invoices.

- Periodic reconciliation: Maintaining accurate and up-to-date records of accounts payable transactions for financial reporting and auditing purposes.

Full-cycle AP flow chart.

This chart visually depicts the full-cycle accounts payable process described above.

AP Automation Tour

Explore 3-way matching in our AP Automation Product tour.

Upstream AP vs downstream AP.

The full-cycle accounts payable processes can be grouped into two categories — upstream and downstream AP flows.

Upstream AP flows.

These are the procurement-related activities that start with strategic sourcing and end with PO creation.

Here are the upstream AP workflows:

- Strategic sourcing (RFx)

- Supplier selection

- Contract negotiation

- Purchase requisition

- PO creation

- Vendor onboarding

- Approval workflow

Downstream AP flows.

Downstream processes involve activities that occur after the PO creation and end with payment execution and reconciliation. The following steps represent the downstream accounts payable processes.

- Invoice capturing

- Invoice coding

- Invoice matching

- Approval routing

- Payment processing

- Reconciliation

The biggest challenges in full-cycle AP.

The full-cycle accounts payable processes come with their own set of challenges that can impede AP efficiency and accuracy. Here are some of the top challenges that AP teams face, along with some stats on AP inefficiencies.

- Poor visibility into spend: Airbase’s Spendlightenment survey of over 200 finance professionals reveals that 54% of respondents have no visibility into spend until after it has occurred, indicating the need for better AP processes. Only 13% have visibility into purchases before they are made. Lack of visibility into spend can raise the risk of maverick spend, fraud, and duplicate spend, which negatively impacts business performance.

- Lack of automation: Over three quarters of respondents in Airbase’s survey believe that automation directly impacts business growth positively. Despite the known benefits of automation, over 30% of businesses have not automated their AP processes, according to a study by PYMNTS. Manual AP processes are time-consuming and error-prone, leading to payment delays that can impact vendor relationships and cash flow.

- Payment delays: Inefficient AP processes can raise the risk of duplicate invoices, missed payments, double payments, and payment delays. APQC’s survey (American Productivity & Quality Center) of accounts payable trends reveals that invoice processing time can go beyond a week for many businesses.

- Time wasted on low-value tasks: The above-mentioned survey also shows that 97% of finance teams waste valuable time on tedious tasks that could be devoted to strategic activities. These low-value tasks include chasing vendor details, invoices, and receipts, alongside fixing errors, GL coding, reconciliation, PO matching, and data transfers.

- Capacity issues: Talent crunch coupled with burnout due to increasing workload continue to be one of the key challenges affecting finance professionals. Capacity issues cause 18% of accountants to make errors daily, while 59% make multiple financial errors each month according to a survey by Gartner.

- Payment fraud: Cybersecurity concerns and payment fraud are the other key areas of concern for AP teams. According to the AFP® Payments Fraud and Control Survey, 80% of businesses faced payment fraud attacks in 2023. All payment methods, including ACH, checks, and wire transfers, are susceptible to attacks, leading to financial losses, compromised financial data, business disruptions, and damage to business reputation.

How to solve inefficiencies across the AP cycle.

The first step to solving inefficiencies in full-cycle accounts payable is to evaluate your existing AP system. Once you identify the steps and bottlenecks, you can take these steps to optimize your AP processes.

- Establish KPIs: Set key performance indicators to measure AP efficiency and identify areas for improvement. Here are some of the key metrics to focus on:

- Cycle time: The time taken to process invoices from receipt to payment, including approval times.

- Accuracy: Invoice matching, invoice exception rate, and payment accuracy rates are some of the metrics to track.

- Month-end closing: The target timeframe for AP activities, such as processing invoices, reconciling accounts, and verifying payments.

- Vendor relations: Vendor satisfaction and response time for queries or feedback on payment processes.

- Cost reduction: Cost per invoice processed or cost savings achieved through process improvements.

- Compliance: Audit findings and compliance with regulatory requirements.

- Centralize PO and invoice management: Use a single entry point for purchase requests, POs, and invoices to improve processing efficiency and visibility into spend.

- Streamline approvals: Clearly define the purchase policy and automate approval workflows to ensure timely and consistent approvals. Ensure all documents and information are captured before creating POs and processing invoices.

- Automate data entry: Implement automation tools to handle data entry tasks, reducing human error and speeding up the process. This allows staff to focus on more strategic tasks.

- Implement fraud prevention measures: Introduce robust measures to detect and prevent fraudulent activities. This includes monitoring transactions, implementing multi-layered approval workflows, and educating employees about potential risks.

- Focus on continuous improvement: With technologies and compliance requirements evolving over time, an ongoing commitment toward process automation, training for AP staff, policy updation, and investment in new technologies.

Level-up your AP process with advanced automation.

We have already seen how a lack of automation keeps AP teams trapped in low-value tasks, negatively impacting their ability to take up strategic initiatives. A majority of respondents in Airbase’s survey firmly believe that automation is the path to success.

Moreover, 92% agree that “accounting teams with a growth mindset should seek out software and systems that can help them reduce repetitive manual work.”

But not all AP automation software are created equally. Legacy or immature systems may fail to address all of the pain points AP teams face, necessitating investment in multiple disparate systems that fail to deliver the ROI you seek.

Airbase stands out as a holistic procure, pay, close solution that helps optimize the AP cycle by:

- Bringing all spend under management with 360-degree visibility into spend across categories.

- Leveraging AI, OCR, and ML to capture invoice details accurately and match them with POs and item receipts.

- Offering granular procurement guidance on creating purchase requests and routing them to the right approval channels.

- Offering vendor management tools, such as a self-service portal, document capture, and faster payment processing.

- Providing global vendor payments to over 200 countries and 140+ currencies via multiple payment methods.

- Accurately reconciling transactions via deep integration with 70+ ERP systems.

- Preventing payment fraud with robust tools and the services of a dedicated fraud investigation team that operates 24/7.

That’s not all. Airbase automates full-cycle accounts payable to deliver these impressive results:

- 83% accounting labor cost savings due to procure-to-pay automation.

- 22-day decrease in time to approve purchase requests.

- Increased profit from vendor management and AP efficiencies worth $140,000.

- $60,000 in savings due to increased expense policy compliance by Year 3.

Here are some infographics that shows Forrester Consulting’s findings on the three-year economic impact of Airbase:

The Total Economic Impact of Airbase

In Summary.

Clearly, optimizing every step of full-cycle accounts payable is the top priority for growth-oriented businesses. This comprehensive process involves fine-tuning everything from PO creation and verification of invoices to payment processing and reconciliation.

While automation is the key to improving the efficiency of your AP processes, choosing the right P2P automation software is as crucial as following automation best practices.

As a unified platform that handles the end-to-end accounts payable processes, Airbase not only eliminates bottlenecks but also helps businesses unlock tangible value. In fact, Forrester Consulting’s report on Airbase’s economic impact reveals that businesses realize a benefit of $979,000 over three years versus costs of $263,000, translating to a whopping ROI of 272%.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana