Events & Webinars

Stay current. Get inspired. Earn CPE credits.

Explore our webinar series

In-Person Events

Join us at Sage Future

CONFERENCE

June 3-5

Georgia World Congress Center

Atlanta, Georgia, and other locations in Atlanta

Path to Becoming a CFO

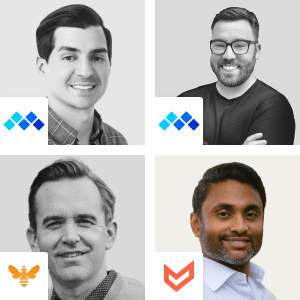

Our signature monthly interview series, featuring top CFOs, board members, and executive recruiters. Stories to inspire and provide guidance on how to build your career in finance. Join us live, download the recording, or find the podcast on your favorite streaming service.

What I Wish I Knew

In this series, Airbase CFO, Aneal Vallurupalli, hosts fellow finance, accounting, and operations professionals to discuss the issues that impact the office of the CFO.

20-Minute Tales from the Frontlines of Finance

Stories from finance pros on solving real problems. These lively discussions promise three actionable take-aways.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana