Bill.com, or BILL, is a cloud-based software designed to help small and mid-market businesses manage bill payments and automate their accounts payable and receivables. Since its inception in 2018, BILL has continued to face stiff competition from multiple players.

If you’re looking for a suitable solution for your business, delving into BILL’s features and exploring Bill.com alternatives is the first step.

Comparison criteria.

Here’s the criteria we used to evaluate BILL alternatives:

- The range and depth of features.

- User friendliness.

- Pricing.

- Reviews and ratings.

Overview: BILL alternatives and competitors.

| Competitor | Top Feature | Primary Market | G2 Rating | Pricing |

| Airbase | P2P | Mid-market | 4.8 | $$ |

| Corpay | Expenses | Small to mid-market | 4.2 | $$$ |

| Emburse Certify Expense | Expenses | Small to mid-market | 4.3 | $$$ |

| Happay | Expenses | Small to mid-market | 4.5 | $$ |

| Melio | AP Automation | Small to mid-market | 4.6 | $$ |

| Mineral Tree | AP Automation | Mid-market | 4.2 | $$$ |

| Spendesk | Expenses | Small to mid-market | 4.7 | $$$ |

| Mesh Payments | Expenses | Small to mid-market | 4.6 | $$ |

| NETELLER | Payment | Small to large businesses | 3.8 | $$ |

| Paycom | Expenses | Small to large businesses | 4.2 | $$ |

1. Airbase.

Airbase, as one of the leading Bill.com alternatives, excels in providing tailored procure, pay, close solutions for accounting and finance professionals. While Airbase does not offer AR automation, P2P, spend management, and AP automation are its forte. The other differentiators include an intuitive interface, ease of month-end reconciliations, integrated corporate cards, and consolidated spend management capabilities.

Bill.com concentrates on AP and AR automation and offers budget management and cash flow forecasting functionalities.

Automated intake process with customizable approval flows

Best features.

- All-in-one P2P platform: Offers tailored procure, pay, close solutions across the modules of Guided Procurement, AP Automation, Expense Management, and Corporate Cards.

- Intake process for requirements setting and transaction routing keeps all stakeholders in the loop.

- Granular AP automation capabilities: Fast-tracks bill creation and approvals while facilitating month-end closing with PO matching, auto-categorization of expenses, amortizations, assisted reconciliation, and support for foreign currency and multiple subsidiary accounting.

- Advanced approval workflows and transaction routing to all stakeholders either in Airbase or via integration with their business systems.

- Advanced expense management: Leverages the power of AI-powered OCR technology and machine learning to automate expense reports.

- Optimizes vendor management: Provides a vendor management portal while streamlining collaboration and compliance. Renewal date notifications.

- Robust payment capabilities: Streamlines payments with direct payments, international payment support, and the ability to link multiple banks to a subsidiary.

- Deep integrations: Offers native and custom integrations with major GLs, over 70 ERPs, HRIS, and popular tech stacks.

- 24/7 fraud and risk mitigation: Flags potential fraud with a dedicated fraud investigation team that operates around the clock.

Airbase G2 rating: 4.8/5

Airbase pricing.

Airbase offers three packages: Standard, Premium, and Enterprise. All the packages include key platform features while optional add-ons are available for travel, purchase orders, and approval workflows. Users can also opt for individual modules instead of the whole platform.

Customers and best suited for:

- Company size: Mid-market to large enterprises (with 50 to 10,000 employees).

- Solution needs: Businesses looking for a scalable solution for Guided Procurement, Account Payable Automation, Expense Management, and Corporate Cards.

Take a tour of Airbase.

Explore Airbase with a self-guided tour.

2. Corpay One.

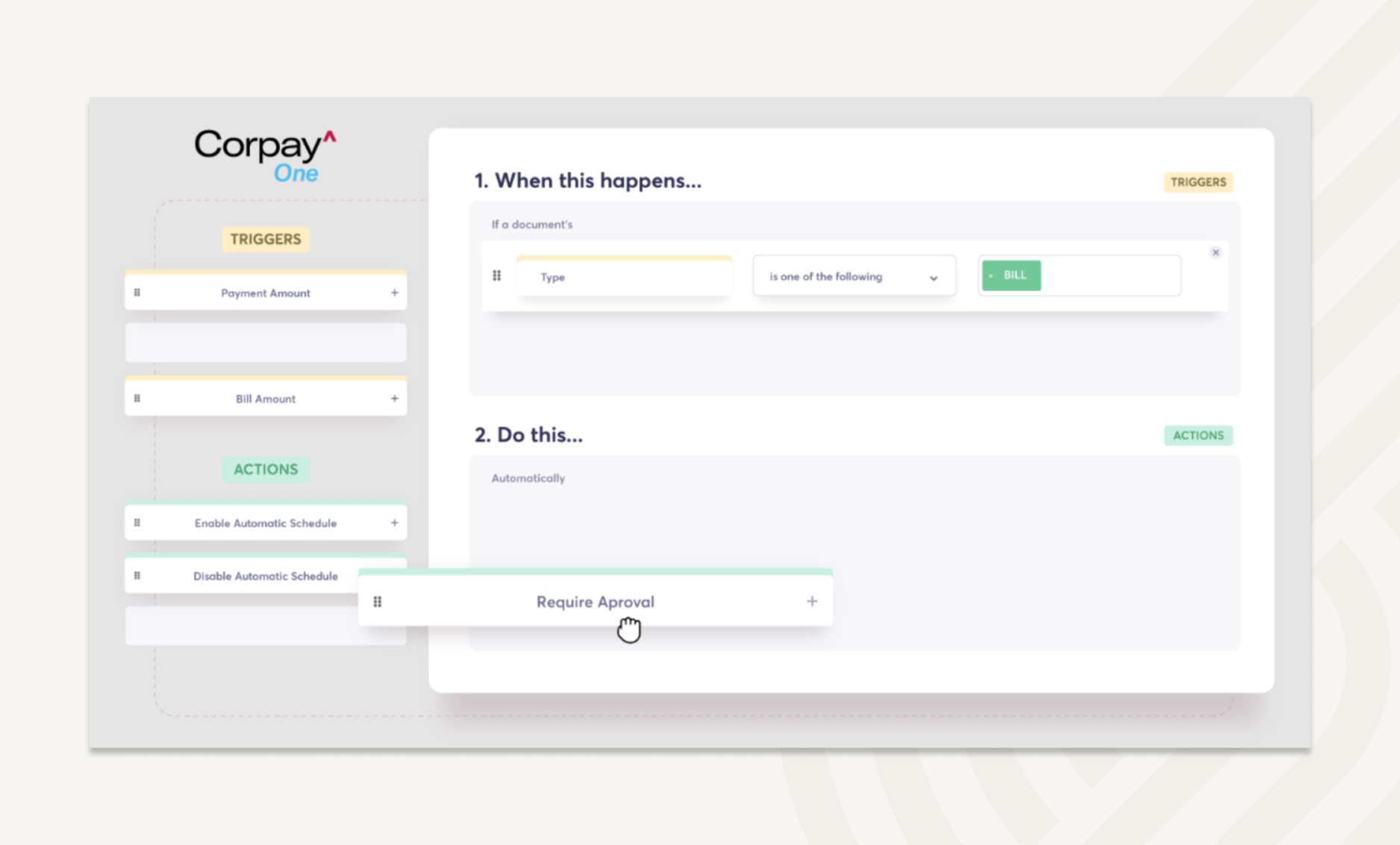

Founded in 2016, Corpay One is a spend management solution for small to medium-sized businesses. It offers tools for expense management, AP automation, and international bill payments, also providing a thorough audit trail to optimize financial performance.

Customizable approvals for spend management.

Best features.

- AP automation: Enables building of custom rules approval workflows with a drag-and-drop approval workflow builder and syncing of expenses to your GL.

- On-the-go expense management: Allows setting of custom spend limits on Corpay One Mastercard and uploading of receipts on the mobile app.

- Seamless approvals in Slack: Makes it easy for stakeholders to decline or approve expenses from within Slack.

- Multiple payment options: Supports international wire payments to 30+ countries as well as vendor payments through ACH, check, and Corpay One Mastercard.

Corpay G2 rating: 4.2/5

Corpay pricing.

While there is no platform fee, Corpay charges a transaction fee for each payment type. In addition, users pay a fee for each document they upload (bills, receipts, invoices, etc.).

The per-document fee ranges from $0.50 for 1-500 documents per month to $0.35 per document for 2001+ documents per month.

Customers and best suited for:

- Company size: Small to mid-market businesses with 10-200 employees.

- Solution needs: Companies that use QuickBooks or Xero and need basic AP automation and expense management solutions.

3. Emburse Certify Expense.

As one of the user-friendly alternatives to Bill.com, Emburse Certify Expense simplifies the way businesses handle their expenses.

Its seamless interface makes it easy for employees to submit expenses, managers to approve them, and finance teams to reconcile payments.

Receipts are automatically collected on a set schedule

Best features.

- Seamless expense management: Enables the issuing of physical and virtual cards with custom spend limits and automates expense reports with ReportExecutive on a set schedule.

- Multiple ways to upload receipts: Leverages Emburse Receipt Technology to extract data from receipts that can be added via email, mobile app, and fax or imported from partner vendor sites.

- Clear audit trail: Tags and codes transactions automatically in Emburse Certify Expense before syncing to GL.

- Insightful analytics: Offers 40 standard reports, a custom report builder, and actionable dashboards for analytics.

- Global payment support: Converts 140 currencies in real time based on the expense date.

Emburse Certify Expense G2 Rating: 4.3/5

Emburse Certify Expense pricing.

Emburse Certify Expense offers two types of plans based on the number of employees. Certify Now, designed for businesses with 1-25 employees, is priced at $12 per user/month, while the Professional plan offers flexible pricing options for small and medium businesses.

Customers and best suited for:

- Company size: Small to medium businesses.

- Solution needs: Businesses looking for an easy-to-use expense management software in addition to travel booking and payment solutions.

4. Happay.

Happay has been one of the Bill.com competitors since its inception in 2012. The company’s focus is on streamlining expense management and corporate travel booking for businesses of all sizes.

Extracts expense data from multiple sources

Best features.

- Multiple expense capture methods: Extracts expense data from physical bills, emailed invoices, SMS, mileage tracking, and pre-paid cards while auto-generating expense reports.

- Automated mileage tracking: Integrates with Uber Business and captures mileage to calculate trip expenses.

- Prevention of duplicate bills: Enables users to upload bills in bulk, while AutoMerge consolidates duplicate bills, removing manual effort.

- Streamlined travel booking: Supports booking of compliant travel while connecting users with multiple suppliers.

- Rich spend analytics: Provides detailed insights into spend and allows users to generate custom reports.

Happay G2 Rating: 4.5/5

Happay pricing.

Pricing information is not available on Happay’s website.

Customers and best suited for:

- Company size: Small, mid-market, and large enterprises.

- Solution needs: Companies seeking to replace legacy systems with modern travel, expenses, and payment solutions.

5. Melio.

If you’re looking for affordable Bill.com alternatives with multiple payment options and basic AP automation capabilities, Melio may be the right choice. With Melio, you can manage your accounts payable and receivables, streamline payment processes, and ensure timely transactions.

Set custom approval workflows for spend

Best features.

- Simplified account payable: Extracts details from uploaded bills, automatically schedules emailed invoices for payment, and syncs transactions with GL.

- Account receivables: Fast-tracks invoice creation and integrates payment button within the email while reconciling payments automatically.

- Multiple payment options: Offers same-day bank transfers, instant transfers, and expedited check payments.

- Supports international payments: Enables batch payments to multiple countries and to vendors who do not have a Melio account.

Melio G2 rating: 4.6/5

Melio pricing.

Melio does not have a platform fee but charges a fixed rate for different transactions. While ACH bank transfer and the first two checks per month are free, instant transfers and fast ACH bank transfers incur a 1% fee. Fast checks and international payments carry a charge of $20 each.

Customers and best suited for:

- Company size: Small and medium businesses.

- Solution needs: Companies who want a B2B payment platform that offers basic AP and AR automation.

6. MineralTree.

MineralTree is one of the suitable alternatives to Bill.com for businesses that prioritize AP automation. MineralTree differentiates itself from BILL with integrations to a plethora of ERPs.

Syncs invoice data with ERP

Best features.

- Smart AP automation: Captures and automatically codes invoice data, carries out PO matching, and syncs transactions to GL or ERP.

- Advanced approval workflows: Enables custom approval workflows based on multiple attributes and automates reminders to fast-track approvals.

- Managed payments: Offers payment support with a dedicated team to minimize transaction cost.

- Real-time dashboards: Displays insights on key areas, including payment mix, cash flow, and AP process.

- Secure virtual card: Offers virtual cards that can be pre-loaded with specified amounts based on established vendor agreements.

MineralTree G2 Rating: 4.2/5

MineralTree pricing.

MineralTree charges a licensing fee in addition to transaction fees and fees based on payment and invoice volume.

Customers and best suited for:

- Company size: Mid-market companies and enterprises.

- Solution needs: Businesses that are looking for AP automation and analytics.

7. Spendesk

Mesh Payments is a good choice for businesses looking for Bill.com competitors with free plans. Apart from travel management, Mesh offers AP automation and spend management solutions. Unlike Bill.com, Mesh Payments also has an exclusive solution for SaaS subscription management.

Reimbursement can be triggered from Spendesk Wallet

Best features.

- Easy subscription management: Groups recurring payments and subscriptions in the platform for easy management.

- Streamlined AP automation: Leverages machine learning to extract VAT details and automate expense account allocation while matching POs with invoices.

- Simplified expense and reimbursement management: Uses OCR technology to extract data, supports reimbursement from within Spendesk wallet, and creation of unique virtual cards with spend controls.

- Efficient approval workflows: Allowing for swift authorization of expenses with customizable approval workflows.

Spendesk G2 rating: 4.7/5

Spendesk pricing.

Spendesk has not listed the pricing information on its website.

Customers and best suited for:

- Company size: Small, medium, and large businesses.

- Solution needs: Companies that prioritize spend management, AP automation, and budget planning.

8. Mesh Payments.

Mesh Payments is a good choice for businesses looking for Bill.com competitors with free plans. Apart from travel management, Mesh offers AP automation and spend management solutions. Unlike Bill.com, Mesh Payments also has an exclusive solution for SaaS subscription management.

Expenses and reimbursements can be managed under one budget

Best features.

- Travel management: Provides multi-agency support, booking tools, and built-in policy enforcement to control spend.

- Expense management: Categorizes expenses with automatic matching of receipts, approval workflows, virtual cards, and quick reconciliation of transactions.

- Payment insights: Offers real-time data on each payment including SaaS subscriptions, travel expenses, and in-person purchases.

- Multi-subsidiary workflows: Enables tracking and management of receipts, expense categorization, and reconciliation across subsidiaries.

Mesh Payments G2 rating: 4.6/5

Mesh Payments pricing.

Mesh Payments’ packages are available across three categories — Pro, Premium, and Enterprise. The Pro plan is free while the Premium plan is priced at $10 per user per month. The pricing for the Enterprise plan is customized based on the business’s specific needs.

Customers and best suited for:

- Company size: Small, medium, and large businesses.

- Solution needs: Businesses with international entities looking for features such as virtual cards, SaaS subscriptions, travel, and global spend management.

9. NETELLER.

NETELLER can be considered as an alternative to Bill.com for companies seeking a robust online payment platform. While it does not have expense management or AP automation capabilities, NETELLER facilitates deposits in its e-wallet and payments in numerous currencies.

Multiple ways to make online payments

Best features.

- Global network of merchants: Serves businesses across industries, including entertainment, retail, travel, and more.

- Payment security: Offers multiple payment fraud protection tools and helps eliminate chargebacks.

- Multi-currency payments: Provides online payment processing across 200 countries and 22 currencies.

- Payments to non-account holders: Users can send online payments to recipients who do not have a NETELLER account with just their email.

- Deposits: Makes it easy to deposit money into a NETELLER account using multiple payment methods.

NETELLER G2 rating: 3.8/5

NETELLER pricing.

NETELLER charges a fee per transaction for different payment or deposit methods. There are two account levels — NETELLER Standard that carries a charge of 2.99% per transaction and NETELLER True with a fee of 1.45%. While users can receive money through NETELLER for free, they have to pay a per-transaction fee of 2.99% for sending money to another NETELLER account holder.

Customers and best suited for:

- Company size: Small, medium, and large businesses.

- Solution needs: Companies and merchants looking for global money transfer and payment solutions.

10. Paycom.

While Paycom is primarily recognized as an HR and payroll software, we have featured it in our list of Bill.com competitors due to its expense management features. Paycom’s expense management solutions offer efficient tracking, approval, and reimbursement of employee expenses.

Scanned receipts are automatically parsed with AI technology.

Best features.

- Automated receipt parsing: Facilitates expense report creation by automatically parsing uploaded receipts using AI technology.

- Credit card integration: Links employees to credit card numbers to expedite the building of expense reports.

- Expense allocation: Syncs with GL and automatically allocates expenses.

- Custom approval flow: Offers customizable approval chains for expense approvals.

- Mileage tracker: Allows employees to track and submit mileage through the mobile app.

- Reimbursement flow: Automatically routes approved reimbursements through the expense tracking software into payroll.

- Custom reports: Provides on-demand reports on expense transactions.

Paycom G2 rating: 4.2/5

Paycom pricing.

Pricing information is not available on Paycom’s website.

Customers and best suited for:

- Company size: Small, medium, and large businesses.

- Solution needs: Caters to integrated HR, payroll, and expense management needs of businesses.

Airbase vs Bill.com.

Moving on to our head-to-head Airbase vs Bill.com comparison, we’ll closely examine the strengths and features of each platform.

What does Airbase do?

Airbase is a unified platform that caters to all spend management needs in addition to offering advanced AP automation, intake-to-pay, and corporate card features. If you are looking for a single platform to handle both your AP and AR needs, Airbase would not be the right choice. Bill.com on the other hand does offer both. However, its ease of use and depth of features cannot compare to Airbase’s modern P2P software if you’re seeking a procurement or spend management solution.

Airbase goes beyond Bill.com with its customizable virtual cards, physical cards, and real-time reporting capabilities. In addition, Airbase stands out from its competitors by enabling international payment across 200 countries in 145+ currencies. A dedicated fraud investigation team that works 24×7 to flag potentially fraudulent transactions and flexible integrations with over 70 ERPs are some of Airbase’s other plus points.

Airbase solutions.

Guided Procurement.

The Guided Procurement module optimizes the intake process with no-code approval workflows tailored for procurement, IT security, legal, and other stakeholders. Airbase integrates with contract lifecycle management (CLM) and GRC (Governance, Risk, and Compliance) systems to streamline processes and optimize compliance.

Accounts Payable Automation.

Airbase leverages cutting-edge AI-enabled OCR technology to automate bills and ensure their accuracy. The platform triggers approval workflows based on parameters such as the amount, vendor, and GL category. Deep integration with NetSuite enables 3-way matching of invoices against item receipts and POs. Airbase also automatically codes, tags, categorizes, and syncs data into the GL.

Expense Management.

The intuitive Expense Management module provides a comprehensive solution for businesses to efficiently track, manage, and report expenses. Employees can easily capture expenses while companies can set customizable spend limits and gain rich insights into spend.

Corporate Cards.

When we compare Airbase with its competitors, it’s clear that Airbase has a more versatile corporate card program with virtual, physical, and partner card integrations for AMEX and SVB. As Airbase integrates with 70+ ERPs including Oracle Corpay, Emburse Certify Expense, and QuickBooks Online, seamless transaction synchronization is a given.

What does Bill.com do?

Bill.com is cloud-based software that automates accounting tasks and expense management for small and mid-market businesses. While the platform does not have intake capabilities, it offers both accounts payable and accounts receivable automation. Integration with QuickBooks, NetSuite, and Sage Intacct allows syncing of transactions and PO matching.

BILL also offers a cash flow forecasting feature with a separate dashboard to view metrics on cash flow and cash balance. In addition, the platform uses historical accounting data and predictive modeling to assess future cash flows.

AP automation.

Bill.com allows users to capture bills from different sources, including emails, uploaded files, and scanned documents. Users can customize approval policies while the software automates the approval routing. Bill details and payments sync automatically to the accounting platform.

Invoicing.

Pre-built templates are available to customize invoices. Users can track the status of their invoices with email notifications while automating payment reminders and recurring invoices.

Bill.com supports payments via credit card and ACH. The payments received get synced to the accounting software for quick reconciliation.

Expense management.

In addition to a dashboard to track spend in real time, Bill.com’s expense management software automates expense reports while coding and syncing transactions to the accounting system. Users can view expense trends based on date range, categories, department, client, and more.

Employees can submit receipts through the BILL mobile app for reimbursement.

Payments and cards.

The platform makes it easy to generate unique virtual credit cards for each vendor with defined card limits that help enforce adherence to the agreed budget. Bill.com also supports payments in 106 currencies across 130 countries. In addition, Bill.com’s managed services handle bulk payment of invoices.

In summary.

While there are many Bill.com competitors, the choice of software depends on your business’s unique needs.

Airbase is the preferred choice for businesses looking for an integrated procure, pay, close platform with a seamless intake process, corporate cards, bill pay, accounting automation, and real-time reporting features.

While BILL focuses on AP and AR automation in addition to expense management, Airbase delivers advanced approval workflows, Slack integration, physical card approval workflows, and cashback facility on cards.

Notably, Airbase is designed to scale with companies from about 50 to 10,000 employees. The ability to handle the accounting, approval, and payment complexity experienced by larger companies is something that should be considered when making this choice. Above all, Airbase is easy to implement and use in addition to being an affordable solution for businesses of all sizes.

See how Airbase represents the next generation of P2P solutions — book a demo with us!

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana