On average, it takes $10.18 and nearly 11 days to process a single invoice — just one! Errors in the accounts payable process extend that timeline and blow up costs.

The full-cycle accounts payable process is integral to a company’s financial health. Managing AP efficiently significantly impacts liquidity and supplier relationships, which are both fundamental to ongoing business success.

But it’s also prone to inefficiency, manual errors, and bottlenecks that derail operations and lead to:

- Late or missed payments.

- Late fees and penalties.

- Reduced cash flow.

- Unhappy suppliers.

Finance teams that optimize their AP process operate more efficiently, and they gain greater visibility into — and control — over their cash flow. The result is an improved posture for strategic investments and a better negotiation position with suppliers.

TL;DR

A full-cycle for the accounts payable process includes all the actions from invoice receipt to final payment. Traditionally a tedious manual process, the Airbase AP automation platform streamlines your AP workflow, reduces errors and fraud risk, and gets your finance team fully in charge of efficient cash flow.

So, what does the best full-cycle accounts payable process for finance teams look like?

Let’s explore.

But first, a quick look at the full cycle accounts payable process flow.

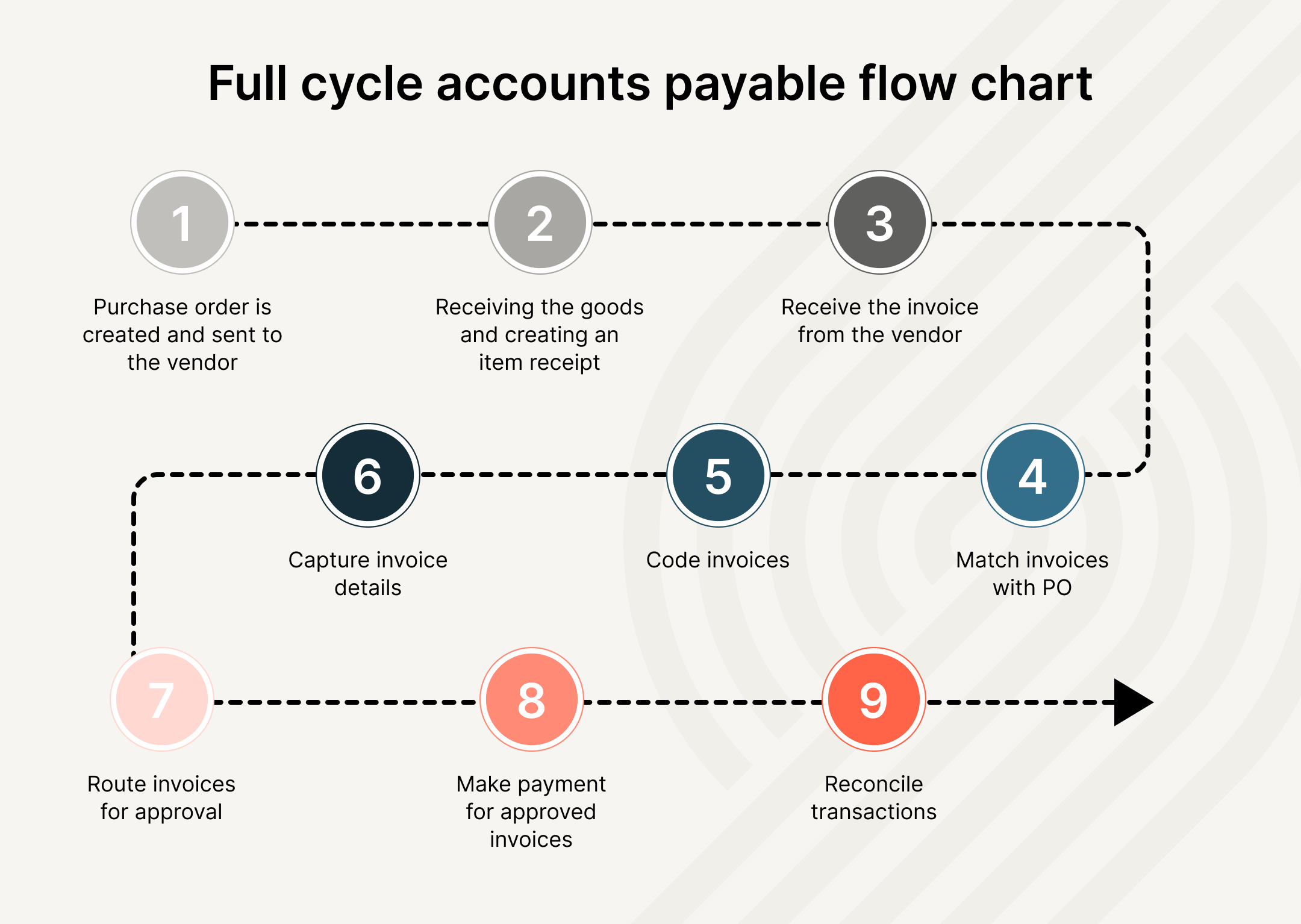

Full-cycle accounts payable process workflow.

Accounts payable (AP) takes charge of the money a company owes its vendors and suppliers for goods or services purchased on credit. For quick reference, this is very different from accounts receivable, where another company owes you money.

Here’s the accounts payable process flow chart for easy understanding of the steps:

If you are looking for a detailed breakdown of accounts payable process steps and the challenges involved in the AP process, be sure to read our latest blog post: Breaking down full-cycle accounts payable.

The components of the best accounts payable cycle.

Here are some of the elements of the best AP cycle that you can incorporate into your processes.

Capture and verify invoices to ensure accuracy.

While many businesses are switching to electronic invoicing, 49.7% of invoices are still sent in paper format, according to a survey titled The State of ePayables 2023 by Ardent Partners.

And, 55% of U.S. B2B invoices are paid late, which means companies regularly waste money on late fees and miss out on early payment discounts.

One of the hallmarks of an efficient AP cycle is that it allows submission of e-invoices in a structured format. This helps eliminate manual data entry, and fast-tracks validation, approval, and payment. E-invoicing is also a great way to reduce your carbon footprint and maintain a clear audit trail.

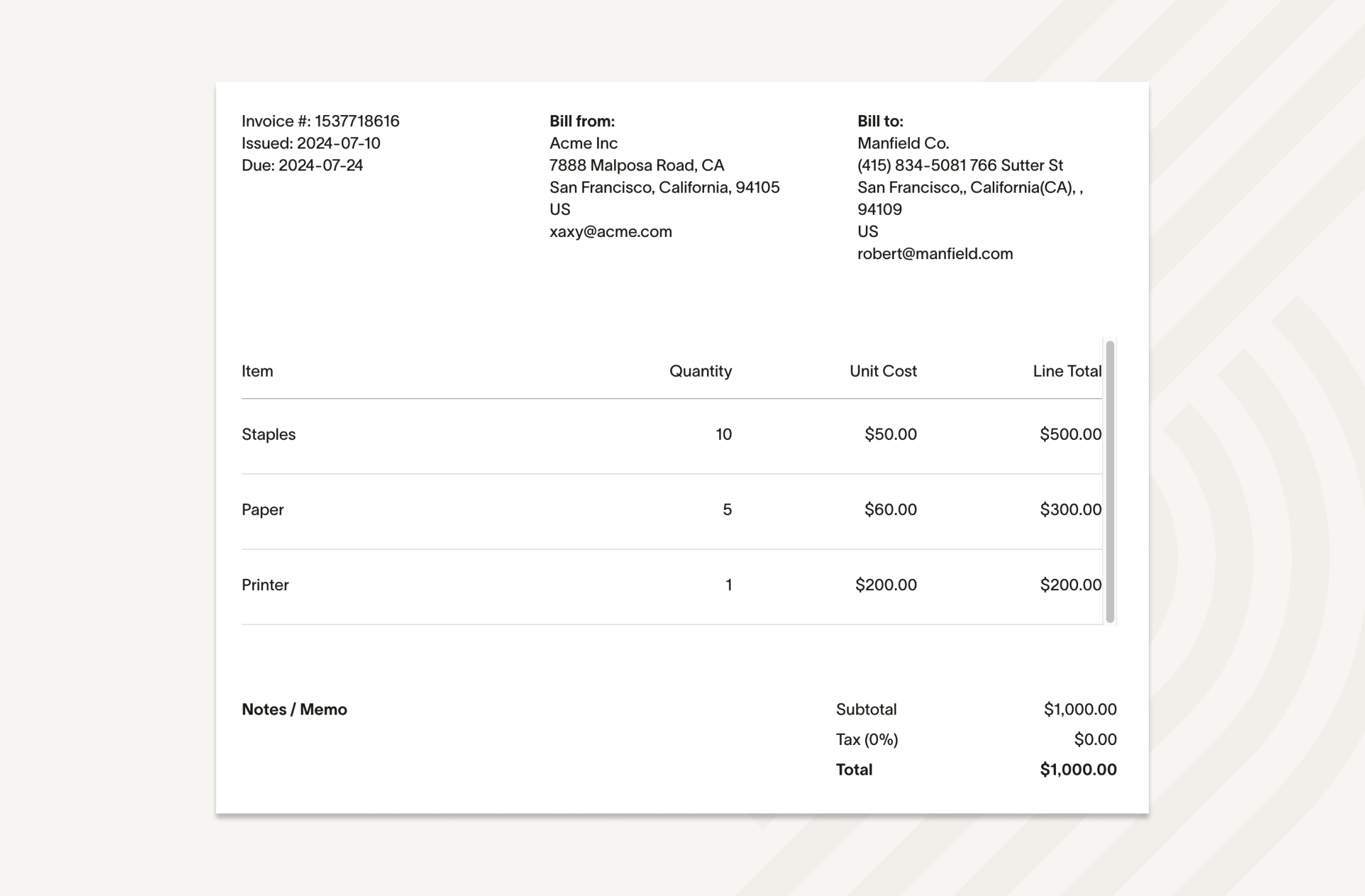

Once submitted, AP teams verify the details of the invoice, such as:

- Name and address of the vendor.

- Date.

- GSTIN of the vendor.

- Billing address.

- Line items that include a description of the provided goods/services.

- Quantity and price of services or goods provided.

- Taxes.

- Mode of payment.

- Payment due date.

A sample invoice with header and line items.

AP Automation Tour

Explore 3-way matching in our AP Automation Product tour.

Make purchase orders mandatory.

Ideally, every purchase should have an associated PO, enabling AP teams to match them with invoices. A PO not only acts as a transaction record but also provides clarity over expectations for the involved parties.

Besides, when non-PO invoices do not include the name of the employee, department, or business unit, AP teams need to follow up and find out who the purchaser and approver are. This can lead to delays in approvals and payments.

In fact, according to the above-cited report by Ardent Partners, 49% of participants identify the lengthy approval process for invoices as the top challenge affecting operational efficiency and supplier relationships.

Ensure efficient vendor management.

Optimized vendor management involves eliminating discrepancies, making timely payments, and building trust. The benefits of improving vendor relationships can include better payment terms, discounts, and enhanced cooperation.

One of the AP cycle best practices is to implement a vendor portal to manage vendor details, invoices, and communication, facilitating updates to payment terms and status checks. Regularly review contracts and service level agreements (SLAs) to ensure compliance.

Prioritize payment based on due dates, payment terms, and vendor importance. Paying vendor invoices on time helps avoid late fees and establish trust.

Implement a smooth AP workflow.

Designing a smooth and efficient accounts payable approval workflow involves carefully planning all the steps from issuing POs to completing payments.

To create an efficient AP workflow, start by identifying and addressing bottlenecks in your existing procure-to-pay (P2P) processes. Depending on your business’s needs, you may need a simplified workflow or a complex one with multiple approval levels.

Define specific rules based on criteria, such as invoice amount, vendors, departments, and authority levels. Another way to fast-track payments is to eliminate approvals for matched invoices.

One way to improve the efficiency of your AP cycle is to foster collaboration between accounts payable and procurement teams. The procurement process should streamline the purchase process for employees while AP processes allow you to capture, validate, and process invoices.

Maintain records of transactions.

The best accounts payable process is one that enables maintenance of thorough and accurate records to monitor expenses, tax deductions, and cash flow. Good record-keeping simplifies audits and regulatory compliance, safeguarding your business during review periods.

Focus on compliance and fraud prevention.

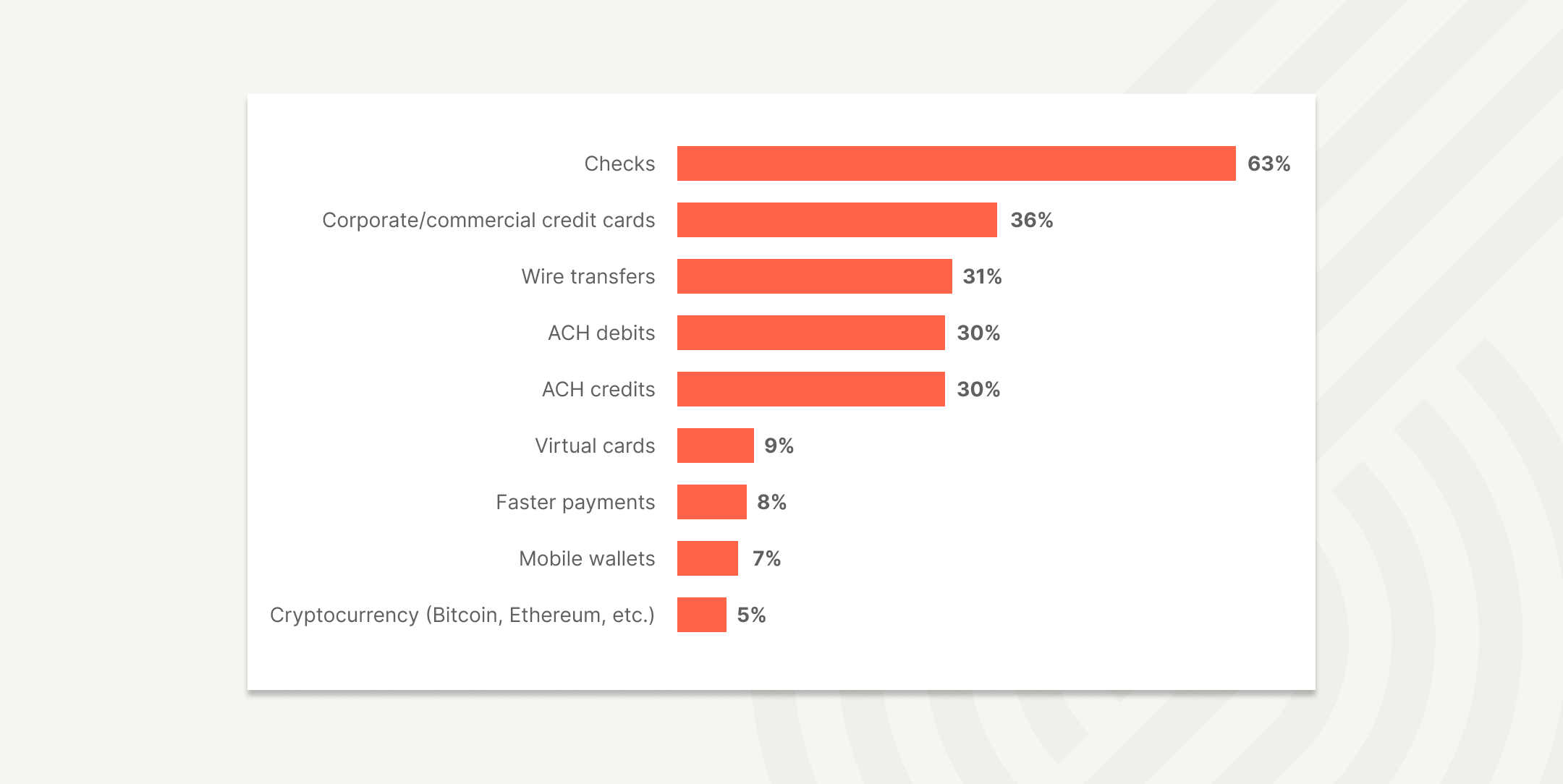

The accounts payable process is only as effective as its payment system. J.P. Morgan’s analysis shows that 71% of businesses were victims of payment fraud via Business Email Compromise (BEC) attacks. The other sources of payment fraud include invoice fraud, vendor imposter, and account hacking.

Among all payment types, checks, credit cards, ACH, and wire transfers are the most vulnerable to payment fraud.

Payment types subject to fraud, 2022.

Worse, most businesses were only able to recover 10% of the money lost due to payment fraud. An efficient accounts payable process includes implementing robust internal controls to detect red flags and prevent fraud. Clear guidelines and multiple layers of checks create a trustworthy and reliable accounts payable process, inspiring confidence in vendors and regulatory bodies.

Conduct regular audits.

Conduct regular audits of your accounts payable process to identify inefficiencies. Regular analysis helps you optimize processes, prevent errors, and enhance accuracy and compliance.

Identify and eliminate bottlenecks and ensure your AP process remains effective as your business grows.

Monitor key metrics.

Track metrics like invoice processing costs, cycle times, and error rates to measure efficiency. Use these insights to identify areas for improvement, streamline operations, and make data-driven decisions.

Automate your AP cycle.

Getting every step listed above right shortens your AP cycle and keeps finances healthy, so there’s no better time to be proactive with your payables than today.

The benefits of AP automation range from faster payment cycle to improved visibility over the entire cycle. Let’s look at some of these benefits.

- Enhanced operational efficiency: AP automation streamlines invoice processing by eliminating manual data entry, minimizing errors, capturing invoice details accurately, and accelerating processing times.

- Streamlined approval processes: Automated workflows ensure that invoices are promptly routed to designated approvers based on predefined rules, reducing delays and enhancing process efficiency.

- Quick payments: By facilitating electronic payments such as ACH and virtual credit cards, automation speeds up transaction times, reduces transaction costs, and improves overall cash flow management.

- Improved vendor relations: Centralized vendor management capabilities in AP automation platforms enhance communication, manage payment terms effectively, and foster stronger vendor relationships.

- Advanced reporting capabilities: In addition to a clear audit trail, AP automation tools offer real-time insights into AP data, enabling organizations to generate detailed reports, analyze spending trends, and pinpoint opportunities for cost reduction and operational enhancement.

But as not all software are created equal, you need the best accounts payable software to take your accounts payable from a tedious and error-prone manual process to an efficient automated workflow. Here’s where Airbase comes in.

Master the full-cycle AP process with Airbase.

Airbase’s comprehensive platform supports the full procure-to-pay cycle and brings everything from initial purchase approval to payment processing under one platform for simplified management and enhanced control.

With Airbase, invoices are automatically captured and matched against purchase orders and receipts using OCR, ML, and AI. Airbase users can choose to have invoice details coded at the line level, by vendor, or summarize the bill into one line item after the invoice is scanned. Generative AI and MIL automatically populate the description and category so the accuracy improves with every transaction.

Those are the building blocks. But the power of Airbase lies in its advanced features that streamline all accounts payable processes and procedures:

- Guided purchase: The Guided Procurement module assists employees in making compliant purchases by dynamically adapting the steps to their responses.

- Custom approval flows: Create custom approval workflows and easily manage vendors through the self-service portal.

- Real-time alerts: Get real-time alerts to issues like duplicate payments, data entry errors, and mismatching purchase orders and vendor invoices.

- Vendor management tools: A self-management portal for vendors to enter details, send invoices, upload documents, and track payments.

- Granular spend analytics: View custom reports and dashboards for at-a-glance insights into company spend and cash flow, including productivity metrics to identify bottlenecks in the AP cycle.

- Automated payments: Airbase automates payments for approved invoices, supporting global payments in 200+ countries and 145+ currencies.

- Seamless reconciliation: A simplified, streamlined reconciliation with over 70 ERPs, including deep integration with NetSuite to fast-track month-end close.

With Airbase, it’s easy to ensure you are adopting AP automation best practices to streamline your entire accounts payable process, from vendor invoice receipt to final payment. Powerful AP automation tools and seamless workflows nearly eliminate manual data entry. Plus, you gain unparalleled visibility and financial control to protect your company’s cash flow so you can spend more time on strategic investments.

Ready to trade your tedious manual approach in for an efficient, automated accounts payable management system?

See how Airbase transforms your full-cycle AP process — request a demo today.

FAQ.

Still have questions? Check out these frequently asked questions about the full-cycle accounts payable process.

What are the steps in the accounts payable process?

The six steps in the accounts payable process are:

- Invoice receipt.

- Invoice verification.

- Data entry.

- Invoice approval.

- Payment processing.

- Reconciliation.

Each step is essential for maintaining accurate financial records and ensuring on-time payments to suppliers. This systematic approach helps organizations avoid payment errors and fraud and improve their overall financial management.

What is the account payable workflow process?

The accounts payable process flow is a series of steps AP departments go through to receive and process invoices:

- Receive an invoice.

- Verify its details.

- Enter it into an accounting system.

- Get approvals from relevant departments.

- Process the payment.

- Reconcile the payment with bank statements.

This workflow is designed to ensure financial accuracy and maintain strong vendor relations.

What are the first four steps in the accounts payable cycle?

The first four accounts payable process steps are:

- Receiving the invoice from the vendor.

- Verifying invoice details, including matching with purchase orders and delivery receipts.

- Entering invoice data into the accounting system.

- Obtaining necessary approvals for the invoices from authorized personnel.

These initial steps form the foundation of effective financial controls and ensure the accuracy of financial transactions.

What are the four functions of accounts payable?

The four primary functions of accounts payable are:

- Invoice processing: receiving, verifying, and recording invoices.

- Payment disbursement: ensuring that all verified invoices are paid accurately and on time.

- Record maintenance: keeping detailed records of all transactions for auditing and compliance.

- Vendor management: maintaining good vendor relationships through timely payments and effective communication.

These functions ensure that organizations can maintain optimal cash flow and a solid financial standing.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  DocuSign

DocuSign  Asana

Asana