VIRTUAL CARDS

Fully leverage the power of virtual cards.

Not all virtual cards are created equal, and it’s the design of the software behind them that provides visibility, spend control, and accounting automation. Airbase virtual cards have the most advanced design available.

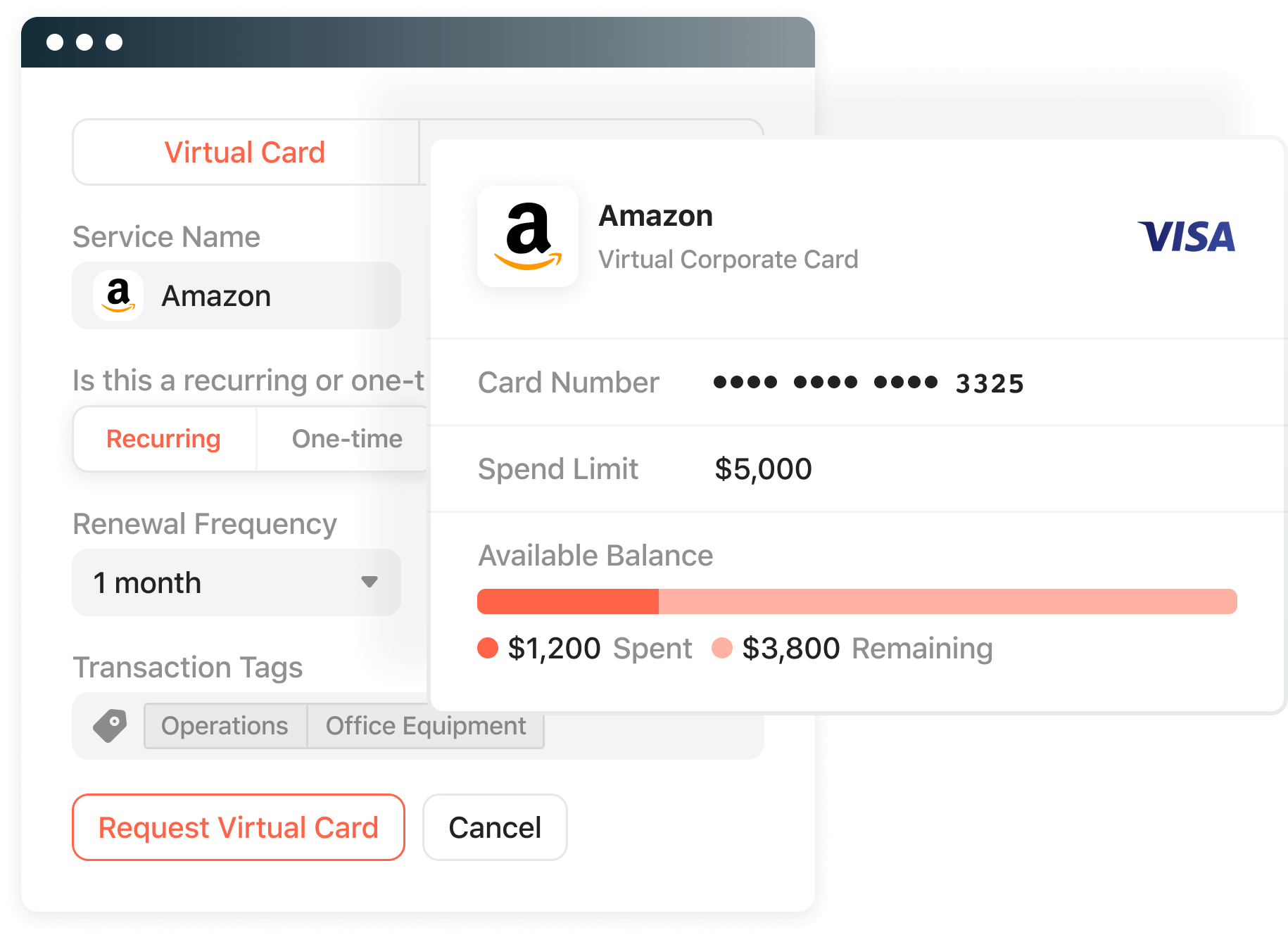

One-time and recurring — the value of vendor-specific virtual cards.

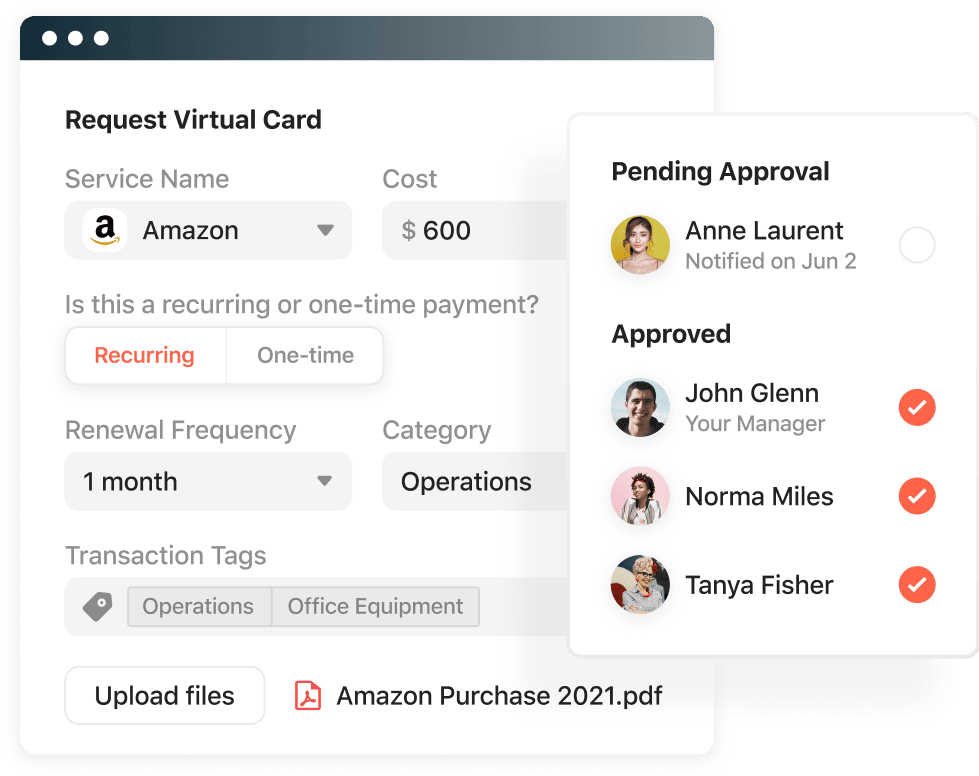

Request spend.

Whether a virtual card is issued for one-time use or for recurring payments, employees can easily and quickly request approval for each purchase. The platform will route the request for approval as per the policies that your company has established.

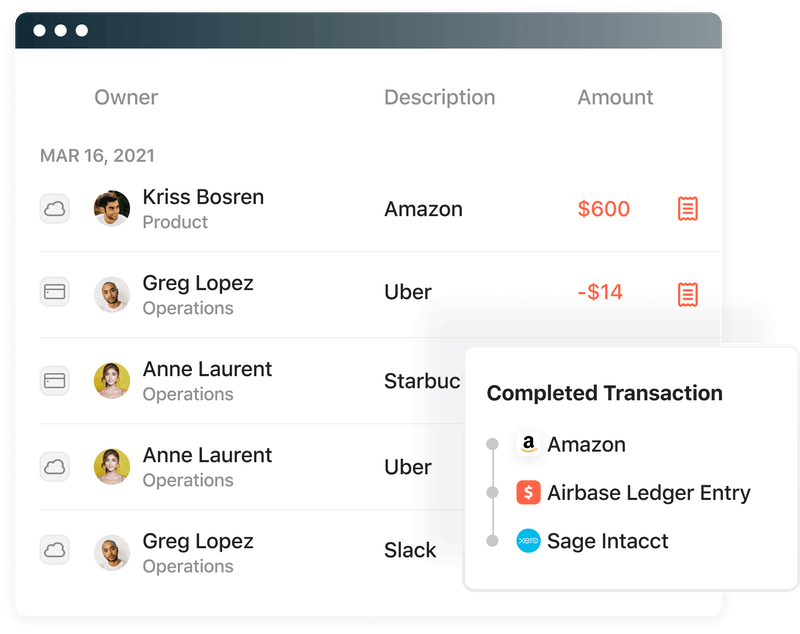

View transactions.

The value of a vendor-specific virtual card goes beyond the visibility and control it provides — virtual card transactions can be automatically synced to the GL. Keep your books current with card spend flowing directly to the GL for a better view of your business, any day of the month.

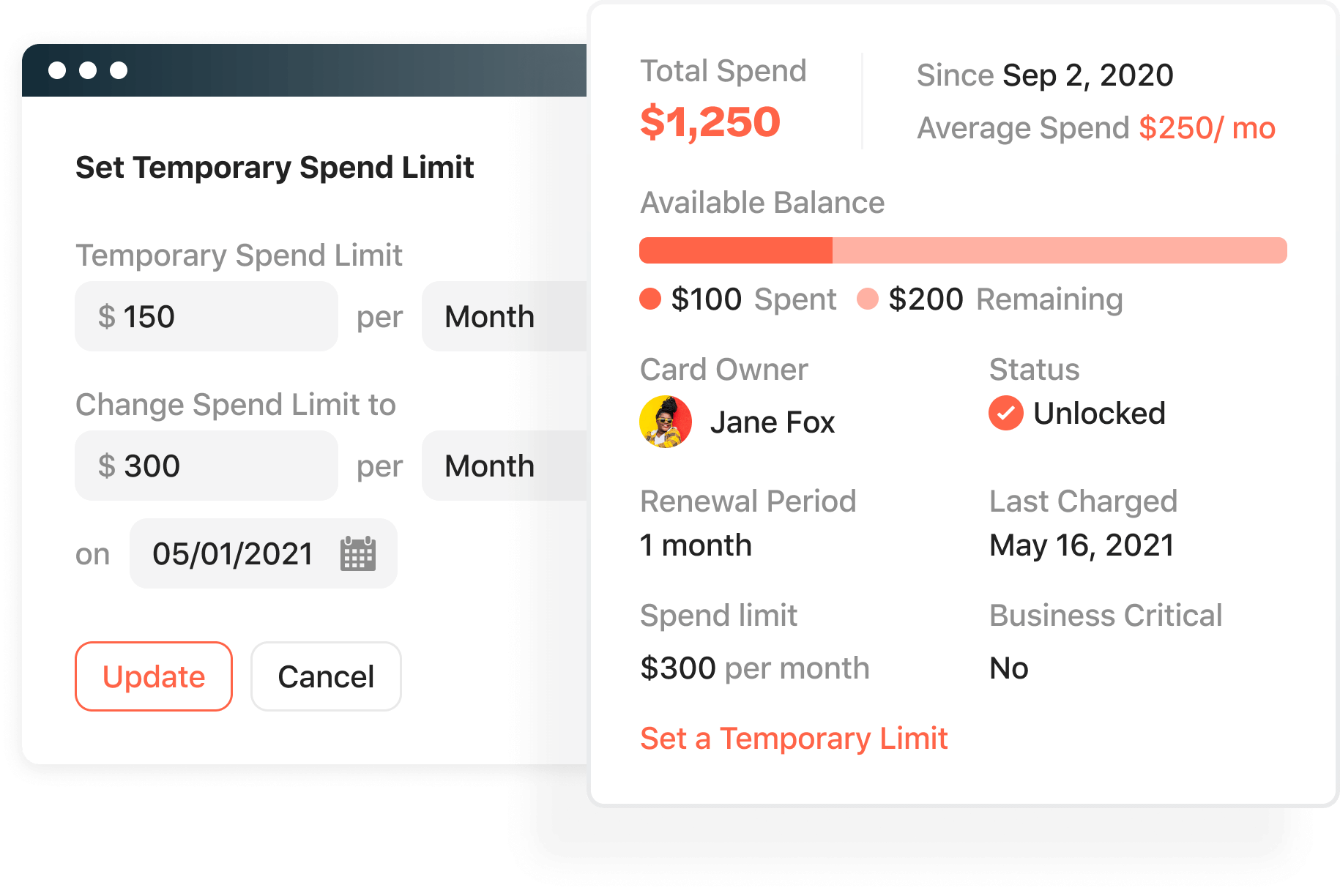

Set controls and limits on each virtual card.

Additional virtual card settings allow for spending limits, number of transactions, and expiration dates on each card. Expiration dates are helpful for recurring charges, and our “pending lock” feature will notify you when a card is approaching its expiration date, so that you can review whether services are still needed.

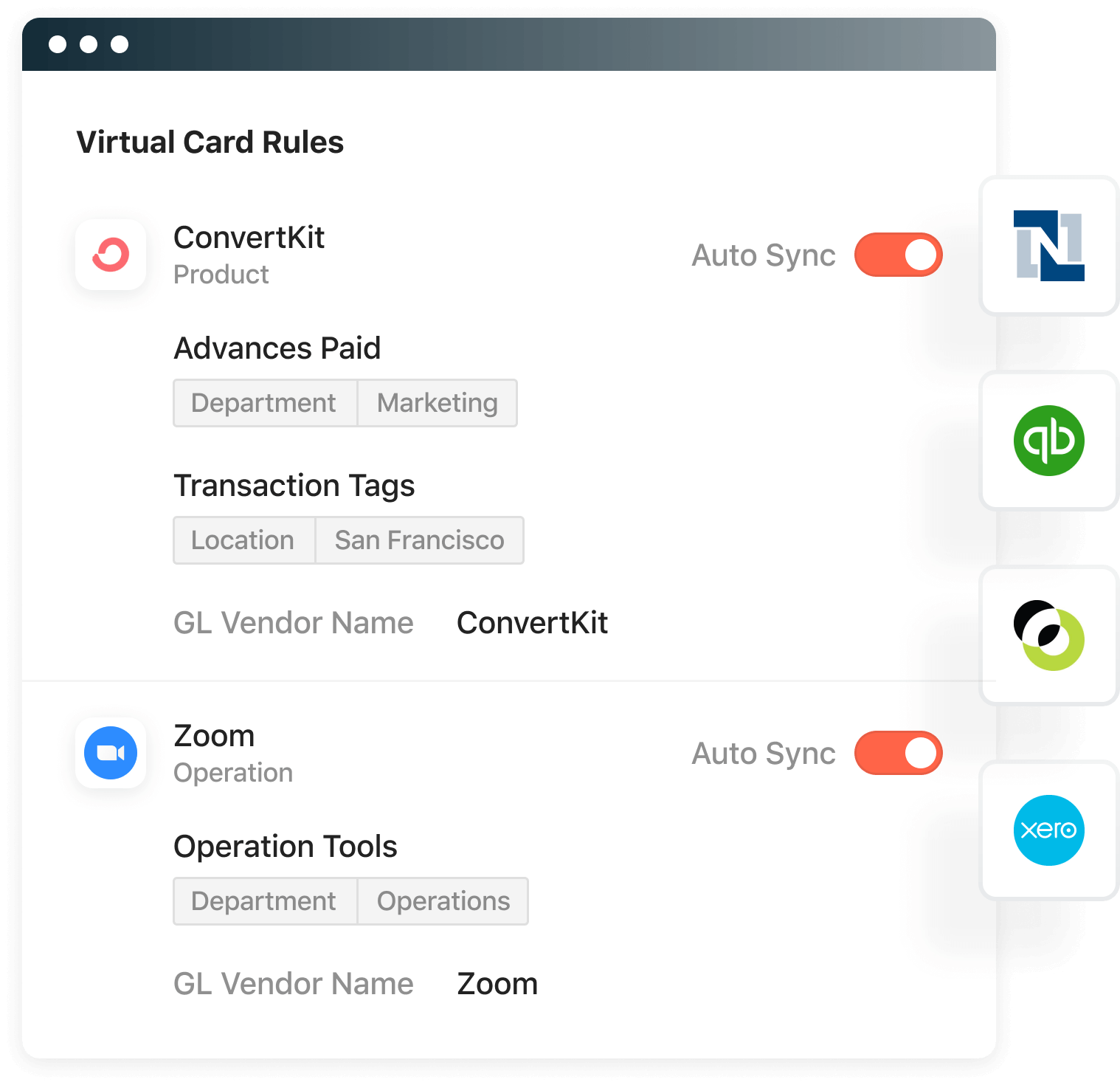

Automated accounting.

Eliminate manual coding and save time with rule-based accounting automation. Automatically code and record vendor-specific virtual card transactions to Oracle NetSuite, Sage Intacct, QuickBooks Online, QuickBooks Desktop, or Xero.

Virtual card transactions flow directly to the GL so that you’ll never have to reconcile credit card statements again.

All documents and contracts in one place.

When approvals, payments, and expense reporting are all contained in the same system, you’ll never have to search through email chains, Slack channels, Google forms, or expense reports to find the documentation you need again.

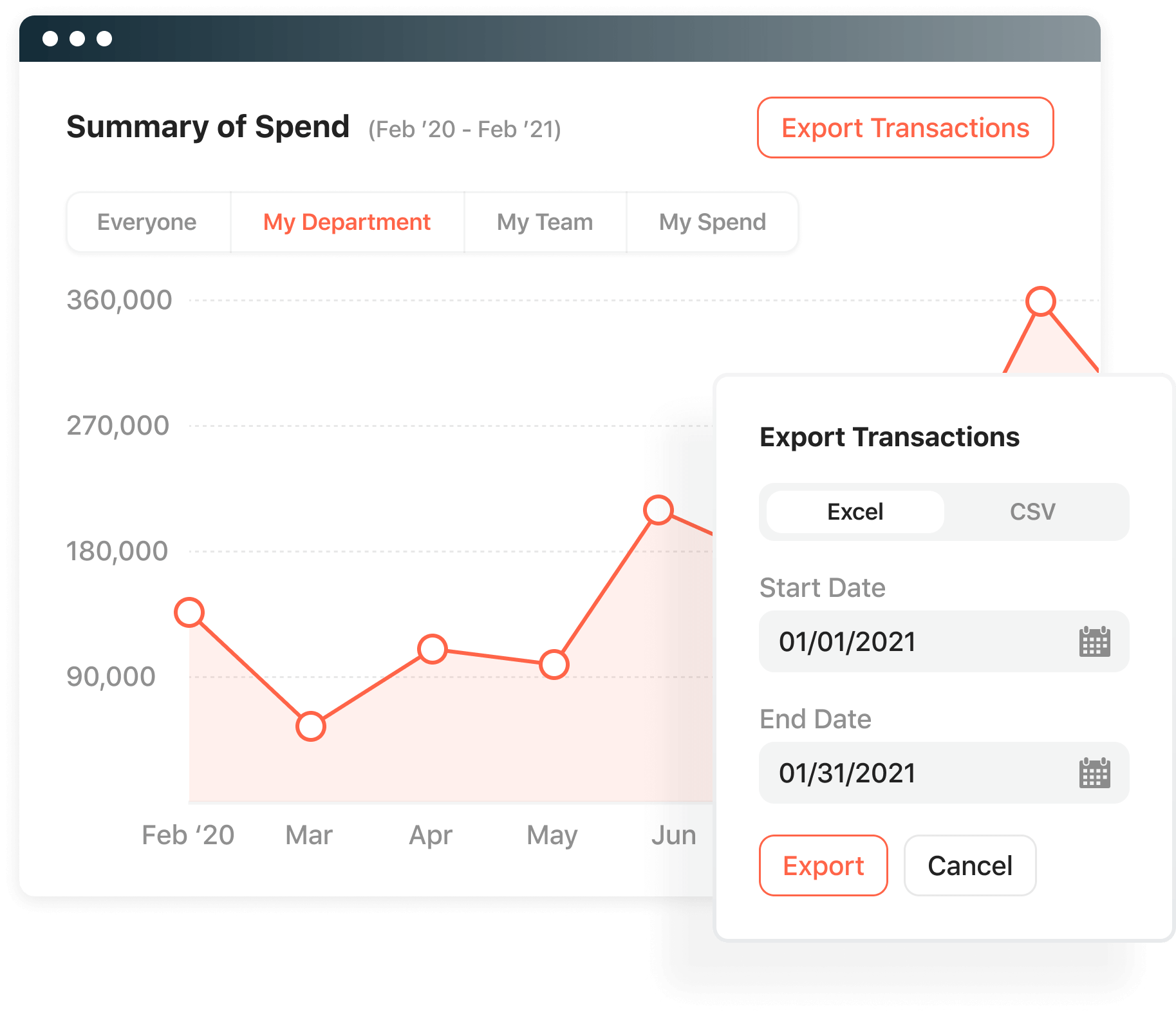

Real-time reporting.

With spend flowing directly into the GL, you’ll have access to card spend in real time. View by department, by spend owner, or vendor to get a clear view of your card spend any day of the month. Because Airbase is a consolidated card and full AP platform, it reports total expenses so that budgets can be better managed.

“Virtual Cards have eliminated Doximity’s operational problems: Airbase’s lightweight pre-approvals keep us in the loop of every dollar before it leaves the bank.”

David Coffman

VP of Finance at Doximity

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana