SILICON VALLEY BANK (SVB) CARD INTEGRATIONS

Automate accounting & approval workflows for your SVB card spending.

SVB credit cards can be integrated into Airbase’s spend management platform. SVB business card users get the benefit of Airbase’s automated approval workflows, control settings, automated accounting, and real-time reporting of all spend.

Get spend management functionality for your SVB business cards.

Spend management provides visibility and control for your SVB business card spending.

In addition to software-enabled cards, the Airbase system also offers automated workflows for Guided Procurement, AP, expenses, and corporate cards. Transform your SVB cards into an automated spend management system for all non-payroll spend.

Our platform covers all non-payroll spend.

Airbase’s comprehensive solution includes all non-payroll spend: AP automation, SVB cards, and expense management.

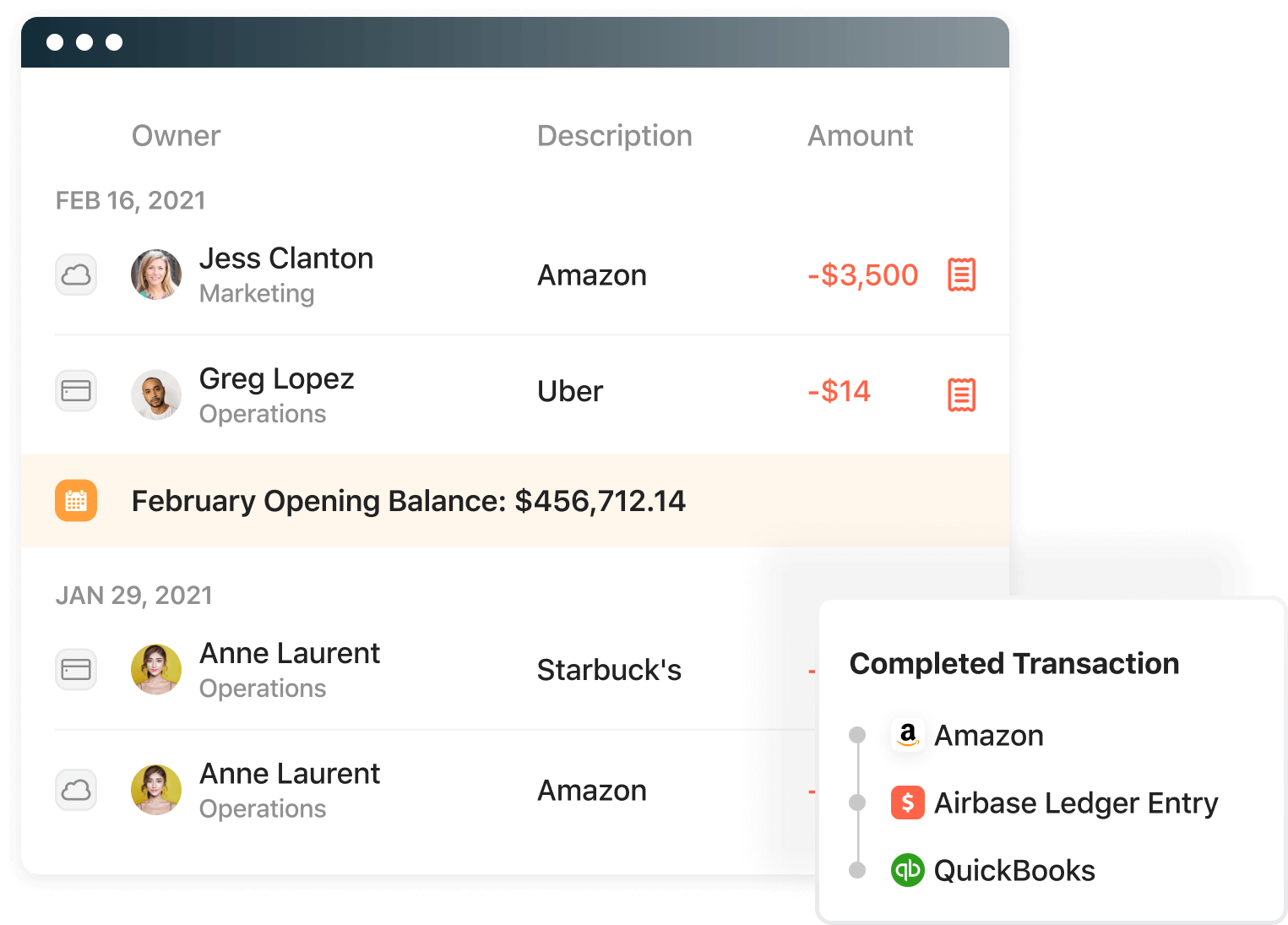

Incorporate SVB cards into your full spend management system for a seamless flow from pre-approvals to booking to the general ledger. Your card spend is important — make it part of a fully automated, comprehensive accounts payable system.

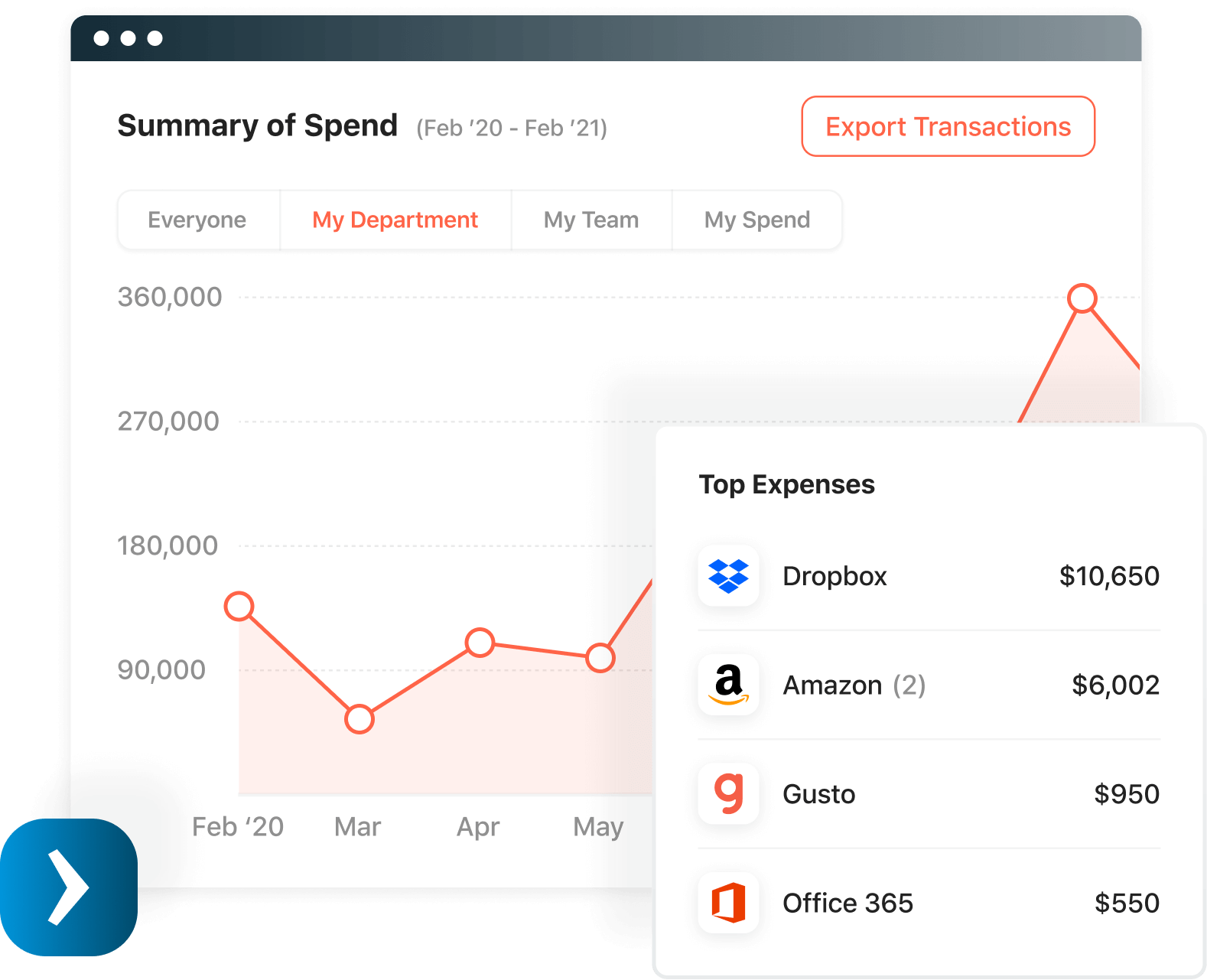

With Airbase, all transactions are categorized up front at the approval stage, or via our auto-categorize feature, so that they are accurately booked to your GL automatically. Get real-time reporting of credit card spend any day of the month.

Or, select our spend management platform for just your SVB credit cards.

Airbase is a flexible solution and can be used to provide spend management functionality to your SVB cards. Get automated approval workflows and use settings to control and adjust spending amounts on SVB virtual cards. Automate the syncing of all SVB card transactions to your GL. Get real-time reporting on all card spend.

Visibility into spending.

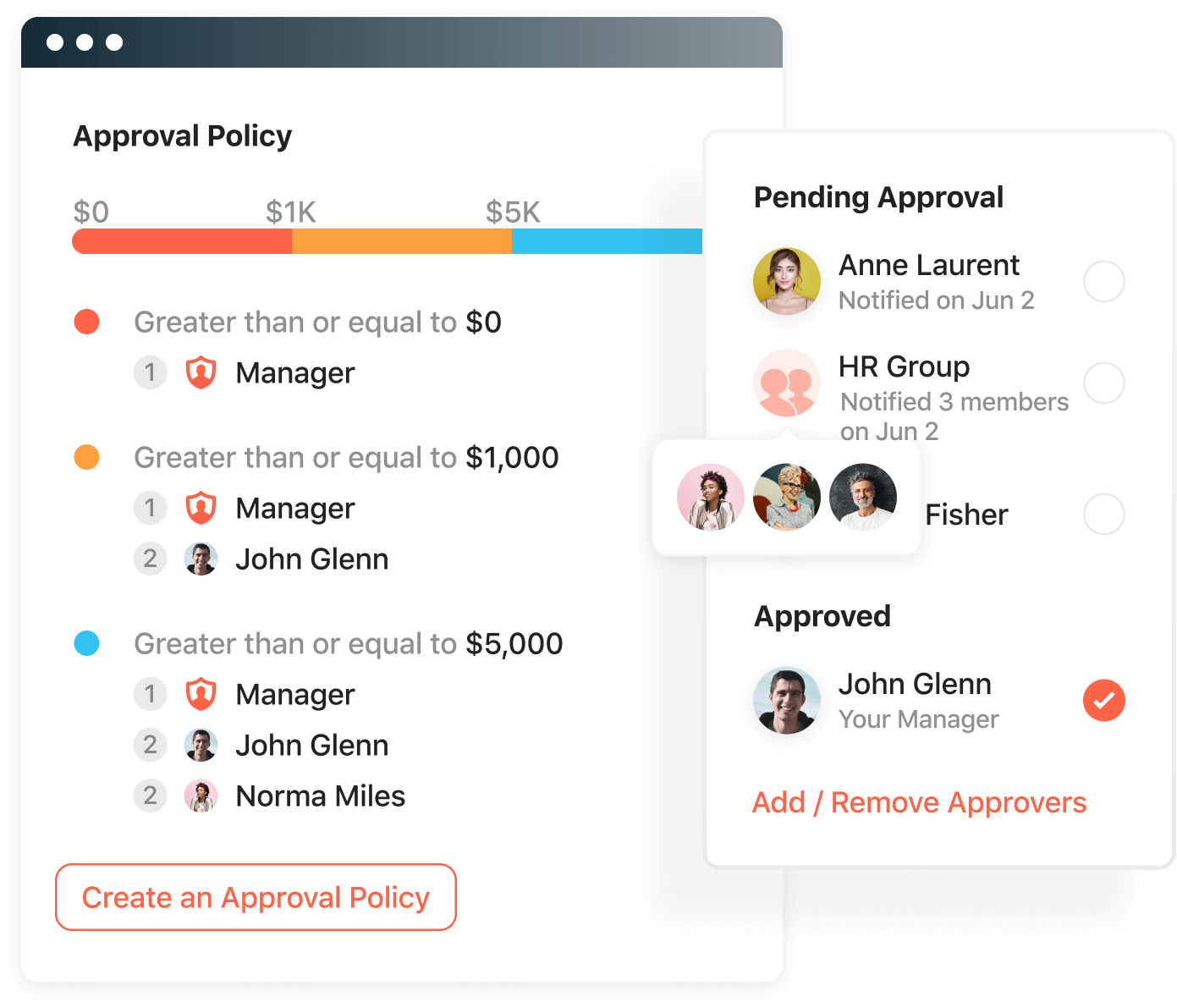

Gain additional flexibility and create custom approval workflows that reflect your company’s unique policies. Set rules based on location, vendor, categories, departments, and more.

With advanced approvals, set approval groups so employees can get the approvals they need, in parallel or sequentially, from all or any member of an approval group.

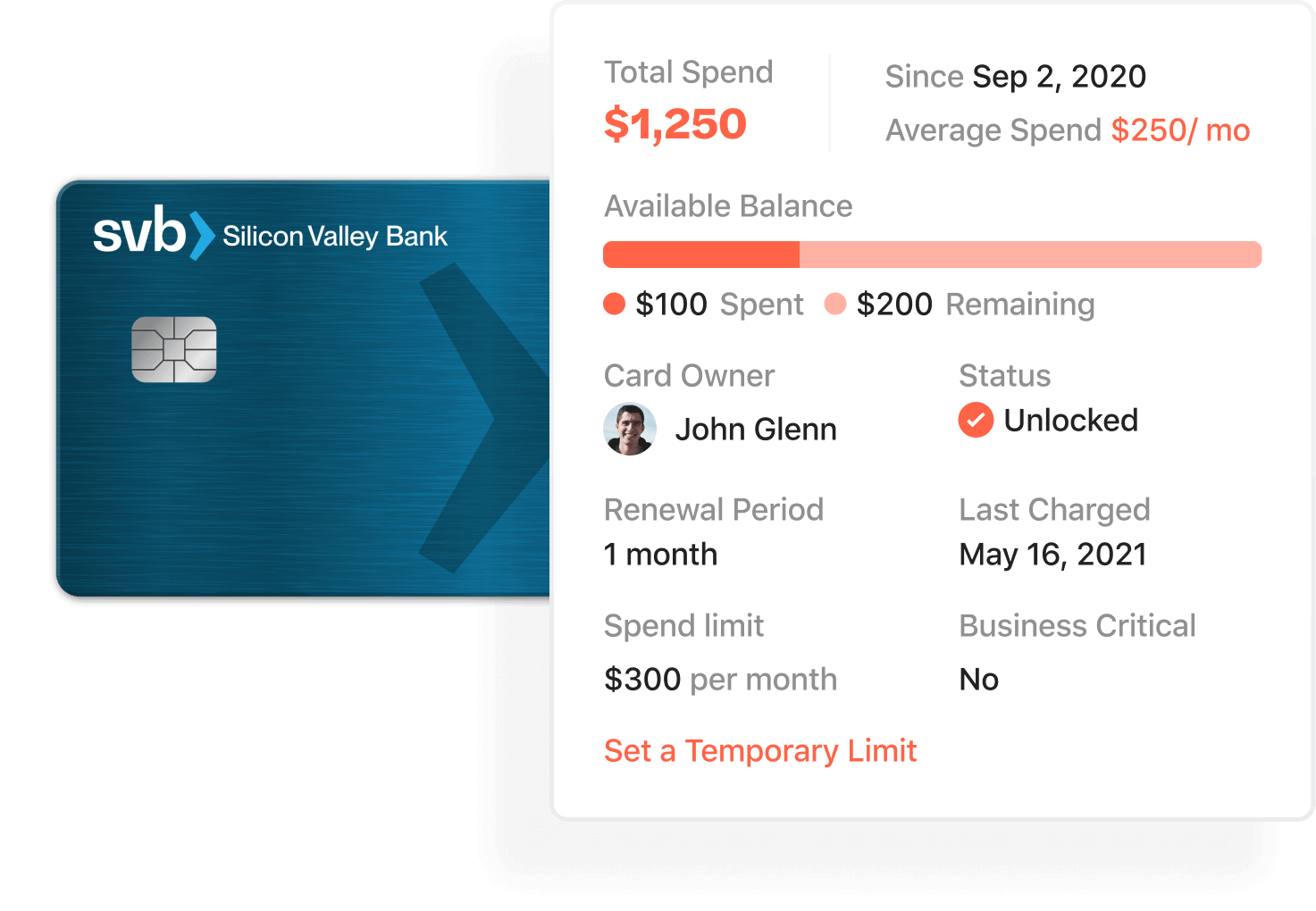

Spending control and accountability.

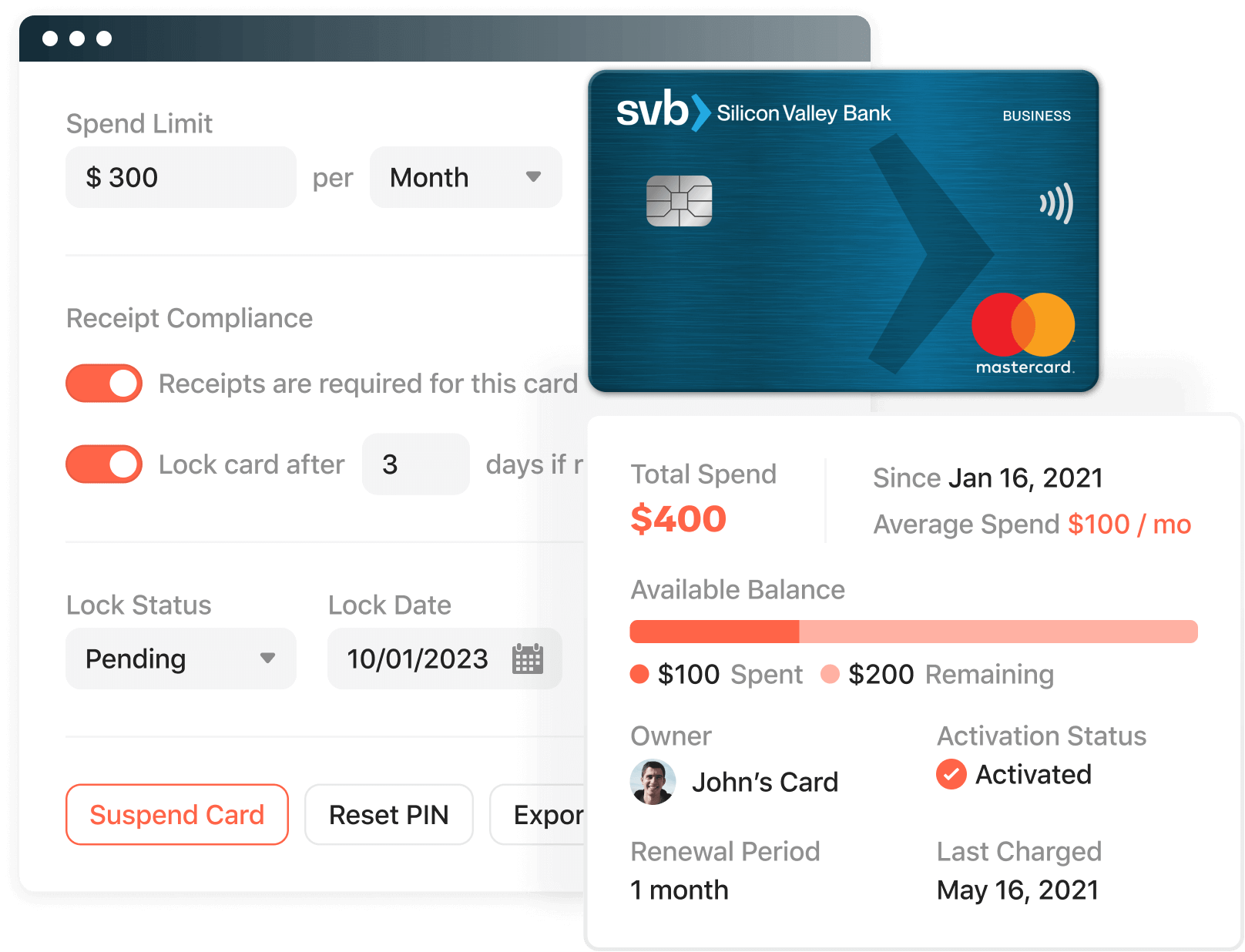

Pre-approve spending on virtual cards based on your company’s policies. Set a spending limit to manage budgets, or a card expiration date to avoid unwanted recurring subscription charges.

Let the system enforce receipt compliance by reminding employees of missing receipts and suspend cards when non-compliance persists over a set time.

Benjamin Pincus, COO/CFO at Expressable

Learn how to update your AP by consolidating all payment types onto one system.

The information about Airbase contained in this overview does not constitute endorsement or recommendation by Silicon Valley Bank.

All credit products and loans are subject to underwriting, credit, and collateral approval. All information contained herein is for informational purposes only and no guarantee is expressed or implied. Rates, terms, programs and underwriting policies subject to change without notice. This is not a commitment to lend. Terms and conditions apply.

Mastercard is a registered trademark of Mastercard International Incorporated and is an independent third party.

The Contactless Symbol and Contactless Indicator are trademarks owned by and used with permission of EMVCo, LLC.

All non-SVB named companies listed throughout this document are independent third parties and are not affiliated with Silicon Valley Bank, a division of First-Citizens Bank & Trust Company.

© First-Citizens Bank & Trust Company. Banking, lending, and trust products or services are offered by Silicon Valley Bank, a division of First-Citizens Bank & Trust Company. 3003 Tasman Drive, Santa Clara, CA 95054.

Jira

Jira  Ironclad

Ironclad  Asana

Asana