Definitive Guide To Spend Management For Startup And Early-Stage Companies

Controlling your spend — start now with a scalable system.

Avoid the startup scramble and embrace a more fluid, automated financing journey. Spend management software handles the full lifecycle of every dollar a company spends outside of its payroll. It will mitigate a number of financial growing pains that startups face — separating you from the rest. Read this guide to find out how.

01

What is spend management?

It is a modern approach to a company’s payables. It consolidates all non-payroll spend onto one single platform that includes corporate cards, bill payments, and employee expense reimbursements. Each of these areas can be implemented at once or individually, as and when a company is ready. Spend management is the software that automates approval and accounting workflows, and provides real-time visibility and control over all company spend. Read all about spend management in our Definitive Guide to Spend Management.

02

Defining startups and early-stage companies.

The early stages and why every dollar counts.

You have a disruptive product, you’re building foundations, and you’re in the first stages of operations. Categorically, you have a team of up to 50 people. With limited revenue running parallel to expanding overheads, the early stages can bring higher risks.

Profits are still germinating; you may even be operating pre-revenue. As you evaluate your market and start to establish yourself, figuring out the finances and operations can be an unwelcome distraction and an overwhelming task. One truth is evident: every dollar counts.

Why do I need spend management when my accounting is early stage?

- It costs nothing and onboarding is easy: The only way out of the early stage is to see past it. There are a number of benefits to employing a robust spend management system — the good news is, it’s available for free and is easy to implement.

- Your capital is limited — don’t lose track of where it’s going: Spend management is a tool that allows your business to account for every single dollar of non-payroll spend. Initial capital as a startup can vary — whether it’s outside investment, crowdfunding, loans, or personal investment.

- Larger companies use spend management — lay a clean foundation: By installing your spend management software now, at no cost, you professionalize your operations both now and later.

- You already have complex issues like making international payments: Small or early-stage doesn’t necessarily mean straightforward. Spend management brings enterprise-level tools to support subsidiaries and international payments that can be accessed as and when you need them.

- A system built around scalability — start small and avoid rip-and-replace later: Your organization structure and balance sheet are still simple at this stage, with liabilities as the biggest concern. But your AP will grow as you do — building a scalable system now avoids rip-and-replace later.

- Have records from the beginning of your company’s timeline in one system: Avoid reconciling records from different systems and software — spend management systems hold all of your payables records in one place since your company’s inception.

- Free yourself and future teams from unnecessary manual work so that you and they can focus on continuing to build the company: Automating functions with spend management software frees up time for your teams to think strategically and contribute more.

Startups need to focus on getting the right systems in place early, and automating processes wherever possible.

— Katie Slattery, Corporate Controller at Fivetran, The Unicorn Playbook Vol. 1

03

The key financial concerns at this stage.

Prioritization is a key factor in the financial success of any business. Here are some of the top concerns for a startup or early-stage business:

Operational challenges:

1. Being able to safely deploy capital to get things done.

As growing teams need access to resources, they will need more than the founder’s personal card. It may be time to implement corporate cards for team members, a system for processing invoices, and a process for reimbursing employees.

2. Setting up initial accounts and GL.

Some startups avoid setting up a formal GL and chart of accounts right away. This delay can restrict options for spend management software and creates manual processes that can become harder to unwind with every passing month.

3. Protecting runway (managing cash with visibility into cash positions).

Tracking and managing your biggest costs, which at this stage is often payroll. But non-payroll spend is right behind and should not be ignored.

4. Collecting and storing documentation for payments.

Receipts, invoices, purchase orders, bills, W-9s, vendor payment information — keeping track of all of these documents is a challenge for any finance team. Automation makes it easy.

5. Enabling spend across the business to support growth.

Handing spending control over to employees speeds up operational cash flow, but must be accompanied by proper approval processes and transactional reporting.

6. Having basic tools to keep the business running.

Whether it’s your software stack or operations model, a solid foundation is key to growing your business.

Policy and process challenges:

1. Implementing new processes, new resources and tools.

Though an inevitable part of scaling, new tools and processes may bring additional complexities and impact your operations. Negotiating terms and documenting purchases takes time.

2. Balancing new processes and changes against disruption to employee performance.

Any disruption to employee resources as a result of new implementations must be balanced against the negative impact on their morale and productivity. Planning can avoid future disruption.

3. Implementing expense policies.

Such policies are imperative, but must be robust, long-lasting, and easy to communicate to growing teams.

4. Tagging and classifying increasing non-payroll spend.

This is where spend management software is an extremely valuable resource as you grow.

5. Accessing financial data to make good decisions.

Capturing real-time, transparent data is vital to your company’s growth, but not always easy.

6. Fear of implementing new systems that may need alteration as financial operations expand.

Implementing operations and tools that can scale with you may be difficult on a startup budget.

Leveraging tools means you don’t have to actually hire for some of the more entry-level roles, or maybe you’ll just need one person instead of three or four.

— Scott Clark, VC Firm CFO, Investor, Advisor, The Unicorn Playbook Vol. 1

04

The key financial concerns at this stage.

Prioritization is a key factor in the financial success of any business. Here are some of the top concerns for a startup or early-stage business:

The power of spend management as a solution.

Cut through low-value, mundane finance tasks with automation.

Resolving these financial concerns individually requires an overly complex response, burdening teams across the company and pulling attention from high-value tasks. As an early-stage company, you may not have the time or resources for this. A more universal perspective recognizes the overarching issues are visibility, real-time reporting, and spend control.

Visibility, real-time reporting, and spend control in every transaction.

Finance and accounting teams that center decision-making around visibility, real-time reporting, and spend control discover a new level of control in their operations. Focusing on those three key areas automatically solves a number of smaller, day-to-day challenges. There will be less tedious reconcilement errands and misaligned spending. Delayed closes are avoided by real-time insights. This frees up time for employees and teams to focus on their primary tasks and strategizing for the future.

So how do companies shift to this approach? That’s where spend management comes in.

Designed to grow with you.

A spend management platform is a consolidated solution to the micro and macro-financial concerns of your company.

The parts of your spend management system that you use at various stages will be reflective of your company size and rate of growth — with multi-faceted and customizable capabilities. Key managerial and financial hires, such as a Head of Finance, can continue to explore extensive functionality as they carry out their functions, analysis, and expand operations.

The following benefits of a spend management system can assist you in quicker and more efficient scaling as an early-stage company:

An all-in-one product:

1. Corporate cards.

Software-controlled physical or virtual cards with approval workflows and automatic transaction syncing to your GL.

2. Bill payments functions.

Schedule, record, and make payments with a fully automated bill payment system.

3. Employee expense reimbursements.

Eliminate expense reports with a system that automatically sends funds to employees’ bank accounts once approvals and documentation are in place.

4. Expandable features as you grow.

Use what you need now with the possibility of greater functions as you grow — avoiding rip-and-replace costs in the future.

5. Facilitates various payment types.

Make payments by check, credit card, ACH, vendor credits, or international wires without having to switch systems.

6. Management control features.

Set approval workflows to reflect your company’s spending. Set limits on card spending or shorten the expiration date to control for unwanted roll-over spend.

Your accounting operations automated:

1. Direct, real-time financial data.

Transactions are recorded as they occur and visible to department heads, budget owners, and other stakeholders.

2. Automatic extraction of data from invoices, bills, emails.

OCR technology digitizes this data so you can reduce collecting and processing documentation manually.

3. Batch bill payments.

Make bill paying easier with payment tracking and notifications.

4. Modernize AP functions and keep up with competitors.

Spend management is being employed by more and more companies, as a solution that grows with you.

5. Auto-categorization.

Whether it is card spend or invoiced purchases, auto-categorization makes it simple to keep the GL current.

6. Receipt compliance, OCR, auto-matching.

Saving your teams valuable time, these technologies reduces manual documentation processing and automate categorizations.

05

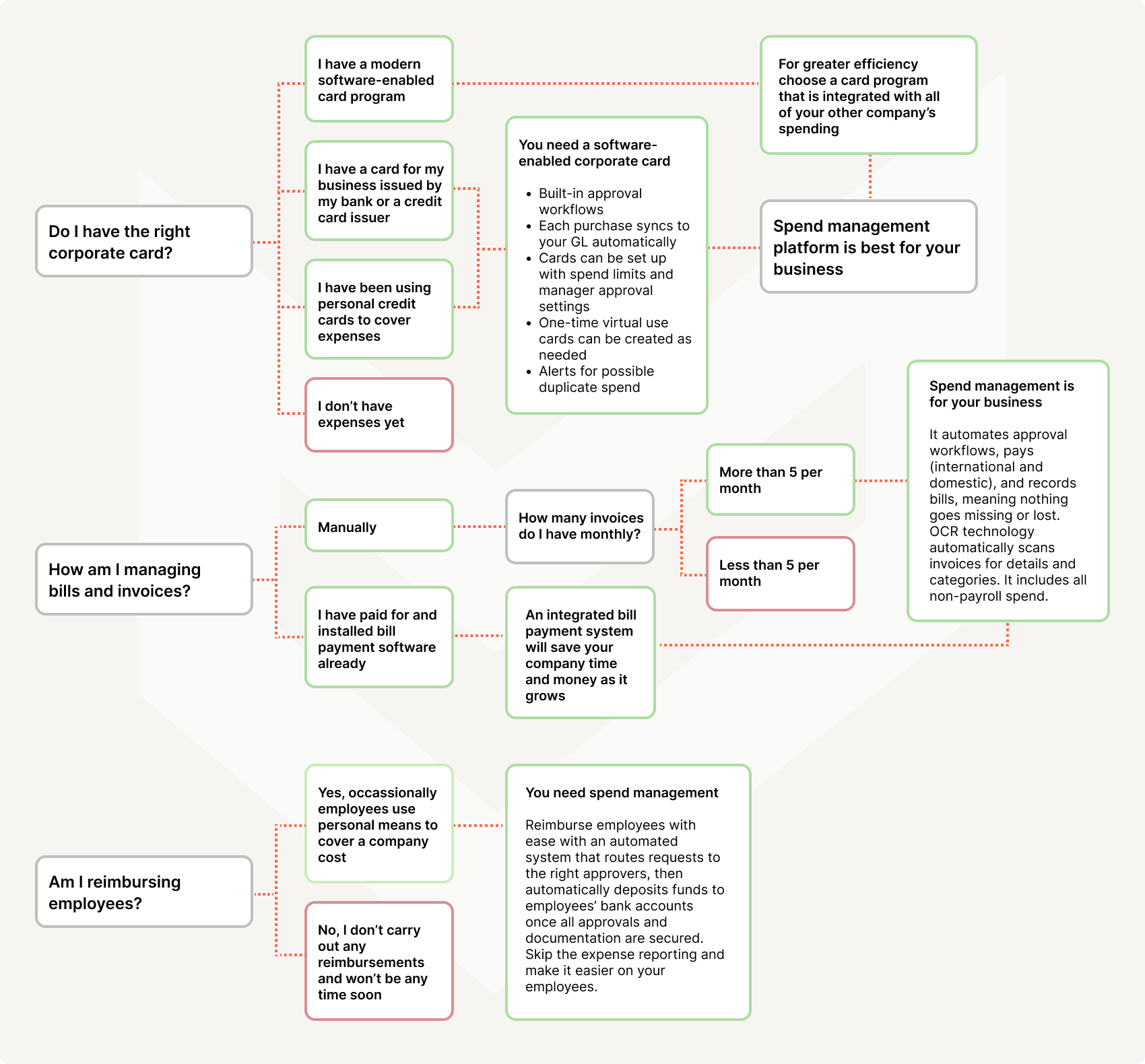

Does my startup need spend management yet?

It’s never too early to implement foundational spend management software, because it can be implemented in parts to address the issues you face at your company’s stage. We’ve devised a questionnaire below to help you decide when your startup needs to get spend management software.

06

Seeing growth? Useful questions to ask as you scale with spend management.

The visibility and control in a small company can quickly evaporate as it grows. Spend management equips you with a system that avoids the typical chaos that growing companies face. Planning now will allow you to skip future rip-and-replace costs. When considering a spend management system we think it is useful to assess their value based on the following 6 performance criteria. Some questions to ask now for each category that your future self will appreciate include:

1. Platform capabilities:

As an early-stage company, do I benefit from using a platform solution vs a series of point solutions?

Yes. Spend management addresses all non-payroll spend as a platform solution. Point solutions handle part of your spending needs, like corporate cards, bill payments, expense reimbursements. A consolidated solution makes a company more efficient with consistent workflows and real-time reporting for all spend. A clean set up now will save time later.

2. Depth of features:

As my company grows can I customize approvals to reflect more complex approval workflows?

Airbase has the most customizable, advanced approval workflows, including approval groups, special routing, and contingency approvals.

3. Flexibility:

Can I use just part of the spend management system and add functionality as our needs change?

Yes. Airbase is a modular system and can be implemented in parts to address your most pressing needs first. You can start with corporate cards or bill payments, for example. Flexibility is also in the form of corporate card choices — Airbase’s own cards, SVB cards, or AMEX virtual Cards all run on the Airbase platform.

As my finance and accounting team grows, does my spend management system have functionality that will be valued by each of them?

Yes. Airbase is designed to delight all users from employees, to budget owners, to accounting and finance professionals. When you eventually hire an AP manager they will thank you for Airbase!

4. Integrations:

As headcount grows how difficult is it to onboard new hires?

Airbase integrates with your HRIS for automatic provisioning and deprovisioning of employees directly onto the Airbase platform.

As my company grows in size and complexity, such that we will need to migrate to an ERP, will my spend management system easily integrate into the new system?

Yes. In addition to QuickBooks Online, QuickBooks Desktop, and Xero, Airbase integrates with Oracle NetSuite and Sage Intacct. Including Airbase in your migration plan is easy.

Won’t a centralized system slow down my remote teams who need to get approvals and get access to funds?

With Slack and email integrations, Rippling and other HRIS integrations, Okta and other SSO integrations, Google Pay/Apple Pay for employee spend, and the Airbase app where employees can be reimbursed directly into their bank account, your Airbase platform fits in seamlessly with your daily operations.

5. Scalability:

As my company structure becomes more complex, will my spend management system allow me to make payments from multi-subsidiaries?

Airbase supports multi-subsidiary payments and booking.

As my company adds foreign currency payments, will my spend management system allow me to make those?

Airbase supports payments in 145 currencies at a fraction of the cost of other foreign currency payment choices.

We don’t really use purchase orders right now but I know I will probably need them in the future. Will I be able to include them in my spend management system?

Airbase POs are an optional module that can be added to your system at any time.

6. User experience:

As I onboard (several) new employees, can I feel confident that they will understand the process and comply with our company’s spending policies?

Airbase is a fully intuitive design so employees can use the system with ease. It lets you customize your approval workflows to reflect your company’s spending.

07

The Definitive Guide to Spend Management.

Read our guide for more information on spend management and how to evaluate its benefits.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana