Curaytor And Airbase: Bringing AP In-House With The Right Automation Tools For Visibility & Control

John Mackin

Head of Finance and Growth at Curaytor

- Saved ~10 hours a month on AP work with automation.

- Cut the time-to-close in half.

- Eliminated mysteries around expenses and costs.

- Improved access to real-time data for forecasting and planning.

John further clarified one of the benefits of this operational efficiency: “Whereas different software results in silos, Airbase helps break the silos and makes information available across departments.”

Curaytor had outsourced its accounting function, but Airbase allowed the company to bring AP in-house, which resulted in saving money compared to the cost of a third-party service. In addition to the cost savings, John notes: “The system has allowed us to save about 10 hours a month for the entire AP process.” Plus, operationally, handling AP in house “has better controls, so our AP manager knows who to ask, which saves a lot of the back-and-forth because you go right to the source, or you are the source.”

The changes brought on by a fully remote workforce, and the economic uncertainties resulting from the COVID-19 pandemic, heightened Curaytor’s commitment to improving its finance operations. “We wanted to make sure that we had full visibility and control over all our expenses and we certainly implemented Airbase at the perfect time. With Airbase, we now understand very granularly our cost of goods sold and the cost of each department, and there are no mysteries coming into the monthly close.”

Curaytor has shaved as much as 10 days off of its month-end close. Before Airbase, the month-end close had been taking up to 14 days to complete. Perhaps, even more importantly, John pointed out that:

John is also responsible for the company’s FP&A. He reports better forecasting with Airbase because the numbers are an up-to-date reflection of actuals, rather than from a month ago.

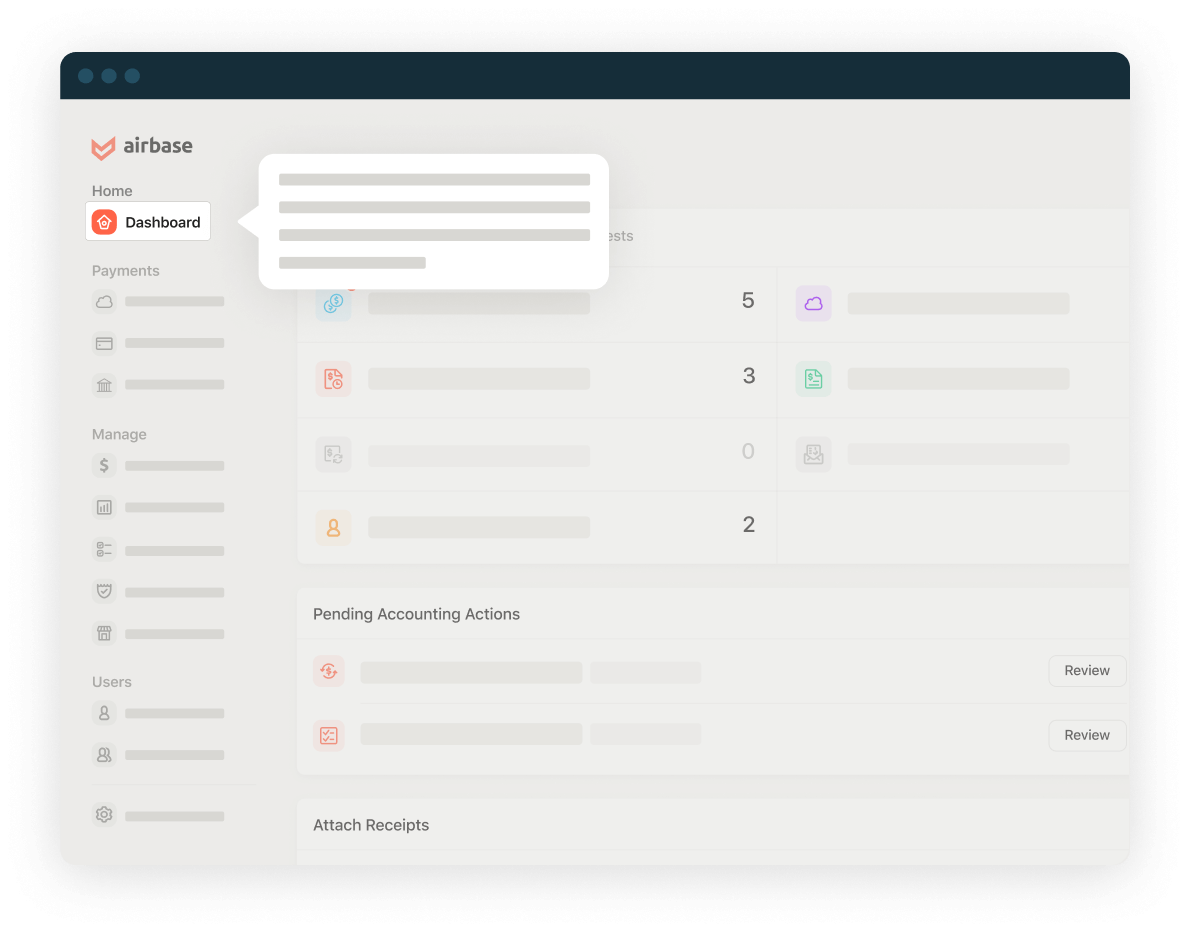

One of the attractions of the Airbase platform for John was its auto-categorization feature that eliminates the time it takes to respond to, and correct for, errors and confusion around booking transactions. “We have hundreds of vendors and going through manually, making corrections in QBO, was an inefficient process. Now, every time a virtual card is created, the category is set and approvals secured, we can update the memo section in QBO so we know without questions who and what a charge is for.”

In addition to streamlining categorization, John has been particularly pleased with Airbase’s Invoice Inbox to smooth out and make efficient, invoicing workflows. With it, he knows that all of the supporting data and documentation creating an audit trail are in one place.

John jokes that he’s an invoice hawk, determined to know about every invoice that is expected and tracks any gaps against ones that have been received. “I’d rather pay it this month when it’s due than have four months of backup.” His goal is to ensure proper spend hygiene and that his payments are going out on time. “With Airbase, there aren’t any mysteries coming our way, and we can see that everything is approved. Airbase allows us to keep track, and pay it when it’s due. This, in turn, supports more effective forecasting.”

When asked what other features he would like to see Airbase provide to his operation, he mentioned he was looking forward to international payments (an Airbase feature slated to go live in Q4 2020). “We want everything to go through Airbase. It’s a single source of truth, we know where everything is.”

John has migrated his existing card spend to Airbase’s virtual cards and learned that this effort really did need to be a team one to make sure everything was captured. Once the cards were migrated, he and his team have been pleased to see how efficient virtual cards are.

“We were already pretty card-heavy and so tying a card to a specific vendor has helped with visibility. From an ROI standpoint, we had a ton of points on the previous cards that were impossible to claim, but with Airbase we get cash back, which is great.”

“When we migrated, we took the opportunity to right-size all of our vendors. For instance, we looked at our subscriptions, like Adobe: how many licenses do we have, how many do we need? We did it across Slack, Gmail, etc. This allowed us to tighten up a lot. With Airbase, we get ahead of the game. At the end of the month I ask, “Do you still need these 12 products?” and each manager indicates if they still need tools every month. It’s just an easy report to pull and has allowed us to stay on top of duplicate purchases.”

John was particularly complimentary about the Airbase onboarding process and the ongoing customer support that he receives.

John learned about Airbase by attending one of its many events and continues to do so today. He appreciates the forums that help connect and inform an ever-growing community of finance and accounting professionals.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana