Kongbasile And Airbase: Making Finance Easier For Startups

Robyn Mahoney

Director

Raymond Abellera

Manager

Spencer Falbo

Principal

- KongBasileConsulting (KBC) uses the Airbase spend management system with clients who seek a comprehensive approach to managing company spend.

- Airbase is increasingly seen as the easiest to use AP software, by both KongBasileConsulting (KBC) and its clients.

- Airbase’s continually expanding product roadmap makes it the right choice for more and more of the companies that KongBasileConsulting (KBC) serves.

To learn more about KBC’s bird’s-eye view into the spend management space, we had a conversation with principal Spencer Falbo, manager Raymond Abellera, and director Robyn Mahoney to learn more about their experience using Airbase with their clients.

The unique perspective of software-agnostic accounting consultants.

Robyn observed that many startup and early-stage companies don’t have solid requisition processes for software. By the time they become clients, many companies will have adopted software that is not optimal. Some are attracted to a specific promotion or use what their friends use rather than thinking about comprehensive solutions that will scale with them.

The time, effort, and cost of replacing systems can be a barrier to switching to better solutions, and KBC consultants often find themselves having to make do with inherited systems. This, however, does not keep the KBC team from staying current and advising on the best setup.

According to Raymond, a key value-add KBC brings is “our ability to benchmark tech companies based on our deep experience with them. We consult on what is needed for a company at a particular stage and advise on processes that will help them as they grow so that there are fewer pain points.”

An internal team at KBC monitors the market for new software products and developments in best practices. Vendors present at their team meetings, and staff share knowledge and recommendations. KBC makes a point to ask clients about their decisions to migrate away from certain tools and what they liked and disliked about them.

Accordingly, KBC has kept an eye on the Airbase platform from early on in its existence and has even served as a beta tester on many of Airbase’s features as they’ve rolled out. Spencer notes that KBC’s feedback is very often implemented in future updates, making the platform work better for KBC and its clients as time goes on.

Why KongBasileConsulting trusts Airbase.

Consultants at KBC have a vested interest in their client’s software choices. As Spencer explains, “We’re interested in solutions that can scale with the company so that we don’t have to replace systems often. Because we’re acting as in-house accounting, we want tools that are going to make us efficient in our work and benefit our clients.” Accordingly, KBC guides clients to appropriate software solutions that will last in the long term.

KBC prefers software that saves time both for them and their clients. A key component of this is automation. Robyn tells us, “We don’t want to do a lot of time-consuming manual work so we’re always interested in ways to automate accounting workflows. Unnecessary manual work is not good for team development and it’s not good for morale, nor is it good for the client’s bottom line.”

Airbase’s native integrations with common general ledgers, such as QuickBooks and NetSuite, prevent the manual work that needs to happen with other bill pay solutions. Robyn gave the example of mirroring NetSuite rules in Airbase so that expenses are funneled into the right place without manual intervention.

Airbase’s easy implementation encourages a positive spend culture.

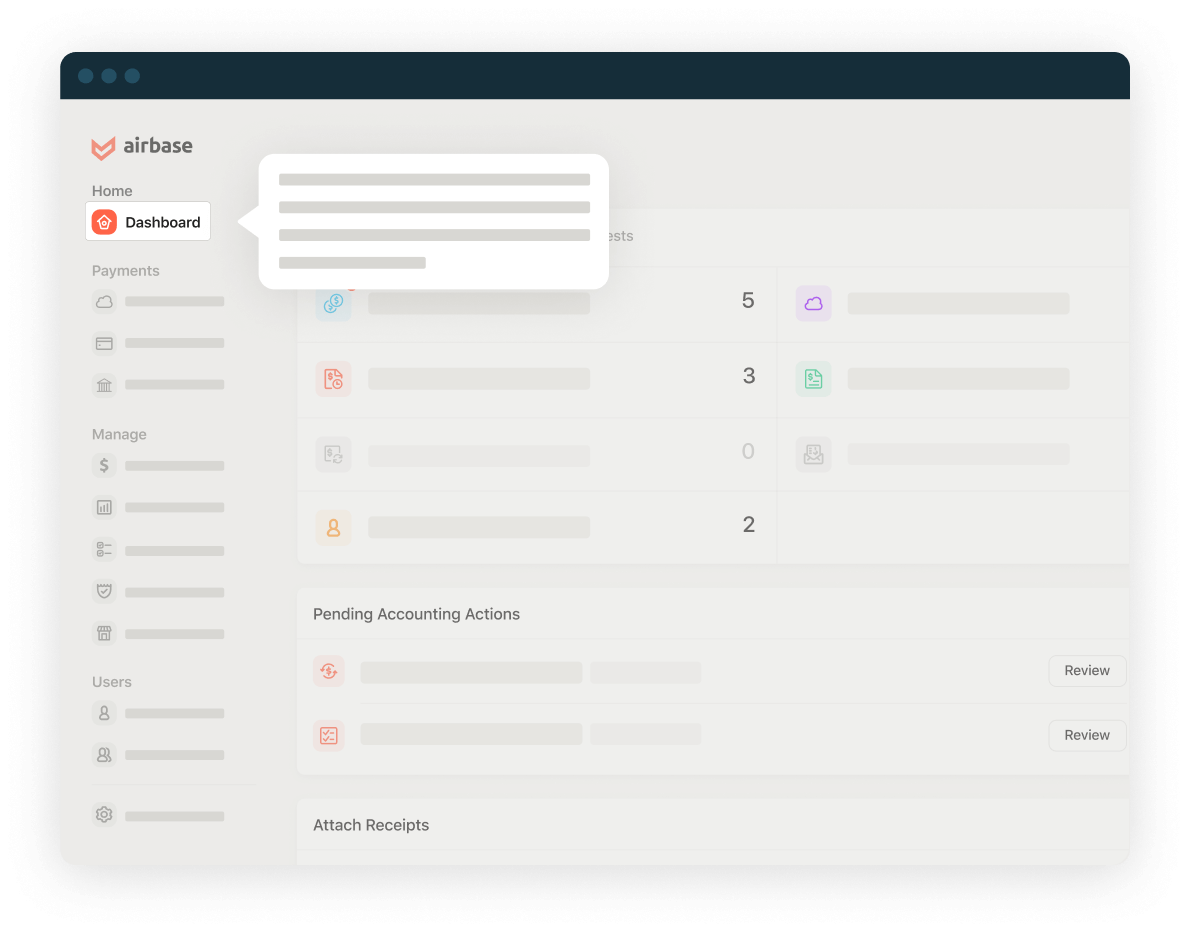

In general, all three of the KBC pros we talked to feel that implementing Airbase is straightforward. They also note that Airbase makes clients think about their spend in new ways. According to Raymond, Airbase “hits all the areas that we try to impart on our clients. Airbase makes it easier for them to visually see the importance of controls as opposed to a theoretical concept of controls.” For some of KBC’s clients, the most difficult part of Airbase onboarding is the mindset shift.

As Spencer explains, “Airbase forces you to think more about your control structures in order to work well with the system. This is particularly evident around corporate card spending where traditionally approvals don’t happen before spending occurs. We want to ensure that we have the appropriate approval structure in place. Just having those conversations is a mindset difference.”

Airbase promotes a change in spend culture, helping clients to think more about controls and how to implement safe practices. In addition to the approval workflows built into card transactions, Spencer pointed out that because Airbase handles all non-payroll spend, the platform can control for overspending.

Airbase is the logical choice.

As an all-in-one spend management platform, Airbase has had an increasingly positive reaction with KBC’s clients and its internal team. And, as features continue to be added, Airbase becomes the right choice for more companies. “It does well, especially integrating with general ledgers,” Raymond tells us. “And it’s fairly simple.” Not having to switch between platforms for bill pay, reimbursements, and corporate cards is a big plus. According to Spencer, “Everybody loves the fact that it’s one login.”

Robyn enjoys “the ability to have a separate virtual card for every service and link each service to a specific person provides visibility into who is spending what. We can identify subscription duplicates to find efficiencies and eliminate redundancy in addition to ensuring spend documentation is complete.”

Airbase’s new higher cashback rate makes Airbase a clear financial win in many cases. In addition, Spencer notes that Airbase’s pre-funded card model allows for higher spend limits for smaller startups.

In addition, Spencer appreciates “not only having the virtual card side of the business but also being able to compare payments from the bill payment to the credit card side to ensure a secondary control, to ensure that we’re not overpaying on expenses.”

Comparing Airbase to its competitors, Spencer tells us, “the team’s happy with it, the clients are happy with it. Logically, it makes more sense.”

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana