M1 And Airbase: How Efficiency And Scalability Helped M1 Finance Scale

Lara McGregor

Controller at M1 Finance

Gee Lim

Senior Staff Accountant at M1 Finance

- The important addition of multi-subsidiary support was implemented quickly and easily.

- Automation and consolidation were key to allowing M1 to grow with such a small accounting team.

- Airbase’s continual improvement and added features scaled as M1 did.

M1 Finance, a personal finance platform, has a highly effective accounting team that may well be breaking records. It has managed M1’s books while the company hired 200 people in 10 months without outsourcing any of its accounting. The most amazing part? The team is composed of just two people. Lara McGregor and Gee Lim balance the books, with Airbase as their AP automation software.

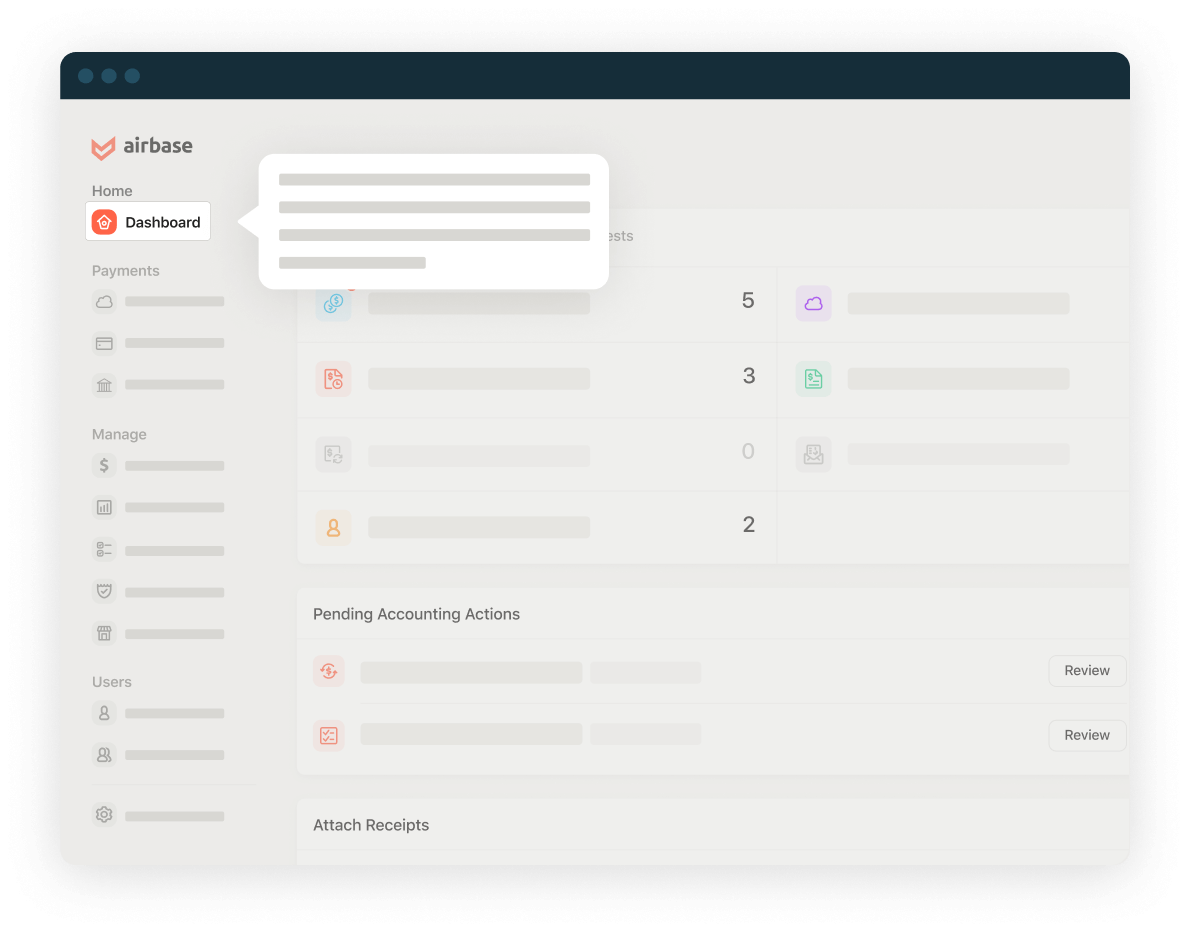

For such a small accounting team to support a startup’s push into mid-market, they needed a robust AP automation software that could handle volume and a quickly growing employee base who needed to make purchases. When asked what their criteria was for selecting a solution, Lara said, “efficiency and scalability.”

Efficiency: Automation, automation, automation.

Lara and Gee make sure they have a workflow in place for every aspect of the accounting cycle. Lara told us, “Our team is lean, so any process that we put together has to be very efficient. And in order to get that efficiency, we need a lot of automation.”

Gee experienced manual workarounds at a previous job where he didn’t use Airbase. He told us, “I would export our credit card activities from our bank, manually label each expense line to each account and each department, and that would then be approved via paper. I’d have to journalize that into NetSuite as well.”

While manual steps like these may work for businesses with few employees or expenses, they quickly become overwhelming. From M1’s founding until mid 2020, the CEO handled accounting and relied on QuickBooks, bank portals, and spreadsheets. For the business to continue to grow, however, it needed a more streamlined workflow, which is where Airbase came in.

Scalability: An AP automation platform that grew with them.

Airbase has allowed Lara and Gee to continue accounting operations without feeling overwhelmed despite rapid company growth. When comparing his work at M1 to a previous role, Gee said, “Even though the volume is higher with the different departments and more people, I feel like I have control on the virtual card rules, the bill payments, and the approval process.”

M1 was a beta tester for Airbase’s employee expense reimbursements product, and of features such as physical card approvals. It was also one of the first adopters of Airbase’s multi-subsidiary support.

Gee told us that “multi-subsidiary support definitely has been one of our favorite features, and was very quickly and very easily implemented with NetSuite and with our bank accounts.”

Even though M1 has been growing at breakneck speed, Lara and Gee have been impressed at Airbase’s ability to keep up with their needs, either by giving access to existing features or rolling out new ones on the Airbase roadmap. Not only was Lara’s desire for a scalable solution realized, Airbase consistently added new and useful features. The product roadmap was constantly communicated, and, in several cases, M1’s feedback was incorporated into updates. “It’s been nice to have Airbase grow with us,” Lara said.

Easy onboarding saves even more time.

Rapidly growing teams need an efficient onboarding process. Because of Airbase’s intuitive interface, Lara and Gee saved time by not having to train employees how to use every aspect of the platform.

In addition, Airbase allowed certain administrative tasks to be taken off Gee’s and Lara’s plates without burdening employees. For example, employees now code their own expenses using a dropdown menu. Even better, Lara and Gee can hide Chart of Account codes that employees would never need to use, reducing coding errors and saving everyone time.

M1 uses Airbase’s advanced approvals settings to set spend limits for different amounts and methods. These settings are easily adaptable, helping M1 stay nimble. Lara and Gee also appreciate how easy it is to switch spend approvers. With around a dozen departments, it is key that there is always someone who is able to approve spend.

How has this power-team managed the books with just two people? As Lara put it, “Airbase has been delivering.”

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana