Vendor management is central to procurement and an integral part of financial management. It enables companies to control costs, mitigate risks, streamline operations, and maintain a healthy supply chain. It is increasingly important for companies that have prioritized environmental and sustainability goals. These companies have added additional criteria to their vendor selection process, requiring ongoing management to ensure compliance with ESG policies.

What is vendor management?

The vendor management process oversees and optimizes the relationships between a company and its vendors. It encompasses a wide range of activities. These activities include selecting and onboarding vendors, negotiating contracts, managing performance, and ensuring compliance. Effective vendor management is crucial for finance teams for three main reasons.

Control costs.

Cost controls are the central reason to build good vendor relationships. Studies show that a world-class procurement team can save a company between 8% and 12% on direct spending. Vendor management is an essential part of securing these savings.

Risk mitigation.

Vendor management involves assessing and evaluating risks. Not all risks can be controlled, but having good relationships can help. Building strong relationships can help mitigate the risks of non-compliance, non-performance, and inflated prices.

This includes evaluating financial stability, ensuring compliance with regulations, and implementing contingency plans in case of disruptions. Effective risk mitigation protects the company from potential supply chain disruptions, reputation damage, and financial losses.

Efficient operations.

Vendor management is important to ensure your business’s smooth flow of goods and services. Keeping open lines of communication to provide advance notice of changes to plans and needs can help in this process.

The role of finance in vendor management.

Finance teams are crucial in vendor management, providing expertise in contract negotiation, payment processing, performance evaluation, and relationship building. By effectively managing vendors, finance teams can significantly contribute to the overall financial success of their organizations.

Developing vendor management processes to meet your needs.

Effective vendor management process will vary depending on your type of business and how unique or specialized your vendors are to your success. Some vendor relationships will be much more strategic in nature.

If many suppliers have the same product or service, you may not need a strong program to manage your vendors. These purchases are more commoditized and there isn’t a need for selection, negotiation, and ongoing communication. Managing that relationship will be essential to your company’s success if a vendor provides unique products or services critical to your business, especially those that cannot be found in other competitors.

Why vendor management is key for businesses.

A good vendor management process can bring important benefits that impact a company’s success. Best practice vendor management can lead to the following benefits.

- Cost control

- Risk mitigation

- Streamlined payments

- Enhanced compliance

- Improved supply chain efficiency

- Better options for dealing with supply chain disruptions

If your business depends on crucial vendors to bring value to your customers, managing them well can lead to success for your business.

Guided Procurement Tour

Take a self-guided tour to see how Guided Procurement helps support all stakeholders.

The benefits of implementing strong vendor management practices.

There are several benefits associated with building and maintaining good vendor management practices. Below are a few examples of how strong practices might help.

Example #1.

Your company received an unexpected order for additional products. Your product relies on raw materials from a vendor. Strong lines of communication mean that the procurement team will have already notified the vendor that additional supplies may be needed. The relationship has been built so that the vendor will be responsive to this type of unexpected need and find a way to fill the order.

Example #2

Your company depends on a vendor recently receiving negative press about their financial condition. A strong vendor management program will have already identified points of weakness and will move quickly to understand and respond to a deteriorating financial condition. One response would be to increase communication. Another would be to line up a second supplier.

Cost savings through negotiation.

Companies can reduce expenses by effectively getting good deals with their suppliers, vendors, and partners. One way to improve bargaining power is by knowing your worth.

Suppliers seek and work to satisfy good customers. If you are a good customer, they’ll work with you by providing better terms and better service. Research the market and know your competitors’ prices and costs. This will help you negotiate better terms.

Finally, set clear objectives in addition to price. For example, saving time on a product or service delivery can save costs, as can payment terms.

Being prepared and considering many factors can make you a more effective negotiator. These skills can help drive better terms with your vendors and greater success for your company.

Improved quality control.

Vendor management is important for quality control. It sets standards, monitors vendor performance, and promotes collaboration between companies and suppliers.

Managing vendors well can help companies improve. It helps with quality control, reducing defects, making customers happier, and gaining a competitive edge.

Enhanced supplier relationships.

Suppliers can enhance their relationships in additional ways. These can bring value to your organization but they can take extra attention, time, and coordination. Automating as many aspects of vendor management as possible frees up eprocurement resources.

- Audits and inspections of vendors can find quality problems early and stop them from reaching customers.

- Collaborative problem-solving allows companies to work together to identify the root causes of quality problems, implement corrective actions, and prevent recurrence.

- Continuous improvement initiatives can provide a framework for identifying areas for improvement and implementing changes to enhance quality.

- Supplier development programs can help vendors improve their quality management systems, adopt best practices, and enhance their overall quality capabilities.

- Quality-based incentives can reward vendors for consistently meeting or exceeding quality standards. This can motivate vendors to prioritize quality and invest in continuous improvement.

- Data-driven decision-making supported by data analytics and quality management software can provide companies with valuable insights into vendor performance. These insights in addition to identifying trends, help improve quality control.

Increased operational efficiency.

A good procurement team with clear policies and software tools can improve the efficiency of your whole finance operation. Efficiencies can be gained in several ways, including:

- Streamlined processes: Effective vendor management establishes clear communication channels, defined performance expectations, and standardized processes for collaboration. This leads to smoother procurement cycles, reduced delays, and improved overall efficiency in the organization’s supply chain.

- Running a good RFP or RFQ process can save a company time and cost. Procurement teams can bring tremendous efficiencies at this stage.

- Enhanced quality and innovation: Vendor management encourages collaboration with suppliers to improve product quality, identify innovation opportunities, and stay ahead of industry trends. This fosters a mutually beneficial relationship where both parties work together to achieve shared goals.

- Improved customer satisfaction: By ensuring timely deliveries, consistent quality, and reliable performance from vendors, companies can enhance customer satisfaction and loyalty. Effective vendor management directly contributes to a positive customer experience and brand reputation.

- Increased agility and adaptability: A well-managed vendor network enables companies to respond quickly to changing market conditions, adjust production schedules, and adapt to new technologies. This flexibility is crucial for maintaining a competitive edge in today’s dynamic business environment.

- Focused on core competencies: By outsourcing non-core activities to reliable vendors, companies can focus their resources and expertise on their core competencies, leading to increased productivity and innovation in their primary areas of business.

In summary, vendor management is not just about managing costs and contracts, it’s about building strategic partnerships that drive operational excellence, enhance customer satisfaction, and contribute to the overall success of the organization.

The stages involved in the vendor management process.

Effective vendor management requires a continuous planning, implementation, monitoring, and evaluation cycle. By following these stages, companies can ensure that they select the right vendors, manage them effectively, and minimize risks associated with their supply chains.

The vendor management process typically involves the following stages to ensure a full procurement solution:

Vendor research and discovery.

Vendor identification and sourcing involves determining potential vendors who can meet the company’s specific needs and requirements. This may involve conducting research, attending industry events, and networking with other companies in the same industry.

Over 5,000 finance professionals participate in Airbase’s Off the Ledger Slack community. One area of constant discussion concerns solutions and service providers for specific problems. Responses are from other finance and accounting professionals who share their experiences with different vendors.

Two ways to conduct vendor research are bottom-up and top-down. In the bottom-up approach, the end user finds the vendor themselves. For example, when the development team needs a software subscription, they are the best ones to decide which vendor is the best. On the other hand, the top-down approach involves the procurement team conducting the research.

Vendor evaluation: Assessing potential vendors to ensure they meet company standards for quality, performance, financial stability, and regulation compliance. This may involve reviewing vendor proposals, conducting site visits, and checking references.

Vendor selection.

When choosing vendors, it’s important to have a Vendor Selection Criteria. Finance and procurement teams work together to decide on criteria like price, quality, reputation, and financial stability.

Vendors that meet the criteria can be added to a list for review. Reviews can start with many potential vendors and then culled down to three to four for final vetting. Often, companies use a Request for Proposal (RFP) or a Request for Quote (RFQ) process for selection. The company sends detailed lists of requirements to potential vendors to provide information about its capabilities.

Request for proposal.

An RFP is a document businesses use to ask vendors for proposals for a project or service. Typically, organizations use RFPs for complex projects or services requiring multiple vendors’ expertise.

The RFP process typically involves the following steps:

- The company creates a document that details the project or service requirements. It also explains the evaluation process and timetable, plus the criteria that will be used to choose a supplier.

- The business distributes the RFP to potential vendors.

- The vendors develop and submit proposals to the business.

- The business evaluates the proposals and selects a vendor.

Difference between RFP and RFQ.

The main difference between RFP and RFQ is the level of detail that is required in the proposal or quote. RFPs typically require a more detailed proposal from the vendor, including information on their approach to the project, qualifications, and pricing. RFQs usually only require a quote from the vendor, including the price of the product or service.

When to use an RFP vs. an RFQ.

You should use an RFP when:

- The project or service is complex and requires the expertise of multiple vendors.

- You need to evaluate the vendors’ approach to the project, their qualifications, and their pricing.

- You need to compare different proposals from different vendors.

You should use an RFQ when:

- The product or service is simple, and you already know what you need.

- You are simply looking for the best price.

- You do not need to compare different proposals from different vendors.

Contract negotiation.

Finance teams play a key role in negotiating vendor contracts, and ensuring favorable terms in pricing, payment schedules, performance guarantees, and risk mitigation clauses. This phase can have an important impact on a company’s margins and bottom line.

Onboarding and integration.

This stage involves integrating new vendors into the company’s procurement system. This may involve providing vendors with training on the company’s policies and procedures, establishing communication channels and a secure vendor portal, and setting up payment terms.

Performance monitoring.

It’s important to monitor vendor performance in your vendor management process to ensure they are meeting the agreed-upon terms of the contract. This may involve tracking metrics such as cost savings, delivery times, and quality standards.

Risk management and compliance.

Supply risk management involves identifying, assessing, and mitigating potential risks associated with vendors, such as financial instability, supply chain disruptions, and cyberattacks. This may involve developing contingency plans and diversifying the vendor base.

Attestations may be used to provide evidence of compliance with data and privacy handling by vendors. These are found in SOC reports that vendors maintain.

Relationship management.

This stage involves building and maintaining strong relationships with key vendors. Doing so will involve regular communication, open dialogue, and collaboration on joint initiatives. Companies with important supplier relationships will often meet regularly in person.

This can help establish trust and a closer bond, and the bond can be especially beneficial to both parties in challenging situations.

Review and renewal.

There are several reasons that the relationship with your vendors might change. That’s why regularly reviewing those relationships is a good idea — typically when the contract is up for renewal.

The review should start by ensuring that your requirements and the vendor’s capabilities are fully aligned. Your requirements may have changed and your existing vendor may be unable to handle your needs.

If the vendor meets your requirements, you might want to renegotiate the price. More competitors entering the market with a cheaper product could create an opportunity to seek a lower price. It could be that you want to review the contract terms and decide if you need changes to those terms, especially payment terms.

In general, it is good to develop a review process for vendor contracts. This process should include the following steps:

- Review the terms of the contract. This includes reviewing the scope of work, the pricing, the service levels, and the termination provisions.

- Assess the vendor’s performance. This includes reviewing the vendor’s adherence to the contract terms, the quality of their work, and their responsiveness to customer needs.

- Identify any areas for improvement. This may include areas where the vendor’s performance has been subpar or where the contract terms could be improved.

Meet with the vendor to discuss the contract review. This meeting should be used to discuss the contract review findings and identify any areas where improvement is needed.

Negotiate any necessary changes to the contract. This may involve negotiating new pricing, service levels, or termination provisions.

Renew the contract. Once the contract has been negotiated, the organization should renew the contract with the vendor.

In addition to the above practices, there are other considerations you may want to focus on:

- Involve key stakeholders in the review process. This includes stakeholders from the departments that use the vendor’s goods or services and stakeholders from the legal and finance departments.

- Use a contract management software system. This type of software can help you to track all of your vendor contracts, automate the review process, and generate reports.

- Get competitive quotes from other vendors before renewing a contract. This will help you ensure you get the best possible price and terms.

- Be prepared to walk away from a contract if the vendor is unwilling to meet your needs.

Offboarding.

Vendor termination is when a company ends its relationship with vendors who are not meeting their needs or performing well. This may involve providing vendors with notice, negotiating termination terms, and transferring business to other vendors.

Offboarding may lead to making changes to how your operations run. Include all stakeholders in the review process so that if you do offboard a vendor, it’s clear to everyone impacted.

Best practices for successful vendor relationship management.

The best practices for successful vendor relationship management will depend on your business and the types of products and services that you purchase.

Establish a defined vendor management policy.

A vendor management policy is a formal document that outlines a company’s guidelines and procedures for:

- Selecting

- Evaluating

- Managing

- Offboarding

Your policy serves as a framework to ensure that the company’s procurement practices are consistent, compliant, and aligned with its overall business objectives. It also provides a description of the vendor management process flow.

A comprehensive vendor management policy typically includes the following sections:

- Scope

- Vendor selection criteria

- Vendor onboarding

- Vendor performance management

- Supply risk management

- Vendor relationship management

- Vendor offboarding

- Policy review and updates

Some companies rely on a dedicated vendor management system, others use the vendor management tools in existing software. Vendor management systems are used by procurement teams to support all aspects of vendor management including vendor selection, tracking vendor data, and also to track vendor performance.

Strategic vendor selection.

Strategic vendor selection is a process of identifying, evaluating, and selecting vendors who can align with a company’s long-term goals and objectives. It involves a comprehensive approach that goes beyond simply finding the lowest-cost supplier. Instead, it focuses on building strategic partnerships with vendors who can provide value beyond price, such as innovation, expertise, and a shared vision for the future.

Benefits of strategic vendor selection:

- Enhanced value creation

- Cost optimization

- Improved quality and innovation

- Reduced risk and increased resilience

- Competitive advantage

Cultivate strong vendor relationships.

Cultivating strong vendor relationships can be done in a variety of ways. The most important of these would be to make sure payments are on time. It’s also important to engage in regular dialogue. Clear communication about your company’s needs and upcoming changes can promote strong vendor relationships.

Building strong relationships helps with the smooth running of your business and translates into savings and efficiencies for all involved.

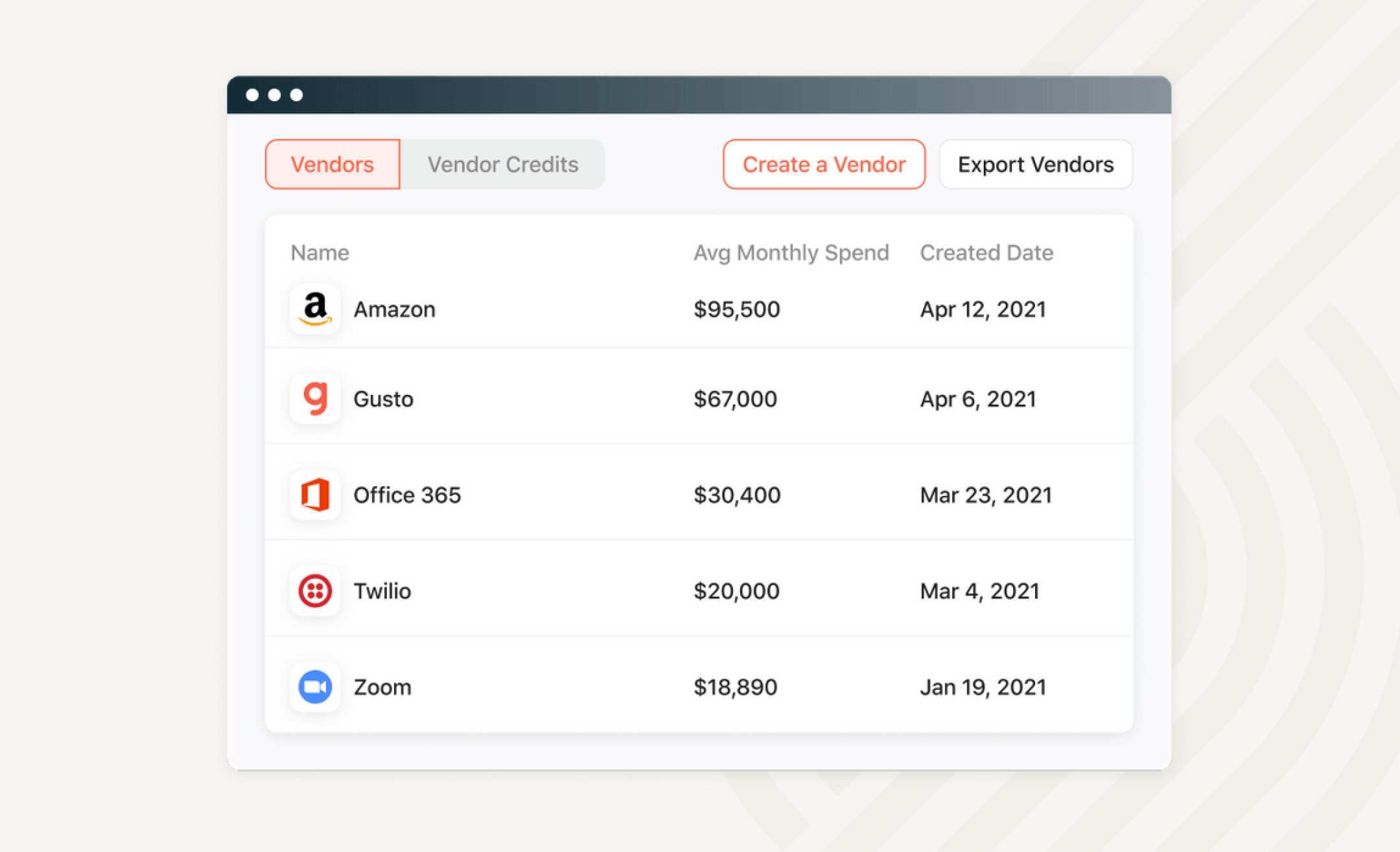

Implement comprehensive spend analysis.

Develop a set of metrics and tools for tracking vendor relationships. This can help track performance at the individual vendor level. Spend management systems often offer reporting capabilities so you can stay on top of how well your vendors are serving your company’s objectives.

Employ technology for vendor management.

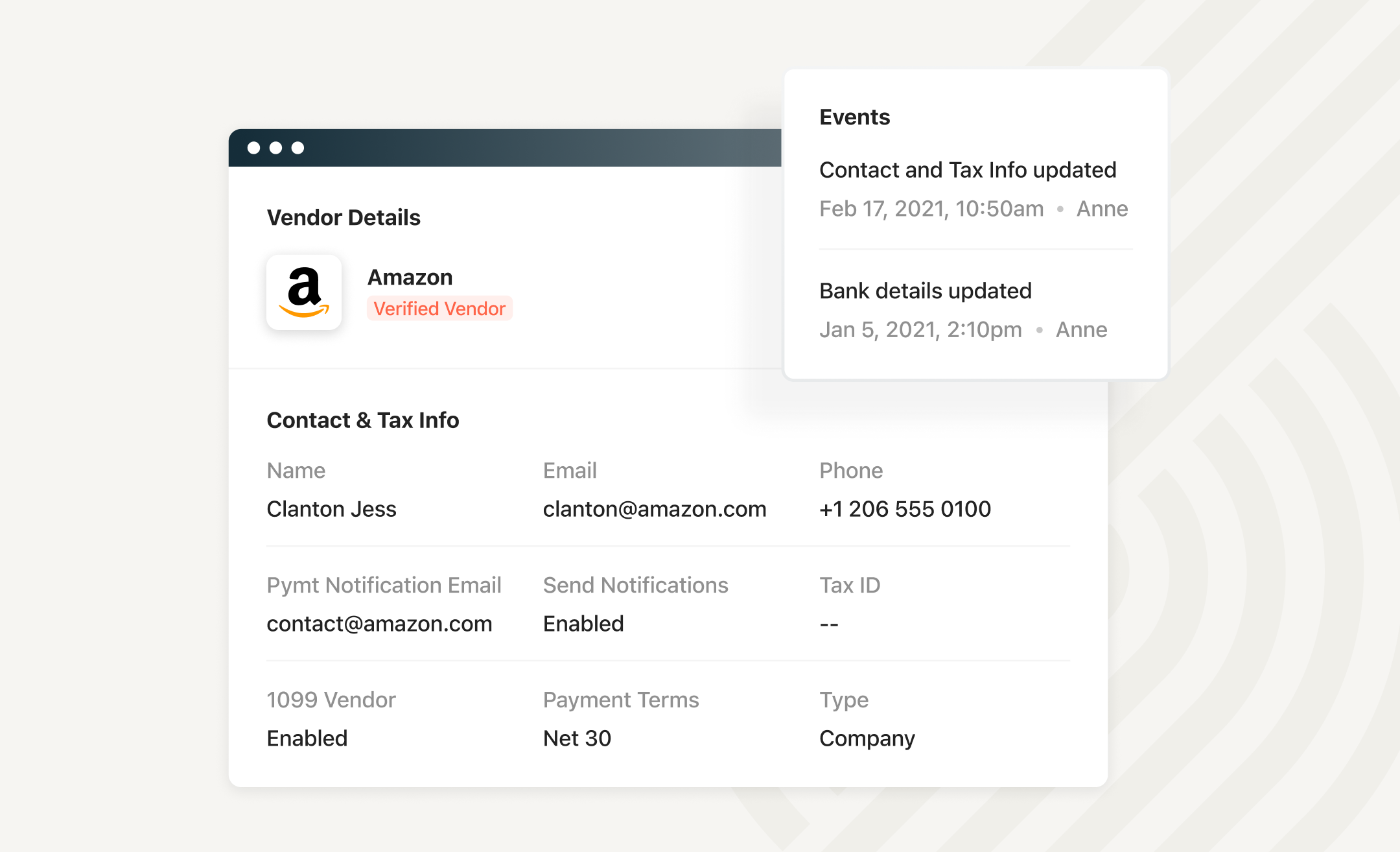

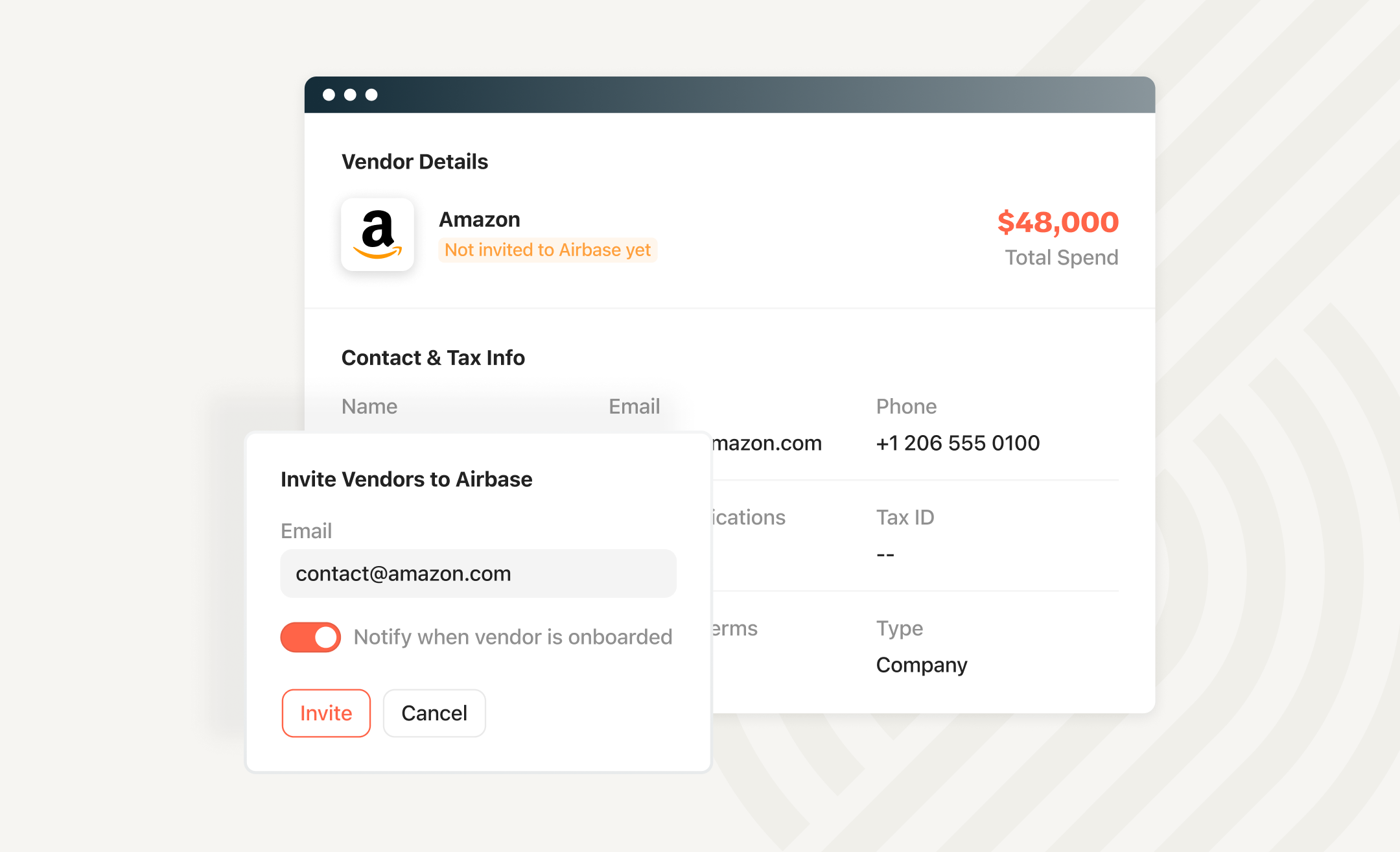

Software solutions for vendor management can be a great benefit to you as the customer and to your vendors. A vendor portal offers a self-serve way for vendors to update records with you, such as information like changes in address or bank account information, or the submission of tax documents.

A good vendor portal will also let your vendors track payment information. This way, your vendors won’t have to ask your accounting team to run ad hoc reports.

Airbase users frequently remark on the ease of managing vendors through our automated procure-pay-close platform. “Airbase has been a game-changer for our vendor management team. It’s made expense management a breeze, giving us more time to focus on what really matters,” states one happy customer.

How a vendor management solution can enhance your operations.

As with all automation, vendor management software can streamline your process and reduce errors. It can also help ensure compliance with your policies. A spend management solution offers vendor management capabilities as part of its overall functionality. These functions include three essential capabilities:

- Ensure that all documentation like contracts and SOC reports have been reviewed and are on file.

- Safe and reliable global payments capabilities, and

- A vendor management portal.

This type of automation can free up time to build stronger relationships and more carefully assess vendor performance.

Assess your requirements carefully before choosing a vendor management software solution. Different procurement software like procure-to-pay systems will offer support for different types of procurement teams.

Your procurement team may be more focused on compliance than performance, or may prioritize pricing. Different solutions can offer different capabilities to fit your needs. Increasingly, software can automate much of the vendor management needs. This can help reduce reliance on additional resources for an effective vendor management program.

Schedule a demo

Learn how Airbase can transform your entire purchasing process.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana