Decentralized spending creates the need for a spend management solution.

The term spend management can mean different things to different people. In this post, we offer a comprehensive definition for the term in order to help people think more broadly about how to plan for, control, and manage company spending.

Spend management is: the administration of approvals, payments, accounting, and reporting of all non-payroll expenditures.

Taken in this broader context, we will give full consideration to why spend management places unnecessary demands on the time and resources of company employees and undue strain on finance teams. We will also discuss some ways that finance teams can reimagine their approach to spend management best practices.

What makes spend management difficult for companies?

High-performance teams need to be empowered. That includes, among other things, giving them the ability to procure the products and services that they need in order to do their job. In the past, purchasing decisions were generally made, and payments executed, by a centralized purchasing or procurement manager. Over the past decades, decentralized spending has shifted away from the conventional T&E to include SaaS, cloud products, as well as other recurring, subscription-based products and services, especially contractors for specialized tasks. Yet in that relatively long period of time, little has been done to rethink the full operational requirements that support decentralized spending needs.

Consider the company where, on any given day, the dev team needs to renew their AWS subscription, marketing needs to pay for digital ads, HR needs to pay a contractor to set up benefits, the sales team needs to pay for rideshare, and the office manager needs to purchase snacks for the office. Allowing each employee to execute these purchases requires approvals, payment execution, booking to the general ledger, and reporting to management. In most companies, each of these parts of the spend management process involve different people, several different software tools, and a range of payment mechanisms.

Finance teams have worked to put tools and operations in place, often using an ad hoc approach that results in a disjointed process. In addition to the resulting messy finance stack, many of the embedded workflows, like approvals for spend, receipt submission compliance, and report generation and distribution, are time-consuming and cumbersome.

The aggravation this situation causes is real. One controller recently claimed that he solved his spend management problem by taking away most corporate cards. We appreciate his frustration but not his desperate solution. Denying work teams easy access to products and services leads to inefficiencies. But the company card does come with several headaches for finance teams, especially when the same card is shared by many employees. This, of course, makes tracking and accountability extremely difficult.

Companies have also responded by implementing a series of software tools for different aspects of the process, including one for capturing receipts and submitting expenses, and another set of tools for making payments. In addition to these disparate solutions, each company will have accounting software where each transaction must be logged and reconciled. The siloed nature of this cobbled together finance stack denies easy coordination across the many individuals involved. The numerous participants in a decentralized system include the employee requesting the purchase, the manager approving it, accounts payable or a credit card company to pay for it, accounting and bookkeeping staff to log the transaction, and a finance team to reconcile results for accurate reporting.

It is helpful to understand the forces that have changed the modern workplace; forces that have, and will, continue to place a strain on traditional spend practices in companies. The first of these forces is the move from centralized, top-down purchasing—which is easy to budget, control and report on—to a decentralized approach. This decentralized spending is felt most acutely in the purchase of SaaS products where the pricing model is subscription based. This model has been an extremely successful one and is expected to be more widely adopted as more sectors evaluate its applicability to their businesses.

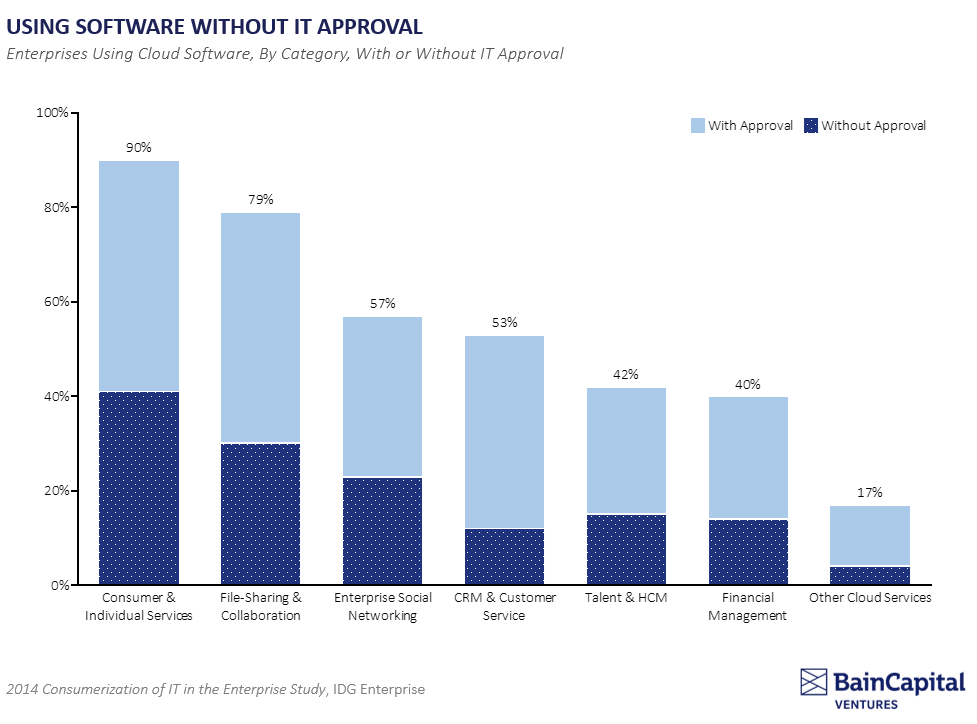

Bain Capital Ventures shared a helpful illustration, as well as conclusions, on this trend in a recent article published on Medium.com called Show Me the Receipts.

Software spending is increasingly decentralized.

Whether you call it consumerization of the enterprise, shadow IT, or bottoms-up software, the reality is that more and more software is sold directly to the end user, rather than through traditional gatekeepers at the C-level and in IT.

Across both modern companies and legacy incumbents, information workers have been empowered to find the software tools they need to solve their business pain points. However, this explosion in bottoms-up, decentralized spending, has created a control, visibility, and budget reconciliation challenge for companies, their finance teams and for functional and business unit leaders.

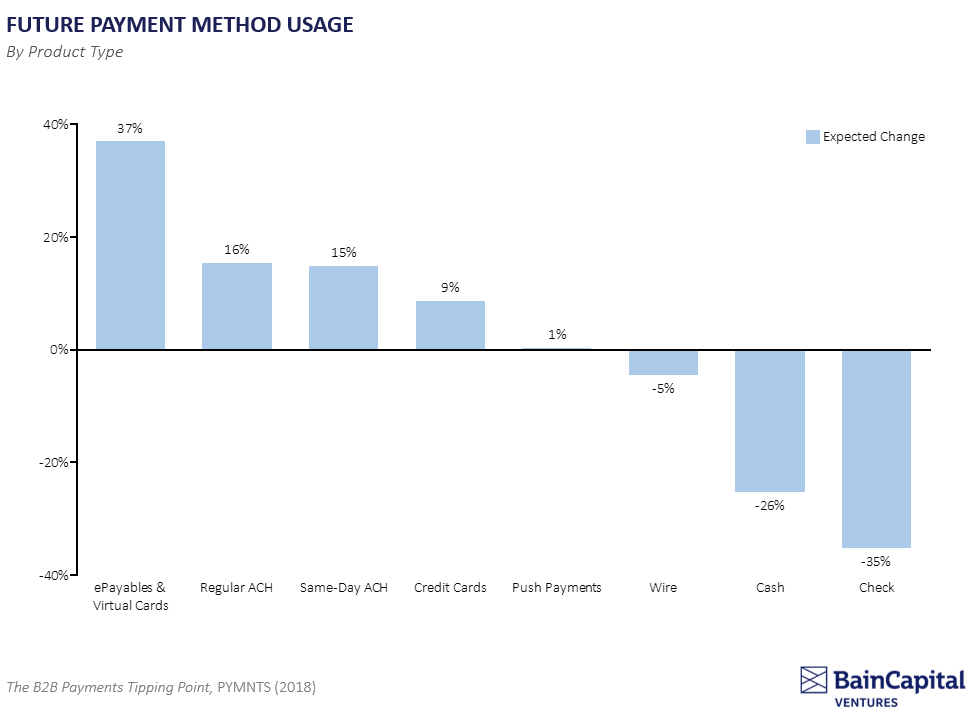

Another driving force that has impacted how companies spend money is the move to digital payment methods. Again, in its recent article, Bain Capital Ventures provides some insight into payment methods.

For the past few decades, the movement to digital has been a sea-change in commerce. Independent surveys have consistently validated the compounding impact digital technologies have had on payment methods, with precipitous declines in cash and check payments. Moreover, as employees buy small recurring licenses for software and cloud services, more of these types of payments are ending up on corporate and personal cards, rather than formal invoices.

B2B payments moving to card/ACH/virtual card.

This digital payment movement has created a set of challenges that add up to significant pain for finance leaders. Without flexible controls, corporate cards may either default to declining or accepting payments, leading to under- or overly-strict policies. When employees leave their companies, they need to have their cards closed, but this also endangers any critical systems that are tied to those digits. As the number of subscriptions increase, it’s easy to lose track, leading to recurring payments for software that’s no longer in use.

With the dual trends, subscription model pricing, and digital payment platforms, expected to accelerate over the next several years, stress put on finance teams will not abate. Particularly as they struggle to reconcile transactions across an array of software. For example, many companies use Google Forms, Slack, and email for spending requests and approval. Then there are the software services that provide for receipt collections, like Expensify, Wave, Shoeboxed, or Smart Receipt.

The disorganized approach to spend management is a widespread practice. According to Accenture: “Most companies fail to manage their indirect spend professionally.” Accenture’s benchmarking shows that the average company effectively manages 50% of spend compared to 90% or more for best practice organizations. For many companies, this deficit is the result of rapid growth where infrastructure is quickly patched together to solve separate problems, like receipt capture, or payment execution.

It takes a little effort upfront to pull together a full spend management plan and implement the changes but, once it’s done, an organization will have improved its operational efficiency and productivity considerably. To begin, it is helpful to evaluate how your company engages in each stage of the process so that they can be incorporated in a single unified solution.

Best practice spend management:

Conclusion: Thinking holistically about spend management.

Most finance teams know intuitively that there is waste in the way that their companies spend money: waste that they could, with better spend controls and real-time visibility, curtail or eliminate altogether. Their jobs are made difficult without time-critical information, especially with scores of decentralized transactions being executed at any given time. Beyond this waste, the fragmentation associated with the various workflows makes effective oversight difficult. It is time to think more broadly about holistic spend management so that siloed solutions do not create greater friction and frustration for your company.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana