Definitive Guide to Spend Management for Early-Enterprise/IPO Companies.

A sophisticated spend management system that wastes no spend and delivers you audit-ready.

You haven’t arrived here without serious planning and a successful strategy. While often cobbled-together systems and tools have bolstered your growth thus far, an emerging focus on compliance now requires a new command of your processes. Being audit-ready and able to withstand the due diligence associated with a potential public offering are now primary focuses.

This guide details how spend management provides the operational and accounting efficiency you need to manage risks associated with payments and ensure compliance.

01

Defining early-enterprise and IPO companies.

Graduating from mid-market with lessons learned.

A monumental stage for any company, going public is now on your horizon. Becoming IPO-ready requires impermeable focus and preparation. Alongside readying three years of audited financials, a heightened urgency exists around risk management and efficient processes.

Whether you’ve arrived at this stage moving at warp speed as a hypergrowth company or over a decade or two of slower growth, the legacy systems and processes you’ve built up simply won’t withstand the demands of this next level. If you haven’t already migrated to an ERP, that typically year-long undertaking will be a top priority.

Heavyweight systems can slow your growth.

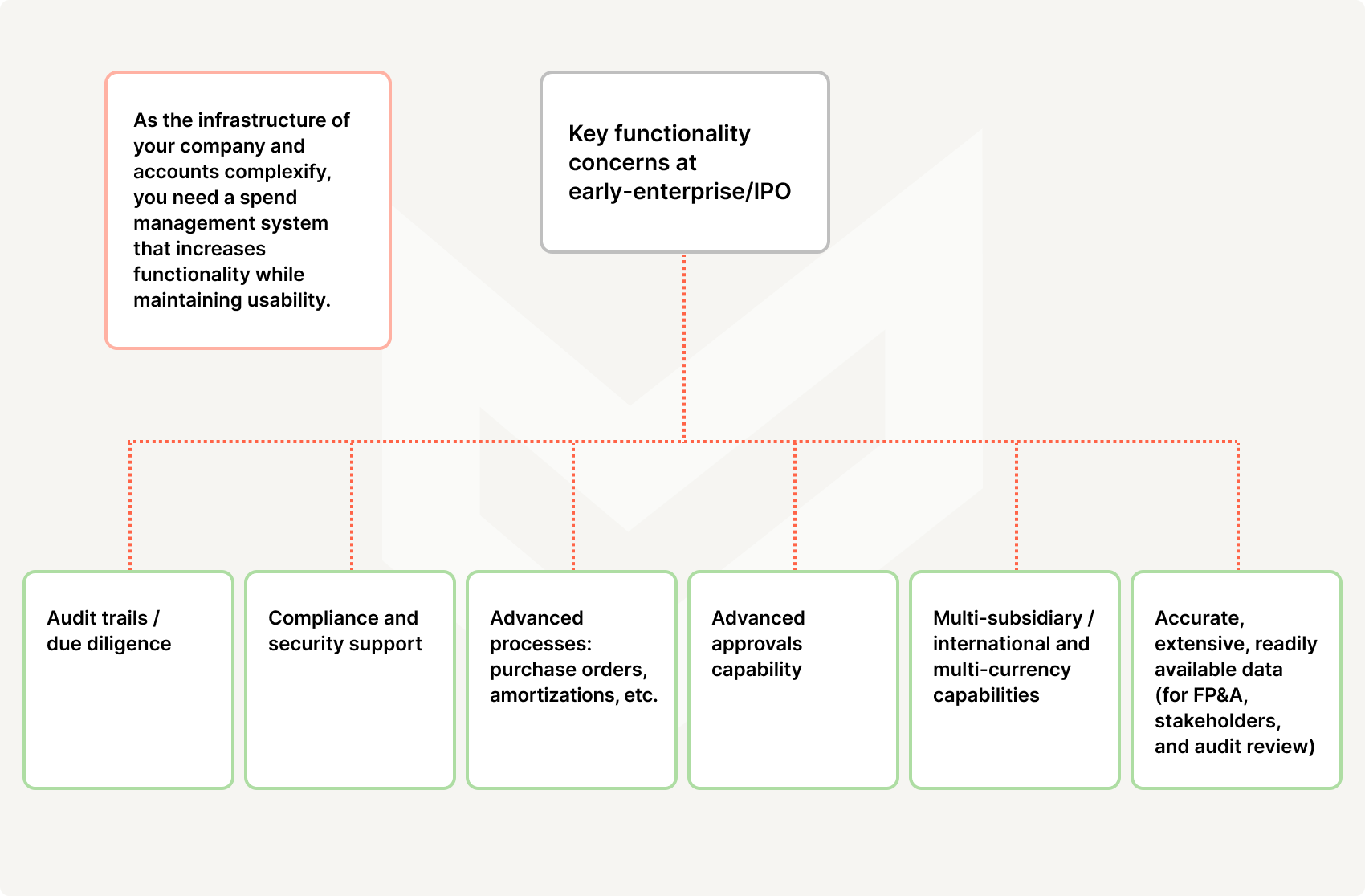

When it comes to managing non-payroll spend, you may be considering an enterprise-level spend management solution. However, it’s also important for a company at this stage to avoid software that is over-engineered and unnecessarily cumbersome. Staying agile is still important — lightweight systems are faster to implement and easier to use.

Compliance, procurement processes, amortization, advanced approvals, multi-subsidiary growth, and international expansion are all increasingly important areas in your organization. The right comprehensive spend management platform can handle all of your needs without becoming overly complexified.

The finance team needs the data coming from your product, your finance stack, your banking information, all of your vendors, every one of your customers, everything that touches any part of your company, to make better business decisions quicker.

— Scott Clark, VC Firm CFO, Investor, Advisor

02

Your biggest financial concerns as an early-enterprise/IPO business.

Identifying priority concerns is a key action in the financial success of any business. While there will be wide variation from business to business, in general early-enterprise companies will be concerned with some or all of the following.

Operational challenges:

1. ERP integration issues.

As operations and accounting complexify, you’ll need to make sure that your systems communicate with each other. Your transaction software must not only sync data seamlessly, but also interact with other tools within your ERP.

2. Spend visibility.

There are now more people, perhaps internationally dispersed, spending more money within your company. Maintaining visibility at all times, and in real time, is important to manage growing risks.

3. Switching from macro-level budgeting to departmental.

Handing spending responsibility to departmental management and singular employees is necessary, but needs effective oversight.

4. Complex company structure.

Naturally, your company is becoming more complicated, with management structures expanding and potential new entities being established. Your systems will have to address both.

5. Access to clean, easy-to-retrieve data and analytics.

You simply don’t have time to generate one-off specialist reporting. Your analytics operations and the ways you use data are evolving, so you need access to clean, real-time data for an increasing number of purposes.

6. Reporting for analysis and audit purposes.

Compliance and the associated processes are more important than ever. Having the easily retrievable, necessary documentation for your audits will save hours of manual effort to track it down.

7. Scaling operational processes and systems internationally and across multiple legal entities.

The framework for risk management and controls must be extendable to the various legal entities that your company now has.

8. Consistent processes to ease onboarding and eliminate confusion.

Adopting consistent processes and workflows company-wide can reduce friction and improve moral.

Policy and process challenges:

1. Efficiencies needed to support large organizations.

Maintaining the most efficient operations possible in a large organization requires automation. Any remaining manual tasks should be automated at this stage.

2. Controlled/auditable process around procurement.

As volumes increase, so too can risk. Automating spend controls and creating a full audit trail of compliance are both necessary.

3. Implementation of planning tools that work with spend tools.

As FP&A increases, pulling the right data and real-time insights from your systems becomes increasingly valuable.

4. Speed of time-to-close needs to be as efficient as possible.

All operations are accelerating and increasing in scale. Therefore, staying on top of protocol and an efficient close is more important.

5. Reducing wasted spend.

With spending taking place across a growing company, visibility can be obscured which leads to wasted spend. Whether this is unnecessary, duplicative, unwanted, fraud, or zombie spend, it is important to control for these risks.

6. IPO readiness.

If you have IPO aspirations, everything your finance and accounting teams do will have that focus in mind. Closing gaps, smoothing bumps, and consolidation help prepare a company for this step.

7. Morale issues.

The journey to IPO requires hard work, dedication, and fast-paced deliverables from across the company. Ensuring your employees feel adequately resourced and supported is imperative to the success of your company.

8. Documenting that processes/policies are being followed.

Evidence of compliance must be accessible and adequately prepared for the audits that your company now faces regularly.

When I think about growth, it’s all about being able to pull the data that we need from our systems.

— Katie Slattery, Corporate Controller at Fivetran

03

The power of spend management as a solution.

Automation, automation, automation.

It’s not possible to control for risks and process the payments for the swell of transaction volumes you now have without either a large team of people or automated systems. Spend management is not simply a matter of automating the accounting workflows, it also automates the approval workflows, and generates an audit trail. Automation also eliminates the human errors inherent in manual work.

Razor-sharp precision and transparency with enterprise spend management.

Your accounting and finance concerns now become more high-stake than ever before. The technology and financial services that you employ at this stage need to be sophisticated, with laser-precision functionality. Easy access to clean, current data is important for not only your growing FP&A team but also the line managers with budgets to control.

Visibility, automated workflows, and spend control in every transaction.

Finance and accounting teams must now ensure that every transaction is controlled, even when that transaction is initiated on the other side of the globe. Teams and individual employees must be able to move quickly, with clarity about spend policies and vendor management. Everyone is better off with more time for strategic initiatives instead of manual processes and integrated spend controls.

It was designed to grow with you.

A spend management platform is a consolidated solution to the micro and macro-financial concerns of your company.

Spend management can become the golden thread that runs through your finance operations at every stage, as a scalable resource that grows with you.

An all-in-one product:

1. Multi-subsidiary and multi-national capabilities.

From carrying out multi-currency payments to facilitating the amortization of non-USD, your spend management system is with you as you grow.

2. Advanced approval processes.

Automatically send approvals to the appropriate department, and group multiple approvers together depending on the type of spend. Every transaction can have a different approval workflow, based on your spend policy.

3. Advanced reimbursement intelligence.

OCR technology speeds up personal expense submission, advanced reimbursement approval workflows, reimbursement summaries for Slack, and more.

4. Mileage reimbursements.

Automatic calculations of mileage reimbursements streamlines a dreaded process for employees.

5. Enhanced user interface and usability.

Reports can be readily pulled to capture all non-payroll spend on an up-to-the-minute basis. Access to spending is available to all stakeholders who wish to track actual spending by individual or by department.

6. Mobile app support for reimbursements.

Employees can link their bank account to the mobile app to speed up reimbursement payments.

7. Reporting capabilities.

Reports can be readily pulled to capture all non-payroll spend on an up-to-the-minute basis. Access to spending is available to all stakeholders who wish to track actual spending by individual or by department.

8. Vendor enhancements for 1099s and W-9s.

Vendors can upload W-9s directly via a vendor portal. The system will prepare a year-end report of 1099 reporting data.

9. SOC 1 and SOC 2 compliance.

Ensuring you choose a spend management system that is SOC 1 and SOC 2 compliant is vital at this stage.

Your accounting operations automated:

1. In-transit payments shown in aging reports.

Assisting in the planning and analysis your teams carry out, these automated projections can give fast, real-time insights.

2. In-progress ledger entries shown on the ledger.

Capture everything that happens as it happens. Even view in-progress GL entries.

3. Accrual projections with filters.

Assisting in the planning and analysis your teams carry out, these automated projections can give fast, real-time insights.

4. QuickBooks and NetSuite deep integrations.

QuickBooks Desktop integration, NetSuite native amortization — the list goes on.

5. Sophisticated HRIS integration.

Integrations with systems such as Rippling, as well as a general awareness of the need for robust HRIS integrations, means your spend management system works for your people.

6. Advanced user management from Okta.

Alongside sophisticated SSO settings, advanced settings and control can also be set surrounding who has access to your system — internally and externally.

7. Multiple ledger support.

POs and card transactions are annotated with ledger numbers so that managing multiple ledgers doesn’t mean more manual labor.

8. Comprehensive PO automation.

With comments enabled on POs, integrated PO workflows, accrual projections, PO editing enabled, and more.

9. Workflows and processes to support centralized spending.

The presence of RFPs, vendor management, and procurement processes are increasingly important and require a comprehensive system.

10. Auditable processes.

Every transaction caught in real time — your software system is the audit trail you now need, right since the beginning.

11. Usable and functional across every area of your company.

Spend management systems arm your finance teams for hypergrowth, but management and employees across the board can also access the system that records and enables policy aligned spending and reimbursements.

12. Invoice inbox.

Keeping records correctly filed from start to finish, auto-categorizing them, and scheduling payments where necessary.

If your systems aren’t ready, you’re not going public because you won’t be able to sleep at night. Nobody is going public with Excel as their system of record.

— Alan Black, Founder at Surfspray Capital

04

Useful questions to ask in the runup to the IPO podium.

Standing taller than ever before, let’s take a step back — questions to realign your relationship with spend management.

Spend management removes the burden of many routine, low-value tasks from your finance and accounting teams, freeing up time to pursue more important initiatives. In the flurry of preparing for IPO and maturing to an early-enterprise company, sometimes the most important foundational questions can get lost in the mix. We’ve compiled some questions your finance teams can ask as they enter early-enterprise territory.

1. Platform capabilities:

Does our system consolidate several point solutions into one?

Eliminating unnecessary aspects of your tech stack will help drive much needed efficiency. Combining all non-payroll spend into a single platform means that three or four point solutions for approvals, expenses, bill payments, and corporate cards can be consolidated into one system.

Does our system support expanding budget and analysis operations?

Real-time data, adjustable spend budgets, readily available interim reports, and comprehensive reporting across all payment types mean your teams and stakeholders can access the relevant data as they need it.

2. Depth of features:

Do we need a separate system for things like mileage reimbursements and per diem spending?

Airbase has developed features to facilitate travel and mileage reimbursements where relevant, so that reimbursing employees remains uncomplicated.

Does our system support expanding into new countries or developing subsidiaries?

Airbase supports payments in 145 currencies at a fraction of the cost of other foreign currency payment choices and offers amortization of non-USD. With multi-subsidiary and multi-national capabilities, Airbase is not just for the here-and-now.

As our operations expand, our centralized spending has expanded too. How is this catered for by spend management systems?

Airbase has carefully focused on expanding advanced vendor features so that procurement processes and vendor management functions are detailed and flexible. At early-enterprise stage, the presence of RFPs, vendor management, and procurement processes are increasingly important and require a comprehensive system, such as Airbase.

As our purchase order and invoice inventory is complexifying, how can we rely on our spend management system to respond?

Airbase has extensive purchase order functionality which handles increased volume with ease. POs can be numbered in correspondence with the GL they’re linked to (if you have more than one), auto-categorized, commented on, requested by employees directly, and so on.

At enterprise-level stage, we need insight into every transaction, including those that are pending. Does Airbase provide this?

In-transit payments are shown in aging and archived reports on your Airbase platform. In-progress ledger entries are also visible, making sure no transaction is ever missed.

3. Flexibility:

As management teams and departments grow, how can the right people control the right spend?

Airbase allows management to set criteria allowing employees to spend where necessary, accelerating operations while keeping control of transactions. Executives can use delegated access so their staff can manage their expenses. Approvers and approval settings are customizable by multi-tier management. You can also set observers who need to be kept in the loop on spending.

Do we have to implement the full spend management system at once or can we do so in parts?

Airbase’s modular platform means that you can implement it in parts (bill payments, corporate cards, expense reimbursements) to fit your operational needs and onboarding capacity.

4. Integrations:

Do Sage Intacct and Oracle NetSuite integrations operate with enough depth to support enterprise spend management?

Airbase continues to develop the already deep integrations we have with NetSuite and Sage Intacct. NetSuite native amortization and other integration features can support you at enterprise-level.

We have a more complexified HRIS system than ever before. Can Airbase integrate with our HR systems?

Airbase integrates with systems such as Rippling, and is hyperaware of the need for robust HRIS integration, so your Airbase platform works for your people as well as your processes. Automatic provisioning and deprovisioning as employees join or leave the organization keeps your spend management system current.

Will the single sign-on login remain secure as the volume of those accessing our system expands?

Airbase integrates with Okta and has SAML Identity Provider support. Alongside sophisticated SSO software, advanced settings and controls can also be applied regarding who accesses your system — internally and externally.

5. Scalability:

How will Airbase help us remain audit-ready and inform our budget and analysis teams?

With accrual projection filters, real-time reporting, customizable budgeting filters, and interim reports that capture real-time data, Airbase has an extensive inventory of features to keep you audit-ready and data-informed.

Is our system helping us to get audit-ready?

Airbase forms an audit trail of each transaction from approvals, to invoices/receipts, to booking so that documentation is filed at the transaction level. The system has a sophisticated invoice inbox that parses emails, finding relevant correspondence with and about vendors and pulling relevant information snippets into the file. Its vendor portal allows for easy uploading of W-9s.

6. User experience:

How does our user interface remain effortless as we expand our employee count?

Airbase offers single sign-on, a mobile app where employees can link their bank account for reimbursements, notification controls, easy receipt submission using OCR technology, and purchase/PO workflows and requests. It’s designed for your people and teams, at any size.

As we grow in complexity, will my spend management platform too?

Airbase has an ambitious and reliable roadmap for new features that we will happily share with you so that you can judge for yourself if your organization and ours are moving toward the same direction.

05

The Definitive Guide to Spend Management.

Read our guide for more information on spend management and how to evaluate its benefits.

Jira

Jira  Ironclad

Ironclad  Asana

Asana