Virtual cards are a game-changer for accounts payable departments. They’re an efficient solution for any business looking to streamline their expense management and procurement processes.

In addition to greater control, security, and flexibility, virtual card payments can save finance teams hours of tedious work. David Coffman, VP Finance at Doximity, says Airbase virtual cards play an integral role in cutting the company’s time-to-close in half.

Let’s take a deep dive into the many benefits of virtual card payments.

What are virtual cards?

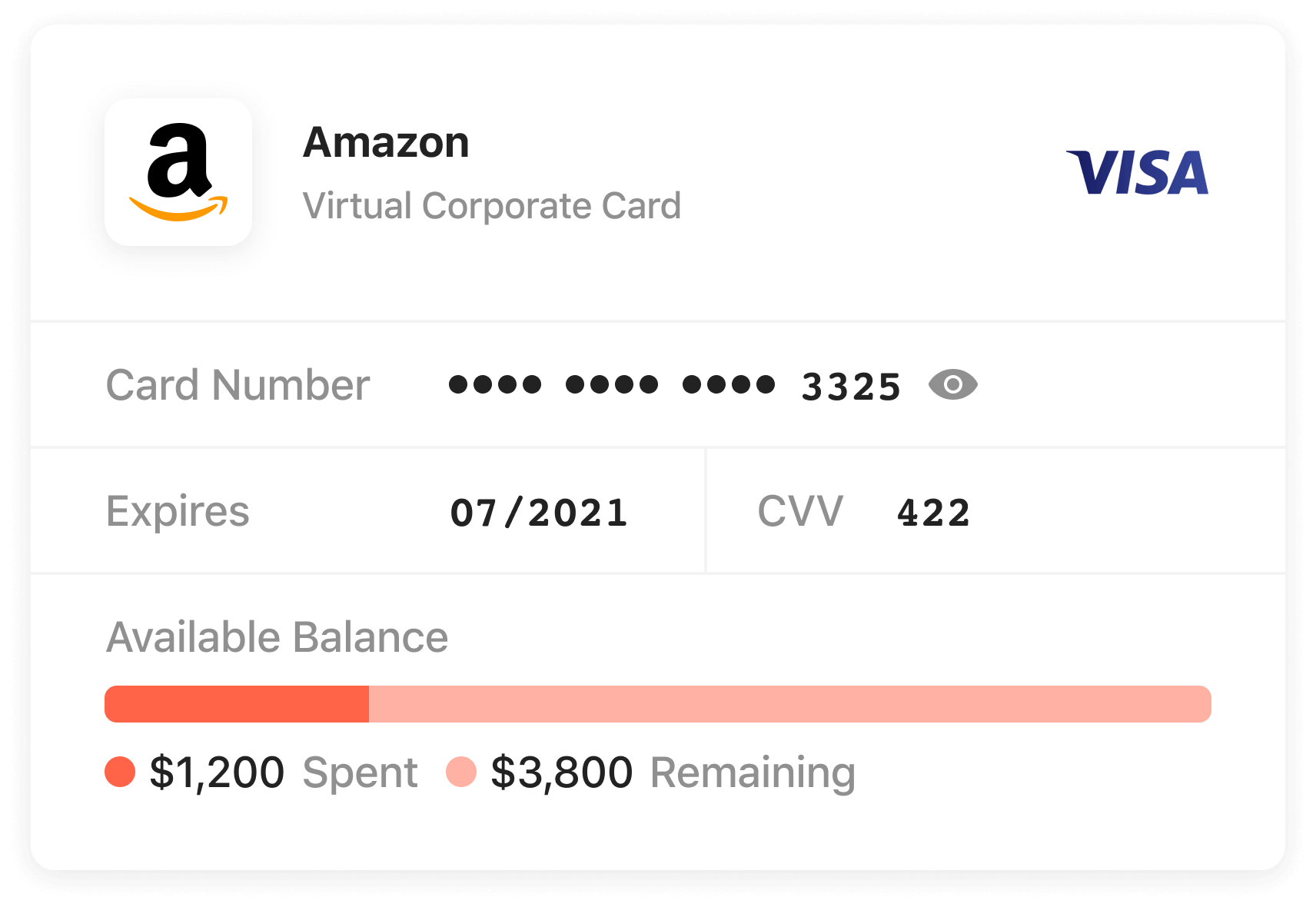

In simple terms, a virtual card is an automatically generated card number that can be used online anywhere that credit cards are accepted — think of it as a virtual terminal. Card payments are made right at the point of sale by entering the number, just like tapping a physical card at a payment terminal.

But when a virtual card payment program is backed by powerful software and accounting automation, the advantages extend far beyond the ease of online purchasing.

How do virtual card payments work?

Making a virtual card payment is a simple process: an employee enters the relevant card details and the payment is processed. But the software behind the transaction creates the magic, and in Airbase, it comes down to the workflows.

When an employee needs a virtual card, the card request is routed through a configurable approval workflow before the money is spent. Approving all card details, including dollar amounts and timeframes in advance means it’s easier to track ownership of employee spending and ensure all stakeholders are aware of an expense before it even happens.

Enforcing spending limits proactively sets clear policies for employees and minimizes surprises for the AP team when the card statements arrive. But, the levers of control can also be adjusted to allow for budget cuts or new opportunities.

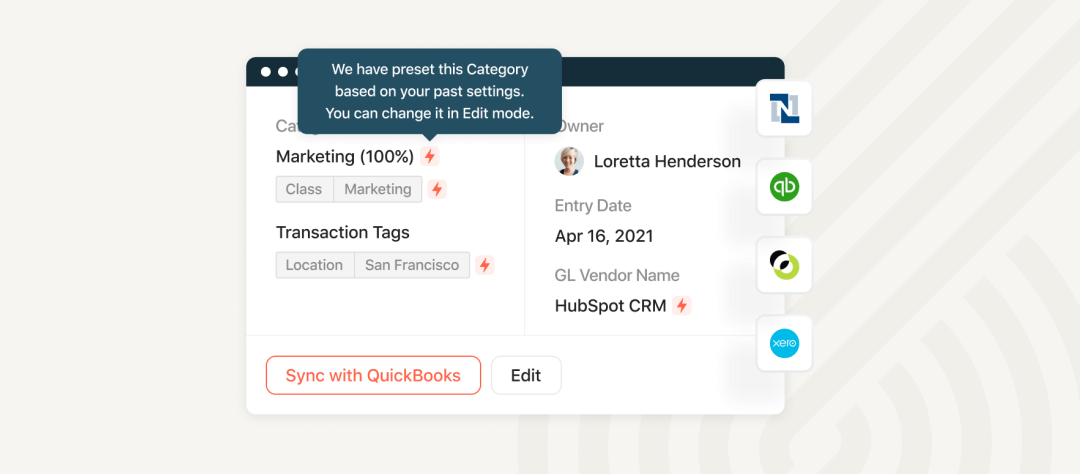

Virtual card payments sync to the GL, eliminating time-consuming reconciliations and ensuring an up-to-date view of financial status at any time. Auto-categorization removes the guesswork for employees and enables a smooth GL sync.

Virtual card payments can also be made offline, just like physical cards, through digital wallets. Just add your card to Google Pay or Apple Pay.

Cards Tour

Explore the benefits of software-enabled virtual cards in Airbase with an interactive tour.

The 7 major benefits of making virtual card payments.

The right virtual card program can save an accounts payable team hours of work every month. Here are some of the main benefits.

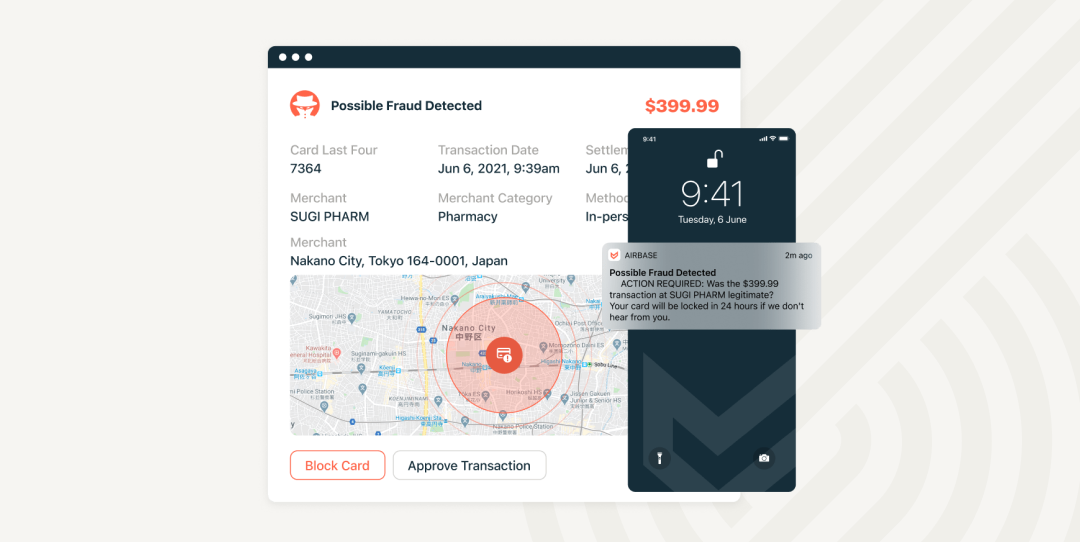

1. Improved payment security.

Virtual cards have built-in fraud protection measures. Because they can be specific to one vendor, they’re useless outside of the intended transaction. And as an added bonus, in the unlikely event of a compromise, the finance department doesn’t have to change the payment details for all recurring payments.

2. Increased visibility.

The transparency created by the request and approval process plays a crucial role in monitoring spend and preventing errors that could slow down the month-end close.

Virtual cards also create an automatic audit trail. Because card expenses flow directly into the GL, you have a clear and accurate insight into your business’s financial health at any time.

3. Enhanced cost savings.

The clear visibility of virtual card transactions also leads to cost savings. Automated controls actively monitor for duplicate charges and recurring subscriptions, with the added feature of alerting users about subscription expirations to prevent unwelcome auto-renewals. Furthermore, their association with specific employees simplifies the process for the finance department to swiftly halt charges linked to departing employees, effectively ending the risk of lingering “zombie spend.”

4. Streamlined reconciliation process.

Although reconciliation is a tedious and time-consuming task, Airbase’s survey of finance professionals found that 36% of respondents still manually reconcile credit card statements. With virtual cards, reconciliation takes place in real time, since transactions book to the GL as they take place.

5. Earn cash back.

Paying by virtual card earns cash back. Although this concept isn’t unique to virtual cards, when a card program is on the same platform as accounts payable, AP teams can pay by virtual card, effectively monetizing AP. Airbase even alerts you to vendors who accept virtual payments so you can move payments made by ACH or check to cards.

6. Improved vendor relationships.

A virtual card payment program is more efficient than paying by traditional methods like check or ACH, which reduces the risk of late or skipped payments. That in turn can improve vendor relations.

7. Reduce inaccuracies.

Virtual cards can play a crucial role in monitoring spend and preventing errors that could slow the month-end close. In addition to eliminating data entry reconciliation errors, the request and approval workflows establish categories and tags at the onset of a request, so managers can review and correct if necessary before the purchase.

How virtual cards are revamping legacy AP departments.

The impact virtual cards have on AP departments is far-reaching. Let’s take a look at how virtual cards fit into AP systems and the results.

Improved working capital.

The ability to set adjustable spending limits on virtual cards and closely monitor spending helps prevent unnecessary or unauthorized spending, which preserves working capital for essential operational needs.

Virtual cards also give precise control over when and how payments are made. This helps manage cash flows by delaying virtual payments until they are due while ensuring vendors are paid on time, optimizing the cash conversion cycle.

Reduced manual processing.

By automating the creation of virtual cards and the virtual card payment program, you can eliminate manual tasks like cutting checks, matching invoices, and data entry.

Employees feel empowered.

The speed and ease of virtual card creation helps employees take accountability for their spending. They no longer have to worry about deciphering confusing policies and approval chains since the system moves their request to the right people.

Diana Ngo, Senior Director of Finance at YourMechanic, explains the impact:

“I hear conversations about spend all the time now. Airbase makes it easy for people to hold themselves accountable for their spending. It’s not just that people are more responsible with money, it’s that they’re more independent.”

When automated processes take over manual work like reconciling card statements, the finance team is empowered to play a more strategic role in their company’s success.

Use virtual cards to generate cost savings.

Airbase’s virtual cards are a powerful tool for generating cash savings. Incorporating virtual card payments into your financial operations can lead to substantial cost savings, which provide greater control over spending and better security. The result is a more efficient and financially responsible business.

Schedule a demo

Ready for a closer look at automating your card spend?

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana