Expanding business operations across the country and around the world was once the realm of large, established companies. But, globalization has increasingly become something that impacts even small and mid-market businesses. The trend has accelerated with the shift to remote work and has been enabled by new software tools that make hiring and paying people around the globe easier. As a result, more SMB and mid-market companies now see the strategic advantage of setting up subsidiaries, both domestically and globally, even if they are not selling products or services in the region. Airbase CFO, Aneal Vallurupalli, recently joined two of his former Mattermost colleagues, VP Finance Tim Quock and Head of Legal Jamie Hurewitz, to talk about the reasons for setting up subsidiaries and the factors that lead to success.

Creating a risk mitigation framework.

All three agree that there is no set tipping point or chain of events that indicates it’s time to think about setting up multiple entities. Instead, the decision is best approached from a risk mitigation standpoint and, therefore, it’s essential to first establish your company’s risk tolerance as part of an overall risk framework. Once that risk framework is agreed upon, it can serve as a guide for the many decisions that follow.

The key to building the framework is to understand the purpose for establishing a legal entity; e.g. tax, employment, to house IP, etc. Historically, entities were considered to be a sales strategy tool if a business felt that a certain country had potential for revenue generation. Recently, however, the decision to set up an entity in a country is likely to be driven by the number of employees in that country. Ultimately, the risks of a subsidiary are unique to each country, so each one should be assessed against a company’s risk framework. It’s helpful to rank the risks in your framework so that (typically scarce) resources are allocated efficiently.

Identify the types of risk.

In the end, a company’s risk threshold shapes the appropriate action. For example, some companies are comfortable with only a very small number of independent contractors outside their jurisdiction, while others are more willing to accept the risk of a misclassification action, which can lead to retrospective tax liability for each misclassified employee. Knowing where your company stands on this will help with decision-making on the number and locations for hiring, and then on the tipping point for establishing a legal entity.

Tax exposure is a top consideration for many companies. When sales get to the point that a country faces permanent establishment issues with corporate tax implications, it may be time to set up an entity. Permanent establishment is determined when a company’s business activities reach a threshold at which they have tax liability in a particular jurisdiction.

Assess the costs.

In addition to measuring the risks, it is important to keep the costs of a subsidiary in mind. The ongoing expense of maintaining a legal entity are not trivial, and the cost (including internal and external experts) of unwinding or shutting down a legal entity can be significant. A risk framework should also include the costs to the company of getting it wrong and having to close down a subsidiary.

Form a working group.

To ensure everyone is aligned on the risk mitigation framework — that they are bought in on the costs of a subsidiary, and that they understand the steps going forward — form a broad working group, including the management, HR, and legal teams. Finance and accounting teams will help decide whether or not to outsource accounting for the entity and how to deal with audits.

Be prepared for the unexpected.

It’s not uncommon to run into unforeseen nuances, so it’s difficult to put a timeline on how long it takes to set up a subsidiary. It’s also very dependent on location, since requirements vary so much by jurisdiction. Some countries may, for example, require an office space or a particular type of bank account, or insist on having a local board member.

Use the right tech stack.

Setting up accounting in multiple locations is often a tough hurdle. One of the most important things to avoid problems down the road is to ensure that the general ledger is robust enough to support both primary and statutory books. For example, NetSuite’s inter-company modules, automated localization functionality, and advanced simulations can save a lot of time. Without features like these, the finance team could spend many hours working with spreadsheets and fixing errors. It’s generally better to manage all entities from one ERP, and any concerns about anonymity can be reduced by thoughtful role-provisioning and access rights within the ERP.

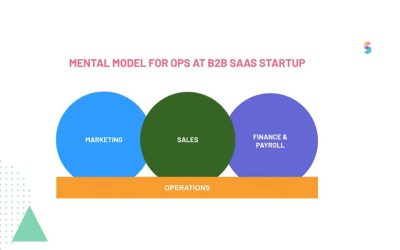

In addition to an ERP that supports multi-subsidiary and multi-currency activities, the rest of a company’s tech stack should also be capable of doing so. Many HRIS systems can handle global payroll, and accounts receivable systems are increasingly able to send multi-currency invoices to customers. On the accounts payable side, the problem can be far more complex. The only spend management platforms that handle multi-currency, multi-subsidiary transactions for global payments are Coupa, for enterprise-level companies, and Airbase, for small to mid and upper mid-market companies. A spend management platform is a full accounts payable solution with corporate cards, bill payments, and employee expense reimbursements managed through one system to capture all non-payroll spend.

Find the right service providers.

In terms of the service providers in different jurisdictions, consider a banking institution with a long reach and a wide partnership network. Using a local bookkeeper is often a good decision, as they will be familiar with local laws and regulations, and will be able to read any documents if there is a language difference.

The ability to manage global teams without placing undue burden on operations and finance requires careful consideration and set-up. A risk mitigation framework will help point your company in the right direction for whether and when to establish a new legal entity. Once that decision is made, having the right tech stack to support multi-currency and multi-subsidiaries will avoid costly accounting and operational friction. Find out how Airbase supports multi-subsidiaries by giving workers around the world the ability to spend money when they need it, while still giving finance teams the visibility and control over spend no matter where it takes place.

Watch now: webinar on setting up subsidiaries.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana