Everyone needs a credit card in the subscription economy. The problem is finance teams can’t give credit cards to everyone—the control risks are too high.

Traditional spend controls—like limiting the number of people who have cards or establishing toothless T&E policies—end up slowing employee productivity. Modern finance teams have to implement controls that balance ease of use with enough rigor to make sure that dollars don’t go to waste.

In this article, we dig into the out-of-date spend control tactics companies currently use and show you how you can replace them with next-level spend management from Airbase.

Outdated tactic #1: Limit the number of people who have company cards.

Corporate cards worked when you could hand out a card and trust that only one person would use it. The VP of sales travelling to a customer conference, for example.

The problem is that cards are also the most convenient way for employees to make quick purchases or pay for an online subscription. Limiting the number of people who have cards ends up working against spend control when a department head shares her card details or IT uses a corporate card as a catch-all for all online expenses.

The new way: Use vendor-specific virtual cards.

Finance teams can use Airbase to solve this problem by having employees create spend requests and generating a unique virtual card for every online expense. Employees get the ease of use of a credit card while finance gets the ability to track transaction owners instantly instead of having to dig through credit card statements and playing detective each month.

Outdated tactic #2: Ask employees to follow a T&E policy and punish them when they violate it.

Creating a policy for when and how to use a corporate card is the easiest way to introduce control over card spend. Most rely on their employees to comply, or only check transactions over a certain dollar value.

T&E policies also force finance teams to take a reactive stance to violations. Finance ends up being the ‘keeper of the policy’ and this fosters a culture of oversight rather than ownership.

The new way: Use a pre-approval policy to issue virtual cards with built-in controls.

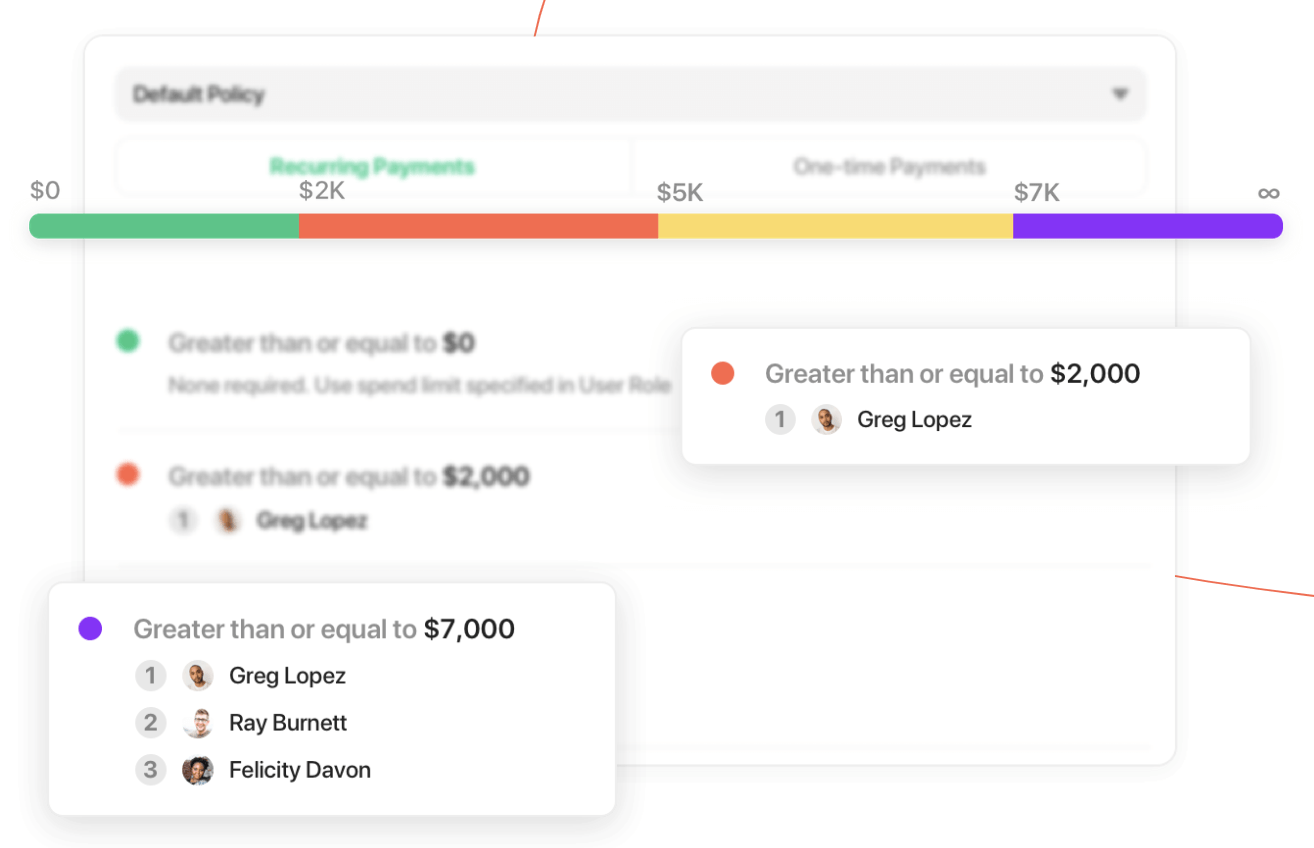

Pre-approval policies allow finance teams to be proactive with controls. All an employee needs to do is submit a spend request in Airbase and the system follows your preset approval settings to send the request to the employee’s manager and the finance team for approval. Once the request is approved, the employee receives an auto-generated virtual card that she can use to complete her purchase.

Having employees follow a spend pre-approval process creates a culture of accountability and gives the company a chance to review spend before it happens. Issuing vendor-specific cards for each request means air-tight control—finance teams can set spend limits on a card to match expected vendor charges and set notifications for declines or extra charges.

Outdated tactic #3: Constantly remind employees about overdue expense reports or missing receipts.

Every month employees have to recall and document what they purchased, organize receipts, and submit expense reports. And finance teams review those reports to update categorizations, follow up on errors, and reconcile expenses.

Tracking down vendors and collecting contracts, W-9s and 1099s, can also add hours or days to an audit timeline.

The new way: Employees upload contracts at the approval stage; vendors upload tax docs at the payment stage.

Airbase solves the reporting problem by having employees upload invoices and supporting documents when they first make the spend request. It’s easier to get employees to upload documents while they’re highly motivated to make the purchase rather than weeks after the transaction when they’re busy focusing on new tasks.

Employees using physical cards get a push notification prompting them to upload a receipt the minute they swipe an Airbase card. Employees that raise an online expense request, on the other hand, upload quotes and contracts as a part of the approval process so there’s zero dependency later on. And finance teams can invite vendors to upload invoices and tax documents directly via the Airbase Vendor Portal.

Outdated tactic #4: Manually track transaction owners in a spreadsheet.

When employees share a credit card, the monthly statement doesn’t indicate who owns each transaction on the card. The standard practice is to follow up with the cardholder, and ask “who made this transaction?” The follow-up is quick if the cardholder remembers which employee requested the purchase, otherwise you have to go out and ask the team.

Airbase data says that the average 100-200 person startup has 120 unique subscriptions. That’s a lot of apps and a lot of employees to track in a spreadsheet.

The new way: Use a pre-approval process to specify transaction owners at the approval stage.

Restrict physical cards to T&E expenses and generate virtual cards for online expenses. You can pull up the vendor list or virtual card list to see an up to date list of all of the services the company is currently using.

Look at the virtual card owner and the approval records to instantly see who originally purchased a service, the business reason for the purchase, and who approved it.

Outdated tactic #5: In the event of fraud, replace the compromised card and migrate payments onto a new card.

Fraud can be particularly time-consuming for businesses that place multiple subscriptions, including mission critical applications, onto a single card. In the case of suspected fraud, finance teams have to suspend the card and update the payment information everywhere the old card was being used, which can be painful if you also have to track down the account admin owners and logins for each service internally.

Diana Ngo, Senior Director of Finance at YourMechanic, told us that fraud became so common that the company always kept a second card from their card provider as a backup for purchasing to use when the primary card went down due to fraud. “We couldn’t jeopardize payments,” she says “in case the one we were using was flagged for fraud and blocked.”

The new way: Assign virtual cards with custom spend limits.

With Airbase, Diana was able to replace the bank-issued credit card and the backup card with virtual cards for every vendor. She placed custom spend and transaction limits on each card so that any charges that didn’t line up with what they were expecting didn’t go through.

By giving each vendor a unique virtual card and setting custom limits, finance teams can significantly minimize the damage if a card gets compromised. Replacing a single virtual card won’t affect other vendors or disrupt mission-critical subscriptions because all vendors have their own unique virtual cards.

Outdated tactic #6: Asking vendors for refunds on unexpected charges.

Unauthorized expenses such as unexpected auto-renewals or poorly messaged changes in pricing place companies in a tough position because they don’t discover the unauthorized transactions until after the charges occur. This puts the finance team in a disadvantaged negotiating position if they have to ask the vendor for a refund.

The new way: Eliminate unauthorized spend.

Finance teams can use Airbase to set spend limits so vendors can only charge up to the pre-set amount. They can also schedule cards to automatically lock at a particular date to prevent vendors from making additional charges such as an auto-renewal charge.

Amer Ali, Head of Strategic Finance and Business Operations at Netlify, tells us these features have reduced follow-up timelines by over 50%. “We had a situation where our monthly spend on an analytics tool doubled suddenly. We found out about it when the card was declined because we had set a limit just above the normal monthly spend. We got in touch with them the next day, removed the tracking, and were able to get back down to our original monthly spend in two weeks.”

Update your spend controls now.

When every dollar counts in a competitive SaaS market, finance teams need to make sure their spend controls don’t get in the way of employee productivity.

Smart companies are implementing spend control systems like Airbase to prevent unapproved spend, mitigate risk, reduce accounting work, and make purchasing easier for employees.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana