In a tumultuous economy, effective expense management is more important than ever. To maintain financial stability and drive strategic growth, organizations must optimize spending and have accurate financial data to inform decisions.

Effective expense management is often challenging due to the complexity and diversity of employee spending. With numerous cost categories, complex approval processes, and the need for accurate recordkeeping, it’s often difficult to maintain control and visibility over all spend. Plus, the rise of remote work and online purchasing have introduced new complexities. Compliance with tax regulations, internal policies, and complex tech stacks further complicate this task.

We’ve curated 12 up-to-date and actionable expense management tips to help you control costs while still helping employees fund the resources and activities they need. Let’s dive in!

What is expense management?

Expense management is the systematic control and oversight of a company’s spending. It involves monitoring, tracking, and approving business costs, such as travel expenses, office supplies, employee reimbursements, and more.

Effective expense management helps organizations streamline processes, reduce wasted spend, adhere to budgets, and gain an accurate view of their financial health.

When it comes to expense management vs spend management, generally speaking, expense management is one component of comprehensive spend management. Effective expense management plays an important role in the value of spend management, which is an entirely new approach to managing all non-payroll spend.

Expense Management Tour

Take a self-guided tour to see how managing expenses can be a breeze with Airbase.

12 best practices for expense management.

Here are 12 easily implemented best practices to help you strengthen expense management for 2024 and beyond.

1) Cloud-based expense management software.

Cloud-based expense management simplifies expense tracking and reporting because it allows real-time updates and access from anywhere with an internet connection. Plus, it offers automated processes to reduce the administrative burden of managing employee spending.

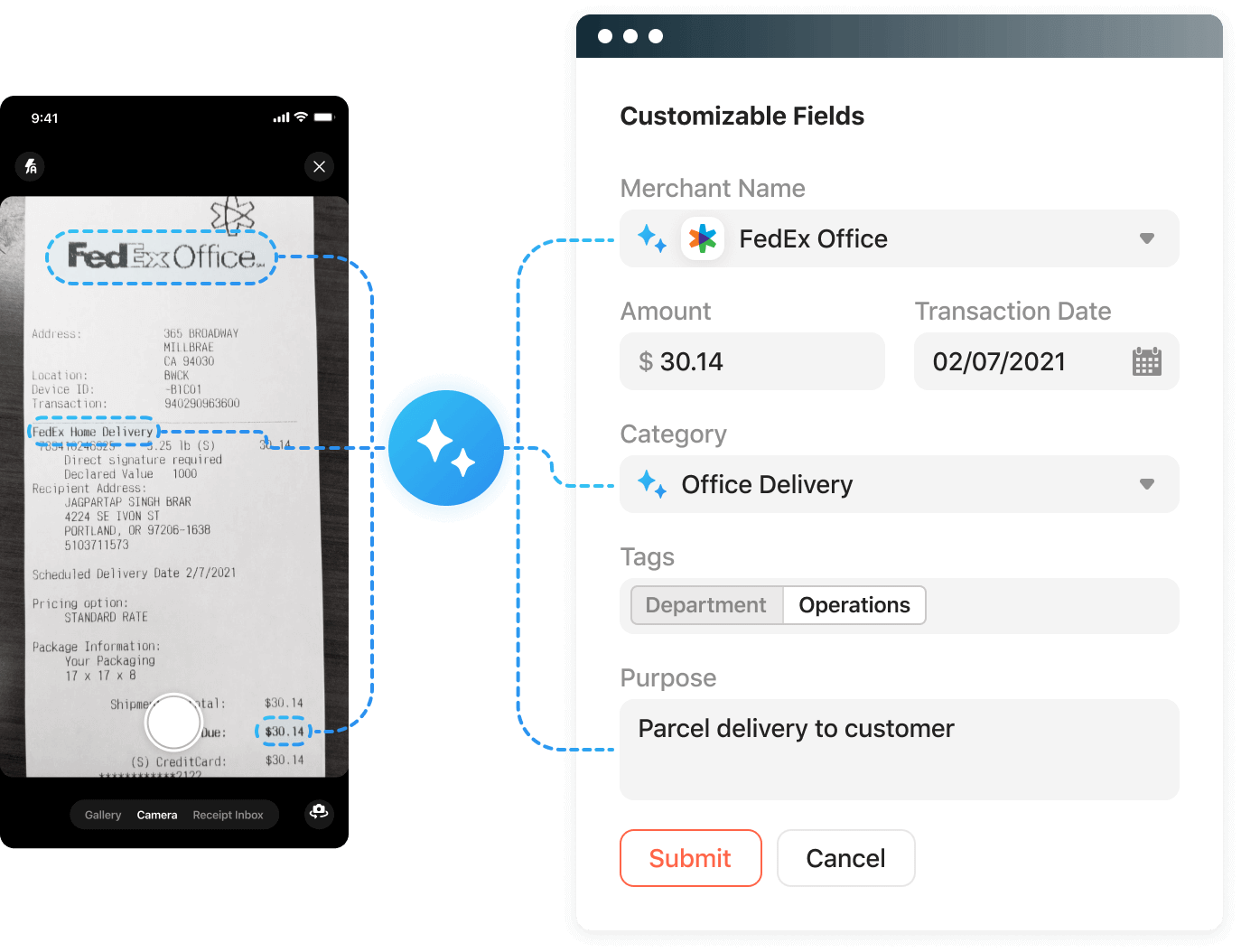

With Airbase’s mobile app, submitting an expense is as simple as taking a photo. Thanks to expense management automation, Airbase can extract the relevant details from the receipt using OCR technology to compile a complete expense report.

2) Expense policy development.

Creating an effective expense policy involves several key considerations:

- Policies should be clear and easily understood, with specific categories, spending limits, and approval procedures.

- They should align with the organization’s financial objectives and culture, while promoting accountability and compliance.

- Flexibility is crucial, so policies must allow for exceptions when necessary.

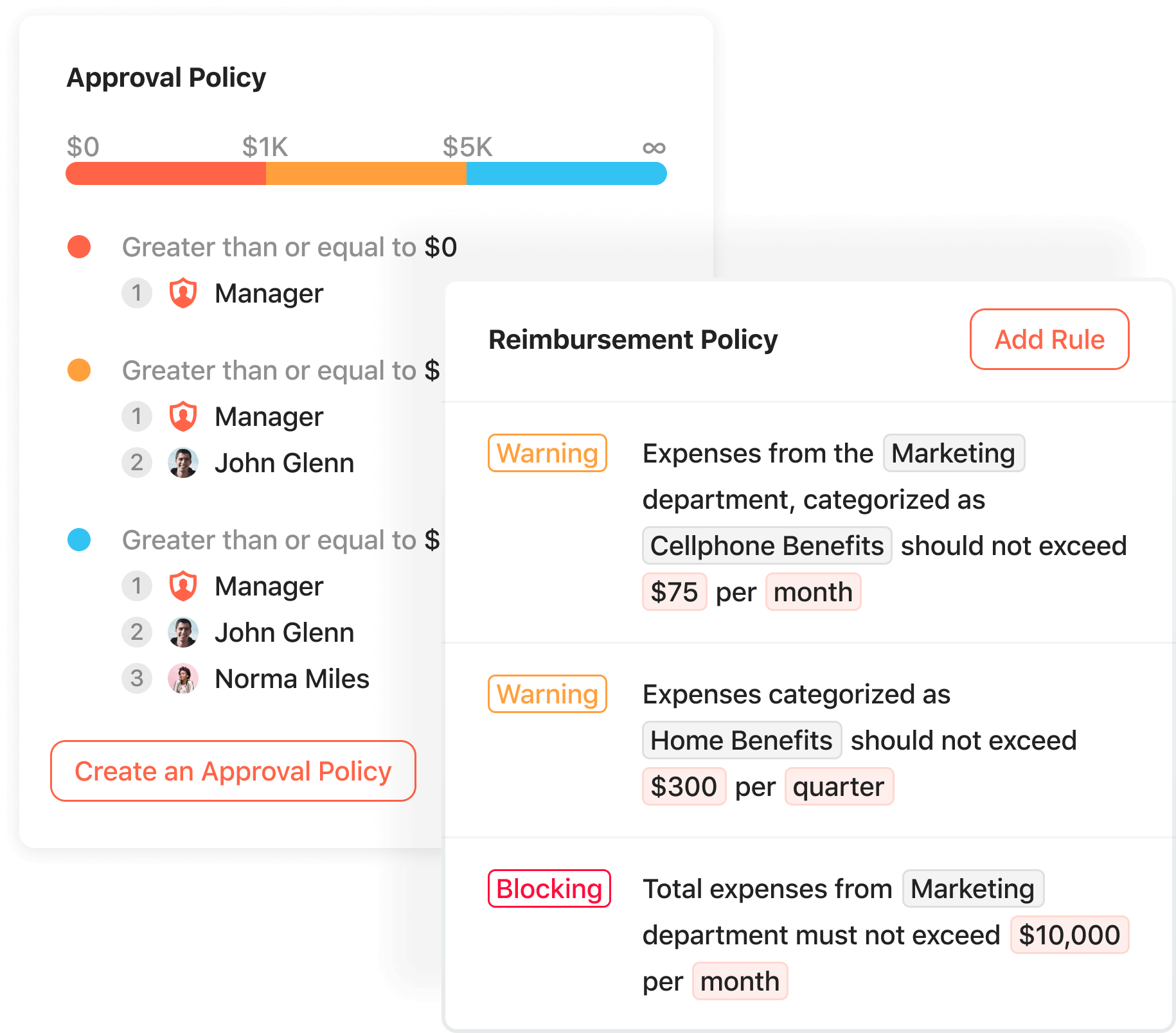

Airbase’s Expense Management module removes the burden of deciphering expense policies from employees. Automated workflows ensure an expense request is routed to the correct approvers, and requests are vetted before the money is spent. This also removes the burden on accounting to “police” expenses and eliminates awkward conversations about non-compliant spending.

Check out some examples of expense policy guidelines in our ebook.

3) Employee training on expense management.

Employee training on expense management is a vital component of fostering a financially responsible workforce. By encouraging a culture of accountability and transparency, well-structured training encourages employees to contribute to a company’s financial health.

Traditionally, complicated processes and systems were a barrier to effective employee training. A system that is intuitive makes it easy for them to follow the correct procedures. That was a central goal in Airbase’s design, and our excellent reviews for usability confirm we’ve succeeded. One G2 reviewer confessed:

“To be honest, I didn’t pay the closest attention to the Airbase training my company had. Miraculously, that’s how I knew how great Airbase was. Without training or lots of follow-up questions, I was easily able to navigate Airbase and quickly complete my task. User-friendly, smart, and simple.”

4) Automated expense report generation.

Automated expense report generation revolutionizes the traditional, time-consuming, and error-prone process of expense reports.

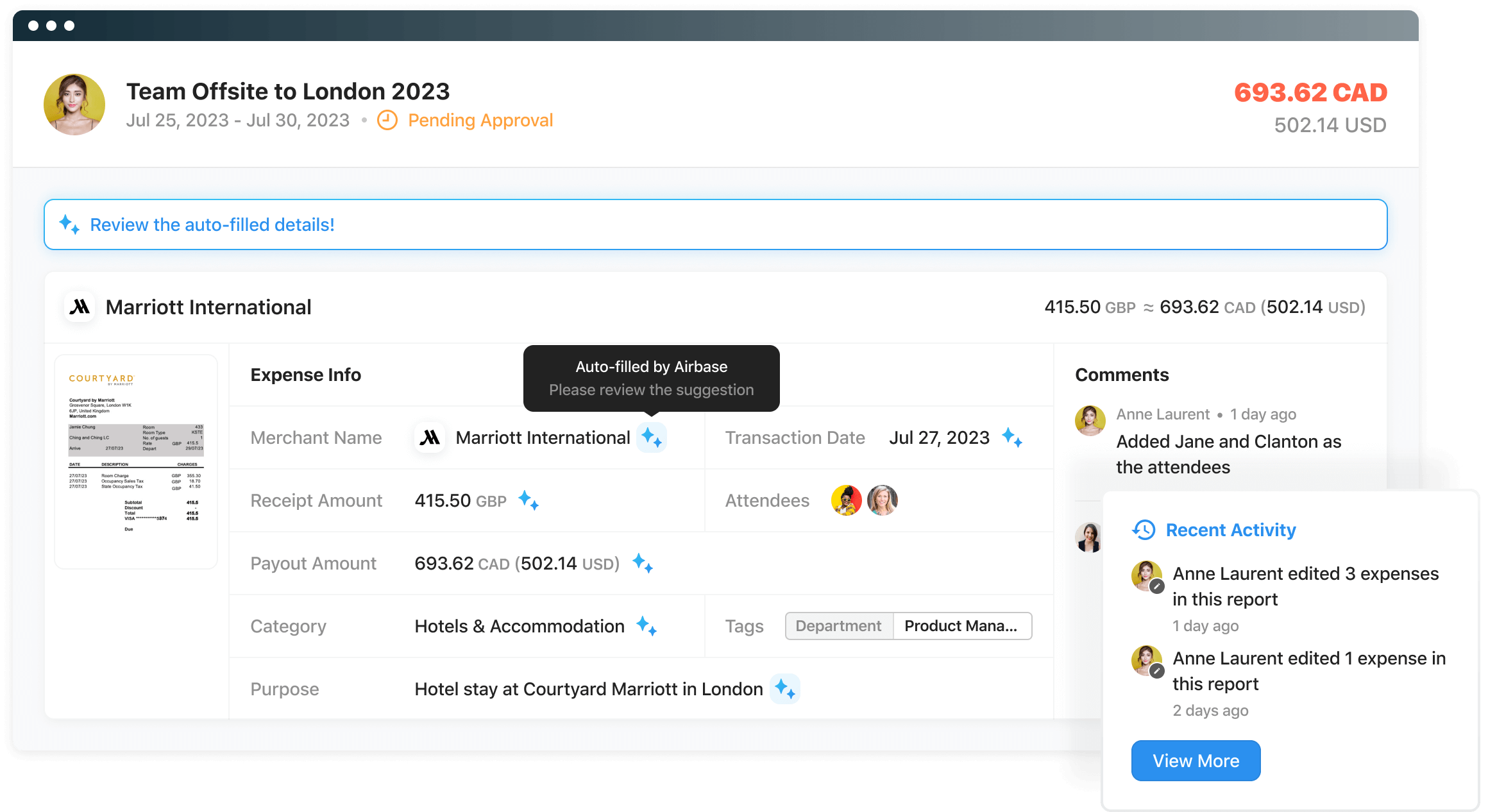

In Airbase, automated workflows and artificial intelligence (AI) and machine learning (ML) power the seamless and efficient creation of detailed expense reports. With smart algorithms, Airbase categorizes expenses, matches receipts, and calculates totals with remarkable accuracy. This not only saves valuable time but also minimizes the risk of human error, leading to more precise financial records.

An automatic sync to the GL creates a real-time overview of spending, so organizations can make informed decisions and swiftly identify cost-saving opportunities. In essence, automated expense report generation enhances productivity, accuracy, and decision-making within the realm of expense management.

5) Expense data analysis.

Expense report analysis is a critical component of managing business expenses, since it offers valuable insights into an organization’s spending patterns. By systematically reviewing expense reports, businesses can identify trends, exceptions, and areas for improvement.

6) T&E policy enforcement.

Travel and expense (T&E) policy enforcement plays a pivotal role in ensuring financial responsibility and compliance. This minimizes unauthorized or wasted spending and promotes fiscal responsibility.

Effective enforcement can be a complex task, however, without the right systems in place. With Airbase, the system enforces compliance with automated approval workflows. The end result is transparency and accountability, assuring all stakeholders that resources are being used efficiently and in accordance with company policies.

7) E-procurement tools.

E-procurement tools have revolutionized the way organizations manage their procurement processes, offering a wide range of functionalities for this traditionally complex process. These tools provide a centralized environment for the procurement lifecycle.

E-procurement platforms streamline the procurement workflow, automating repetitive tasks such as purchase orders and invoice processing. This automation reduces manual errors, enhances process efficiency, and accelerates decision-making. As a result, e-procurement tools are instrumental in transforming procurement from a traditionally manual and paperwork-intensive process into an efficient, cost-effective, and data-driven operation.

8) Policy review cycles.

Regular expense policy review updates are essential to ensure your financial guidelines align with your organization’s evolving goals and the dynamic business landscape. As markets change, new technologies emerge, and regulatory requirements shift, expense policies must adapt.

Airbase makes it easy to adjust workflows in response to changes on the ground. Plus, our no-code workflows make it easy to loop in additional stakeholders, or change who approves what.

9) Expense fraud detection.

Expense fraud detection is more important than ever as fraud is rising at an alarming rate. By leveraging advanced technologies, data analytics, and ML algorithms, expense fraud detection can detect various forms of misconduct, including duplicate spend requests, altered receipts, or policy violations.

Expense fraud detection is a critical component of any organization’s financial risk management strategy. Airbase’s approval processes provide the layer of control and oversight needed to control unauthorized expenses. By increasing visibility into spend in real-time, any fraudulent activity is identified immediately.

10) Automated invoice processing.

By automating the invoice process, organizations can significantly reduce the time and resources required for data entry and reconciliation. This not only accelerates the payment cycle, but also reduces the risk of human error.

Automation also leads to better tracking and organization of invoices. In Airbase, all supporting documentation, including any email conversations sent with the invoice, is stored in the transaction file, ultimately streamlining financial operations and improving compliance in the event of an audit. This automation is essential to spend management.

11) Support for international reimbursements.

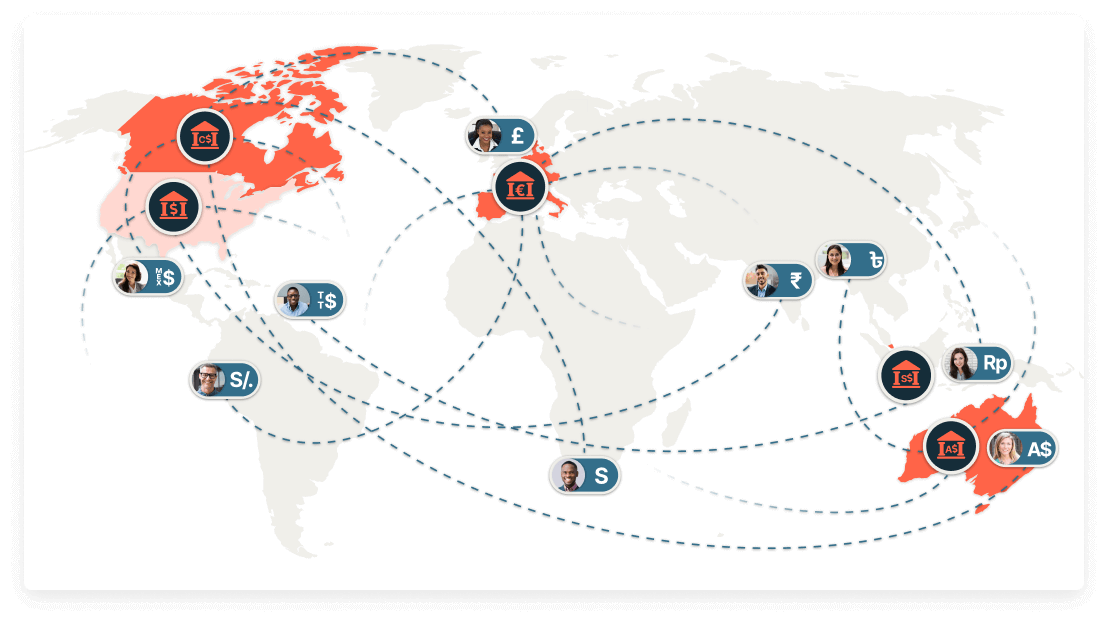

In today’s global economy, the ability to reimburse employees around the world is imperative. In Airbase, NetSuite users can process employee expense payments across multiple subsidiaries, spanning 45 different countries and in 15 currencies. You can have distinct accounting and approval policies for each subsidiary.

Employees receive direct payments in their local bank accounts in their local currency. Expense reports sync to the subsidiary account in NetSuite in its functional currency.

12) Consulting for expense management.

Engaging financial experts for refining expense management strategies is crucial when facing complex financial challenges, significant growth, or changes in the market.

During times of economic uncertainty, consultants can provide crucial insights to ensure fiscal responsibility, optimize cost efficiency, and mitigate risks. Airbase’s solution consultants will assess your requirements, recommend the best expense management resources, and work collaboratively to ensure your team is getting the most out of Airbase.

Get started with Airbase Expense Management.

Find out how Airbase Expense Management will help you manage spending for 2024 and beyond.

Schedule a demo

Easy, comprehensive, accurate, fully approved expenses.

Jira

Jira  Ironclad

Ironclad  Asana

Asana