DIGITAL WALLET FOR BUSINESS

Contactless payment with Airbase.

Add your Airbase physical card to your Apple Pay or Google Pay digital wallet for contactless payment.

In addition to your personal cards, you can now add your Airbase business card to Apple Pay or Google Pay. If you’re not already a digital wallet user, now might be the time to consider becoming one.

Digital wallets provide contactless payment to eliminate risk.

Digital wallets are convenient and are more secure than using a physical credit or debit card. This is because card details are not shared with a merchant when a purchase is made. Instead, a unique token is generated to approve each transaction.

Digital wallet purchases are “contactless,” which adds another type of security for our cardholders. As businesses work to provide safer environments by minimizing physical contact, we expect to see a continued surge in demand for contactless payments from retailers and consumers alike.

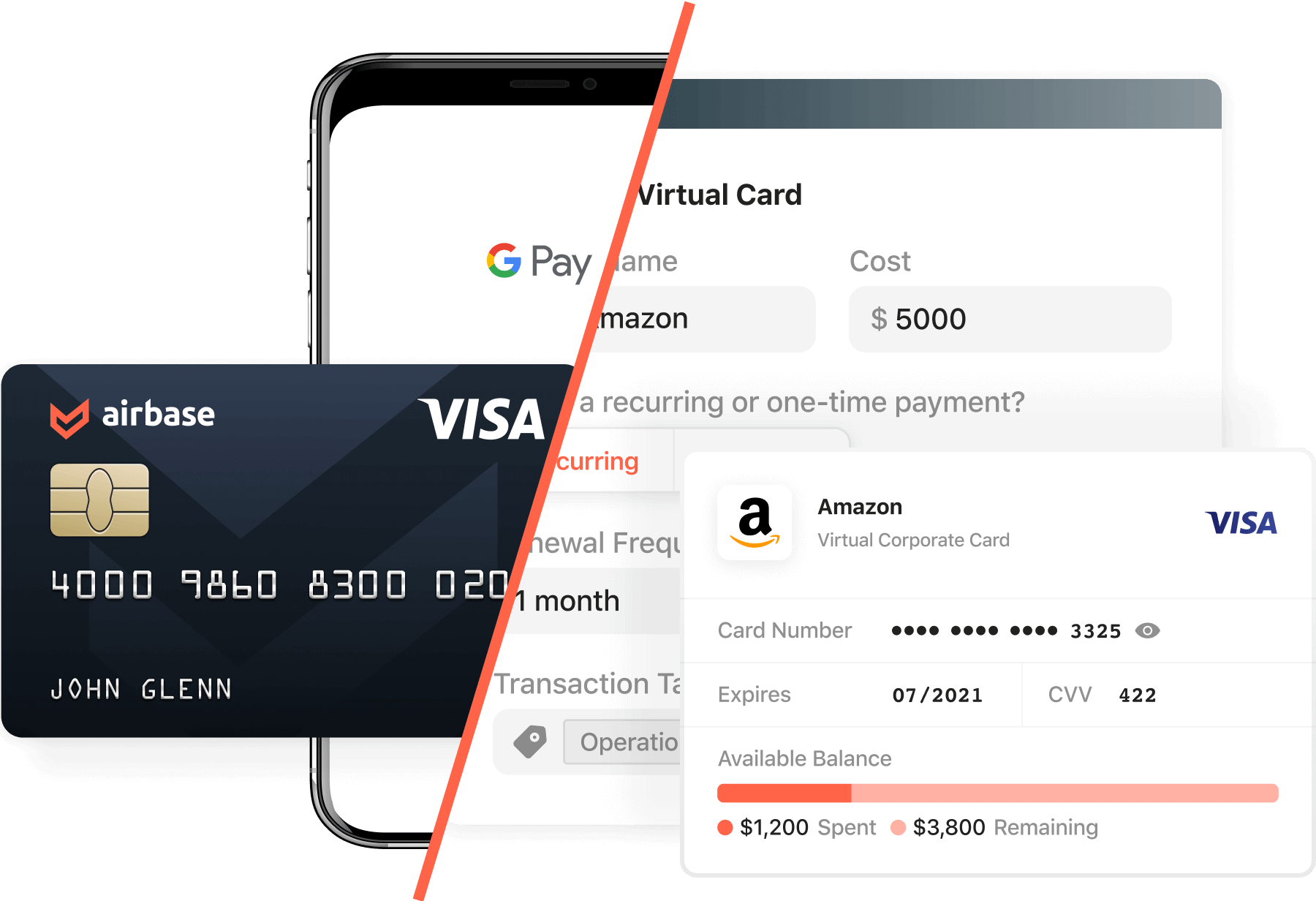

Digital wallet vs virtual cards.

Digital wallets are a consumer-based product and are increasingly accepted by retailers, restaurants, taxis, and public transportation. The B2B sector also has other payment tools, like virtual cards, that carry additional benefits for company card spending, notably helping with spending controls and automated accounting entries.

At Airbase, we also know that there are times (for example, when traveling, or at a restaurant) that a physical card is easier to use than a virtual card. Now you can make your physical Airbase corporate card contactless so you don’t have to carry it around, hand it to people, or sign for it.

Learn more about corporate cards

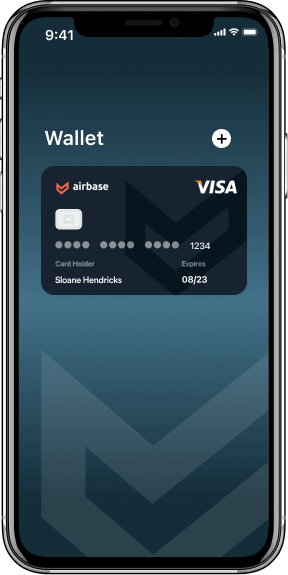

Here’s how to add your Airbase card to your digital wallet.

-

Go to the Wallet app and tap.

-

From the Payment Cards screen, tap Credit or Debit Card.

-

Scan the card using the mobile camera or type in the card details using Enter Card Details Manually option.

-

Once the card has been added, card verification is required for security purposes. Airbase will send a one-time password to your work email to confirm your identity.

-

Tap Next on the Card Verification screen.

-

Use Enter Code option and enter the code you received via email. The card is now added to Apple Pay account.

Google Pay for business cards.

-

Open the Google Pay app.

-

Tap +Payment.

-

Add your card details and tap Save.

-

You can now start making payments using the card in Google Pay.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana