Bill Pay Amortization

The test of an advanced AP platform is amortization.

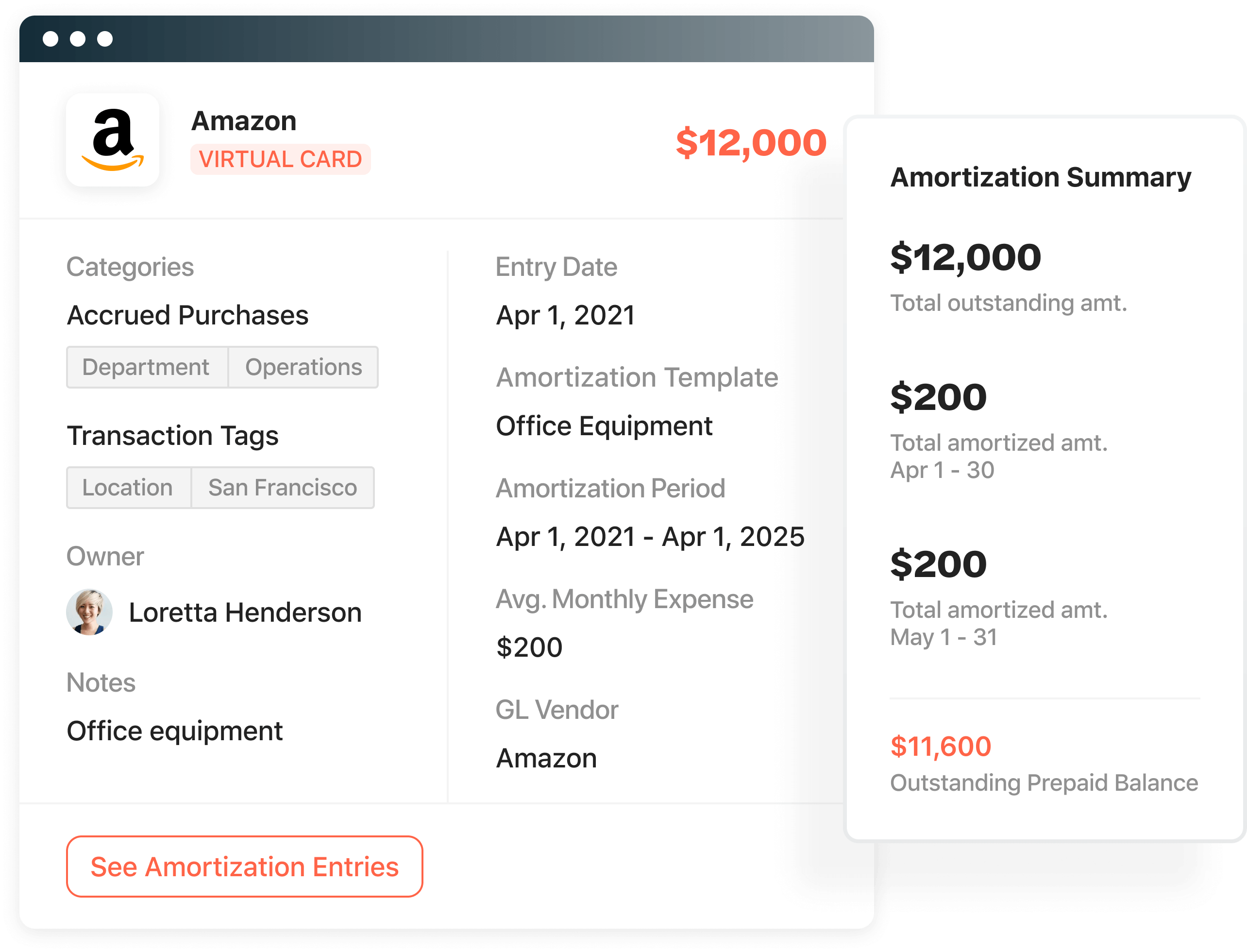

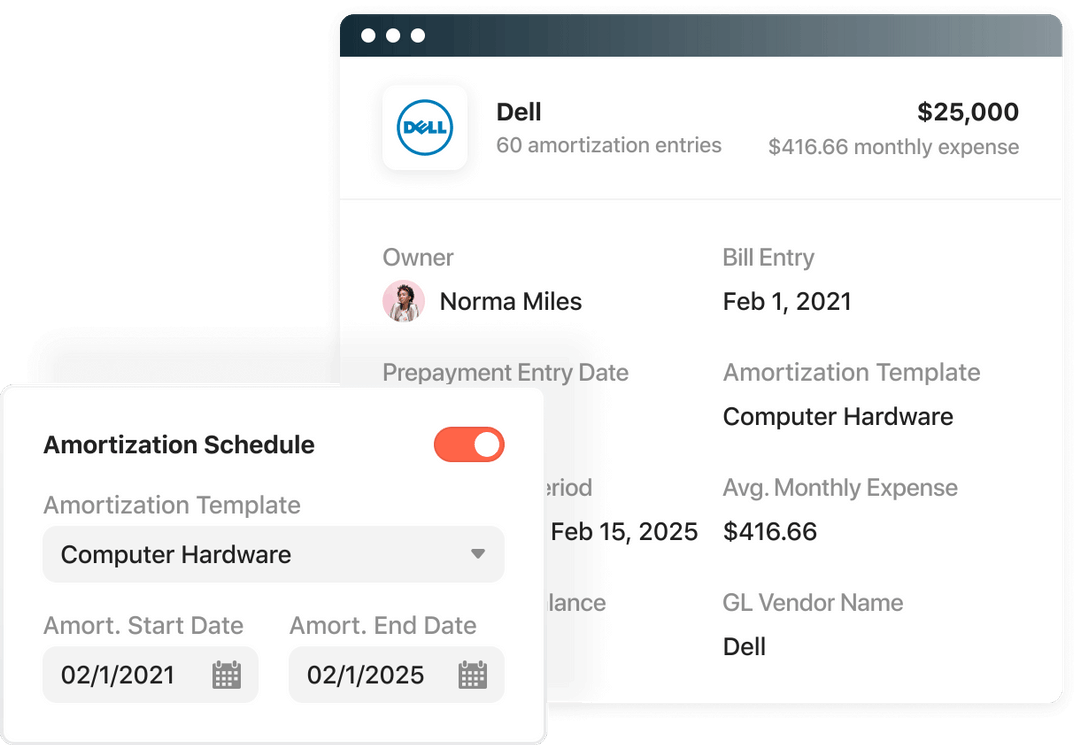

Generate and track a payment amortization schedule.

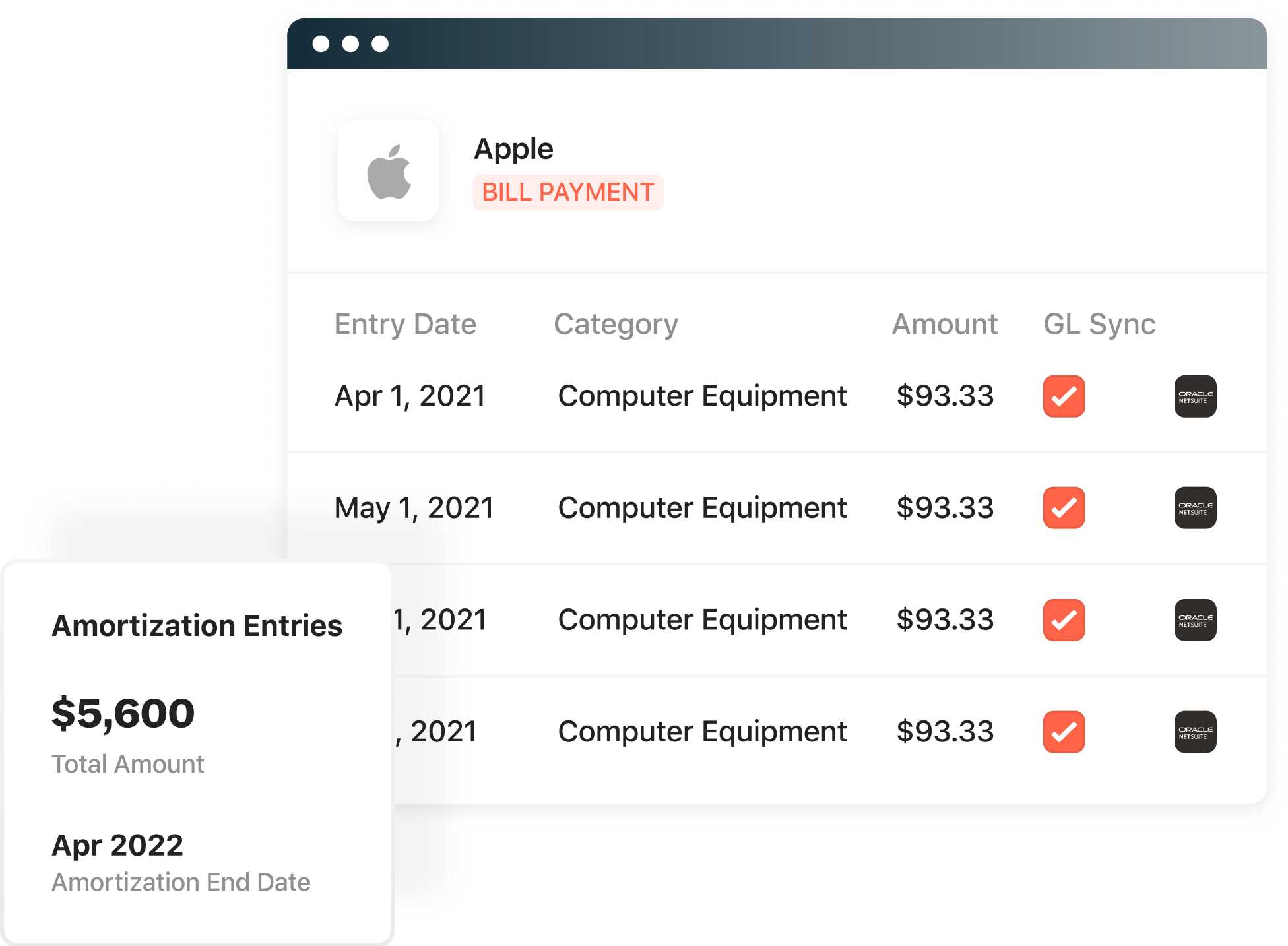

Booking details are displayed with the total amount split equally in each time period and can be automatically synced to the GL. Keep track of all the pending entries in Airbase and eliminate spreadsheets.

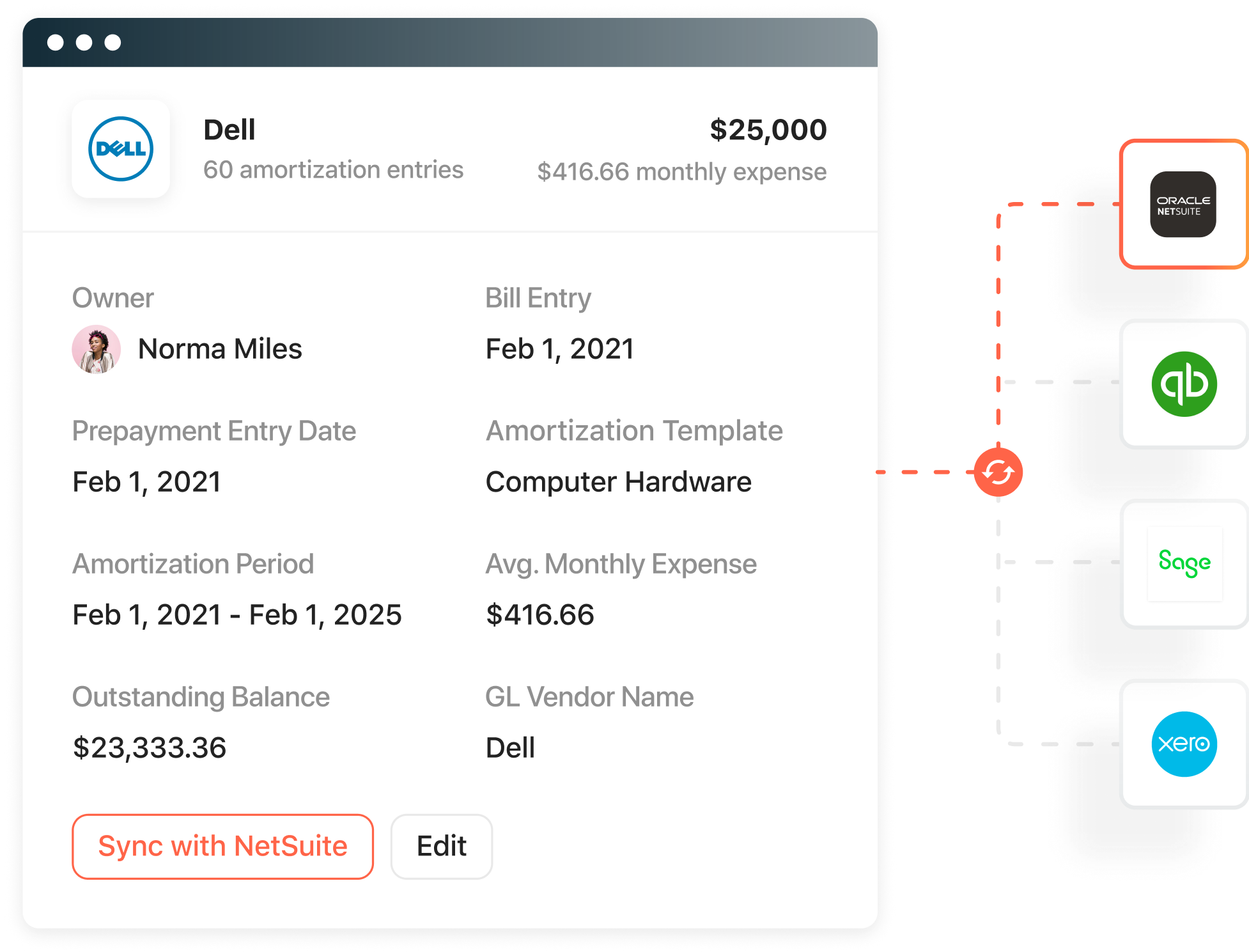

Automatic bill payment amortization syncing to the GL.

Payment Amortization for NetSuite GLs.

“The automated amortization schedules for pre-payments mean our AP team can set up pre-payments so that they’ll amortize appropriately in NetSuite, with no error. That’s been a significant time saver.”

Eoin Hession

Controller at Medely

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana