American Express® Cards + Airbase

Automate accounting & approvals for American Express® virtual Card spending.

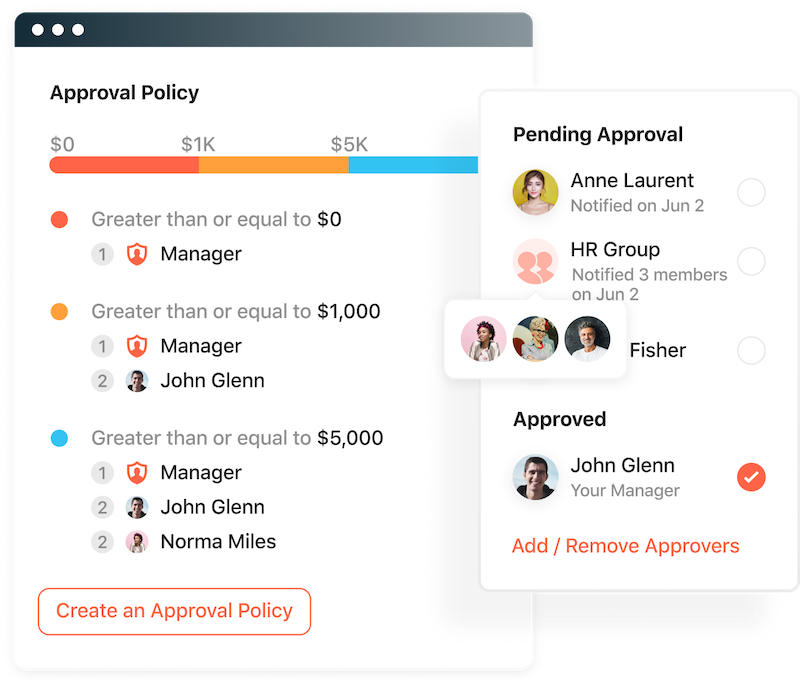

Upon enrollment1, customers can create an American Express® virtual Card on the Airbase platform and enjoy the visibility and control provided by spend management. All virtual Card users must be located in the United States. Airbase’s system automatically routes your employees’ requests to create an American Express® virtual Card to the right approvers, captures transaction details from virtual Cards and enrolled physical American Express® Corporate and Small Business Cards, and syncs details to your compatible general ledger.2 Integrating your eligible American Express® virtual Card within Airbase allows you to automate and manage non-payroll Card spending within your company’s spending policy. Fees may apply.

For illustration purposes only

Spend management for your American Express® virtual Cards.

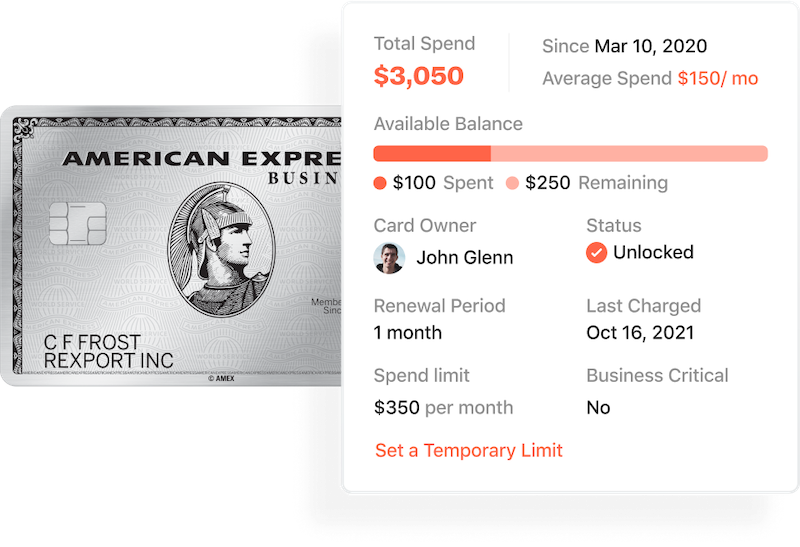

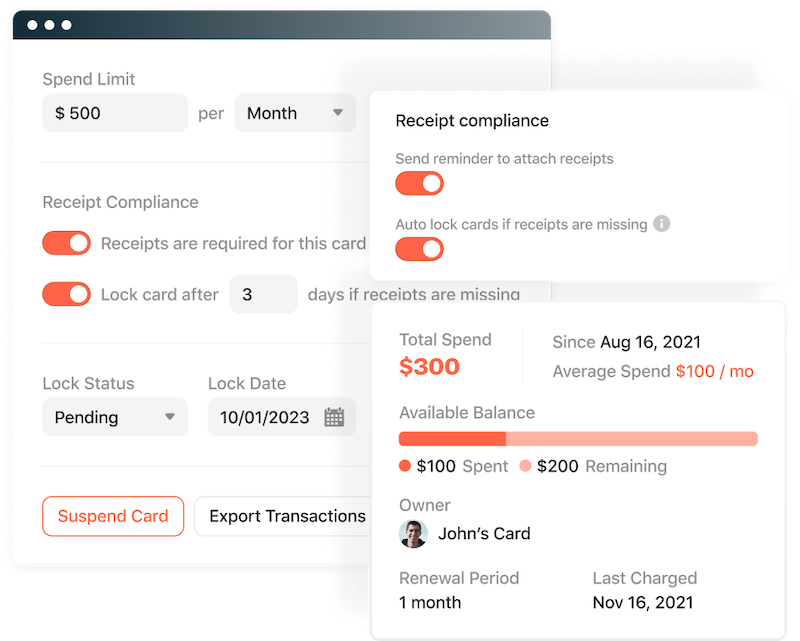

- Pre-approve and adjust spending limits on American Express® virtual Cards.

- Control spending with user-defined spend limits, expiration dates, merchant category restrictions, and Card templates.

- Categorize transactions at the approval stage or use the auto-categorization feature to help reduce errors.

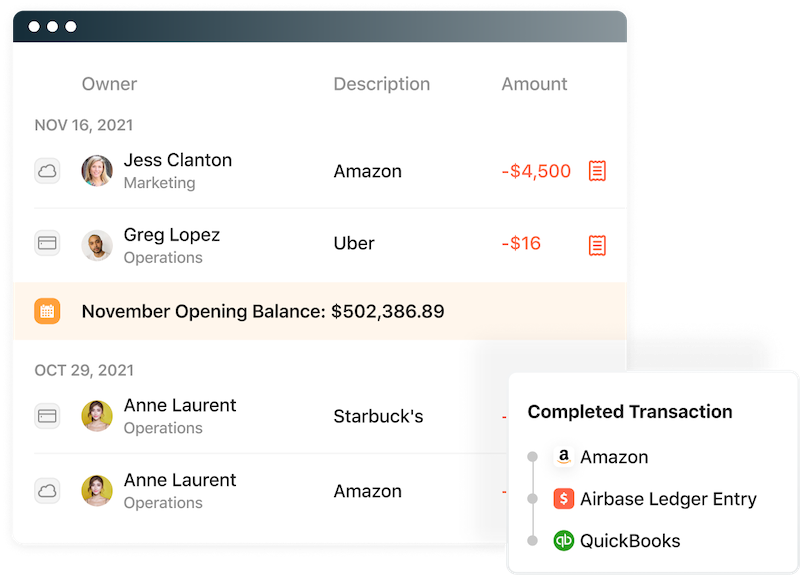

- Automatically sync all virtual and physical Corporate Card transactions to your compatible general ledger and help reduce manual reconciliations.2

- Earn the rewards of your American Express® Card when used to make virtual Card payments on eligible purchases.3

For illustration purposes only

For illustration purposes only

Use the platform to manage non-payroll spending.

Reduce costs related to a fragmented spend management process.

With different packages1 to choose from, the Airbase and American Express® integration provides a comprehensive tool to help manage your business spend all on one platform.

For illustration purposes only

For illustration purposes only

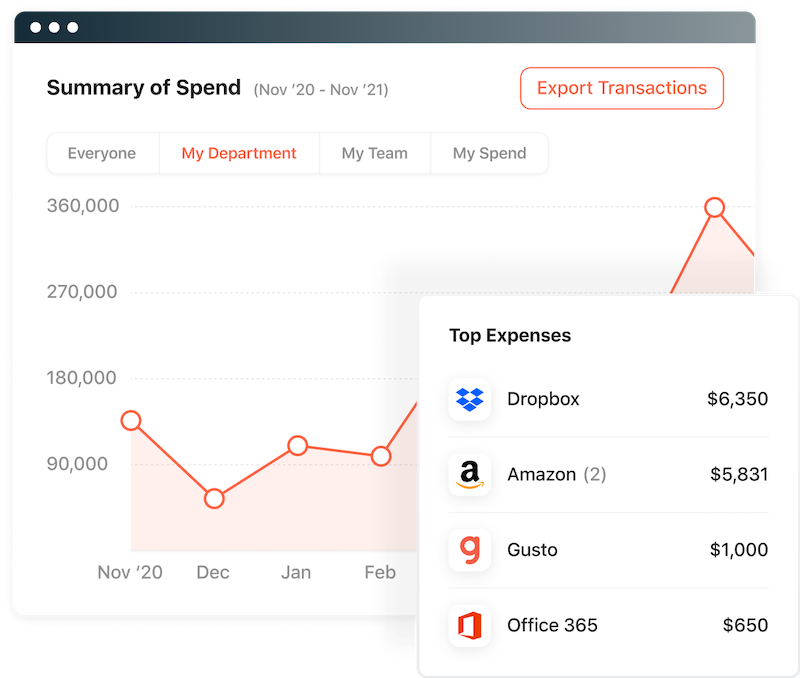

Visibility into spending.

Since all budget owners can view their spending in real time, any day of the month, your accounting team won’t have to spend time running special reports.

Control over spending.

Airbase enables you to automatically setup missing receipt notifications to your employees instead of manual review by your accounting personnel team. Control makes spending with virtual Cards easy for everyone.

For illustration purposes only

Airbase integrates American Express® virtual Card transactional data into the following accounting systems.

Airbase packages include:1

Platform Features

- Flexible, customizable spend control workflows.

- End-to-end compatible general ledger accounting automation.2

- Real-time reporting and visibility.

American Express Card Integration

- American Express® virtual Cards generated from your Small Business and Corporate Cards.

- Subscription management with alerts and scheduled Card locking help prevent auto-renewals.5

- Duplicate spend alerts in the Airbase platform flag payments for the same vendor.

Accounts Payable Automation

- Streamlined bill payments and vendor management.4

- Earn the rewards of your Card when paying bills with virtual Cards.3

- Automated categorization and expense account tagging drive automatic syncing to compatible general ledgers.

Expense Management

- Efficient employee domestic employee expense reimbursement.

- Clear, customizable policies.

- Simple receipt upload from Airbase mobile app with optical character recognition support.

- Optional travel management.

Services

- Guided onboarding support.

- Dedicated customer success manager.

- Professional support, comprehensive help center, and live chat.

Get started today.

2Compatible general ledger software systems include NetSuite, Sage Intacct, QuickBooks Online, and QuickBooks Desktop.

3Not all Cards are eligible to earn rewards. Terms and limitations vary by Card type.

4Advanced approvals are offered as part of an upgraded package for an additional fee. Contact your Airbase representative to learn more. Final transaction approval is dependent on American Express approval.

5Airbase does not cancel virtual Card purchases for recurring subscription charges. Please contact the subscription provider to cancel services.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana