Fraud prevention is a critical aspect of financial management. Effective fraud prevention centers around a set of strategies and practices designed to safeguard an organization’s assets, financial integrity, and reputation.

Finance teams play a pivotal role in identifying, mitigating, and preventing fraudulent activities that can significantly impact a company’s bottom line.

What is fraud prevention?

Fraud prevention is a series of proactive measures to detect, deter, and mitigate the risk of fraudulent activities within an organization.

Fraud can manifest itself in several ways, including embezzlement, misappropriation of funds, financial statement fraud, invoice fraud, and cyber fraud.

The primary goal of fraud prevention is to establish robust controls and processes that reduce opportunities for fraud to occur, and to swiftly identify and address any instances that do happen.

Key strategies for fraud prevention.

Internal controls.

Establishing and strengthening internal controls is fundamental to fraud prevention.

Finance teams should implement segregation of duties, requiring multiple individuals to be involved in key financial processes to deter fraudsters.

Regular reviews and audits of financial transactions and accounts provide an additional layer of control.

Employee education and training.

Investing in educating and training employees on the organization’s ethical standards, policies, and procedures is also a key element of fraud prevention.

Awareness programs on common fraud schemes and their detection empower employees to identify and report suspicious activities.

Whistleblower hotlines.

According to the Association of Certified Fraud Examiners, companies lose an average of $1.7 million annually, and a big part of that number is where employee fraud often goes unreported for a very long time.

Implementing anonymous whistleblower hotlines provides employees with a secure channel to report suspected fraudulent activities without fear of retaliation.

These hotlines encourage a culture of transparency and accountability within the organization.

Continuous monitoring and data analysis.

Using technology for continuous monitoring and data analysis helps finance teams identify anomalies or irregularities in financial transactions.

Advanced analytics and machine learning enhance the detection of patterns indicative of fraudulent behavior.

Vendor and third-party due diligence.

Fraud prevention extends beyond internal processes to include due diligence with regard to vendors and third-party partners. Verifying the legitimacy and reliability of external entities helps mitigate the risk of fraudulent schemes involving external actors.

Source: PYMNTS survey

Take a tour of Airbase.

Explore Airbase with a self-guided tour.

Challenges faced by finance teams.

Adaptive tactics of fraudsters.

Bad actors continuously evolve their tactics, adapting to changes in technology and business processes. Keeping up with emerging fraud schemes poses a constant challenge for finance teams.

Internal collaboration and communication.

Effective fraud prevention requires collaboration and communication across various departments within an organization.

Overcoming silos and ensuring information flows seamlessly can be a challenge for large and complex organizations.

Cybersecurity threats.

With the increasing reliance on digital platforms, cybersecurity threats have become a significant concern for finance teams.

Cybercriminals use sophisticated techniques to gain unauthorized access to financial systems and manipulate data, exploiting vulnerabilities in networks, software, or human behavior to gain unauthorized access.

Phishing happens when cybercriminals use deceptive emails, messages, or websites to trick individuals into revealing sensitive information such as login credentials.

For example, a cybercriminal might send an email posing as a legitimate financial institution, prompting the recipient to click on a link and enter their login details.

Once obtained, these credentials provide unauthorized access to financial systems, allowing cybercriminals to manipulate data, initiate fraudulent transactions, or compromise sensitive information.

Advanced persistent threats (APTs) are another sophisticated technique employed by cybercriminals. APTs involve prolonged and targeted attacks on specific organizations, aiming to gain access and extract valuable information over an extended period.

For example, a cybercriminal might use malware to infiltrate a financial institution’s network, remaining undetected while silently collecting data over weeks or months. Once the cybercriminal has gathered sufficient intelligence, they can manipulate financial data, compromise transactions, or even use sensitive information for illicit purposes.

Best practices for effective fraud prevention.

Proactive risk assessment.

Conducting regular risk assessments helps finance teams identify potential vulnerabilities and prioritize areas that require enhanced controls. By being proactive, organizations can stay ahead of always-evolving fraud risks.

Utilizing technology solutions.

Advanced technology solutions, such as fraud detection software and artificial intelligence, help finance teams identify anomalies and potential fraudulent activities.

These tools automate the monitoring process and provide real-time alerts.

Regular audits and assessments.

Conducting regular internal and external audits helps evaluate the effectiveness of existing fraud prevention measures. Audits provide insights into areas that may require improvement and offer an opportunity to adjust strategies accordingly.

Incident response plan.

A well-defined incident response plan is crucial for minimizing the impact of any detected fraud. Finance teams should establish clear procedures for investigating and addressing fraudulent activities promptly.

How Airbase helps with fraud prevention.

Airbase is a SOC 2 Type II and SOC 1 Type II compliant company.

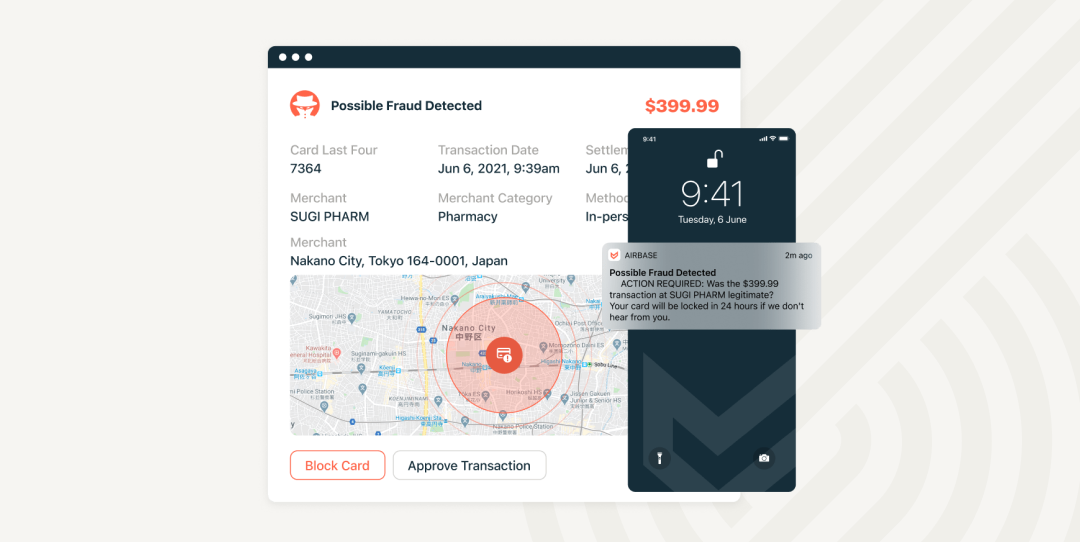

Airbase employs robust fraud detection mechanisms with responsive warnings, creating a proactive shield against potential threats.

Any alterations to vendor bank account details trigger notifications, requiring approval to safeguard AP teams from falling victim to falsified information — a common target for fraudsters.

The implementation of two-factor authentication for bank account changes via the Vendor Portal adds an extra layer of security, protecting vendors from scams. The Vendor Portal ensures secure management of account details, eliminating concerns about the validity of emails requesting updates.

The use of virtual cards, with spend limits and expiration restrictions, mitigates the risk associated with compromised cards. Generated on-demand by the purchaser, virtual cards eliminate opportunities for vendor fraud.

A secure “share” feature for card numbers enhances collaboration within the organization without compromising card security. This feature allows authorized individuals, such as a purchase manager, to securely share card details with team members or external contractors for authorized spends.

In the event of a lost or stolen card, they can be easily locked and unlocked from the dashboard, offering quick and efficient control over potential security breaches.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana