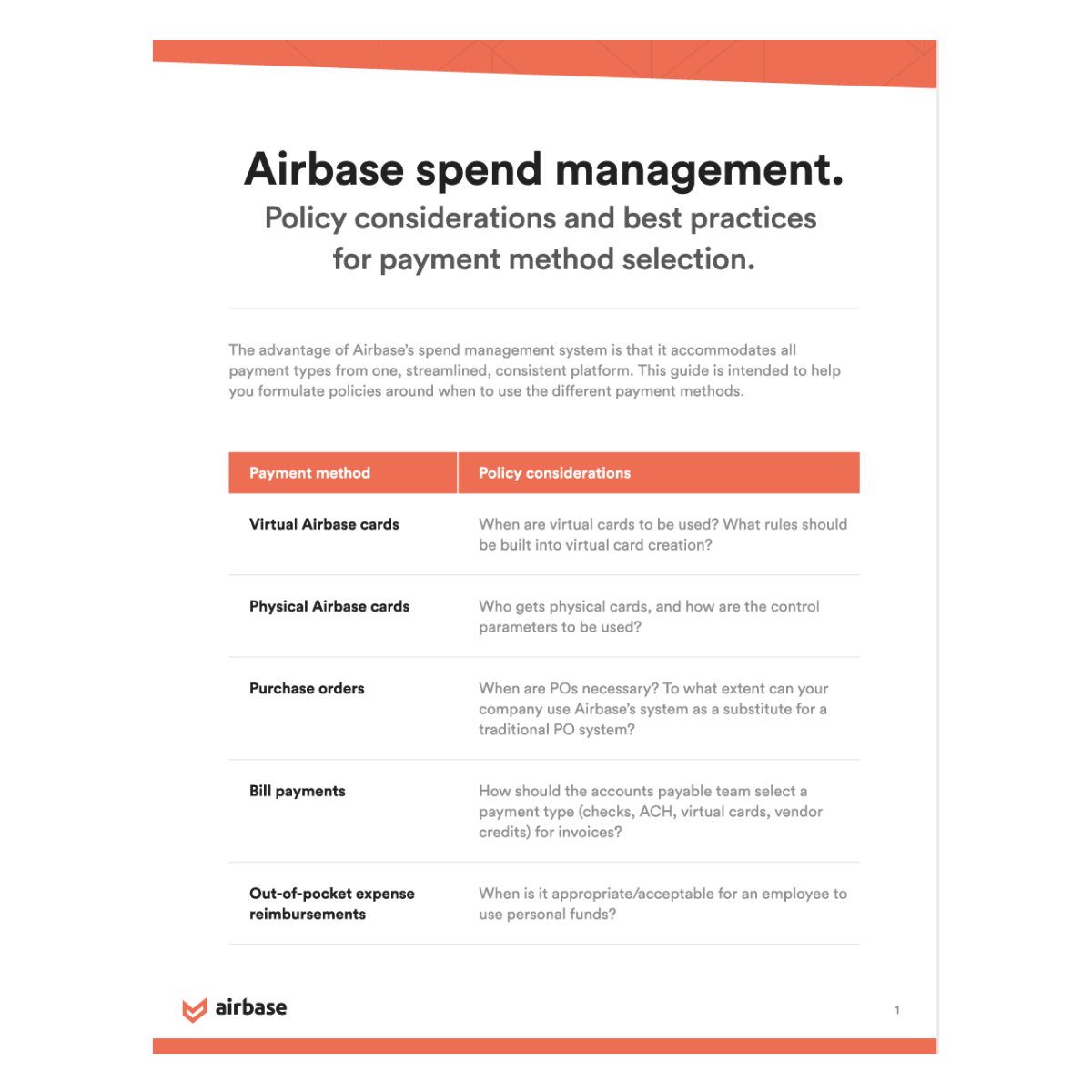

Policies & Best Practices For Different Payment Methods

The advantage of Airbase’s spend management system is that it accommodates all payment types from one, streamlined, consistent platform. This guide is intended to help you formulate policies around when to use the different payment methods.

01

Virtual cards.

Policy considerations:

Every employee can be set up in Airbase and can then request spend to make a purchase using a virtual card. All transactions are pre-approved and duplicate spend is automatically flagged. Virtual card spend controls help to prevent waste (e.g., recurring payments for services no longer needed). These cards provide an efficient automated experience for the accounting team, since transactions automatically sync to the GL, and earn cash back paid directly to the company. For all of these reasons, virtual cards make up 90% of the transaction volume for the average Airbase customer.

Suggested best practice.

Virtual cards should be selected for all purchases where an employee can use a card for payment. In particular, it is advisable to create vendor-specific virtual cards and to put recurring expenses on them; both practices are for safety and ease of management.

Airbase capabilities:

- Card requests can be made by anyone who has been provisioned onto Airbase.

- Pre-approvals secured for each transaction based on the rules set by the company.

- Users can request increases to spend limits.

- Categories, amount, and expiration date set at request.

- Card creation on approval with easy, secure transfer of card details to vendor.

- Transactions are posted automatically to the GL.

- Can be set up for monthly or annual recurring payments.

- Can be locked or suspended online by employees or admins.

- Offers cash back.

02

Physical cards.

Policy considerations:

Provide guidance on who qualifies for a physical card. Identify when and where physical card use is appropriate; even if an employee has a physical Airbase card, a virtual card may be more beneficial. Physical cards do not have pre-approval workflows and their transactions do not flow automatically to the GL, though they do have a receipt compliance feature. Your policies should address guidance for control parameters (e.g., spend limits) and if, and at what point, cards will be locked for noncompliance.

Suggested best practice.

Employees who have been issued a physical Airbase card should restrict its use to those situations in which a virtual card is not accepted (i.e., in-person purchases). Daily, weekly, or monthly spend limits should be placed on these cards, particularly for per diems.

Airbase capabilities:

- Issued to specific employees.

- Controlled by setting spending limits.

- Temporary spend limits can be set to accommodate things like specific events.

- Cardholders receive alerts for suspicious activity and can block a card if it has been compromised.

- Can be added to an Apple Pay or Google Pay digital wallet.

- Transactions are communicated, as they occur, to be approved and then synced to the GL.

- Offers cash back.

03

Purchase orders.

Policy considerations:

Companies use POs to provide a clear audit trail of contract terms, payment dates and details, approvals, and vendor deliverables. With a spend management system, a PO is not always required for internal purposes since Airbase allows for contracts to be attached to transactions and generates an audit trail of requests, approvals, and transactions. There are times that a vendor requires a PO and/or situations where AP teams prefer PO workflows, and it is simple to create one within Airbase. POs give companies the opportunity to summarize terms and conditions between themselves and the vendor and can serve as a contract in the absence of one. Policies should address when your company expects to create a PO for a transaction.

Suggested best practice.

Purchase orders should be created when a vendor requires it or when the payment terms and/or deliverables in a contract are complex, need to be accrued over some period of time, require inspection of deliverables before a payment is made, or is over a specified threshold amount.

Airbase capabilities:

- Creating a PO is an option for any non-card request.

- Details that can be added to the PO include payment terms/dates and vendor deliverables.

- The PO can be white labeled and sent to the vendor.

- The PO can be matched against invoices as they arrive.

04

Bill payments.

Policy considerations:

After receiving an invoice, accounts payable will select a payment method — this will be influenced by the vendor’s requirements and what is best for the company. Most AP teams try to avoid writing checks, only use expensive wires when absolutely necessary, rely on ACH payments as an efficient payment method, and use vendor credits whenever they can. In addition to these traditional payment options, Airbase gives accounts payable a new and efficient payment method with virtual cards. This method is often the preferred one since it generates cash back and automatically posts transactions to the GL. Vendors that accept card payments accept virtual cards.

Suggested best practice.

Accounts payable should optimize the payment method for:

- Economic returns based on cash back, less any fees for card use.

- Ease of processing.

- The needs of the vendor.

Airbase capabilities:

- Provisioned employees can submit a request that will be routed to the appropriate approvers.

- The invoice is captured in a special inbox for processing by accounts payable, including information pulled from email threads that reference an invoice or payment.

- All payment methods are readily available from the dashboard, including checks, ACH, virtual cards, and vendor credits.

- Vendors can input their account information into the vendor portal.

- W-9 compliance settings restrict payment until tax documentation is received.

- Virtual cards have the benefit of cashback rewards and they sync directly to the GL.

05

Out-of-pocket expenses.

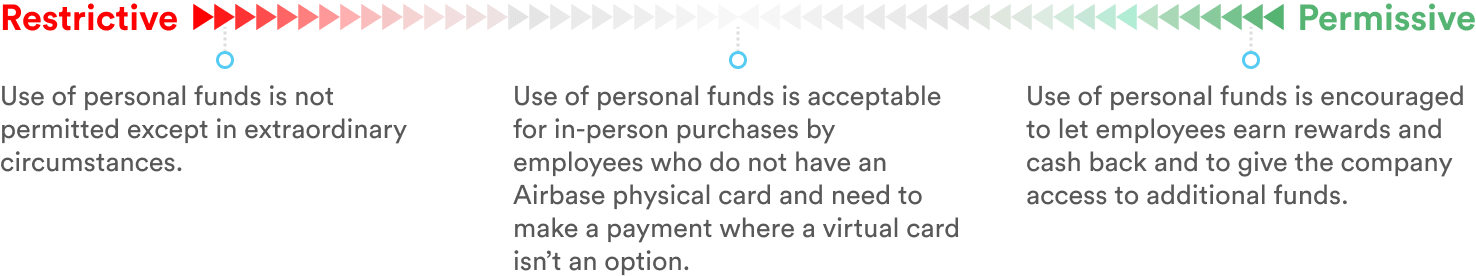

Policy considerations:

Decide and specify the extent to which you are comfortable with your employees using their own funds to make purchases. Note that when employees’ funds are used, approvals are after-the-fact, limiting control and real-time visibility into spend. Most companies do not wish to give every employee a corporate card, so employees are accustomed to using their own funds and then seeking reimbursement. However, because every employee can be given access to virtual cards with built-in pre-approval compliance, there are fewer cases where employees need to use personal funds to make purchases. If your policy is to avoid personal card use as much as possible, then a best practice would make Airbase physical cards available to employees that need to make regular in-person purchases.

Suggested best practice.

Use of personal funds for purchases is permissible, though reasonable effort should be made to use other payment types first. Other payment types are preferred for the additional value they provide (e.g., pre-approvals, automation, cash back). The use of personal funds is expected to be by employees who don’t have a physical Airbase card and yet still, from time to time, need a physical card to complete an in-person transaction. Reimbursements can be paid on demand and should be submitted for all personal expenses within [X days] of purchase.

Airbase capabilities:

- Any employee provisioned onto Airbase can access reimbursements, submit a claim, and upload receipts.

- Requests will be routed to the approver(s) specified per company’s policy.

- Accounting makes the payment directly to the employee’s bank account.

- Transactions can be easily synced to the GL.

06

Summary comparison of different payment methods.

| Airbase virtual cards | Airbase physical cards | Bill payment/ purchase orders | Personal funds | |

|---|---|---|---|---|

| Pre-approval functionality | ||||

| Approval routing functionality | ||||

| Easy document submission | ||||

| Cash back | ||||

| Auto-categorization | ||||

| Direct sync to GL | ||||

| Deniable spend request | ||||

| Spend limit rules | ||||

| Card maturity/expiration rules | ||||

| Relevant vendors displayed | ||||

| Relevant categories displayed | ||||

| Flags possible duplicate spend | ||||

| Visibility of spend before transaction | ||||

| Mobile support | ||||

| Resistant to fraud | ||||

| Ideal for back office | ||||

| Ideal for employees | ||||

| Ideal for in-person purchases | ||||

| Real-time spend visibility | ||||

| Recommended use cases | Whenever possible, especially for recurring expenses or when security is a concern. | Whenever physically swiping a card is required. | Large and/or complex contracts, or when vendors specify the use of POs. | Niche T&E, when a physical card is required to make a purchase and the employee doesn’t have a company card. |

| Example | Recurring, similar transactions from the same vendor (e.g., SaaS subs). | Client dinners. | Supplies or services delivered over a longer period of time. | Smaller in-person purchases of goods or services. |

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana