Mid-Market Companies – The Definitive Guide To Spend Management | Ebook

Streamlining your spend, consolidating systems, and growing spend analysis.

Help your finance teams avoid multi-system reconciliations as your operations expand and become more complex. Spend management software handles the full lifecycle of every dollar a company spends outside of its payroll. It automates each touchpoint of every dollar spent, whether that is done with a corporate card, paying an invoice, or reimbursing personal funds. It streamlines and automates approvals, booking, and reporting. It gifts you additional time for strategic initiatives. Read this guide to find out how.

01

Defining mid-market companies and how your accounting is evolving.

Being mid-market: the broad criteria.

The definitions of enterprise and early-stage companies act as bookends to the largely undefined mid-market category, which sits blockaded between them. Defining mid-market companies is a more conceptual task than defining startups or early-enterprises/IPO companies.

Though you can generalize that a mid-market company usually has 100–500 employees, they are often evaluated and categorized based on a very broad revenue range. Falling anywhere between a street company (less than $5 million in revenue) and a unicorn company (over $1 billion in revenue), cataloging mid-market companies exposes a very large cohort.

Moving past basic AP functions.

You’ve probably implemented a series of point solutions to handle your spending — a corporate card program, an expense management system for employee reimbursements, and an automated bill payments system. These point solutions culminate in a messy tech stack requiring manual reconciliations, forcing accountants to shift from one system to the next, and making information syncing to the GL unreliable.

There is little visibility into who is spending what, nor is there a way to control spending against budget. The economic impact is beginning to be felt as the subscription costs for your software tools rise as you add more employees to your ranks. At the same time, your go-to-market activities are ramping up with swelling transaction volumes for ad spends.

For me in finance, the issue is to ensure visibility to various data sources.

— Scott Clark, VC Firm CFO, Investor, Advisor

Every dollar still counts. Now you need scalability.

Growth has resulted in complexified processes, more names added to your team, and increased volume across many areas. At this juncture, your finance team needs increased visibility and control as you scale. Automating financial and accounting functions increases the time your key players can spend on strategizing and reducing their low-value workload.

This guide will help you understand how a spend management system responds to you entering the mid-market, offering you additional features, allowing you to scale efficiently — separating you from the rest.

02

Your key financial concerns as a mid-market business.

Identifying priority concerns is a key action in the financial success of any business.

After exiting the early stages, concerns will be heavily impacted by how fast a company is growing and what has been put in place thus far. Airbase has broken down some of the top concerns for a mid-market business below:

Operational challenges:

1. Keeping up with rapid addition of employees.

More people means more processes. The accounting and finance teams responsibilities will now inevitably grow in scope from the multiplier of more employees spending company money.

2. Paying contractors or remote teams.

Who you’re paying may now diversify past your present payroll system. A shift from employees to contractors who fall into your accounts payable makes flows less predictable and more complicated, especially if foreign currencies are involved.

3. Spending time implementing tools.

Often overlooked, the operational side effects of new implementations can slow down productivity rates and performance.

4. Increased volume in many areas, e.g., payments and vendors.

Naturally, as you scale there is more to handle. This requires more organization and efficiency.

5. Chasing documentation.

More employees and transactions can make a finance team, which may not be growing in size, feel overstretched.

6. Increasing data for FP&A.

The presence of FP&A in your company is now increasing. Obtaining the necessary data, and ensuring its accuracy, is a requirement that previously may have only been felt during an annual budgeting process.

7. Implementing an ERP/migrating to a different GL.

Naturally, you may need a more sophisticated GL or ERP. But will your existing tools integrate with the GL? What tools or current software do you have to facilitate this?

8. Reconciling tools, financials, and audit trails.

Managing gaps in your tools and reconciling financial omissions and errors from a lack of consolidation. Most mid-market companies have a messy tech stack made up of free, narrow point solutions used as bandaids during the startup phase. The value of each of these should be assessed in light of your current demands.

Policy and process challenges:

1. Efficacy as operations expand.

Dealing with one-offs, exceptions, and getting transaction details right.

2. New financial leaders and HR processes.

Influencing the systems used and payroll software, changes can be expected as leadership and departments expand.

3. Marketing has the biggest spend and information flows.

As the company ramps up its GTM efforts, more will be spent on marketing software, ad buys, events and conferences, and contractors to create collateral. T&E will increase for sales and marketing. The whole department often shares one corporate card making it impossible to have visibility into who is spending and how it should be categorized.

4. Capturing approvals and documentation.

Communication is fragmented, taking place across a variety of mediums, such as Slack, emails, meetings, or calls. There is no single repository for all of the information tied to a specific transaction.

5. Policy compliance and creation amongst mounting confusion.

Alongside growing financial operations, deciding how to execute expanding policies can be hard to gauge. New financial leaders juggle drafting these policies, obtaining evidence of compliance, and successful overall implementation.

6. Fear of implementing new systems that may need alteration as financial operations expand.

Accounting teams are strained as they reconcile numbers across multiple, expanding systems. At this stage, a unified, consolidated software is your saving grace.

I was doing too much work below my level because we didn’t have the types of tools that are available today. I was manually moving data from system to system. Freeing up that time means doing a lot more things at, or above, your level.

— Scott Clark, VC Firm CFO, Investor, Advisor

03

The power of spend management as a solution.

Cut through low-value, mundane finance tasks with automation.

Resolving these financial concerns individually requires an overly complex response, burdening teams across the company and pulling attention from high-value tasks. A more universal perspective recognizes that the overarching issues are visibility, spend control, and automated workflows.

Visibility, spend control, and automated workflows in every transaction.

Finance and accounting teams that center decision-making around visibility, real-time reporting, and spend control discover a new level of control in their operations. Focusing on those three key areas automatically solves a number of smaller, day-to-day challenges. There will be less tedious reconcilement errands and misaligned spending. Delayed closes are avoided by real-time insights. This frees up time for employees and teams to focus on their primary tasks and strategizing for the future.

So how do companies shift to this approach? That’s where spend management comes in.

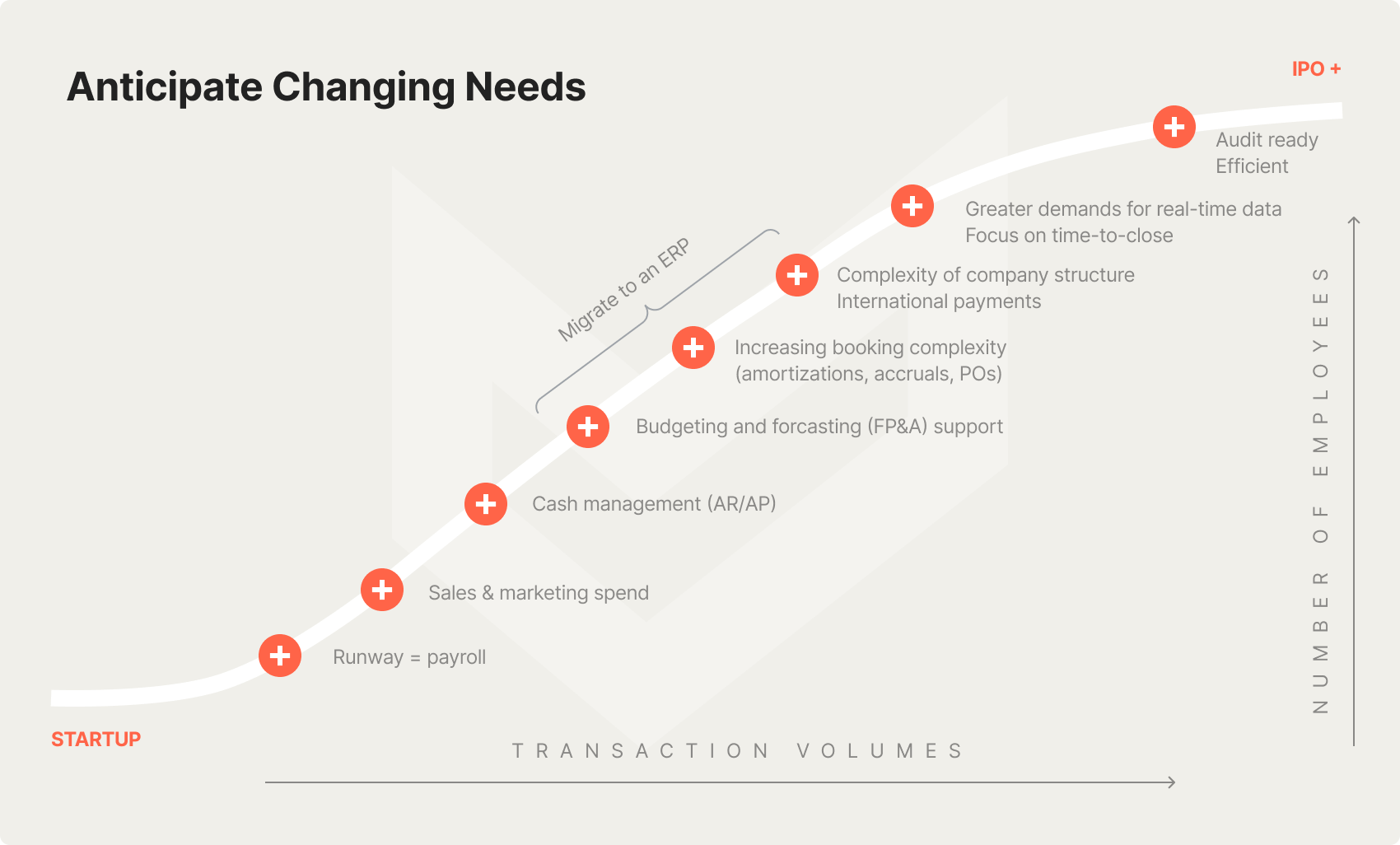

It was designed to grow with you.

A spend management platform is a consolidated solution to the micro and macro-financial concerns of your company.

The parts of your spend management system that you use at various stages will depend on the size of your company and how fast it’s growing. As a customizable, multi-feature system, you can use the features you need as you need them.

New priorities, same spend management platform.

As spending grows there is a lack of visibility and control over the deployment of capital. Financial leaders, who are ever mindful of fiduciary responsibilities, are increasingly focused on finding ways to de-risk operations. Leadership is now looking at key metrics on growth, conversion, and churn.

Spend management will help your company conquer what this mid-market chapter is all about: scaling operations, increasing visibility and insights, analytics and reporting, and maintaining control. Here’s how:

An all-in-one product:

1. OCR technology to scan invoices and receipts.

Saving your teams valuable time, this technology reduces manual documentation processing.

2. Mobile app.

Allowing employees to request approval for spend and upload receipts on the go.

3. Vendor portal providing clear interactions and history.

This portal allows vendors to upload information including W-9s and review payment status.

4. Facilitation of complex, configurable approval workflows.

Workflows within your software can be elaborated on as your organizational structure becomes more complex.

5. Scalable tools.

You need features with extendable functionality, whether it’s multi-currency and subsidiary features, PO support, amortizations, or complex approval workflows.

6. Increased visibility and control.

As processes complexify, spend management software gives visibility and control, whether it’s spending with cards or via invoiced payments.

7. Advanced, rule-based approval policies.

As your organizational structure becomes more complex, you’ll need advanced settings for approvals routing and compliance tracking.

8. Auto-categorization of spend.

Ensure a smooth automatic sync of each transaction to the GL with auto-categorization.

9. Native integrations.

At this stage many companies have migrated to NetSuite and gaining access to custom fields and amortization schedules makes work easier.

10. Consolidated system for all non-payroll spend.

Replace legacy systems for bill payments, corporate cards, and expense reimbursements with one platform.

11. Multi-currency/subsidiary expansion support.

Whether going global or developing subsidiaries, spend management software has your back.

Your accounting operations automated:

1. Integration with your HRIS and expanding HR operations.

Provisioning/deprovisioning employees made easy.

2. Avoid duplicate payments and subscriptions.

Flag vendors when a request is made where the company already has subscriptions.

3. Routed approvals, captured booking information, and automatic syncing to ledger.

Automation is the key to creating a scalable organization.

4. Spend and approval consolidation.

Apply the same approval workflows to cards, purchase orders, and reimbursements.

5. Migrations to a new ERP.

A top spend management provider will help you migrate your data to a new ERP.

6. Dedicated customer service.

A trusted, established spend management provider offers resources to ensure that your spend management processes are most efficient. This may include migrating to an ERP at this stage.

7. Collaborative software for outsourcing.

Perhaps you still haven’t fully moved finance functions in-house. You need spend management software that facilitates external collaboration.

8. Improved spend culture and policy compliance, boosting your business.

Employee autonomy over spend and software that ensures policy compliance gives everyone the sense of control they need.

04

Seeing growth? Useful questions to ask as you scale with spend management.

Evolving past daily operations.

Your company’s now-established financial operations are evolving past the basic recording of past activities. Finance teams are harnessing your key performance indicators and translating them into projected roadmaps.

In the mid-market chapter, you will execute more technical analysis of your processes and growth, focusing more on growth, churn, and starting to evaluate wasted spend closely.

Future planning is off course when you ask the wrong questions.

Spend management software frees up time for your finance teams to ask the important questions by removing the burden of many routine, low-value tasks through automation. We’ve compiled some questions your finance teams can ask as they break the glass ceiling into enterprise level.

Over my career, I’ve learned that I can’t just build something that works for now, it also needs to work in a year or two years’ time, even if that makes it a little more difficult to build.

— Jason Lopez, Controller at Lattice

1. Platform capabilities:

Do our individual siloed solutions cost us more than a single consolidated one?

Many of the standard AP and expense management software becomes increasingly more expensive as a company grows and needs to purchase additional seats. What was once “free” is starting to cost significantly more. It is worth considering how today’s costs and anticipated future costs compare to a single-platform solution.

2. Depth of features:

Does our system support expanding budget and analysis operations?

Real-time data, adjustable spend budgets, readily available interim reports, and comprehensive reporting across all payment types means your teams and stakeholders can access the relevant data as they need it.

Does our system support expansion into new countries or developing subsidiaries?

Airbase supports payments in 145 currencies at a fraction of the cost of other foreign currency payment choices. With multi-subsidiary, and multi-national capabilities, Airbase is not just for the here-and-now.

3. Flexibility:

Are we happy with our software stack or is it time to rebuild?

Airbase’s multi-tier platform packages can offer you what you need, when you need it, based on your budget. Reflecting on cost and ROI, and asking whether your software stack facilitates the functions you need as you grow (e.g., moving functions in-house) is important at this stage of growth.

4. Integrations:

As headcount grows, can I automatically provision (and deprovision) new hires to my spend management system?

Airbase integrates with your HRIS for automatic provisioning and deprovisioning.

As my company grows in size and complexity, such that we will need to migrate to an ERP, will my spend management system easily integrate into the new system?

Airbase integrates with Oracle NetSuite and Sage Intacct and is designed to transition from basic GL to ERP with ease.

Day-to-day, what integrations are available with Airbase to make using our system easier?

With Slack and email integrations, Rippling and other HRIS integrations, Okta and other SSO integrations, Google Pay/Apple Pay for corporate cards, and the Airbase mobile app where employees can link their personal bank accounts for reimbursements — your Airbase platform fits in seamlessly with your daily operations.

5. Scalability:

Can our spend management system help us as we build out FP&A features?

With accrual projection capabilities, as well as real-time reporting, there are a number of ways Airbase can help you obtain the data you need for expanding FP&A.

Are purchase orders starting to play an increasing role in our operations and can our system incorporate them?

Airbase has extensive scope for purchase order functionality, handling any increased volume with ease. POs can be numbered in correspondence with the GL they’re linked to (if you have more than one), categorized, commented on, requested by employees directly, and so on.

6. User experience:

Are we moving any functions in-house and, if so, is it going to destabilize our system?

A comprehensive spend management system, such as Airbase, should be versatile in how both internal and external stakeholders, and outsourced functions can collaborate. When moving functions in-house, you’ll find the settings and functions you need waiting for you — so that reconciling previous data and processes is made easy.

Are the policies and processes around spend that we’ve employed working?

Airbase offers adjustable spend limits, comprehensive approval workflows, and auto-categorization of spend, so your finance and management teams can quickly evaluate and control the spend that happens and its compliance with internal policy.

05

The Definitive Guide to Spend Management.

Read our guide for more information on spend management and how to evaluate its benefits.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana