SOLUTIONS FOR VPS OF FINANCE

Control your company’s destiny with Airbase.

Get the time and tools to tell the stories about the numbers, not just compile them.

Build operational muscle and controls to close quickly and scale efficiently.

Ensure a healthy spend culture and eliminate wasted spend.

Eliminate a messy tech stack and manual tasks.

Experience easy onboarding, happy employees, and the value of real-time data.

One single, unified platform.

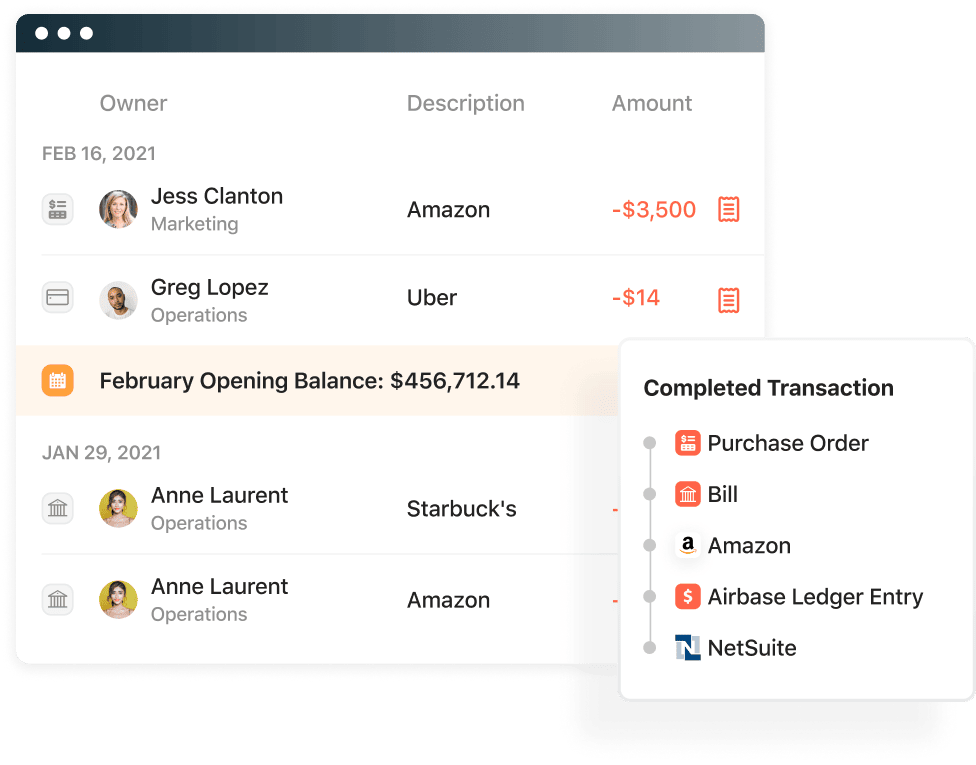

Using siloed systems for spending company money — one for AP automation, one for corporate cards, and another for expense management — is inefficient. Airbase solves this by consolidating all spending onto one consistent platform. With built-in approval workflows and the efficiency of accounting automation, your GL will be current and accurate. The resulting real-time visibility into spend helps you make better informed business decisions.

Whether you pay with a virtual card, a physical card, ACH, check, international wires, or even vendor credits, Airbase lets you manage the whole spend process from one unified system.

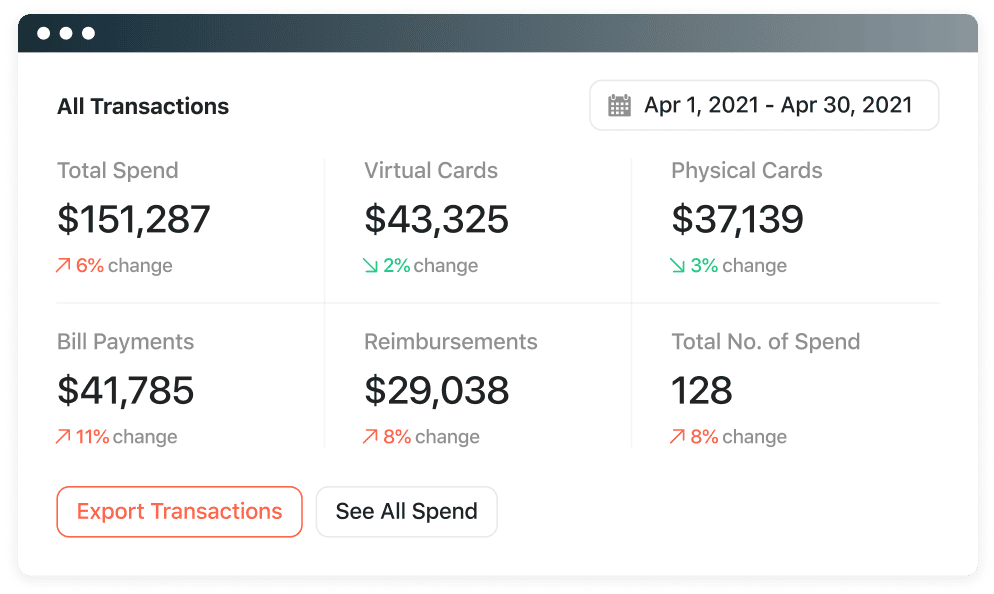

Visibility and control for a healthy spend culture.

Take the friction and confusion out of company policies and processes when employees spend your company’s money.

A clear request and approval workflow keeps teams moving, and ensures and records information about compliance for all stakeholders.

Get real-time reporting of actual, total non-payroll spend any day of the month. When everyone can see spend, everyone can own it.

Free up valuable time from routine, low-value tasks.

We’ve built automation into every activity associated with company spend, including:

Request and approval workflows.

Auto-categorizations.

Automatically syncing to the GL.

Bank reporting for reconciliations.

Invoice Inbox for automatic capture of invoice details.

Get control, visibility, and cash back.

Improve spend controls.

Spend requests and approvals take place via email, mobile app, or Slack to keep teams moving. Pre-approval for card purchases helps control the budget.

Give every card a budget.

Visibility into what is being spent any day of the month helps inform important business decisions.

Simple receipt capture.

Employees using a physical card can upload receipts from their desktop or via the mobile app, and virtual card users can attach receipts to each transaction.

Generous cash back.

Earn cash back for your company on all physical and virtual card purchases.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana