SOLUTIONS FOR ACCOUNTING MANAGERS

Control your company’s destiny with Airbase.

Increase your value to the company.

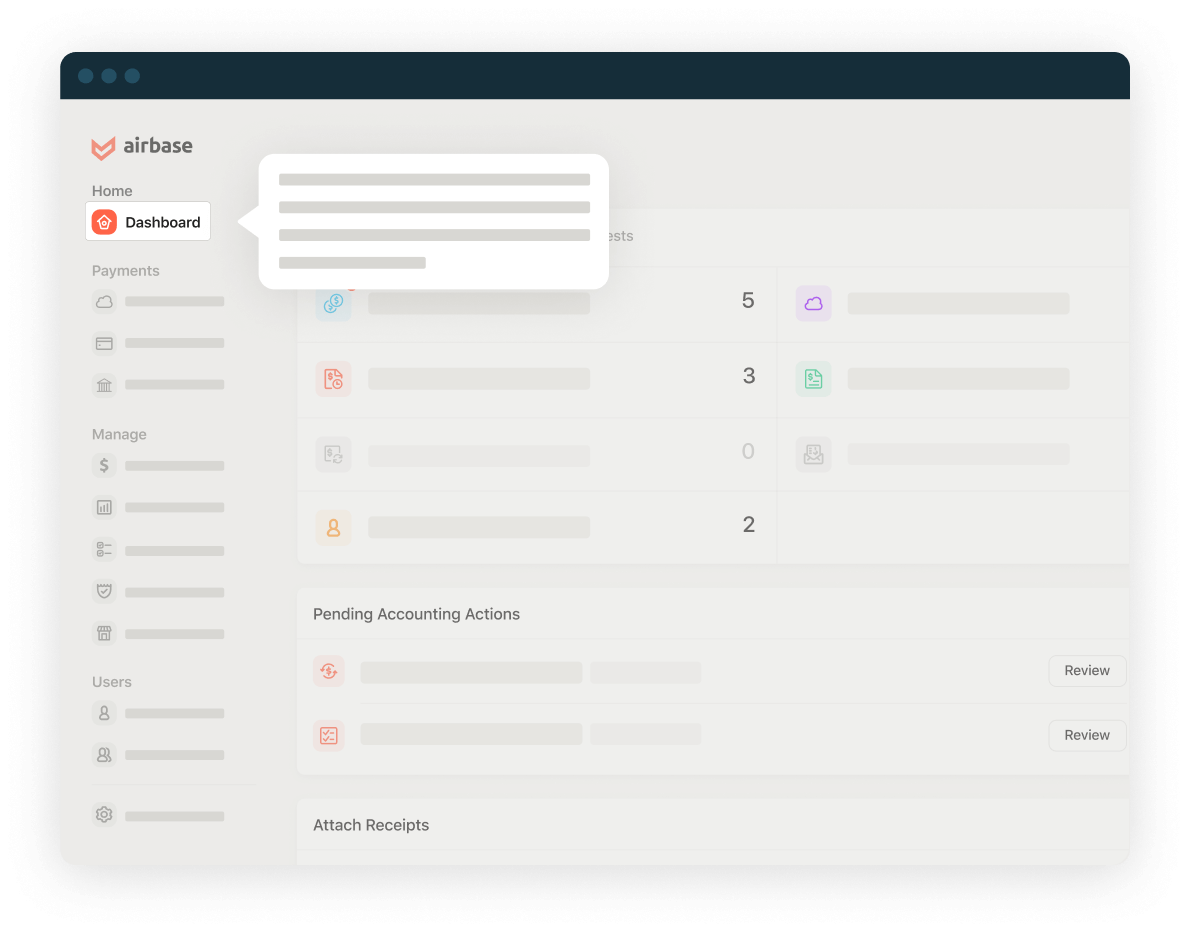

Automate manual tasks with tools that automatically compile a clean audit trail.

Eliminate receipt chasing and card reconciliations.

Consolidate card spend and AP into one convenient system.

Accounting automation.

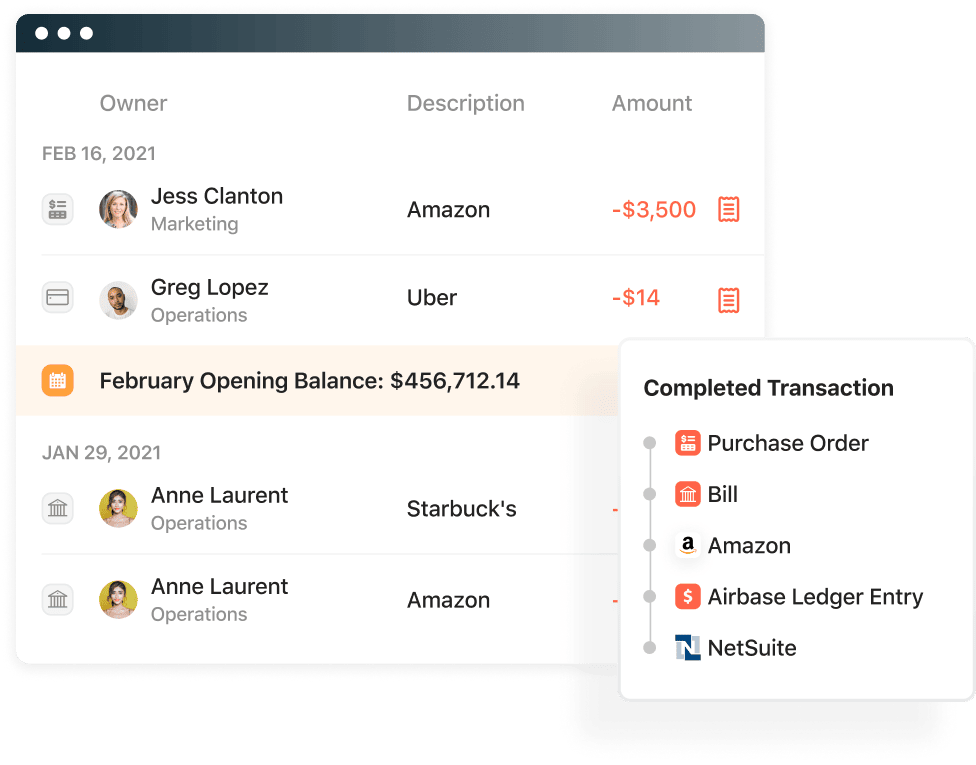

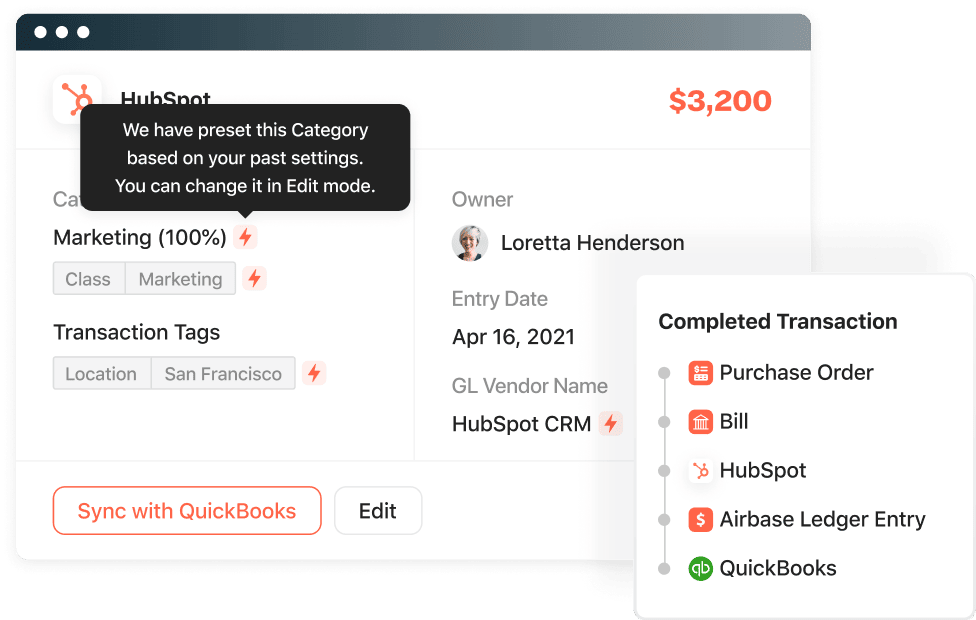

Automatic syncing to your GL saves time, eliminating messy CSV files or manual entries.

Our corporate card program automates approval workflows.

Virtual card transactions flow automatically to the GL, so that you don’t have to reconcile credit card statements.

Use receipt compliance setting and let Airbase enforce your policy.

Built-in W-9 compliance so that payments aren’t sent without the form on file.

Automatically capture invoice documents and correspondence to an Invoice Inbox.

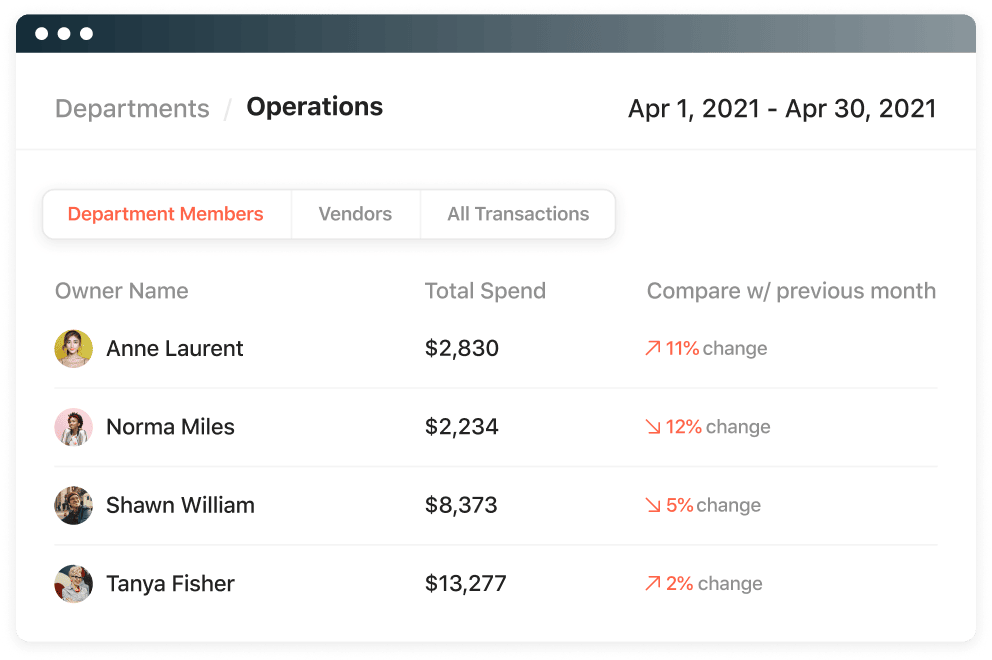

Real-time reporting.

Free up valuable time from routine, low-value tasks.

Request and approval workflows.

Auto-categorizations.

Be a hero.

Update and upgrade your company’s AP function, card program, and expense management.

Improve spend controls.

Use spend requests and approvals to ensure that company expenses are pre-approved before employees make card purchases.

Automate low-value, manual tasks.

Eliminate credit card reconciliations and receipt chasing. Automate approval flows and syncing to the GL.

Give visibility to everyone.

Budget owners can see their department’s spend, and everyone making purchases can see what they have spent.

Cut monthly time-to-close in half.

The right automation tools free you up to make a more valuable contribution to your company’s business performance.

“We didn’t have a budget for a headcount, so instead, we implemented Airbase. Not only did we automate everything, but now we have all these controls, these reviews, these approvals — it’s more than a headcount could ever give us.“

Chris Morello

Director of Accounting at SeekOut

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana