Intake-to-pay is a term used by some new intake software providers. As of this writing, analysts have not recognized it as a separate category like procure-to-pay, or source-to-pay. Given its nascent status, we think it’s important to understand what it means and how it might impact procurement software options.

So, what is intake-to-pay (I2P), and how does it compare to the long-standing process category known as procure-to-pay (P2P)? And most importantly, which one is right for your business?

We’ll look at what each procurement model delivers to answer these questions.

In short, intake to pay describes a specialized subset of procure to pay that incorporates modern software concepts, including intuitive user experience, collaboration, insights and analytics, and integrations with adjacent systems.

I2P narrows in on a specific aspect of procurement, while P2P is a comprehensive, ongoing, end-to-end approach. But what does that actually mean for your procurement operations?

And how do you determine which process will best support an orchestrated spend cycle that serves your business?

Here, we’ll answer these questions with a detailed comparison of I2P and P2P, outlining features, benefits, and strategic uses so you can determine which system best aligns with your specific operational needs and financial goals.

Introduction to intake-to-pay (I2P).

Intake to pay (I2P) was developed to handle a gap in the procurement process, a gap made more apparent by the rapid rise in decentralized spending. Procurement has long been associated with a centralized process. Procurement specialists assess requests, requirements, suppliers, and negotiate pricing and contracts, and create purchase orders.

Decentralized spending occurs when employees across an organization are empowered to make their own purchases.

Decentralized spend has long been a part of T&E spending but it has expanded to include software subscriptions, ad buys, and professional contractors. Much of this occurs outside of procurement approval workflows, vendor vetting, and specialist input.

Intake-to-pay created a single entry point for all employees to request purchases for any type of spending, regardless of location or type of spend. This means that all spend (centralized and decentralized) is under management through required oversight and review by all stakeholders. I2P is in a category of collaborative, integrated software made possible by two advancements in technology: cloud-based computing and APIs.

Legacy P2P systems were ill-suited to this decentralized process, which required every employee to have access to the system for all purchases, large and small. However, as we’ll see, the more modern versions of P2P are built to handle decentralized spending.

I2P was designed to handle the needs of organizations with a lot of decentralized spending. As such, it’s a specialized segment within the broader procurement landscape. It focuses primarily on the initial intent/approval phase of procurement with greater support for indirect decentralized spend rather than direct spend, which tends to be centralized. These systems aim to reduce human errors, increase transaction speeds, and improve financial compliance.

Requisition and initial assessment.

The intake-to-pay process begins with an initial assessment to clearly define the organization’s goods and services requirements. This step is critical, as it lays out detailed specifications, terms of reference, and statements of work.

The results will inform all subsequent procurement activities, ensuring that every purchase aligns with the business’s strategic objectives. Effective initial assessments help reduce the risk of over or under-purchasing, and they set clear expectations for suppliers.

Budget and compliance.

The next step in the intake-to-pay process is determining the budget. Procurement teams will start by conducting a detailed market analysis of standard costs. Using this information, they can negotiate with suppliers to secure the best possible prices.

This stage often requires collaboration between procurement and finance departments to align the spending with broader financial strategies. By developing an informed, realistic budget, companies can avoid the pitfalls of overspending or compromising on quality.

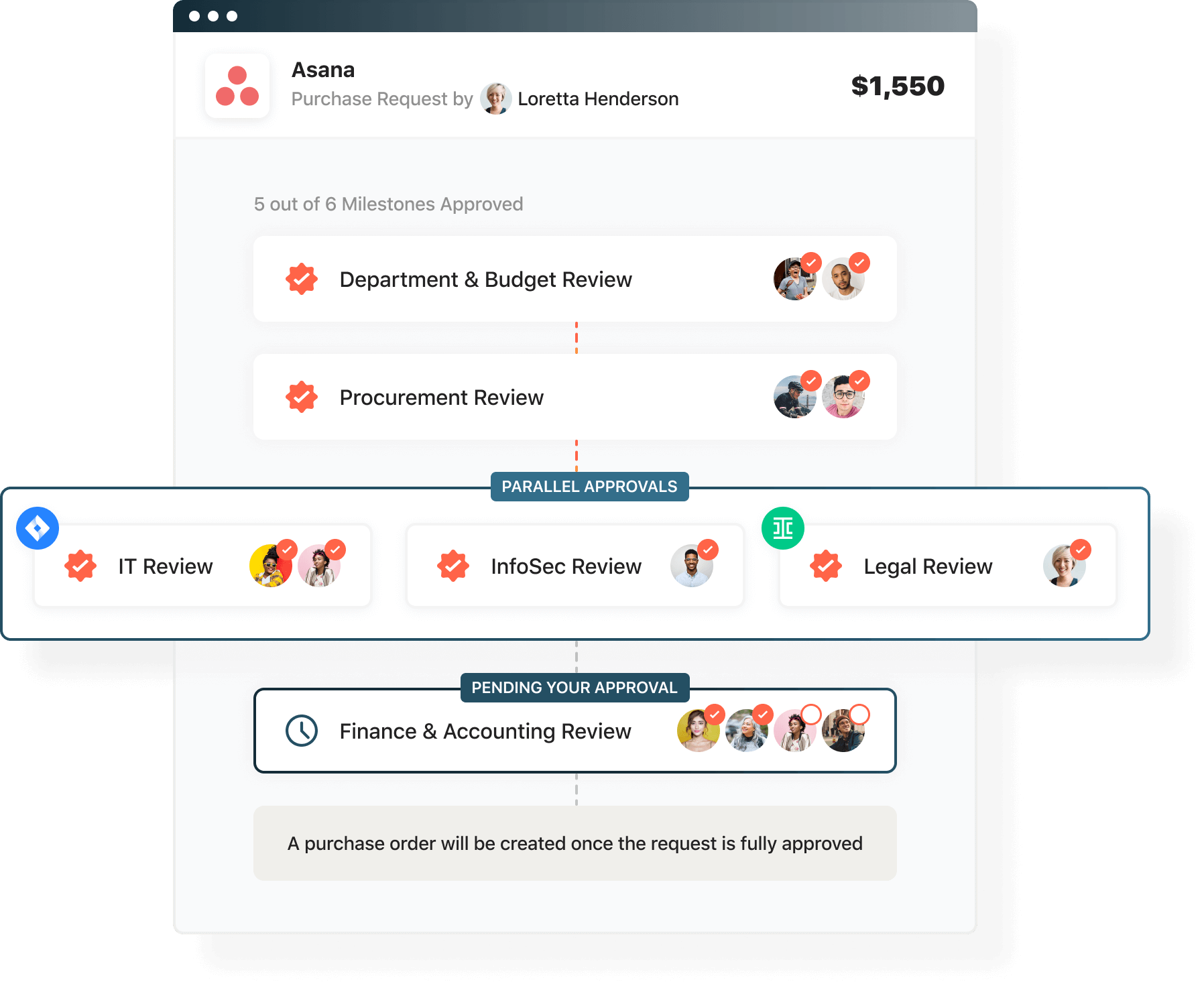

In addition to approvals for budget, other stakeholder sign-offs are required to make sure that SOC reports and legal contracts are in compliance with company policies. I2P includes routing of approvals to budget owners, IT, infosec, and legal. That routing can be to the software platforms that those specialized teams use to manage their workflows like Jira, Asana, Ironclad, or DocuSign. This creates the seamless “orchestrated” process from initial request to sign-off.

Procurement process.

Following budget approval, the procurement team can create a purchase requisition and send a formal purchase order to the selected vendor. Purchase orders serve as a contractual offer to buy products or services, so precision is vital here.

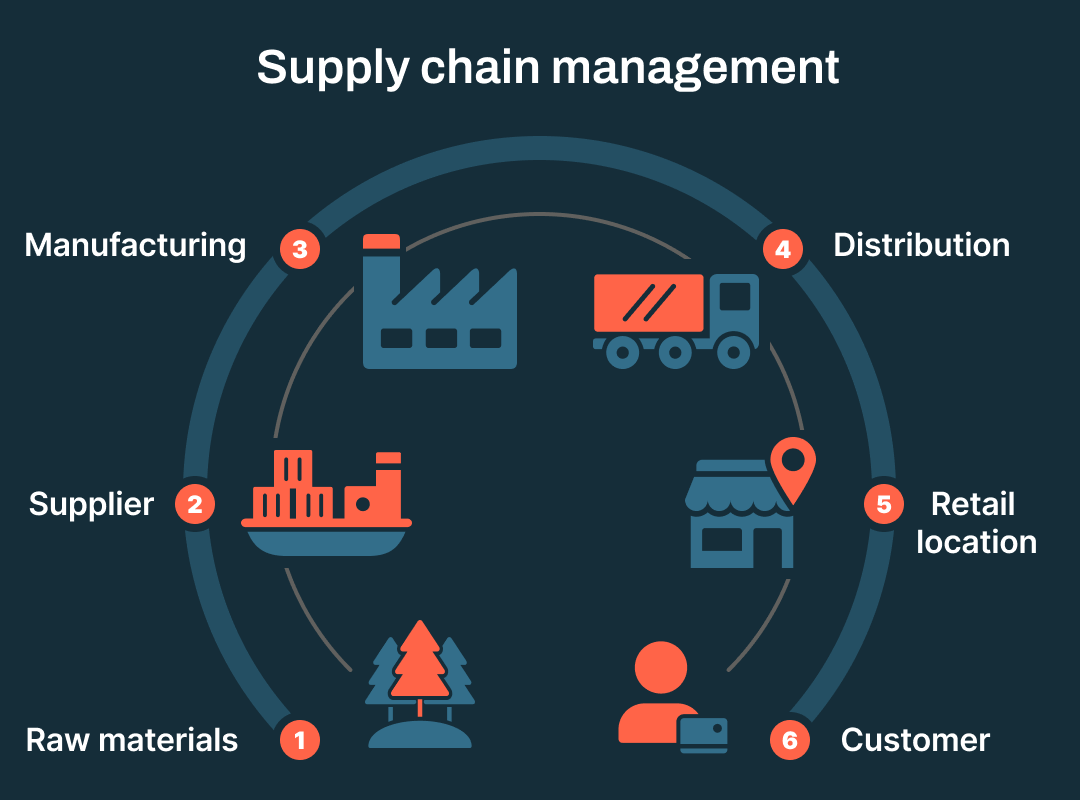

A strong, detailed contract will improve efficiency and eliminate any legal ambiguity in the procurement process. It also sets the stage for smooth vendor onboarding and relations, as well as effective supply chain management.

Invoice processing.

When the vendor delivers the goods or services, they will issue an invoice, which the accounts payable team must cross-reference and verify. This verification process is critical to ensure that the supplier has delivered as expected and has billed according to the initial agreement in the purchase order.

Invoice discrepancies can lead to financial losses, legal disputes, and damage to professional relationships. So this step is vital for maintaining financial control and accountability.

Making the payment.

The final step in the intake-to-pay cycle is making the payment. While this may seem simple, payment approvals require high levels of accuracy and security. Organizations should have several layers of authorization necessary to prevent fraud and ensure compliance with internal controls. The finance department plays a key role here, ensuring accurate record-keeping and effective cash flow management.

Intake providers contract with third-party vendors to handle payments which can slow the payment cycle to several days compared to a P2P system that handles payments directly. If getting payments to vendors in less than 5-7 days is important to you, it is worth finding out about this timing from a potential I2P vendor before selecting them.

Introduction to procure-to-pay (P2P).

The procure-to-pay process is a more comprehensive approach to procurement. P2P integrates and automates the entire process, from need identification to invoice approval, payment, and closing the books. This holistic method streamlines operations enhances transparency, and improves control across the entire purchasing lifecycle. It assumes a continuous cycle rather than a discrete workflow.

Traditional procure-to-pay systems often lacked the automation of an intake process, leaving a gap to be filled by point solutions. Modern P2P solutions like Airbase have included this intake process as part of its automated solution.

Requisition and need identification.

Like intake to pay, the procure to pay cycle begins with strategically identifying necessary products or services. Gaining input from various departments is vital, as this will ensure that purchase requisitions align with the overall business goals and operational needs. Effective need identification helps companies optimize resource utilization and avoid unnecessary expenditures.

Requisition approval.

The requisition approval stage is a critical control point for purchase justification and authorization prior to commitment. This step involves multiple levels of scrutiny to confirm that the procurement is necessary, cost-effective, and within budget. The approval process is integral to maintaining fiscal discipline and aligning procurement activities with business strategies.

Supplier selection.

Selecting the right supplier goes beyond comparing prices. Procurement teams must also consider quality, reliability, and service. In the P2P process, procurement professionals conduct comprehensive evaluations of potential vendors to ensure that they meet the organization’s standards and expectations. This step is essential for building strong, mutually beneficial supplier relationships that can provide competitive advantages.

Invoice processing.

Like I2P, P2P invoice processing requires a thorough comparison of the invoice against the purchase order and the goods or services received. Ensuring accuracy here is essential for financial integrity and to prevent errors that could impact the organization’s financial health.

Payment authorization.

The final step in the P2P process is authorization of payment to the vendor. Again, stringent checks and balances are key here to ensure that all payments are accurate and justified. The finance team is responsible for efficient payment processing and accurate recording of all financial transactions in the accounting system.

Vendor management

Vendor management is an essential part of a P2P solution and is overlooked in an I2P process. A significant part of procurement’s role is renewing contracts with existing vendors as they come up for annual or biennial review. This requires software that will provide notifications of upcoming contracts as well as collaborative tools to get input from all stakeholders in the mix.

For most companies, renewals are a central part of the procurement workload. Vendor management helps keep costs down by preparing in advance of renewals by assessing the market for alternatives and the latest competitor pricing.

Guided Procurement Tour

Explore our automated procurement workflows in the Guided Procurement tour.

Comparing I2P and P2P.

I2P and P2P systems aim to streamline procurement processes but differ significantly in scope and focus. Intake to pay concentrates on optimizing the invoice and payment processes, whereas P2P offers comprehensive, end-to-end management of the entire procurement cycle. Let’s explore the differences and similarities between these two approaches in more depth.

Similarities.

Intake to pay and procure to pay systems share several fundamental elements and key steps that aim to refine and optimize procurement processes, including:

- Streamlining and automation: Both I2P and P2P focus on streamlining and automating the procurement and accounts payable processes. By implementing these systems, organizations can minimize manual tasks, reduce errors, and increase operational efficiency.

- Efficiency, visibility, and control: Both systems are designed to enhance procurement operational efficiency, providing greater spend visibility and improved financial control. As a result, companies can better manage their budgets, make more informed spending decisions, and identify cost-saving opportunities.

- Invoice processing and payment authorization: Integral to both systems are highly scrutinized invoice processing and payment authorization stages. These steps ensure payments are accurate, justified, and timely, which is essential for maintaining cash flow and supplier relationships.

Differences.

Despite their similarities, I2P and P2P have some significant differences that affect their suitability for different organizational needs. These key distinctions include:

- Scope: I2P’s scope is more focused and built with the procurement officer in mind. It primarily targets the requisition, approval, and purchase order creation part of the procurement cycle. In contrast, P2P covers the entire procurement lifecycle — from the initial need identification to invoice processing, booking to the GL, and ongoing vendor management.

- Adoption and maturity: P2P systems are more broadly used and considered more mature, with well-established standards, extensive documentation, and robust research. This makes P2P a reliable choice for organizations looking for a proven solution with ample support and community resources. Conversely, I2P is relatively newer and caters to a niche market, so it may not offer the same level of community support and standardization as P2P.

It’s vital that organizations understand these similarities and differences when deciding which system best meets their specific procurement needs. By prioritizing the end-to-end control of P2P or the targeted capabilities of I2P, companies can better align their choice with their strategic goals and operational requirements.

Implementing I2P or P2P: Best practices and considerations.

Adopting either an I2P or P2P system requires strategic planning to ensure successful implementation and maximization of benefits. Before you get started, it’s important to familiarize yourself with the best practices and considerations for both systems.

Implement change management.

Successful implementation of an I2P or P2P system requires a robust change management strategy. You will need to prepare the organization for change, communicate effectively across all levels, and provide training to ensure everyone understands the new processes and tools. The goal is to minimize disruption and resistance, ensuring a smooth transition and faster realization of benefits.

Integrating I2P with existing ERP systems.

For intake-to-pay implementations, tight integration with the organization’s existing ERP, accounting, and financial systems is crucial. A seamless integration will help streamline processes, reduce errors, and provide a unified view of financial data, which is essential for accurate reporting and decision-making. This will also provide a solid foundation for smooth and robust AP automation.

Leverage data and analytics.

Both I2P and P2P systems generate a wealth of data that can provide insights into procurement patterns, supplier performance, and cost management. Organizations can leverage data analytics to identify trends, forecast needs, and make informed decisions that drive efficiency and cost savings.

Robust data security.

Given the financial transactions involved in both I2P and P2P, ensuring strong data security is critical. Organizations must implement modern cybersecurity measures to protect against unauthorized access, data breaches, and other security threats. This includes secure data storage, encrypted communications, and regular security audits.

Use cases and scenarios for I2P and P2P.

Now that you have a better understanding of I2P and P2P, let’s take a look at the best use cases for each and why organizations may opt for one over the other.

When to use I2P.

Intake to pay is particularly beneficial for organizations that focus heavily on the intake aspect of procurement. It’s ideal for companies that have an automated AP function that handles the more complicated aspects of accounting for payments.

For example, I2P may be a better choice for:

- Organizations aiming to streamline and automate only the invoice processing and payment aspects of their accounts payable workflows.

- Businesses focused on improving efficiency, visibility, and control, specifically over the intake and payment aspect of procurement.

- Companies that require a higher degree of anonymity and privacy in financial transactions.

When to use P2P.

A P2P system is more appropriate for organizations that need a comprehensive solution encompassing the entire procurement cycle. This approach is beneficial for businesses aiming to improve overall procurement efficiency, maintain compliance, strengthen supplier relationships, and enhance decision-making through integrated systems.

This includes organizations that are working to:

- Refine and standardize their entire procurement lifecycle, from need identification to final payment.

- Streamline and integrate all procurement activities, rather than focusing solely on the invoice-to-payment aspect.

- Improve overall efficiency, compliance, supplier relationships, and data-driven decision-making across all procurement operations.

Implement a proven process with established standards, documentation, and widespread support.

Choosing the right approach for your business.

When choosing between I2P and P2P, your organization’s specific needs and strategic goals should guide the decision. While I2P systems narrow in the financial aspect of procurement, a P2P approach will provide a comprehensive strategy that spans all procurement operations.

This is why many businesses find that a procure-to-pay system better supports an orchestrated spend cycle and gives them more control over their budget, spending, and financial planning. From the initial purchase request to the final reconciliation of the books, P2P provides a seamless, automated procurement workflow for ultimate control over company spend.

Airbase offers comprehensive, modular solutions for procurement, which includes spending that doesn’t involve a PO in the definition. With Airbase, you gain access to valuable insights and powerful automation that you can leverage throughout the procurement lifecycle.

Ready to see how a procure-to-pay system can revolutionize your procurement strategies? Schedule an Airbase demo today.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana