Virtual cards are one of those innovations that make you think, “Ah, nice, the future has arrived.” Their ease of use, clear logical extension from the way we’re used to paying for things, and the additional security they bring, are the surface benefits that many appreciate. But not all virtual cards are created equal, and some cards have capabilities below the surface that are game changing. As a recent TechCrunch article points out, the effectiveness of virtual cards ultimately comes down to the software behind the card. Knowing the capabilities of the software is the key element to understanding how virtual cards enable business continuity.

The right software behind a virtual card combines spending oversight workflows with the creation and use of each card in order to give companies important visibility and control over all spending.

The impact of COVID-19 on the workplace is expected to accelerate the use of virtual cards. One obvious advantage is that it’s easier to give a remote employee a virtual card, rather than hand over a shared corporate card or, worse, share the number over the internet. Requests and approvals can be done online, or on a phone through an app, which works well for busy, distributed teams. And, of course, virtual cards provide the ability to make socially distanced payments.

Virtual cards are also an easy, secure way to increase the oversight and responsiveness that are vital for business continuity today. The events of 2020 related to COVID-19 have made it even more important to see financial transactions in real time – to have the ability to adjust spending policies and budgets quickly.

This visibility and control allows department heads, senior management, and finance teams to stay on top of budgets – something that is valuable in normal operating environments and essential when the business environment is in turmoil.

How virtual cards can improve efficiency.

The goal of a business continuity plan is to help an organization retain its central functions in the face of a disaster. The plan should outline policies and procedures to minimize the impact of disruptions on all aspects of a business. A central component of business continuity is the speed at which companies must react to events. After all, disasters are by definition disruptors to our normal routines, and no amount of planning can foresee every possible outcome. That means real-time, actionable data is important.

When an automated approval system is built into a virtual card creation workflow, it’s easy to track each transaction in real time.

If, for example, a virtual card is used to pay a bill, it’s possible to view the invoice, the approval chain, the amount, due date, and all other relevant information and supporting documents, in one place. Approvals for a purchase are secured before it takes place, instead of after the fact, when it’s often too late to make budget changes. Reconciliation and reporting work can then be automated, enabling finance teams and budget holders to view real-time financial data and make more informed decisions.

Improved productivity for more savings.

In an uncertain economic environment, an efficient deployment of resources is more important than ever, and a good business continuity plan carefully examines inefficient processes. Time spent paying bills, collecting receipts, following up on approvals, manually reconciling statements, and adjusting categorizations and tags, all add to a longer month-end close. These kinds of tasks point to the need for more efficient alternatives.

A faster month-end close also lessens the uncertainty that can accompany a complicated, long closing process. During that time, a company is vulnerable to not knowing their financial condition. Moving to a shorter closing time, or even a continuous close, narrows that window of uncertainty, which in turn strengthens a company’s ability to make decisions in the face of disaster.

Automating processes, including the approval and creation of virtual cards, also frees up hours for more strategic work. When optimum productivity is essential for survival, this shift can have a big impact on a company’s resiliency.

The budgetary benefits of virtual cards.

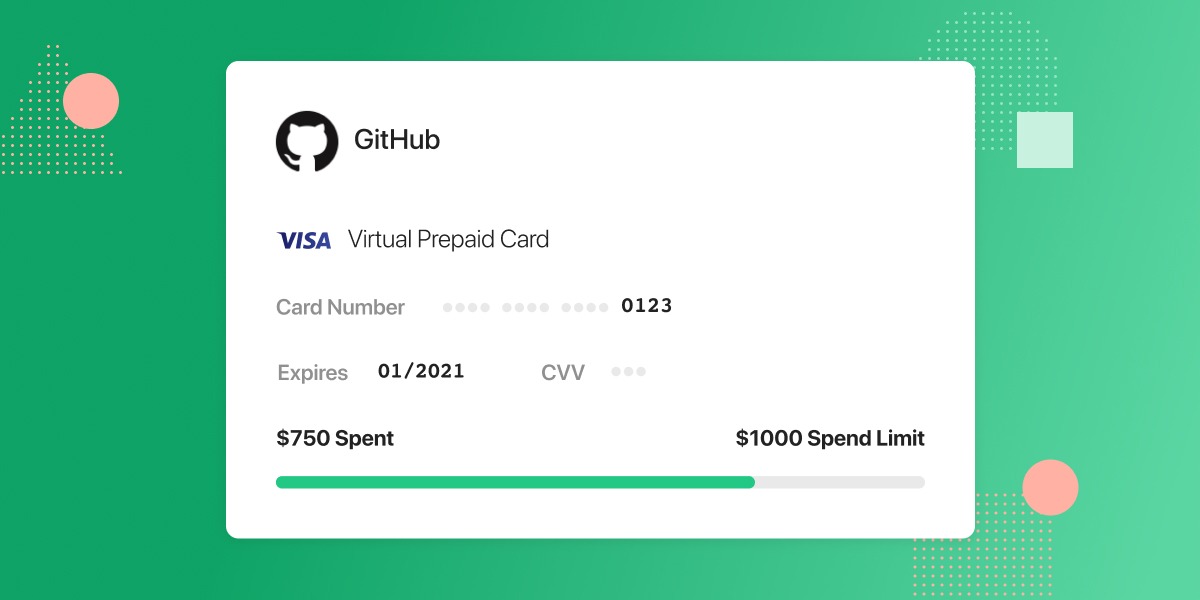

Virtual cards with good software behind them provide a frictionless way to keep employees within budget by allowing a budget owner to set a spending limit for each card created.

The ability to set parameters for a card, like the amount and the expiration date, also make it easy to quickly adjust budgets and enforce their implementation in response to unexpected events. Since managers have visibility into, and control over, card spend before it happens, they can adjust the levers of control.

Clear policies and workflows can also increase employee compliance. Oversight and controls empower managers to monitor all spending against approved budgets as it occurs. As an extra boost for the budget, companies can earn cash back every time they use a virtual card. Smart finance teams can optimize cash back by using virtual cards for recurring expenses.

How virtual cards offer peace of mind.

Fraudulent activity has increased recently, with the Federal Trade Commission reporting that Americans have lost over $152.6 million to fraud following the onset of the COVID-19 pandemic. Fraudsters are hard to stop, and they’ll keep coming up with more nefarious ways to try to get your money. But a good business continuity plan builds in defenses for protection.

Because a virtual card is typically created for a specific vendor, it is difficult to use for other purposes. That makes it significantly less vulnerable to fraud. According to a report by the Association for Finance Professionals, during 2019, 74% of businesses experienced actual or attempted fraud related to checks, and only 3% experienced similar incidents related to virtual cards. Another security benefit to virtual cards that is tied to a specific vendor is that if a card is compromised, it can be easily canceled without having to invest time tracking down other places where the card is used.

Many of the strategies outlined in a business continuity plan can improve productivity and transparency in daily operations. Virtual cards can help businesses be prepared for whatever the future holds.

We’d love to show you more of the amazing software behind our virtual cards. Schedule a demo here.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana